November 17, 2020

What to expect from Canada and the U.S. this marketing year, and how demand is shaping up in Mexico.

New crop black beans, No. 1 grade from Michigan. Photo courtesy of Sam Peck.

For North American bean growers, this year’s harvest ran the gamut across the continent, progressing in orderly fashion from north to south, with excellent results in Canada, a mixed bag in the U.S. and poor production in Mexico.

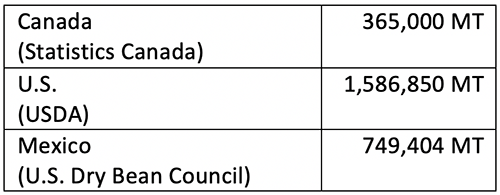

In the northernmost country, Statistics Canada pegs 2020 dry bean production at a record 365,000 MT, up 15% over last year. In the U.S., the USDA estimates production at nearly 35 million cwt (about 1.59 million MT), a 68% increase over last year’s weather-stricken season. But in Mexico, severe drought conditions hit the major bean growing states of Zacatecas, Durango and Chihuahua. SIAP had previously estimated spring-summer dry bean production at 954,000 MT, but the U.S. Dry Bean Council has it at 749,404 MT, which, though higher than last year’s short crop of 592,670 MT, is still below the average of 852,102 MT.

The GPC checked in with sources in all three countries to give Pulse Pod readers a better sense of the situation on the ground.

Canadian bean growers seeded their dry bean crops in early June under cool and wet conditions, giving rise to concerns about disease pressure. By the end of the month, however, conditions turned hot and dry, and those concerns evaporated. The high temperatures came at an ideal time for the crop and helped bump up yields.

The harvest began around August 30 and, thanks to prevailing dry conditions, nearly wrapped up by mid-October, a welcome departure from the previous two years, when weather conditions extended the harvest into November.

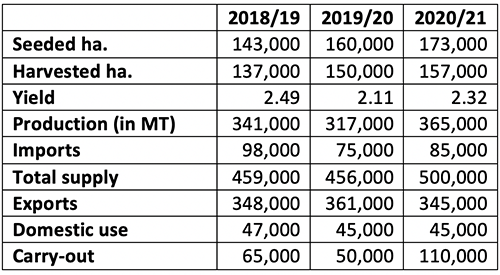

In its October 22 Outlook for Principal Field Crops, Statistics Canada estimates production at 365,000 MT off of 157,000 harvested hectares and yields of 2.32 MT per hectare.

Keven Sawchuk, senior merchandiser at Viterra, however, expects that Statistics Canada will be revising its production estimate upward as final numbers are tabulated. In his opinion, Canada’s 2020 dry bean production amounts to at least 390,000 MT and possibly as much as 410,000 MT.

As he sees it, Statistics Canada missed some bean fields.

“There was a little more speculative planting, especially in Manitoba where soybean acres dropped off considerably and they had one of the largest pinto bean plantings they’ve had in a long time,” he explains. “It was surprising and not fully realized until crop insurance time.”

Sawchuk estimates just over 400,000 acres (nearly 162,000 hectares.) were seeded to beans.

“This is probably the first time we reached 400,000 planted acres in 20 years,” he says.

For the past three years, as the EU and the U.S. have been embroiled in a trade dispute over Airbus and Boeing subsidies, Canadian farmers have been receiving strong signals from Europe and seeding more beans in response.

In addition to expanded seeding, Sawchuk maintains that above average yields were achieved in all of Canada’s dry bean production regions.

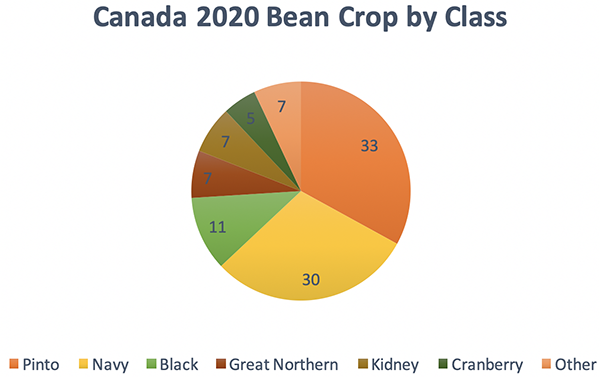

In terms of quality, unlike the mixed bag of the previous two years, he expects that 75-80% of this year’s beans will grade No. 1. He provides the following percentage breakdown by class for the 2020 crop (see pie chart below).

Compared to last year, Sawchuk says there were notably more kidney and cranberry beans seeded this year. Additionally, grower interest in navy and dark red kidney beans exhausted the seed supply and when they were no longer available, growers planted pinto beans instead. In Manitoba, this led to a near doubling of the area sown to pinto beans, from 47,000 acres in 2019 to 90,000 acres this year.

On the marketing side, Sawchuk anticipates strong demand for pinto beans from Mexico. He says there is also demand in West African markets, but the question there is whether importers will have access to currency. In Europe, buyers from Italy, Portugal and Spain will continue to prefer to import beans from Canada instead of the U.S. in order to avoid the tariff on U.S. imports. In addition to pinto beans, Europe also imports large volumes of white beans and some black beans. On black beans, there is also new demand from Chile, a consequence of recently arrived Venezuelan immigrants.

By the end of the marketing year, Sawchuk foresees a carry-out of 10-15,000 MT on pinto beans, 5-10% on black beans, near zero on white, yellow, pink and red beans, and less than 5% on each of the other classes.

“We are seeing demand outpace supply on navy beans,” says Sawchuk.

He also notes that China, once a significant exporter of black beans, is now a bean importer.

“China is buying a lot of small- and mid-caliber white and black beans. If this trend continues, the black bean carry-out could drop into the low single-digits,” he says.

Sawchuk cites the following new crop prices:

Source: Statistics Canada, Outlook for Principal Field Crops, October 22, 2020.

In the U.S., dry beans are grown over a wide area with disparate weather conditions and harvesting dates.

The biggest dry bean growing state in the U.S. is North Dakota, which historically accounts for more than a third of total production. Sam Peck of Jack’s Beans International says North Dakota’s dry bean crop was hit by two major weather events this year. The first occurred at planting, when excessive rains drowned out bean crops throughout the state. The second struck just as the bean harvest was getting underway, when a major frost event hit on August 31. The North Dakota growing areas were the hardest hit and Peck estimates the two events combined led to a decrease in yield potential of 20-25% based on initial planted area estimates.

“The freeze just clocked small reds and cranberry beans in North Dakota,” says Peck. “Those supplies are going to be tight. Cranberry beans especially are going to be very hard to find. And we will see a lot of purple beans in North Dakota’s black bean crop.”

In Michigan, another major dry bean growing state, Joe Cramer of the Michigan Bean Commission reports the weather was a rollercoaster ride. He describes conditions at planting as “beautiful”, but indicates heavy rains followed as the crop was emerging, requiring some replanting. July and August were hot and dry, but rain came as the crop entered the flowering stage.

“Then Mother Nature turned up the heat, shut off the water and we lost a lot of our potential,” Cramer relates.

Michigan, though, was spared the late August frost, as were other parts of the growing area. Further south and to the west, Peck reports Nebraska (the top Great Northern bean growing state in the U.S.) and Colorado did see some freezing temperatures, but other than some damage to Colorado pinto beans, the impact was minimal. Hot and dry weather in August kept the crops in both states from seeing above average yields.

The U.S. bean harvest got underway in August and was all but wrapped up by the end of October, with the last of the beans coming off the bean fields of Michigan. Generally, the harvest went smoothly and took place during the regular window. Over in the West Coast, in the state of Washington, there were some harvest delays as thick smoke from forest fires during the month of September blocked sunlight and kept the morning dew from drying out.

In its November 10 Crop Production report, the USDA estimates overall dry bean production at 34,984,000 cwt off of 1,683,000 acres and yields of 2,079 lbs/acre. Peck, however, believes North Dakota’s bean production is being overstated.

“I drove around the growing area in August and saw the crop was planted late in the central part of the Red River Valley,” he says. “There was a lot of drown out over there.”

The Red River Valley is a major U.S. growing area that straddles the states of North Dakota and Minnesota. The major classes produced there are pinto, black and navy beans.

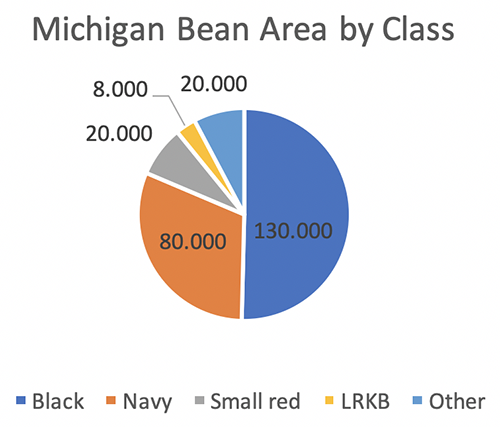

In Michigan, Cramer indicates bean plantings were up 30% on the year, with black beans accounting for at least half of the increase. Navy beans saw above-average yields, and black and small red beans saw near average yields. Cramer pegs overall Michigan production at 5.75 million cwt off of 250,000 acres and yields of 2,300 lbs/acre. It is too early to define yields by bean class, he says, but offers the following seeded area breakdown: 130,000 acres of black beans; 80,000 acres of navy beans; 20,000 acres of small reds; 8,000 acres of light red kidney beans; 20,000 acres of all other beans.

Based on his personal yield assumptions, Peck offers the following production estimates for the major bean classes grown in the U.S.: 13.5 million cwt of pinto beans; 6 million cwt of black beans; 4.75 million cwt of navy beans; and 1.5 million cwt of Great Northern beans.

On carry-in, Peck indicates panicked buying during the early months of the COVID-19 pandemic saw inventories for most bean classes dwindle considerably. He reports tight supplies on light red kidney beans and small red beans, and practically zero stocks of cranberry beans. The only bean classes that may be on the heavy side are dark red kidney beans and black beans.

Peck cites the following new crop FOB prices per MT:

However, with grain prices trending upwards, many growers are opting to hold onto their beans for now, notes Peck.

On the demand side, he reports especially good movement on navy beans into China and decent interest on Great Northern beans from Chile and Far East markets.

“Because of the dry conditions, the quality on the white beans is just beautiful,” says Peck.

Nebraska Great Northern beans, No. 1 packaging quality. Photo courtesy of Sam Peck.

Demand for pinto beans is also picking up steam in the Dominican Republic and Mexico.

Mexico is a major market for U.S. dry bean exports, and while Peck reports some demand on pinto beans, he says there hasn’t been much on black beans. For Michigan, Mexico is a key black bean market.

“Our friends in Mexico have told us they are going to need to buy some beans,” says Cramer. “But they haven’t told us when and we are anxious to hear from them.”

Mexico is currently harvesting its spring-summer dry bean crop. News reports indicate severe drought dramatically reduced production in the top bean growing states of Zacatecas, Durango and Chihuahua. These three states combined account for more than 85% of Mexico’s annual bean production.

On October 24, the U.S. Dry Bean Council published an update on Mexico’s harvest and estimated total spring-summer dry bean production at 749,404 MT, which is 21.5% less than the government’s previous estimate of 954,000 MT.

In addition to drought conditions, the bean crop was also hit by a late October frost.

Francisco Gutierrez, CEO of Grupo Agro, reports crop damage from the drought and the frost is still being assessed. Yield loss is worse than initially feared, he says, and adds, “We are seeing the possibility of a 50% reduction or more in production.”

Last month, at Pulses 2.0, Gutierrez had estimated Mexico’s black bean production of 398,000 MT. Now he anticipates the crop will come in below 200,000 MT and more imports will be needed. He projects black bean import demand at 90-100,000 MT and pinto bean import demand at 30-40,000 MT.

At the moment, Gutierrez says, buyers are re-evaluating their import plans and also keeping an eye on the fluctuating exchange rate.

“I think towards the end of November we will have more clarity on Mexico’s crop,” he says. “We will then know how much of a deficit we have and how much we will need to import.”

Pinto beans / Great Northern beans / Navy beans / Black beans / Small red beans / Light red kidney beans / Cranberry beans / Canada / Keven Sawchuk / Manitoba / Statistics Canada / European Union / USA / US Dry Bean Council / North Dakota / Michigan / Nebraska / Michigan Bean Commission / Red River Valley / Sam Peck / Joe Cramer / Mexico / Zacatecas / Durango / Chihuahua / China / Chile

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.