March 24, 2021

With people staying at home and cinemas around the world closed down, the pandemic had a profound impact on the global popcorn trade.

For moviegoers everywhere, it had to be one of the more nostalgic experiences of the COVID-19 pandemic, to see, as they walked by their favorite movie theater, the now-showing posters still up from before lockdowns were imposed: Parasite, Pain and Glory, 1917, Les Misérables.

But at the same time, although it shuttered the theaters, the pandemic made cinematic entertainment an even bigger part of people’s lives. Advised to stay at home and avoid large gatherings, families huddled in their living rooms and turned to streaming services to pass the time.

And whether it’s the silver screen, the television or a computer monitor, what’s a good movie without popcorn?

For nearly a century now, the film and popcorn industries have been intimately intertwined. It’s a relationship born out of the Great Depression, when enterprising vendors wheeled their popcorn carts up to the entrance of movie theaters, offering moviegoers a tasty snack that was affordable even during those hard times. Today, popcorn is the snack of choice for movie nights at home and when friends gather to watch major sporting events or for friendly get togethers.

On balance, then, with theaters closed but movies and hit series available with a click of the remote control, how did the popcorn industry make out during the pandemic? Did home consumption offset losses from the movie industry?

To find out, the GPC reached out to sources in key popcorn markets.

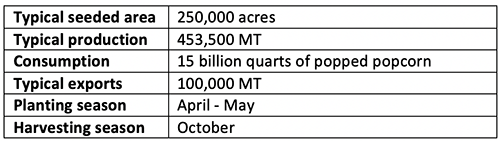

According to the Popcorn Board, the U.S. produces 1 billion pounds of popcorn a year on average. That works out to more than 453,500 MT, making it the world’s leading popcorn producer by far. It is also the leading consumer, with Americans enjoying more than 15 billion quarts of popped popcorn annually, the equivalent of 47 quarts per capita. Statistics kept by the Popcorn Board indicate the U.S. exports about 220 million pounds (nearly 100,000 MT) of popcorn per year. The biggest foreign markets for U.S. popcorn include Mexico and the nations of Southeast Asia and the Middle East.

Popcorn is grown across the U.S. corn belt, with Indiana and Nebraska vying for the title of the top popcorn producing state. Other major popcorn growing states include Iowa, Kentucky, Missouri and Ohio. All told, 250,000 acres are typically seeded to popcorn every year. The crop is typically planted from April to May and harvested in October.

To see how the COVID-19 pandemic impacted the 2020/21 marketing year, the GPC contacted Norm Krug, founder and CEO of Preferred Popcorn, headquartered in Nebraska.

“COVID-19 had a major impact on consumption, with the obvious decline being in the cinemas and sporting venues where popcorn is normally served,” he said. “The impact was global. Nearly every cinema in the world was greatly affected by the pandemic. That brought about a great challenge for the popcorn industry. What do we do with this extra popcorn?”

In the case of Preferred Popcorn, the company adapted to the drop off in sales by erecting new, modern grain storage facilities. But additional, somewhat unexpected help came from increased home consumption.

“In-store grocery sales ramped up significantly and that helped offset the decline in cinema demand,” says Krug. “Microwave popcorn sales were up 50-60% and ready-to-eat sales were up, as were Amazon sales.”

Those sales channels helped Preferred Popcorn recoup about half of the sales it lost from the cinema industry’s closure.

“I think those increased sales will be positive in the long run because consumers are becoming accustomed to consuming popcorn in their homes,” says Krug. “Heading into the summer, no one knows for sure, but we all hope and expect that the cinema industry will recover. When that happens, maybe we’ll come out stronger because of the increased in-home consumption.”

Preferred Popcorn also experienced an increase in export sales during MY 2020/21. Krug report shipments to Egypt and other markets were up during the pandemic.

“In those markets, I think the increased demand was largely because their usage is not tied to the cinema industry,” says Krug. “Its consumer usage and it increased because people were staying at home more.”

Krug estimates his company saw a 20% increase in export demand in MY 2020/21.

Looking ahead to the 2021/22 crop, Krug reports planting conditions “are looking good” heading into the planting season. Conditions are dry at present, but last winter’s abundant snowfall has helped maintain soil moisture levels. Additionally, Krug points out, irrigation is available over much of the U.S. popcorn growing area.

“The most interesting thing, though,” he continues, “is that the prices of all the commodities – corn, soy, wheat – are rising sharply going into the 2021 planting season, so popcorn acreage will most likely be normal to lower than normal because the people who grow commodities are also the ones who grow popcorn.”

Consequently, Krug foresees popcorn prices rising slightly in MY 2021/22.

“It appears that the world supply of popcorn is quite tight because of reduced production in Brazil and Argentina, and it appears that demand will be quite strong in 2021/22,” he surmises.

“Popcorn is a healthy, whole grain snack and I think it will continue to be popular,” Krug adds.

He notes that in recent years, the ready-to-eat segment has been growing and he expects the trend to continue.

“It was a difficult year with COVID, but we certainly expect the industry to rebound and popcorn to remain a viable snack well into the future,” he concludes.

Photo courtesy of Preferred Popcorn.

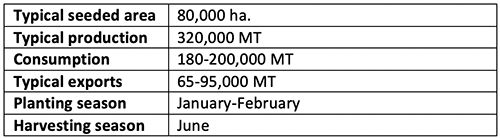

Brazil typically produces 320,000 MT of popcorn a year. Most of the crop goes to satisfy domestic demand, estimated at 180,000 – 200,000 MT. Peak popcorn consumption in Brazil takes place during the Festas Juninas, a series of celebrations held in June to celebrate the harvest. Normally, Brazil tends to have surplus popcorn production and exports 65,000 – 95,000 MT a year. The top export markets for Brazilian popcorn are India, the UAE, Peru and Egypt. The crop is usually seeded between January and February and harvested in June. On average, 80,000 hectares are seeded to popcorn, mostly in Mato Grosso, Brazil’s biggest popcorn producing state.

Iuri Bruns, founder of Samba International, reports that despite the closure of movie theaters and the cancellation of parties during the Festas Juninas, domestic consumption actually increased during the pandemic.

“Because of COVID, consumption was probably around 230,000 – 240,000 MT in 2020/21,” he says. “Household consumption doubled because of the pandemic. It more than offset losses from the cinema sector and the cancellation of the Festas Juninas.”

The increased demand drove up domestic prices and made the local market more attractive than export markets. According to Bruns, domestic prices were at a level equivalent to $700 C&F/MT. Consequently, he estimates the volume of Brazil’s 2020/21 popcorn exports at about 15,000 MT.

Those strong prices, however, are not translating into more hectares this planting season.

“The problem with specialty crops like popcorn this year is that farmers in Mato Grosso are seeing prices for yellow corn at levels they’ve never seen before,” explains Bruns.

Not only has popcorn lost ground to yellow corn, the seeding of the crop has also run into planting delays as growers struggle to get their soybeans off the fields. Soybeans were planted late in Brazil this crop year due to dry conditions. Growers held back on seeding soybeans hoping for rain, which didn’t materialize till mid to late November. Now, at harvest time, growers are facing the opposite problem: too much rain.

“In western Mato Grosso, it is too muddy to go in and harvest soybeans,” says Bruns. “And even the growers who managed to get their soybeans off can’t plant their second crop because it is too wet to get the machines in the fields.”

Bruns visited the growing area in early March to see how the seeding of the popcorn crop was progressing. Usually, most of the popcorn crop would be in the ground by then, but Bruns found that only about 50-70% of the crop had been seeded.

“And it rained practically every day I was there,” he adds. “For growers, the priority right now is harvesting soybeans and planting yellow corn. That’s what they are focused on, and at these prices, they’ll keep on planting yellow corn right through March 15. They are taking a chance planting that late, but at these prices, it’s worth the risk.”

Bruns anticipates Brazil’s popcorn area this year will be the smallest in years.

“I expect 40,000 to 45,000 hectares will be seeded to popcorn,” he says. “We may not have enough production to cover domestic demand and we don’t have any inventories remaining. We are waiting for this new crop.”

Brazil, he is certain, will need to import popcorn in MY 2021/22. He pegs import need at 20,000 to 40,000 MT. Traders, he says, will be looking to Argentina and the U.S. for supplies.

“Brazil is facing a COVID-19 emergency. There are still lockdowns. Some states are on red alert. Everyone is at home, and so I think the consumption of popcorn will remain strong,” he says.

But, he cautions, with the recent sharp devaluation of the Brazilian real, it may turn out that, unlike the previous marketing year, export markets may result more attractive than the domestic market in 2021/22.

Taking a longer view, Bruns is concerned that Brazil’s intermittent presence on the international scene may cost it its share of export markets.

“Most international popcorn buyers are not spot buyers. They need reliable suppliers. And in the past two to three years, Brazil has struggled to deliver,” he says.

Brazil usually harvests its popcorn crop in June. This year, though, given the delayed planting and cool temperatures during the summer, Bruns believes harvest activity may peak in early July.

What a difference a week makes! Young Davi Ackermann da Silva visits the same field of popcorn in Mato Grosso on March 13 and 21. Photo courtesy Iuri Bruns, Samba International.

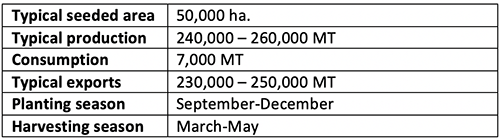

Argentina is the world’s top popcorn exporter. It produces 240,000 – 260,000 MT of popcorn per year on average. Because its domestic consumption is minimal, almost all of its production is available for export. Argentina exports popcorn to more than 110 countries throughout the world.

To find out how the COVID-19 pandemic affected Argentina’s popcorn trade, the GPC contacted Sergio Casas, president of CAMPI (Argentina’s Chamber of Popcorn); CAMPI’s members account for 75% of Argentina’s popcorn exports.

Casas reports that, as lockdowns were imposed, demand from entertainment sectors, such as amusement parks, tourism and especially cinemas, was negatively affected in both the domestic and export markets. These losses, however, were more than offset by increased home consumption both abroad and in Argentina itself. In 2020/21, Argentina exported 232,000 MT of popcorn, with the European Union being the top buyer, followed by Colombia, Egypt, Türkiye and Peru.

“There was more demand than availability in 2020/21,” says Casas. “You can see this in the price increases of the past few months. Prices are still trending upward and there is no carryover from 2020 to tide us over until the new crop becomes available.”

Argentina’s popcorn harvest is currently underway. CAMPI estimates 45,000 hectares were seeded to popcorn this year, which is 10% below the average. He attributes the subpar seeding to the loss of area to high priced soybeans and corn, both of which are easier and safer to grow than popcorn.

Additionally, the production outlook is further complicated by challenging weather conditions.

“Unfortunately, the major popcorn producing area in Argentina has been impacted by La Niña during the entire growing season,” says Casas. “There has been less precipitation, and this has affected production. We expect yields to be at least 20% below average.”

The dry weather also setback the development of the crop and slowed the arrival of new crop. Casas indicates most exporters have barely received 10% of the crop as of March 15; normally, they receive 20% of the crop by that date. The harvest is expected to continue through late May.

“We will definitely have a smaller than expected crop,” says Casas. “The lack of rain affected yields, the grain size and, to a lesser extent, the expansion rate.”

In conclusion, Argentina heads into the 2021/22 marketing year with below average production and zero carry-in at a time of increasing world demand, including previously unforeseen demand from neighboring Brazil.

“For these reasons, we expect the global popcorn market to remain firm throughout 2021 and well into 2022,” says Casas.

Argentine popcorn crop showing signs of water deficiency. Photo courtesy of CAMPI.

Popcorn / COVID-19 / USA / Mexico / Southeast Asia / Middle East / Brazil / Norm Krug / Preferred Popcorn / Iuri Bruns / Samba International / Nebraska / Mato Grosso / Argentina / Sergio Casas / CAMPI

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.