September 1, 2022

GPC’s Dario Bard and Global Garbanzo’s Navneet Chhabra talk to Mert Hazar of Arbel to get the lowdown on Turkey’s 2022 kabuli chickpea crop and its effect on the global shortage.

Back in May, at Pulses 22 in Dubai, Global Garbanzo’s Navneet Chhabra made headlines when he projected a 20% decrease in the world’s kabuli chickpea supply. Major origins, including the U.S., Canada and Argentina, all seeded fewer chickpeas this year. On top of that, the war in Ukraine drastically curbed production there and disrupted trade out of the Black Sea region.

The tight supplies saw markets turn bullish. In Russia, for instance, where kabuli chickpea prices tend to be the most competitive ($550-$600 per MT in recent years), prices stood at $750-$800 in May and, with the outbreak of the war, climbed to $950-$1,000 per MT for farmer-dressed product. And although Russia’s chickpea prices have since returned to pre-war levels, they still remain above the historic average.

Given the supply situation, all eyes are now on Turkey, where the kabuli chickpea harvest is in full swing and the government recently eased export restrictions. To find out how the crop is shaping up there and what the trade can expect from this major kabuli chickpea re-export hub, the GPC teamed up with Global Garbanzo (GG) and spoke to Mert Hazar, director of trading at Arbel, one of Turkey’s largest pulse companies and a GPC President’s Club Platinum Partner.

Snapshot: Market Outlook for Turkey’s 2022 Kabuli Chickpea Crop

|

Production |

180-200,000 MT |

|

Carry-in |

3-5,000 MT |

|

Domestic consumption |

100-120,000 MT |

|

Projected exports |

60,000 MT |

Mert Hazar: Turkey’s chickpea harvest started in early July and will continue until September, which is the normal window for us. This is a big country, with mountains and valleys, and while harvest has concluded in some parts, it continues in others. As of mid-August, I’d estimate harvest progress at about 50%.

MH: Yes, we did not have good weather conditions last year. But this year, thank God, was different. In neighboring countries, like Italy, Greece and Russia, the winter was pretty dry, but in Turkey we got good rains and then it was not so hot. This was a big help to our farmers and had a positive impact on the quality of the crop, as well as on yields.

MH: This year, the quality of the crop is very good. The climate conditions and rainfall were very good, and the quality is superior to last year’s. Color and size are perfect.

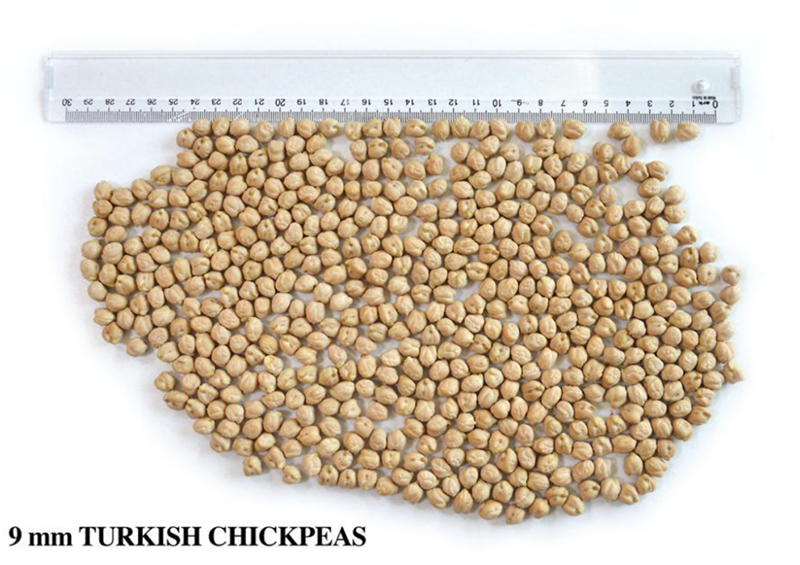

In terms of calibers, we have product ranging from 6 mm to 10 mm. The bulk of the crop, about 50%, is of the 8 and 9 mm sizes. Most of the rest is 7 mm, with small amounts of 6 and 10 mm.

New crop 9 mm chickpeas. Photo courtesy of Arbel.

MH: This year, the area seeded to kabuli chickpeas fell off by about 20% compared to last year. However, we are seeing a 30% increase in yields. As a result, we are expecting a crop of between 180,000 and 200,000 MT, which is enough to cover domestic consumption and leave product available for export, as well.

MH: Turkey is a country of 85 million people. All told, our consumption amounts to 100,000 – 120,000 MT of chickpeas per year. I should mention here that as tight as chickpea supplies are, it is white beans that are the most problematic this year. There just are not enough white beans in the world. Production is down in Argentina, Kyrgyzstan and Turkey. Here in Turkey, dishes made with white beans and chickpeas are similar, and when white beans are not available, consumers will substitute chickpeas for them. The white bean shortage, therefore, will result in greater demand for chickpeas this year. How much more? We will have to wait till winter to see.

MH: Yes, we have approximately 3,000 – 5,000 MT of carryover, which is normal for us. Last year, some buyers purchased chickpeas from farmers and stored them in their warehouses, waiting for higher prices. But then the government imposed an export ban and they were unable to sell their inventories. These old crop chickpeas were properly stored and are of good quality.

MH: Not at the moment, but there are rumors that it will. Domestic consumption in Turkey and throughout the Middle East picks up in winter, and the Grain Board may enter the market a bit before then to assure that enough chickpeas stay in the country to meet that demand. Rumor has it that if the Grain Board does enter the market, it will be for amounts large enough to boost prices.

For right now, though, exporters are the ones buying significant quantities of chickpeas from farmers.

MH: Right, the export ban on chickpeas has been relaxed. Right now, prices are convenient and availability is not an issue.

Under the new policy, until November, exports are capped at the total amount exported from January through October 2021. This gives farmers ample time to sell their new crop. After November, however, exporters are only allowed to export the same volume they exported in the past for a given month. Because of the export ban in 2021, the government is using 2020 numbers as a benchmark. So, for example, if you exported 100 MT in December 2020, you could export 100 MT this December. And if you didn’t export anything that month, the government allows you to export one container, which is 25 MT. The idea here is to allow exporters to maintain their export markets.

MH: Turkey exported 60,000 MT of kabuli chickpeas in 2021-22, and we expect a similar amount in 2022-23 under this new policy. The buying of Turkish chickpeas picks up in winter and peaks right before Ramadan. This year, because Ramadan begins at the end of March, our exports will peak in January and February, when export quotas will be in effect.

MH: The main markets for Turkish chickpeas are in Europe and the Middle East. Chickpeas are shipped to European destinations and trucked to Middle Eastern destinations.

On this point, it should be noted that shipping costs are starting to fall. About a month ago, we had shipping agents visit our office and offer to meet our needs at more reasonable prices. That is quite a change from what we experienced during the pandemic, when it was difficult to reach them and container availability was very limited. Additionally, fuel prices are dropping as well.

All this makes it easy for us to ship product via container and of course we will also continue to supply markets like Syria and Iraq via overland routes.

MH: Right. The transit trade in kabuli chickpeas is about double the export of Turkish chickpeas, so around 120,000 MT. Turkey supplies chickpeas to seven countries in the Middle East: Iran, Syria, Iraq, Lebanon, Jordan, Israel and Palestine. The demand from these markets differs; some prefer Russian chickpeas, others prefer Mexican, Canadian or Indian chickpeas. If the political situation in the region stabilizes, demand will increase and the chickpea trade to those countries will increase.

MH: This war has had severe repercussions. For starters, it collapsed our oil pipeline. And the disruptions to trade have been drastic. Both Russia and Ukraine are major suppliers of key agricultural goods, and these disruptions have driven up food prices.

Fortunately, cargoes are now starting to arrive in Turkey again. Goods from Russia can now arrive directly to Turkish ports. And in the past few weeks, Ukraine started to ship cargoes as well. If this keeps up, we won’t have food shortages in Europe and the Middle East.

With regards to chickpeas specifically, the war has drastically reduced production in Ukraine. Ukraine used to export chickpeas, but now companies there are importing chickpeas from Turkey. Russia, on the other hand, has ample production of chickpeas and countries in need of supplies can import chickpeas from there.

MH: Right now, Turkish chickpea prices are the most competitive in the market, even lower than Russia’s. Our exchange rate against the U.S. dollar also helps make us competitive. For this reason, we are seeing even stronger demand than usual.

To give you an idea, Turkish 7 mm kabuli chickpeas are selling for $950 FOB and 9 mm chickpeas are selling for $1,100 FOB.

Global Garbanzo / Navneet Chhabra / Chickpea supply / Kabuli chickpea / Mert Hazar / Arbel / War in Ukraine

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.