July 1, 2021

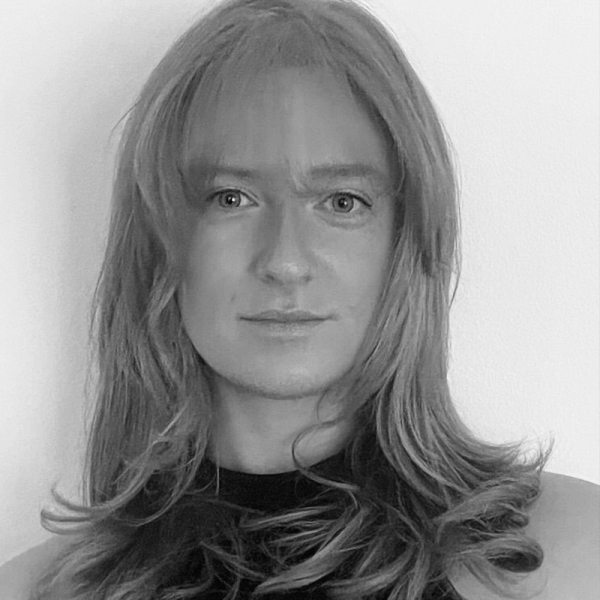

Pedro Cortes of Akila group on leveraging their global network in a crisis and the outlook for this year's Brazilian bean crop.

With offices in 6 countries across three continents and trading in rice, sugar and flour as well as beans and pulses, Akila is no small player in the world of agricultural commodities.

With the COVID-19 pandemic beginning to slow down at last, a clear picture has been emerging of the complex interplay of consequences it has had and continues to have on global trading. One person who has been observing the myriad complications at a macro level is Pedro Cortes, who works in Business Development in Akila’s Americas faction. In this interview, he gives GPC readers a unique insight into what challenges the multinational company has faced during the COVID-19 pandemic and how they have responded.

It changed everything. Not just the high prices of the ocean freight but also lead times are much longer now. The long lead times on their own would have been complicated enough but combine it with the decreased availability of containers and the situation became really problematic. To be able to manage, we need to plan much better and have more stock; it’s very complicated at the moment. It was such an unforeseen situation that’s been going on for more than a year and it looks like it’s going to take another year to get back to normal. We heard that it’s only next July or August that the ocean freight market is going to stabilise. Which means that from now until the end of the year, it’s going to get even worse, especially with Christmas and the volume for the holidays.

Yes. The main region in which we are active in sales is Southern Africa and because of the delays and the ocean freight rates, there’s been an increase in prices. Pulses are quite popular in South Africa - they consume a lot of dried beans, for example - but if these become too expensive they’re going to eat something else. What’s abnormal about the COVID situation is that in general, all the agriculture commodities have gone up in terms of price so it’s difficult across the board.

To be honest, it’s not just the container shortage - the main problem was actually finding space in the vessel. There’s a huge demand and all these logistical problems have caused a huge backlog. With all the problems with the Suez Canal, things got even worse and so now we’re talking about a massive backlog. Here in the U.S, with the government giving people a lot of money there have been further problems because a lot of people just don’t want to work. It’s difficult to find truck drivers and there’s a huge problem with logistics at the port. There are no drivers for the full containers or the empty ones and so all the ports on the West coast are in a big mess and that affects the whole globe because we cannot move the containers. Now, for example, there are lots in the US but none in the Far East.

That’s very difficult to say. If you look at the ocean freight as a very relevant factor and the prices, it doesn’t look good. In some key destinations and origin points, the ocean freight price went up by 3 or 4 times. It’s very complex. It’s been more than 6 months like this and we’re looking at another 12 months before it will get better - and before it gets better, it’s going to get worse, with Christmas coming. Demand is already starting for the shipments for products for Christmas. It’s going to be quite a challenge.

It’s a great advantage. We can source from different origins. We can get a good flow of communication and understanding across the world, not just because of our offices but also because of the other agricultural commodities with which we trade. As I mentioned, the logistical factors are very relevant to our final price so we have to be very efficient not only at the point of origin but also with our logistics. Nowadays, if you have good logistics, you can trade better than if you just source well and particularly in this moment in history, good logistics are more important than the product. For example, in some countries you can produce a really good product but it loses value if you cannot move it out of the port.

It cannot solve the problems, unfortunately, but it does give us an edge. In India for example, they’ve been increasing the container rates for the last year because of the logistical problems but, in the last month or two, it’s accumulated to such a point that they’ve literally just stopped the service and you can’t get a booking at all so cargo is just sitting in the port. On the other hand, demand is increasing in Europe, the US and China so on the one hand you have this huge demand and on the other there’s a massive logistical disruption.

Better planning! We are importing more products ahead of time to keep the flow going. We can mobilise our network to change the point of origin at certain times to avoid the bottlenecks. The flow from South America - Argentina, Brazil, Uruguay - to South Africa and the Far East is not too bad compared to the situations in Europe, North America and India. In that sense, there is some flow from West to East; they need the empty containers back there so it’s not too bad.

The weather has been very challenging! We’ve had rain which we weren’t supposed to have, droughts and recently a frost in the south. Local prices have been very high in the last 12 months so Brazil bought a lot of beans from Argentina. We’ve had competition from corn because soybean prices are also very high and so lots of corn is being planted.

Demand is up, demand is always there. The challenge is more about moving the products in and out of India. Into India, depending on the origin of the product, the flow is not going to be that bad but for exports out of the country it’s going to be complicated.

I would say that the next 12 months are going to be very challenging and so it’s more important than ever to plan and carry a large inventory to avoid surprises. These days, managing to get the cargo shipped doesn’t mean the end of the obstacles: transit time can sometimes be double the norm because all the ports are so congested, our cargo can get stuck for an extra 30 to 45 days. But, you have to play the game. Be smart, be ahead of the situation as much as you can and plan better.

Akila trades in light speckled kidney beans, purple speckled kidney beans, pinto beans, green and yellow peas and a variety of pulses, including lentils. They have offices in the USA, India, Brazil, South Africa, Namibia and Uruguay.

READ THE FULL ARTICLE

Pedro Cortes / Akila Group / light speckled kidney beans / purple speckled kidney beans / pinto beans / green peas / yellow peas / USA / India / Brazil / South Africa / Namibia / Uruguay

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.