November 22, 2023

Global Garbanzo’s Navneet Chhabra and the GPC’s Dario Bard spoke with Ali Siddiqui of the Northern Chickpeas Alliance (NCA) about Canada’s 2023 kabuli chickpea crop.

Ali Siddiqui, Head of Trade, Northern Chickpeas Alliance.

During the COVID-19 pandemic, the experience of the kabuli chickpea markets was different from that of other pulse industries. The demand for kabuli chickpeas in many key destination markets is driven mainly by the HoReCa sector (hotels, restaurants, catering), a sector that was practically shuttered during national lockdowns. Further, as countries implemented protectionist trade policies to ensure food security, the dynamics of dependencies between typical source markets and demand markets changed.

The general expectation was that crop year 2023/24 would usher a return to normalcy. But additional critical factors have, as Ali Siddiqui of the Northern Chickpeas Alliance puts it, “disconnected chickpea pricing this year from the typical fundamentals”.

A healthy and well-podded chickpea plant. Photo courtesy of NCA.

Ali: This year, we were unpleasantly surprised to learn that a lot of Albertan farmers who had been consistent chickpea growers in the past dropped chickpeas entirely from their rotations. This had nothing to do with economics or supply and demand. It was simply driven by farm agronomy. On the other side, Saskatchewan chickpea regions were a mixed bag once again with their acreage. So, we form our opinion based on regional and local ground realities.

With that in mind, we believe the government figure of 306,000 acres is high. Instead, we estimate approximately 250,000 acres were seeded to chickpeas this year. On yields, we came to the opposite conclusion. The government estimate is low on an average basis. The yields the government is reporting are reflective of drought areas. We did have areas of bad crop, but in Saskatchewan, where 70% of the corp is grown, we also had areas of average to above average production.

Our production estimate is not that far off. We are estimating 150,000 MT with a standard deviation of 15,000 MT, which puts the government estimate on the low end of our range.

Ali: In terms of physical appearance and overall quality, this year’s crop is one of the best in the last 10 years. This is partly a result of dryness. Dryness hurts yields and size but improves the nutritional value and physical attributes of chickpeas.

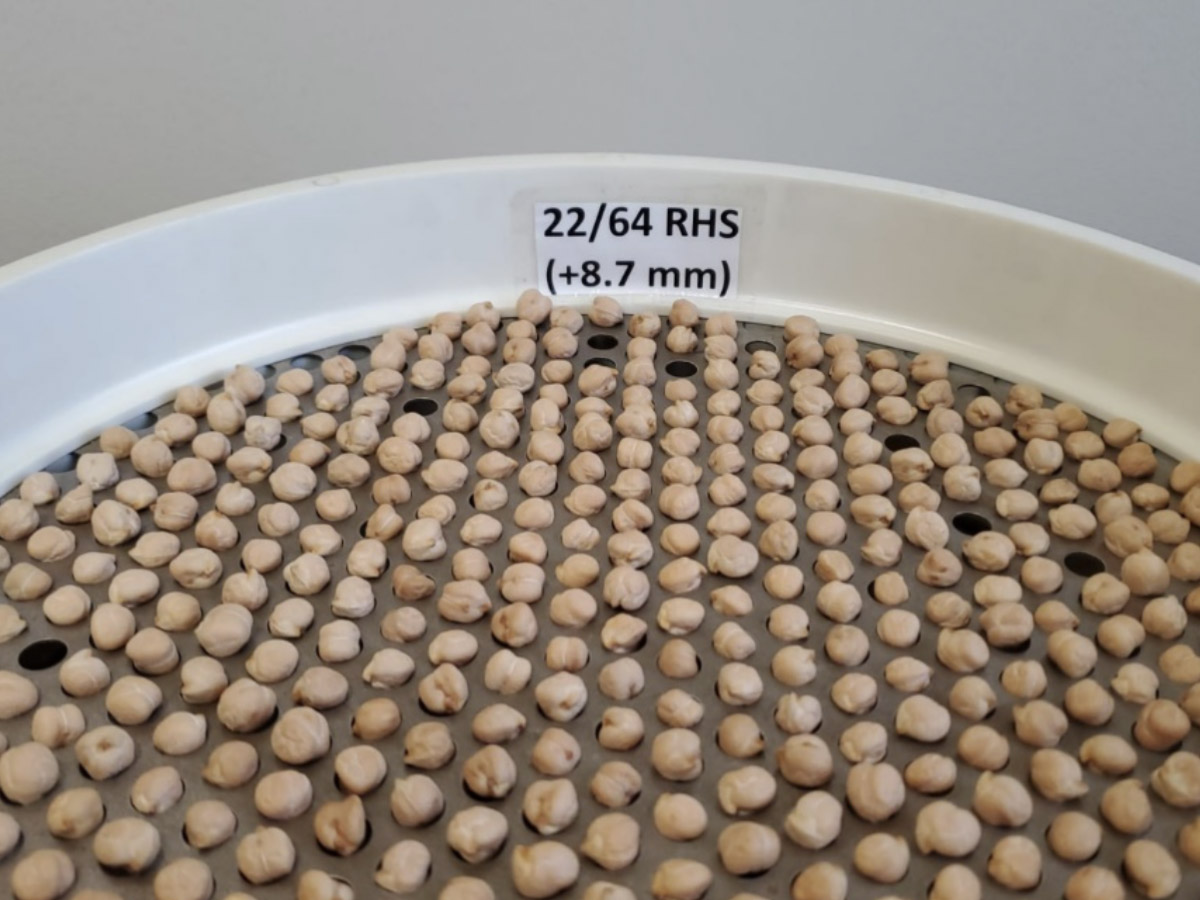

On sizing, the typical distribution is 10% 7mm, 50% 8mm and 40% 9mm. Drought is obviously going to hurt that and this year we have fewer 9mm and slightly more 7mm. To make a commercial analogy, in an average year, if the facility processes five containers of 8mm, we can generate four containers of 9mm approximately. In a drought year, that falls to one or two containers of 9mm.

An example of of Canada’s sized chickpeas. Photo courtesy of NCA.

Ali: There is a sizeable demand for Canadian chickpeas. The U.S. is always our top export market. The top ten are rounded out by certain bulk markets, like Pakistan, Türkiye, and European markets. The world’s top ten importing countries represent the lion’s share of what moves out of Canada.

At the moment, the bulk markets are absent. Even so, given the shorter crop and the smaller carry-in we are working with, we are not going to have sufficient chickpeas to service demand. As a result, you have seen a very firm establishment of prices from Canada since harvest was completed.

But, despite the smaller crop size, the ratio of domestic consumption to exports will not change substantially. The overall quantity shipped out of Canada will be much lower, but the ratio will not change.

Ali: The way to understand the demand trend is to set the right context. When NCA started, Canada’s population was approximately 30 million. Today it is 40 million. The country grew by 10 million people in a short period, mostly due to immigration. Therefore, all aspects of the domestic food sector are set to increase. In Canada, the retail packaging, canning and hummus sectors have a natural growth based on increased food consumption. A fourth sector, the pet food sector, which is very large in North America, has been a demand juggernaut for the past 10 years. But demand for chickpeas as an ingredient has generally plateaued and is stable today.

Photo courtesy of NCA.

Ali: I believe this number is fine. In the grand scheme of things, this amount is practically nil. I would also like to point out that it is in the hands of a very select few farmers and processors. Therefore, it is not an amount that hurts or adds to the market or adds to the farmers’ gain or pain.

In terms of caliber and quality, last year we had an average crop. Therefore, the quality was good and the sizing was slightly better than this year. But again, the quality and sizing of the old crop do not change the dynamics of what the industry is facing this year.

Ali: The beauty of the chickpea world is that no demand market depends solely on a single supply source of chickpeas. What that means is that chickpeas are generally interchangeable. Based on use and function, the world has options open to it all the time.

This being said, given that drought hit Türkiye first and then the U.S. and Canada, it is fair to say that Russia’s successful crop has been the world’s saving grace. Had Russia not produced the volume and quality it did, we would be seeing a higher price ceiling for the medium calibers. People in the industry will say there is no relationship between Russia’s small calibers and the medium calibers from the U.S., Canada and Argentina. This is true, except for the fact that Russia establishes the price floor for all chickpeas in many important destinations. And if that price floor is low, it will not allow the price for medium calibers to surpass a certain ceiling. That is what we are seeing. When drought hit Türkiye’s production and then North America’s production, we saw prices increase, but then 8 and 9mm chickpeas from Canada and other origins met a price ceiling. This is where we are as of today for the medium calibres.

At the same time, we have to understand that there is a large part of the manufacturing world from Asia to Europe and domestically in North America that does not entertain Russian chickpeas for a multitude of reasons. Therefore, Russia’s large crop may be providing a ceiling, but at the same time, prices for medium calibers are not falling either. The sentiment has been firm as a result.

Ali: As I mentioned, the U.S. is the biggest importer of Canadian chickpeas. Behind them, Türkiye and Pakistan have historically vied for second place. Both are absent this year. This might be its saving grace because if it weren’t for the financial difficulties and inflationary pressures these markets are facing, chickpea prices might be much higher today.

Now, the absence of these two markets does not impact our bulk chickpeas business for this year because we are receiving support from the other segments mentioned earlier. But their absence is certainly one of the reasons that international pricing has been unable to break the present price ceiling for mid-sized chickpeas.

This goes to my point that we are at a comfortable ceiling right now. If these markets were to become active, there is a potential for global pricing to increase beyond January 2024. There is, though, one final saving grace for these markets, and that is India. The million-dollar question for these bulk markets, and the answer to whether pricing will increase after January, is if India will come to their rescue. What we know so far is that India seeded into drought conditions but that their seeded area is up 25% over and above last year’s already increased acreage. These bulk markets prefer Indian chickpeas and given India’s shorter transit time, the trajectory of kabuli chickpeas beyond February hinges on whether India will receive moisture within the next three weeks.

Ali: Pakistan once documented importing approximately 40,000 MT of chickpeas from Canada. It was Canada’s second-largest importing market for several years for our medium 8-9mm product. Why is it absent? Pakistan is mainly a small-caliber, volume-driven market. Russia is heavily supporting that lane this year. But Pakistan also has a strong 8-9mm bracket. That bracket is being serviced by Iran at the moment. Iran, however, has never produced sufficient quantities of chickpeas to service a country like Pakistan over 12 months. For the past three months, they have been doing it successfully, but the expectation is they will only be able to keep it up for another month or two.

So, Iran is servicing Pakistan’s 8-9mm needs and Russia its 6-7mm needs. That is why Pakistan is absent. Of course, it is also suffering from a scarcity of U.S. dollars and inflationary pressures. These macroeconomic factors, though, have improved recently.

Ali: As of mid-November, on a CIF basis to the destination market, 7mm product is offered at $1,100-$1,150 per MT, 8mm product is offered for $1,180-$1,225 per MT, and 9mm product is selling for $1,325-$1,350 MT.

Processed and packaged chickpeas ready for shipment. Photo courtesy of NCA.

NCA is a company known to its global customers and partners as a dedicated supplier of Canadian chickpeas. Kabuli chickpeas account for 95% of its export portfolio, servicing all market types including wholesale, canning, hummus and retail packing. Additionally, through its joint venture partnerships, the company has a presence in Canada’s two chickpea growing provinces, Saskatchewan and Alberta.

kabuli chickpea / Navneet Chhabra / Global Garbanzo / Ali Siddiqui / Northern Chickpeas Alliance / Canada / Canadian chickpeas

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.