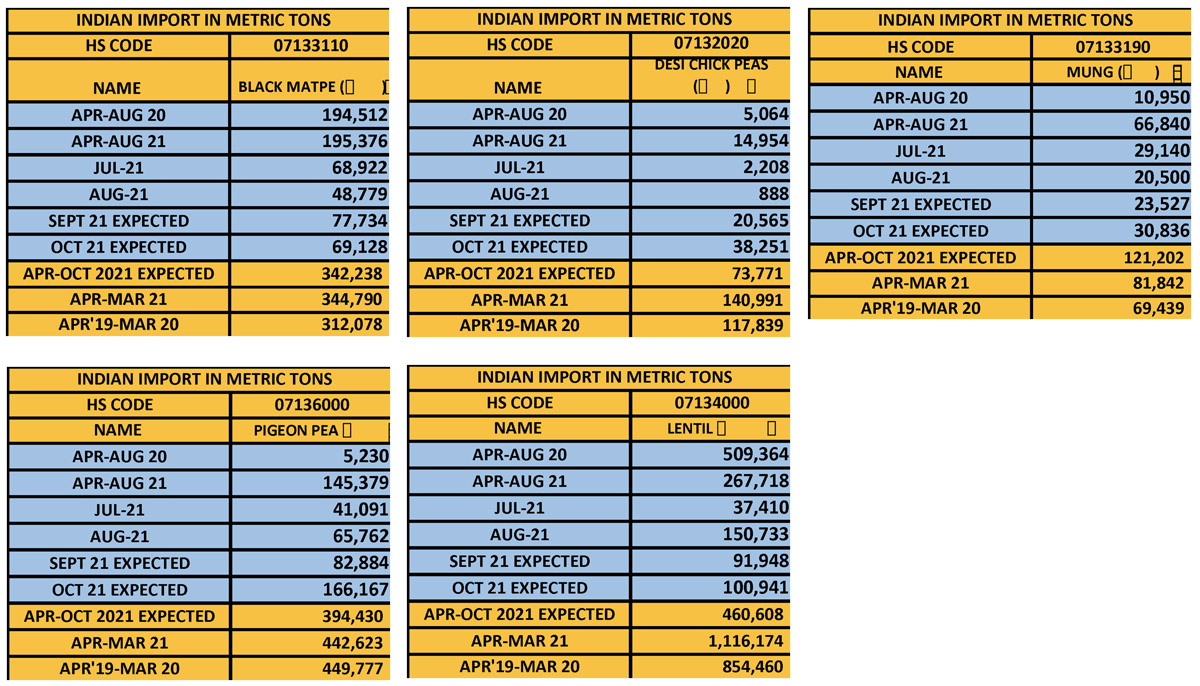

Tur imports from different countries (October 2021)

Country Quantity (in Tons)

Malawi: 16196.53

Mozambique: 61,833.64

Myanmar: 23,974.24

Sudan: 1,593

Tanzania: 59,715

Uganda: 2,853.8

Total: 1,66,167

Tuar Imports at Various Ports

Port Quantity (in Tons)

Mumbai: 61640

Chennai: 27,662

JNPT: 68,739.76

Kolkata: 624.28

Mundra: 7,000

Tuticorin: 500.68

Market facing huge drop in demand

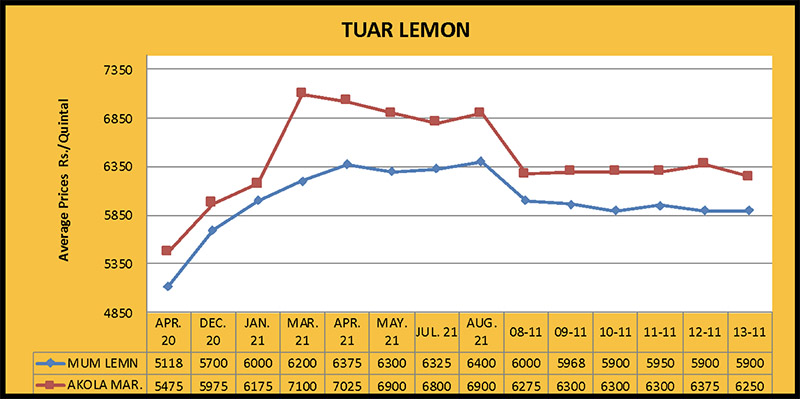

Due to continued availability at the port and continuous selling by the stockists, the tuar market remained under pressure this week. New arrivals in Maharashtra, causing stockists to push old stock and putting pressure on rates. Last week, tuar lemon fell by Rs. 50, Arusa by Rs. 150 and Gajri by Rs. 100 per quintal at Mumbai Port bringing prices to Rs. 5,900/5,950, Rs. 5,250 and Rs. 5,200 per quintal, respectively.

Burma

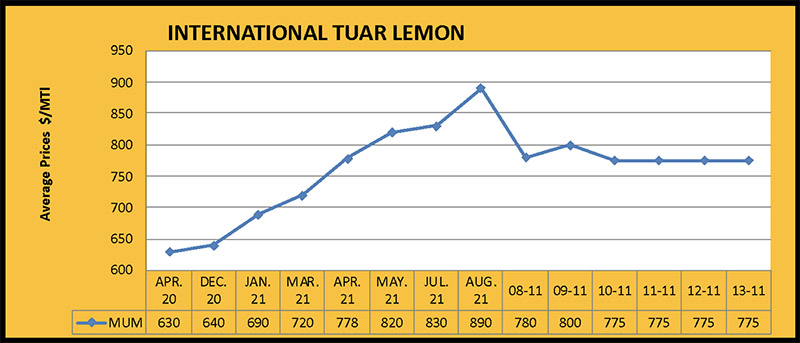

Both Burma and Linke tuar registered a strong price decrease due to weak export demand, with Burma falling by $ 65 to $775 and Linke by $ 75 per tonne to $ 775 per tonne.

Maharashtra

Due to weak offtake in tuar dal and weak demand from mills, Maharashtra witnessed a bearish trend. Due to reduced demand, Akola tuar fell by Rs. 100, Nagpur by Rs. 100, Solapur by Rs. 100 and Amravati by Rs. 100 per quintal and with this downturn, prices were Rs. 6,250, 6,300/6,350, Rs. 6,200/6,300 and Rs. 5,700/5,900 per quintal, respectively.

Karnataka

In Karnataka, tuar prices declined due to increased selling and decreased buying. As a result, Gulbarga Tuar fell by Rs. 150/200 and traded at Rs. 6,000/6,200 and Bidar by Rs 200 to Rs. 5,001/5,909. per quintal.

Delhi

Due to the impact of the port's decline and sluggish demand, Delhi Tuar fell by Rs. 50 per quintal to Rs. 6,050, with new product trading at Rs. 6,250. Maharashtra traded at Rs. 6,250, and Haryana / Uttar Pradesh line at Rs. 5,600

Madhya Pradesh prices reduced to Rs 5800 per quintal.

Other

Due to sluggish demand from pulse mills, Katni tuar fell by Rs. 200 per quintal to Rs. 6,050/6,100 per quintal. Similarly, Raipur tuar last week decreased by Rs. 100 per quintal to Rs. 6,500 per quintal. Maharashtra and Karnataka lines traded at Rs. 6,500/6,550 per quintal. This week, buying and selling was normal in Kanpur Tuar and prices remained stable at Rs. 6,200 per quintal over the weekend.

Tuar Dal

Due to weak buying, tuar dal fell by Rs. 100/200 per quintal and Delhi Fatka traded at Rs. 8,950/9,300, Katni Fatka Rs. 8,650/8,800, Raipur Fatka Rs. 8,400/8,550. Latur prices dropped to Rs. 8,600/8,800, Gulbarga traded at Rs. 8,600/9,200 and Indore at Rs. 8,500/8,800 per quintal.

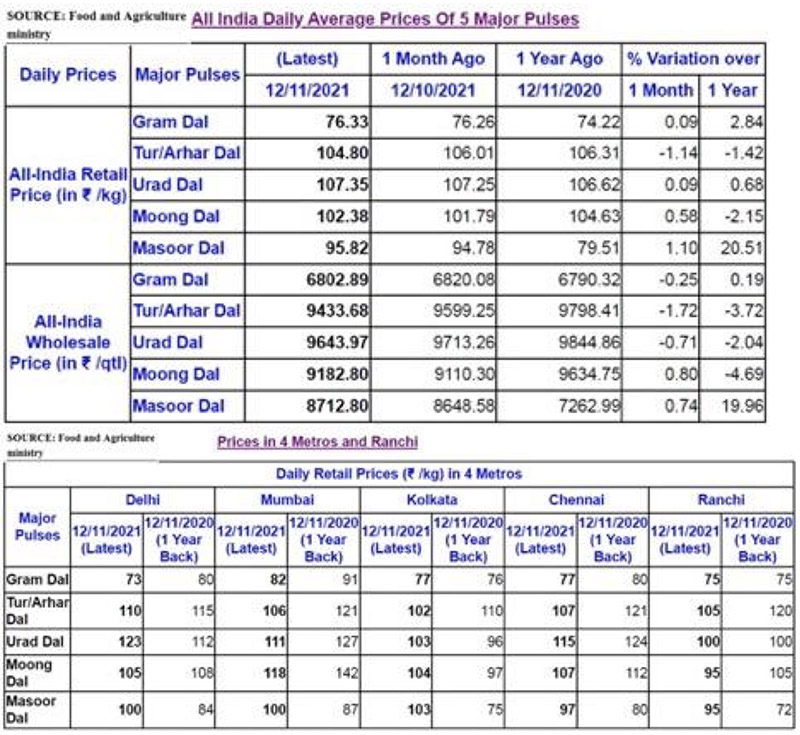

Despite the fall in retail inflation in September, the threat of inflation remains

Although retail inflation declined to 4.35% in September 2021, the lowest in the last five months, many leading agencies believe that the threat of inflation is not over and it is likely to rise again in the coming days. Inflation based on wholesale prices declined to April levels in September but remained high at 10.7%. The retail food inflation rate declined by just 0.68% in September as compared to August. The figure of September 2021 does not seem high due to the base inflation rate being at a low level of 1.3% in September 2020, but for the first four or five months of the current financial year, the prices of edible oilseeds, pulses, cotton and vegetables have increased. In fact, the huge increase in the prices of petrol and diesel made transportation costs very high due to which market prices continued to rise.

Due to the assembly elections in some states in April and May, the increase in the price of petrol and diesel was curbed but from June the situation changed. Although there was no unexpected increase in the prices of rice, wheat and coarse cereals, prices of other food commodities continued to rise consistently. No psychological impact on the market was observed, even for the higher level of production estimates by the government.

The government started a serious effort to curb prices but it did not yield much positive results. The unseasonal rains in October have caused damage to pulses and oilseeds crops, which is likely to reduce yields and negatively impact quality. On the other hand, due to the high prices of pulses and edible oils in the international market, import expenses are sitting high. The government tried to bring down the market by drastically cutting the import duty on edible oils and lentils, but the producers of exporting countries are getting most of the benefits of duty cuts. The impact of newly imposed stock limits and deregulation of imports of some pulses has been limited and rising food inflation remains a matter of concern for the government.

Despite excellent production, exports of pulses from Australia are expected to be affected.

Pulses including gram and lentils are expected in Australia at the next harvest but exports are expected to be affected to some extent due to lack of containers and high shipping costs. Globally, ships are currently moving faster in the more profitable routes and more containers are also available but, in Australia, there is still a shortage of ships and containers.

The shipments of agricultural products are also being affected by the heavy loading and unloading of industrial sector cargo at several ports in Australia. According to critics, the export of cereals and pulses is beginning to be particularly affected. Over one million tonnes of pulses produced in Australia were exported in bulk in 2020 due to shortage of containers and the same situationis likely to occur in 2021.

Interestingly, in October 2021 the bulk shipping fare jumped to the highest level in the last 13 years although it has now been slightly tempered. According to trade analysts, there should be a bumper production of pulses in Australia at harvest but exports are likely to be expensive, difficult and risky. India imports large volumes of lentils from Australia and the government has reduced the customs duty from 33%to 11%. Sowing of Rabi crops has started in India, including gram, lentil and peas. Due to the late monsoon rains, conditions have remained favorable for sowing crops in the fields, and the area and production of pulses are expected to increase as a result. Despite this, Indian importers can try to increase the import of lentils from Australia, taking advantage of the cut in customs duty.

Harvesting of the new crop has begun in Australia and exportable stock will continue to increase over the next few weeks. If prices remain lower than in Canada, Indian buyers will show strong interest in buying Australian lentils. There has also been a huge bulk import of lentils in India.

Signs of increase in imports from Afghanistan to India through Attari check post

Amritsar. The imports of various commodities from Afghanistan to India through the Attari Integrated Check Post (ICP) route are showing signs of a huge increase in the past few days. Officials of the Land Port Authority of India say that now 70-75 trucks are importing dry fruits, fresh fruits, onions, pulses and other items at Attari ICP every day. It is through this check post that India trades with Afghanistan and Pakistan over land. The Attari Check Post is located near Amritsar, in the Punjab. Previously, 40-50 trucks reached India daily through this route but for the last three or four days, daily numbers have been as much as 75. When the Taliban took control of Afghanistan in August, goods started arriving in just 5-10 trucks from the Attari border and traders feared the trade route could be closed at any time. However, this did not happen and now the number of trucks laden with goods is increasing. According to official sources, goods arrived at the Attari check post in 73 trucks from Afghanistan on November 10 while the number of trucks arriving on November 9 was 71. Business seems to be growing regularly and may continue to do so. When the Taliban took power, there were fears of closure of business with Afghanistan but this also did not happen; bilateral trade continued and is now slowly growing. Afghanistan is going through a severe economic crisis and is in dire need of foreign exchange so the Taliban government is not in favor of stopping trade with India. Onion prices are rising in India, so there is a possibility of importing from Afghanistan. Soon the number of trucks coming from in could increase to more than 100, although the security at the border post has not yet been increased. On November 9, 33 trucks had arrived with onions, out of which 16 trucks were sent back as there was no vacant space at the IPC and the authority's checking machine (scanner) was not working. The authorities, however, have denied this, saying that there is no shortage of space and only a couple of trucks are sent back occasionally for security reasons.

Abbreviations

Tuar/ Arhar: Pigeon Peas PP

Mung: Green Mung

Urad: Black Matpe

Chana: Gram, Desi Chickpea

Matar: Pea

Masur: Lentil

Besan: Gram Flour

Mandi: Market yard

Bhav: Prices

Dal/Daal: Processed Pulses (Directly for human consumption)

Rs: Indian Rupees (1$=Rs 74.25)

Rahul Chauhan

Director, IGrain India

igrainind@gmail.com

+91 9350141815

Twitter igrain_india

IGrain / Rahul Chauhan / India / Burma / Maharashtra / Karnataka / Delhi / Tuar Dal / Pigeon Pea / Desi Chick Peas / Mung / Lentil / Black Matpe

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.