Port

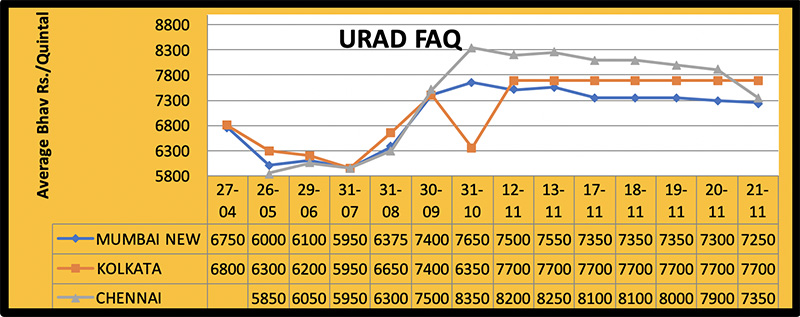

Mumbai. The supply of urad in the market is increasing. The lifting of processed pulses in local markets is down; consequently, there has been observable pressure on the market. Millers control the purchasing of urad. In the local mandis (market years), urad arrival is normal but activities are weak. During the past week, urad prices at port fell by Rs. 200 and new crop urad traded at Rs. 7,400/quintal in Mumbai; old crop traded at Rs. 7,300/quintal. Chennai FAQ Rs. 7,400, SQ Rs. 8,400 and Kolkata Rs. 7,700 per quintal over the weekend. Normal demand and normal variation in prices are expected. Over the weekend, urad prices at port increased $15. By the weekend, the price hit USD 890 and SQ $ 1,015 per MT. Demand is expected to increase.

New Delhi

The impact of decreased urad demand was also seen in Delhi. Urad was down Rs. 150-200 by the weekend on weak buying of pulses by millers and processors. Domestic prices were at Rs. 7,000-7,600, imported FAQ 7,625 rupees and SQ 8,900 rupees per quintal. Demand is expected to increase.

Uttar Pradesh

Urad sales were better in Uttar Pradesh than in other states. Stockists are selling inventories as prices continue to decline. During the week, urad registered a decline of Rs. 100-200 and traded at Rs. 7,400 in Bareilly, Rs. 5,200-6,200 in Lalitpur, Rs. 6,000-6,600 in Jhansi and Rs. 6,900-7,100 in Chandausi. Demand is expected to increase, but with the persistence of selling, there is little hope that prices will rise.

Maharashtra

Urad arrivals remain a common sight in the mandis of Maharashtra. Due to weak buying, prices fell by Rs. 100-200. Over the weekend, prices stood at Rs. 6,000-6,500 in Jalna, Rs. 3,600-3,700 in Akola and Rs. 4,000-7,800 in Udgir. Demand is expected to remain normal. Urad arrivals will decrease.

Rajasthan

In Rajasthan market yard, urad recorded a drop of Rs. 100-300. Weekend prices per quintal stood at Rs. 5,600 in Jaipur and Rs. 6,000-7,000 in Sumerpur. At other mandis, trading occurred at reduced prices.

Other Markets

In Gulbarga Mandi-Karnataka, urad registered a fall of Rs. 300. Over the weekend, the price stood at Rs. 4,000-7,200. Vijayawada urad did not see any rapid downturn and the price remained at Rs. 7,500-7,800.

Urad Processed Dal

Demand for urad dal was sluggish. Urad dal prices fell by Rs. 100-200 by the weekend on selling by pulses mills. Weekend prices stood at Rs. 8,500-11,000 per quintal. Demand is expected to remain normal.

Total Urad Arrivals in Key Markets Kharif 2020

(From November 2 – 23, in quintals)

State-Arrivals

Maharashtra

Latur 6,550

Barshi 15,750

Ahmednagar 9,000

Gujrat

Rajkot 7,700

Madhya Pradesh

Ashok Nagar 1,215

Beena 1,463

Ganj Basoda 2,850

Uttar Pradesh

Lalitpur 13,350

Jhansi 288

Chandausi 4,850

Bilsi 1,800

Karnataka

Gulbarga 12,700

Bidar 4,561

Bhalki 426

Gadag 2,303

Hubli 488

Rajasthan

Kekri 6,885

Sumerpur 1,850

Myanmar Container Shortage-Foreign trade likely to be affected

Foreign trade has been affected due to the acute shortage of containers in the Asian country of Myanmar (Burma). Exports of rice, pulses and maize expected to be extensively impacted while this shortage persists, probably for the next two months. The COVID-19 pandemic is disrupting the supply of containers. Trade analysts believe that if there are not enough containers available, the export of some products from Myanmar may come to a halt. The movement of ships to ports has become irregular. Exporters are competing for containers. Consequently, container prices are changing unexpectedly. According to critics, most of Asia’s containers are stranded in European ports and have not returned due to the global health crisis. As a result, container prices have doubled and even tripled. At present, there is no significant adverse impact on exports from Myanmar, but these are expected to be felt in the coming weeks. Shipping companies do not want to haul empty containers while there is not much import of containers from Europe and America to Asian countries. There is a shortage of containers at ports. If containers are sourced from Singapore, the cost increases.

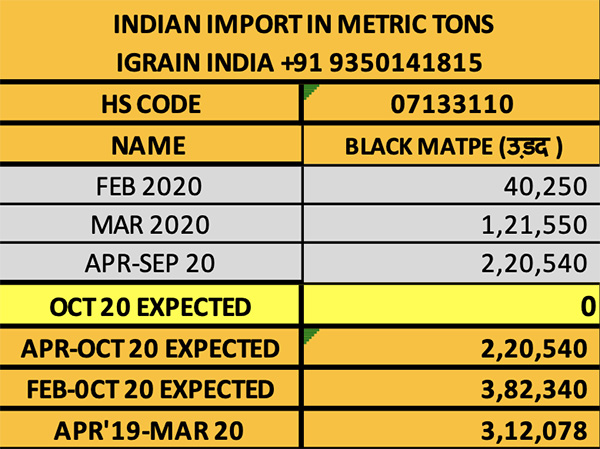

Pulse and bean exporters are worried. It is difficult to find empty containers. Exporters say the situation is affecting the shipment of pulses and beans from Myanmar and therefore efforts are being made to sell them in the domestic market. The government of India has authorized the import of 4.00 lakh MT of pigeon peas, 1.50 lakh MT of urad and 1.50 lakh MT of moong. Myanmar was expected to fill a good part of these quotas.

Sowing of rabi crops in Andhra Pradesh is far behind last year’s pace

In Andhra Pradesh, an important agricultural producing state in South India, rabi crop sowing might have reached 3.56 lakh hectares by November 18, far behind the pace of 5.28 lakh hectares by that time last year. The state agriculture department set a rabi sowing target of 23.96 lakh hectares.

The area under paddy and pulses is expected to grow rapidly. For the current rabi season, the state’s target for paddy seeding is 8.01 lakh ha. For coarse cereals it is 3.61 lakh ha. And for pulses it is 9.74 lakh ha. The total food grains target is 21.36 lakh ha. And the oilseeds target is 1.51 lakh hectares.

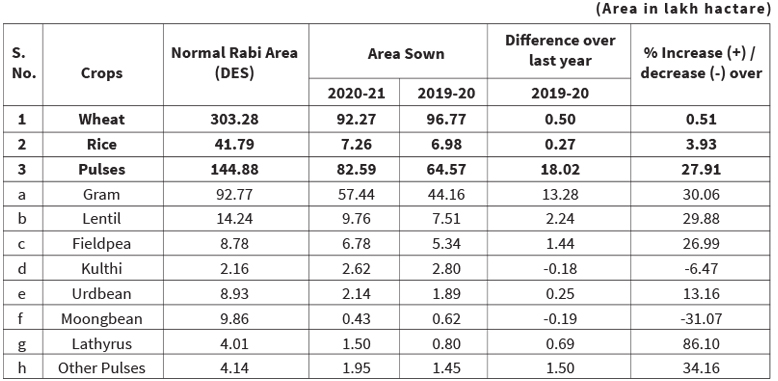

Gram sowing estimated to increase by 11% to 118 lakh hectares

Industry-trade sector associations-organizations and analysts believe that during the current rabi season, the area seeded to gram could hit 11 million ha., an 11% increase over last year. Weather conditions are favorable and the MSP has been raised. The open market price for gram is running higher than MSP and has farmers quite excited.

An American company estimated the seeded area at 112.40 lakh ha. An FMCG firm in India estimated 119.80 – 123.10 lakh hectares. The Pulses Association estimated 120 million ha. The All India Dal Mill Association estimated 112.40-117.70 lakh ha. The Madhya Pradesh Grain Pulses Oilseeds Trade Association estimated 112.40 lakh ha. BJSN Agro estimated 107 lakh ha. Kedia Commodity Com Trade estimated 126.30-128.40 lakh ha., Intelligent and Monetary Services 135-140 lakh ha., Kotak Securities 120-128 lakh ha. and Indian Pulses Research Institute 110 lakh ha.

In the 2019-20 rabi season, the area sown under gram reached 107 lakh ha. nationally. Only one firm estimated this year’s rabi gram area would be on par with last year’s. All the other firms-associations estimated a sizeable increase. The pace of sowing thus far suggests there may be a large increase in the area under gram.

At present, gram prices at the major wholesale markets is running at Rs. 5,175-5,200 per quintal, while the prevailing price at this time last year was Rs. 4,500 – 4,550 and the 2019/20 MSP was Rs. 4,875.

The Pulses Research Institute says that if it rains in winter, farmers prioritize the seeding of wheat, but if it is dry, they prioritize the seeding of gram. This time, there is the possibility of increasing the area sown to gram.

The important gram growing areas of the top producing states like Madhya Pradesh, Maharashtra and Rajasthan have not received adequate winter rains this time, so the sowing of gram is expected to continue at a much faster pace. By November 13, the sowing area of gram had risen by 40% to 44 lakh ha. compared to the previous year. The government has increased the minimum support price of gram by Rs. 225 to Rs 5,100 per quintal for the 2020-21 season. With the increase in area, there will be good increase in the production of gram.

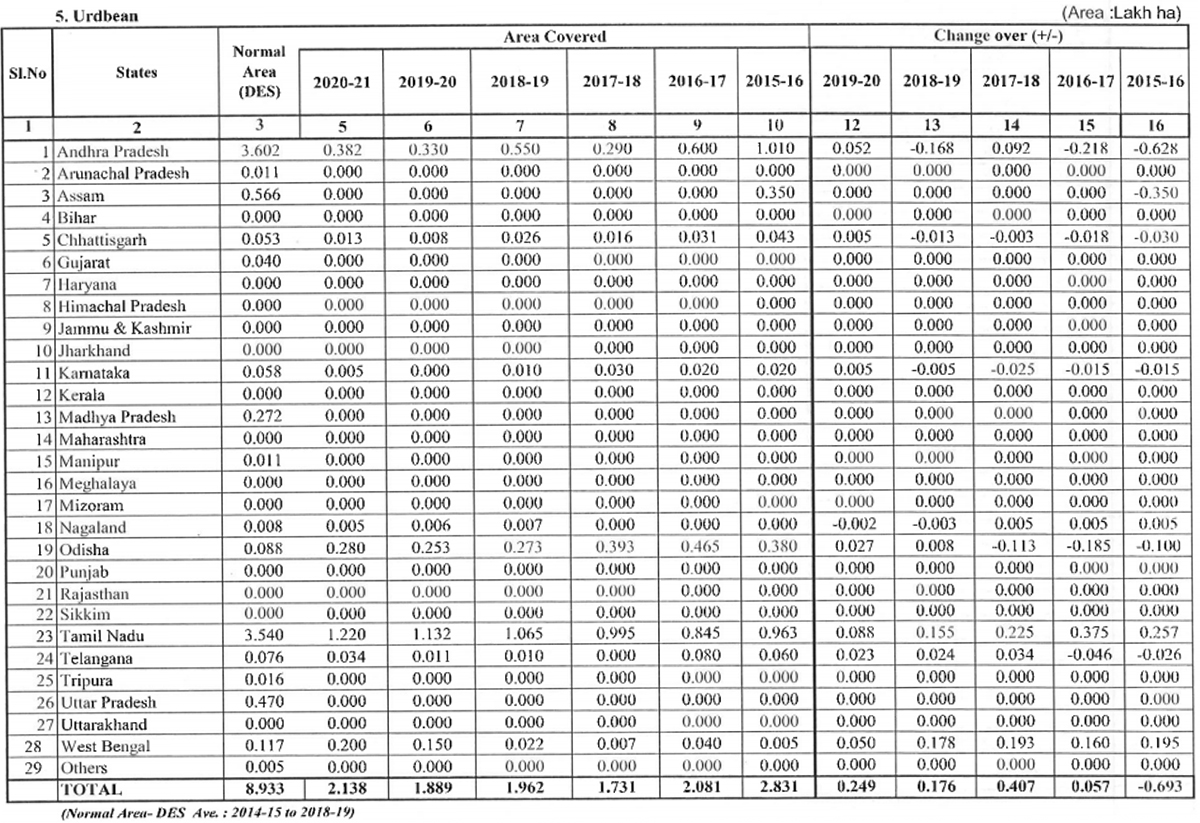

URAD SOWING: DEPARTMENT OF AGRICULTURE, COOPERATION & FAMERS WELFARE

Abbreviations

Tuar/ Arhar: Pigeon Peas PP

Mung: Green Mung

Urad: Black Matpe

Chana: Gram

Matar: Pea

Masur: Lentil

Mandi: Market yard

Bhav: Prices

Dal/Daal: Processed Pulses (Directly for human consumption)

Rs: Indian Rupees (1$=Rs 74-75)

Rahul Chauhan

Director, IGrain India

igrainind@gmail.com

+91 9350141815

Twitter igrain_india

India / Rahul Chauhan / Urad / Myanmar / Maharashtra / Telangana / Andhra Pradesh / Madhya Pradesh / Uttar Pradesh / Rajasthan / Mumbai / New Delhi

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.