March 30, 2022

IGrain’s Rahul Chauhan provides information on pricing and current inventories, as well as import figures and news from domestic and international markets.

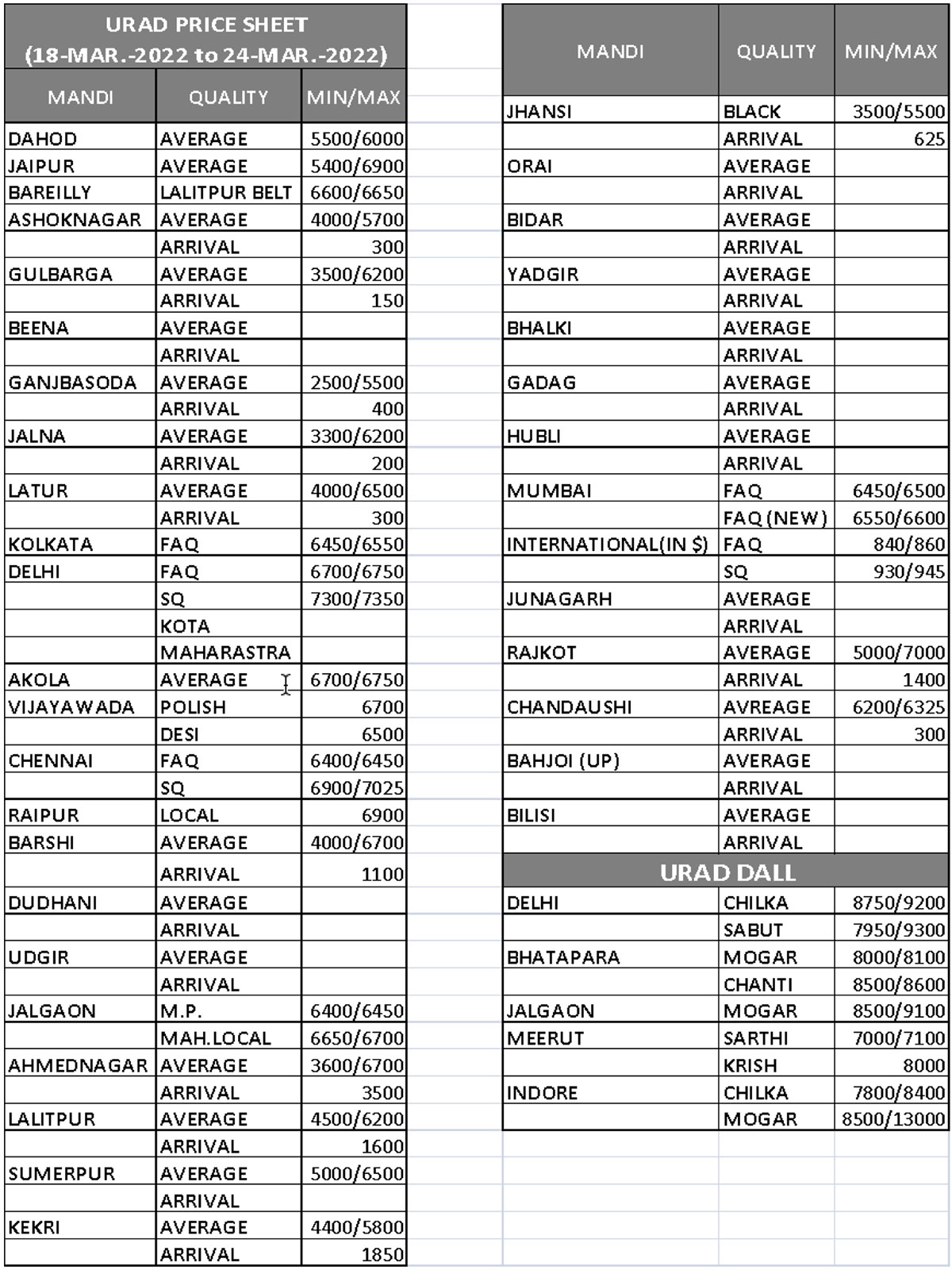

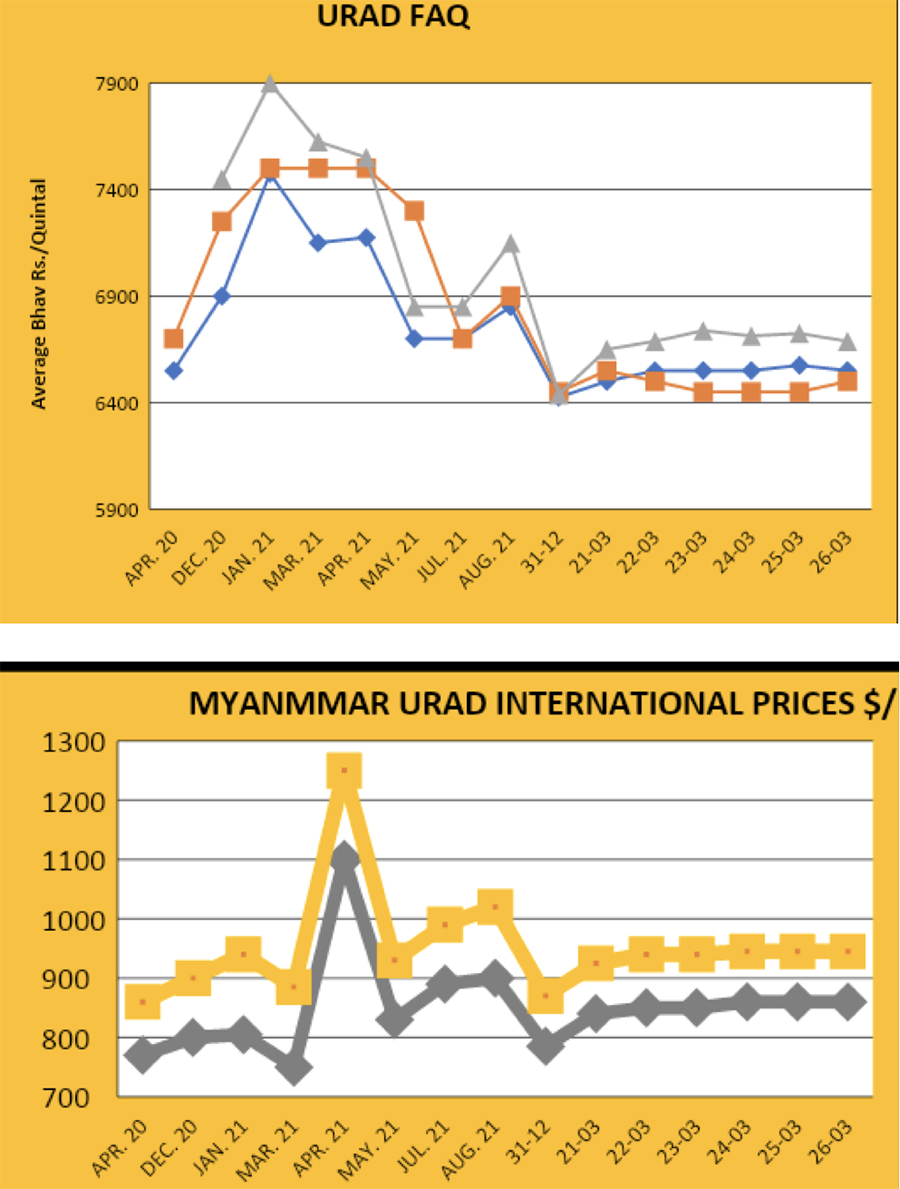

Small improvement in prices

Chennai

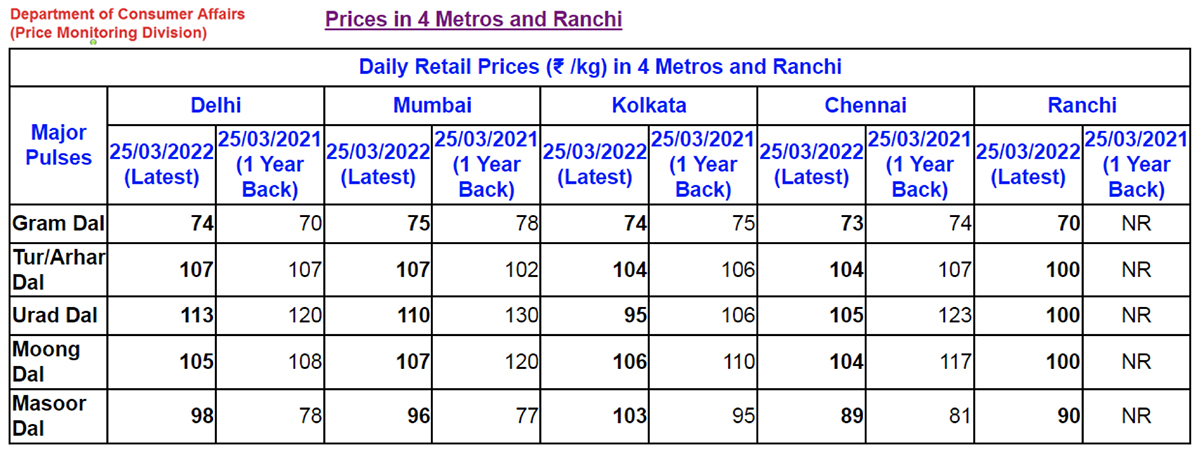

Urad prices witnessed a slight correction last week on the back of sporadic buying. Due to continued buying from millers, Chennai urad FAQ registered an improvement of Rs. 25 and SQ by Rs 75 per quintal and, with this improvement, the price of FAQ rose to Rs. 6,425 per quintal and SQ to Rs. 7,025 per quintal. Similarly, Mumbai prices are also up by Rs. 25 per quintal, selling at Rs. 6,625 per quintal over the weekend.

Burma

Both FAQ and SQ Burma prices increased by $ 20 per ton last week to maintain export demand, with FAQ trading at $ 860 and SQ at $945 per ton.

Delhi

Last week, Delhi prices recorded an improvement of Rs. 50 per quintal and sold at Rs. 6,750 per quintal and SQ Rs. 7,350 per quintal due to the support from port and customer support.

Maharashtra

Maharashtra prices saw sporadic buying, due to which important markets showed an increase of Rs. 50/100 per quintal. By the weekend, Latur was trading at Rs. 4,000/6,400, Barshi Rs. 5,000/6,700, Jalgaon Rs. 6,450/6,700, Jalna Rs. 3,000/6,500 and Ahmednagar Rs. 3,700/6,700 per quintal.

Madhya Pradesh

Due to normal demand, Madhya Pradesh prices remained stable. In Ashoknagar, prices were stable at Rs. 4,000/5,600, in Ganjbasoda at Rs. 2,500/5,500 and in Indore at Rs. 7,000/7,200 per quintal over the weekend.

Rajasthan

Due to weak buying, Rajasthan prices fell by Rs. 50/100 with Jaipur selling at Rs. 5,400/6,900, Kekri Rs. 4,500/6,300, Sumerpur Rs. 4,500/6,000 per quintal at the weekend.

Other

Due to sluggish buying, Vijayawada prices remained stable at Rs. 6,500 per quintal and Rs. 6,700 per quintal in Polish. Gulbarga and Karnataka prices, however, increased by Rs. 200 to Rs. 3,500/6,200 per quintal.

Urad Dal

Last week, demand for urad dal was sluggish but prices remained stable at Rs. 8,000/9,300 per quintal.

Good production of chana due to increased sowing and favourable weather

New Delhi. Government data shows that the sown area of chana, the most important pulse of the rabi season, increased by 4.57 lakh hectares from 110.38 lakh hectares in 2020-21 to 114.95 lakh hectares in the 2021-22 season. Although there was some decline in the sown area in Karnataka, Rajasthan, Andhra Pradesh and Haryana, the area increased significantly in states like Maharashtra, Madhya Pradesh, Gujarat, Uttar Pradesh and Telangana. The acreage in Maharashtra has even surpassed that of Madhya Pradesh, 26.60 lakh hectares compared to 25.05.

In Gujarat, the area reached 11 lakh hectares while there were 20.40 lakh hectares sown in Rajasthan, 11.05 lakh in Karnataka, 5.95 lakh in Uttar Pradesh, 4.05 lakh in Andhra Pradesh and 1.30 lakh hectares in Telangana. The sown area of chana in other states of the country was close to 8.85 lakh hectares.

The weather and rainfall conditions were generally favourable in February in the major producing states. As a result, the Gujarat government has estimated chana production to reach a new record level of 24.90 lakh tons, jumping from 14.37 lakh tons last year. Production is also expected to improve in other provinces. Although the Union Agriculture Ministry has estimated total domestic production to reach an all-time high of 131.20 lakh tons - much higher than both the fixed target of 106.60 lakh tons and last year's production of 119.10 lakh tons - the trade industry believes production will be more like 129 lakh tons.

The arrival of new chana has started in many wholesale mandis and supply is expected to pick up after the Holi festival in all the major producing states.

Pulse prices likely to improve

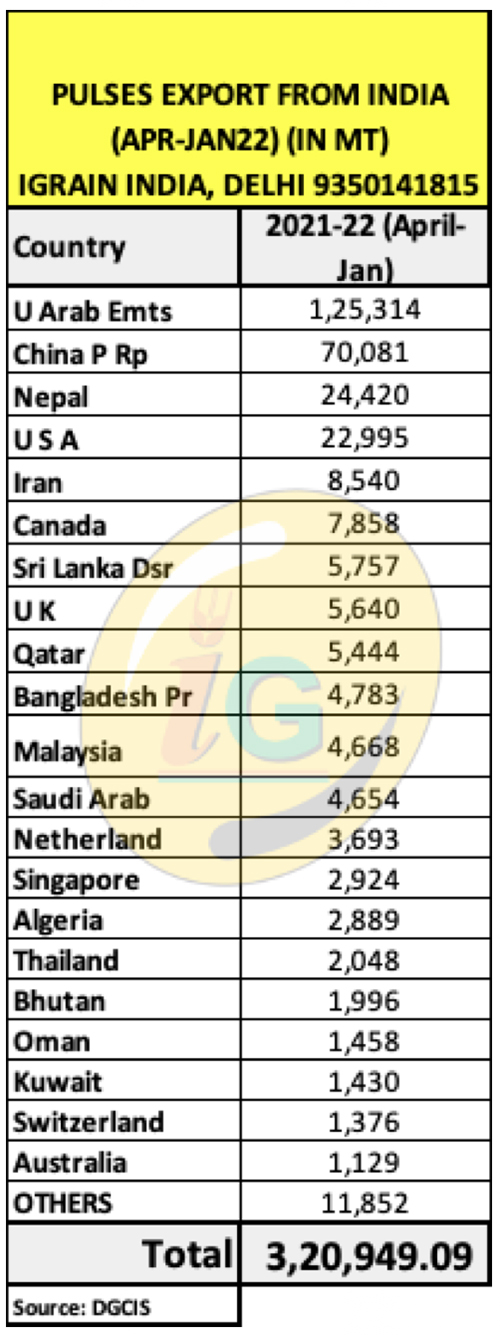

The Government agency NAFED is procuring tuar at the MSP of Rs.6,300 per quintal. As prices are close to or above the MSP, procurement is very low. According to figures provided on an online portal on March 7, only 15,110 MT of tuar has been procured. In the last Kharif procurement season, 1,481 MT of urad and 16,877 MT of tuar were procured.

The price of lentils is much higher than the government support price and it seems unlikely that it will come down even when new goods start arriving steadily in the mandis. Supplies of urad and moong will increase in South India. Pulses prices may get some support if the demand for pulses increases.

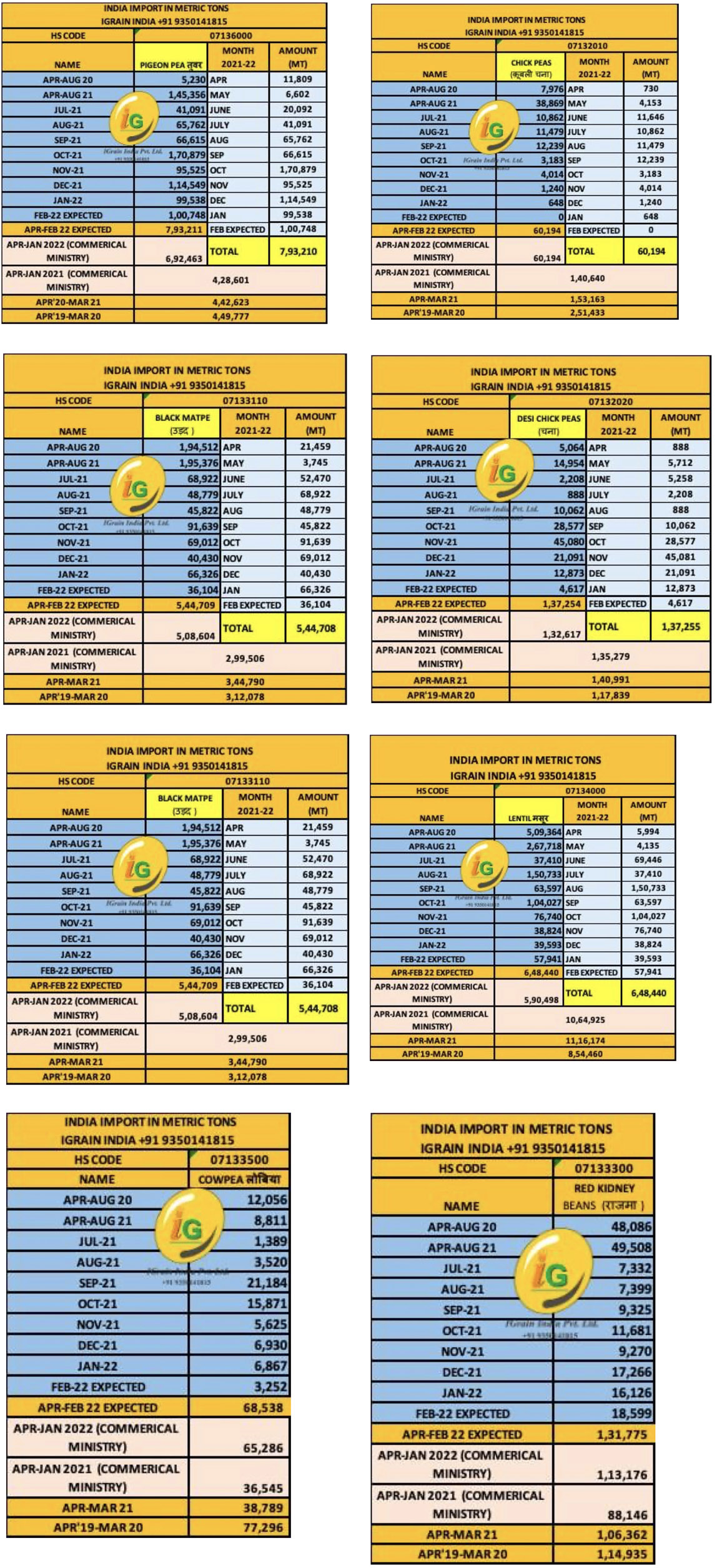

New Delhi. The Central Government has extended the time limit for free imports of urad (black matpe) and tuar (pigeon pea) by one year with a view to increase supply and availability in the domestic division and keep prices at a reasonable level. The period of free import was set to end on March 31, 2022 but the notification no. 63/2015-20 issued by the Directorate General of Foreign Trade (DGFT), a body under the Union Ministry of Commerce, dated March 29, 2022, states that the import of urad under ITC (HS) code 07133110 and Tuar under HS Code 07136000 will be in the 'free' category until March 31, 2023. Before this notification, imports with the Bill of Lading dated until March 31, 2022 were allowed to reach Indian ports by June 30 of the same year.

The import extension is a precautionary step resulting from domestic production of both urad and pigeon pea showing signs of decreasing. Urad is mainly imported into India from Myanmar while tuar is imported from Myanmar and some African countries. With the extension of the free import period, the pressure on the prices of both pulses in the domestic division may increase for a short period.

The extension is a consequence of many meetings with concerned members and associations of the pulses industry, who were asking for long term policies and shows that the government is taking a serious attitude towards the pulses industry.

Difference between actual and estimated figures

New Delhi. The rabi production estimate released by the Union Agriculture Ministry last month has created confusion, doubt and uneasiness in the domestic market. Industry-trade organizations are not satisfied with the government production estimates and believe that they have been inflated. The rabi production estimates of wheat, maize, gram and mustard are the main ones that have been called into question.

According to the government data, wheat production has increased from 109.6 million tons to a new record of 111.3 million tons. However, organizations believe that the actual output could be 10-15 percent less than the government figures.

According to the Agriculture Ministry, the total sown area of rabi pulses is 1.68 lakh hectares with total production expected to be 183 lakh tonnes. Under this, the production estimate of gram has increased from 115 lakh tons last year to 131 lakh tons. Nevertheless, most analysts believe that total production will not exceed 100 lakh tons, meaning that the official figure is about 30% higher than the business estimate.

It appears that in third advance estimate in May, the government will make up the changes in the production figures

The production estimate of Kharif pulses has already been reduced from 95 lakh tons to 86 lakh tons between the first and second advance estimates. The production estimate of Rabi pulses may also be reduced in the third advance estimate.

Differences in industrial and governmental production data creates problems when it comes to making policies and running inventories.

Government procurement of mustard started in Haryana - purchase of remaining crops from April 1

Chandigarh. In Haryana, the process of government procurement of mustard formally started on March 21 while the procurement of wheat, gram and barley will start on April 1. According to official sources, the procurement of wheat will be done from April 1 to May 15 and 398 mandis and purchase centres have been opened across the state for this purpose. Likewise 11 have been opened for gram, 25 for barley and 93 for the purchase of mustard. The central government has fixed the MSP for wheat at Rs. 2,015 per quintal, gram at Rs. 5,230 per quintal, barley at Rs. 1,635 per quintal and mustard at Rs. 5,050 per quintal for the current Rabi marketing season.

Rabi chana procurement has already started in Gujarat, Maharashtra, Karnataka and Madhya Pradesh and will start in other states on April 1.

Rabi harvesting in full swing

New Delhi. Major rabi crops, including gram and mustard, are being harvested vigorously in most parts of the country. The pace of wheat harvesting, however, is off to a relatively slow start although the speed is likely to increase from April onwards.

According to government data, total wheat area in the current Rabi season is 343.26 lakh hectares, with harvesting complete in 8 percent of the area. Similarly, out of the total sown area of 168.27 lakh hectares of Rabi pulses, harvesting is complete in 47 percent of the area. In the data released by the Union Ministry of Agriculture for harvesting readiness of Rabi crops, it was reported that the wheat crop is still in various stages of progress and maturity in most of the major producing states.

The sowing area of gram reached a new level of 114.95 lakh hectares this rabi season while the area of lentils was 17.71 lakh hectares. So far, 46% of the gram crop has been harvested and 44% of the lentil crop. Similarly, 55% of the total production area of 102.79 lakh hectares of oilseed crops has been harvested.

Summer crops sowing in full swing

New Delhi. An overview of the latest weekly data of the Union Ministry of Agriculture shows that the total area under summer (zaid) crops during the current year has improved to 38.03 lakh hectares as of March 17, 2022. The area is 20 thousand hectares more than the 37.83 lakh hectare sown last year. Within the last week, the area has increased by about 4 lakh hectares, clearly indicating strong interest in sowing from farmers.

According to the data, the total area of summer paddy has come down from 26.65 lakh hectares last year to 25.39 lakh hectare this year. However, the sown area of pulse crops increased from 2.74 lakh hectares to 3.46 lakh hectares in the same period. Under this, an increase was recorded in the area of two major pulse crops – urad and moong.

On the other hand, the area under oilseed crops fell from 5.45 lakh hectares in last year’s summer season to 5.26 lakh hectares this year. Sowing of coarse cereals, however, increased from 2.48 lakh hectares last year to 3.10 lakh hectares. In many areas, sowing is still in process. The temperature has started increasing in the central and north-western parts of the country, which will likely have an impact on sowing, but the weather conditions in eastern India and the southern states are still favorable for sowing. Prices of pulses have softened due to a pick-up in supply of Rabi crops. Rice prices have remained stable to a large extent but both maize and oilseeds are trading at higher levels. The arrival of some other summer crops, including moong and urad, will likely start in May.

Government of India agrees to abolish fumigation fines on Canadian pulses imports

New Delhi. The Trade Minister of Canada visited Delhi at the beginning of March to hold talks with the Government of India. During the meeting, the Government of India decided to waive the fumigation fines on pulses imported from Canada, which will bring a huge relief to Canadian pulse producers and exporters as, for the past several years, this fine was affecting the pulses business.

Canada's trade minister has said that until a definitive resolution to the matter is found, there will be no fumigation penalty on shipments of Canadian pulses to India. Pulse Canada has also issued a statement welcoming the announcement of relief in the fumigation penalty. On March 11, Canada's Trade Minister met the Union Minister of Commerce and Industry in New Delhi and both sides announced the resumption of talks on the Integrated Economic Partnership Agreement (IEPA), a discussion that has been stalled since 2017. In addition to the resumption of negotiations for a free trade treaty (FTA), the two sides have also agreed to enter into an advance progress agreement that includes sanitary and phytosanitary resolutions. It was also agreed that they would work together to understand and validate the process to be followed regarding pest risk management in Canada. The chemical methyl bromide is not used for fumigation of ship-loaded pulses at Canadian ports as usage is banned in Canada. India, on the other hand, has agreed to indefinitely suspend duties on essential fumes for Canadian pulses shipments until a permanent solution is found.

Domestic demand for pulses is estimated to reach 326.40 lakh tonnes by the year 2030.

New Delhi. The total demand for pulses in India is expected to jump to 326.40 lakh tons by 2030, a huge increase from the current demand of 267.20 lakh tons. The Union Agriculture Ministry has estimated the domestic production of pulses at 269.60 lakh tons during the current marketing season, which is 2.40 lakh tonnes more than the total demand and consumption of 267.20 lakh tonnes. The Union Minister of State for Food, Consumer Affairs and Public Distribution indicated that a working group was formed by NITI Aayog to estimate the demand and supply for the period up to the year 2033. Aayog was entrusted with the responsibility of estimating the demand and supply of various agricultural crops, livestock and agricultural inputs. Report shows that domestic demand and consumption of pulses will continue to increase regularly. A National Food Security Mission has been implemented by the Ministry of Agriculture, which is a centrally sponsored scheme with the objective of increasing the production of rice, wheat, pulses, coarse cereals and nutritious cereals.

Many districts have been identified in which a special emphasis will be given to increase soil fertility and the productivity of crops. The average productivity rate of various pulse crops in the country is still very low. During the current marketing season, the average yield rate of tuar is 825 kg per hectare, 1221 kg per hectare for gram, 586 kg per hectare for urad, 596 kg per hectare for moong and 973 kg per hectare for masoor.

Abbreviations

Tuar/ Arhar: Pigeon Peas PP

Mung: Green Mung

Urad: Black Matpe

Chana: Gram, Desi Chickpea

Matar: Pea

Masur: Lentil

Besan: Gram Flour

Mandi: Market yard

Bhav: Prices

Dal/Daal: Processed Pulses (Directly for human consumption)

Rs: Indian Rupees (1$=Rs 75.9) 30 March, 22 at 04:27 PM IST

Rahul Chauhan

Director, IGrain India

igrainind@gmail.com

+91 9350141815

Twitter igrain_india

IGrain / Rahul Chauhan / India / Burma / Delhi / Maharashtra / Madhya Pradesh / Rajasthan / Urad Dal / Pigeon Pea / Lentil / Cowpea / Red Kidney / Black Matpe / Desi Chick Peas / Chick Peas

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.