December 30, 2020

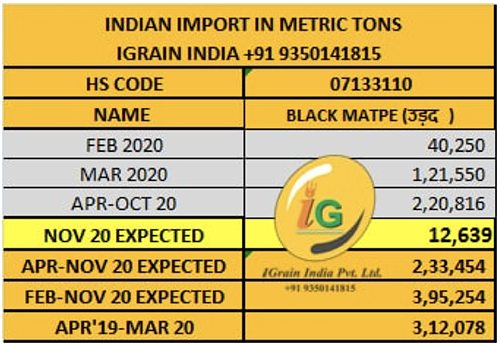

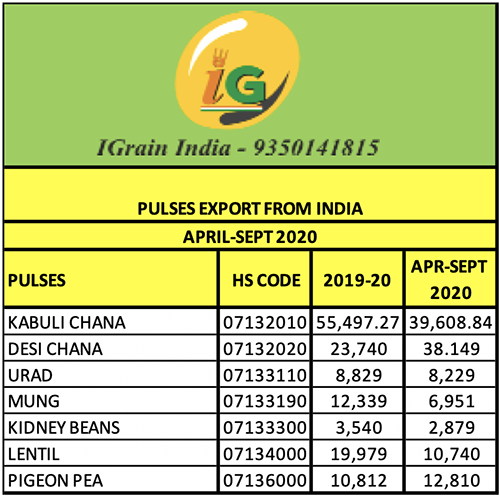

IGrain’s Rahul Chauhan provides information on pricing and current inventories, as well as import figures and news from domestic and international markets.

Urad: Prices Drop on Lower Demand

Mumbai Port

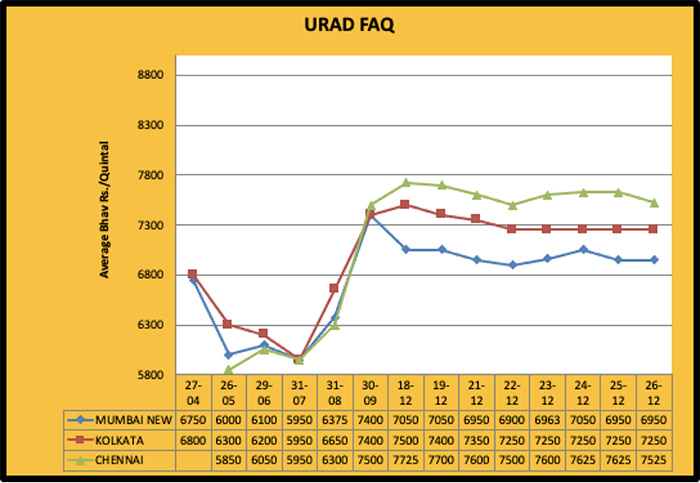

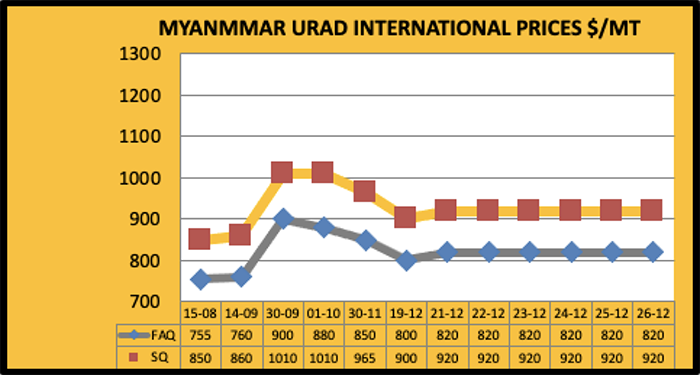

Lower demand and selling pressure drove prices down. Millers buying as per need. During last week, Burma FAQ Urad at the port traded $820 and SQ $920/MT, on par with previous week prices. Urad prices at port declined by Rs 50/100. As a result, the price of Mumbai FAQ old crop was Rs. 6,900/100 kg and new crop traded at roughly Rs. 7,000.

Chennai Port

Traded prices at Chennai Port FAQ were Rs. 7,275 and SQ Rs. 7,975; Kolkata Port was Rs. 7,250 per quintal. Urad demand is expected to increase, consequently reducing further drop in prices.

New Delhi

Urad business in Delhi remained sluggish due to lower prices at ports. Due to the farmers' protest, Delhi surroundings are closed. During the current week, Urad prices in Delhi dropped by Rs 100 to Rs. 7,300 FAQ, SQ 8,300 and desi 7,700. Urad demand is expected to be normal this week.

Maharashtra

Millers offtake declined and prices declined by Rs. 100-300. Traded prices at Jalna were Rs. 3,500-5,800, Akola Rs. 4,200-6,000, Jalgaon Rs. 7,275-7,550 and Ahmednagar Rs. 7,100-7,300 per quintal. Demand is expected to improve.

Uttar Pradesh

Urad buying in Uttar Pradesh was weak. Stockists sold in line with demand, so there was no movement in prices. By end of previous weekend, the traded prices at Bareilly were Rs. 6,950/7,000, Gwalior Rs. 5,200-6,200 rupees, Jhansi Rs. 5,800-6,200 per quintal.

Madhya Pradesh

Urad buying queries were less among millers/processors. During last week, prices declined by Rs. 100/200. With this decrease, the price at Bina market yard was Rs. 3,500-6,200, Ganjbasoda Rs. 2,000-6,000 and Ashok nagar Rs. 4,000-5,800 per quintal over the weekend.

Other Markets

No fluctuations observed in Dahod, where price remained at Rs. 5,500-6,000 per quintal. Gulbarga Urad was also reported steady at Rs. 4,000-4,800 per quintal. Vijayawada Urad recorded a drop of Rs. 200 rupees and was traded Rs. 7,100-7,300 per quintal.

So far Urad has been sown in 5.75 lakh hectare this Rabi season compared to 5.69 lakh hectare in the same period last year. Urad production is estimated to be on par or higher than previous year. No damage reported Pan India.

Urad dal (Processed Urad)

Urad's market downfall has affected Urad Dal: Weak buying during the current week led to a decline by Rs 100/300, with prices reported at Rs 7100/10450 per quintal.

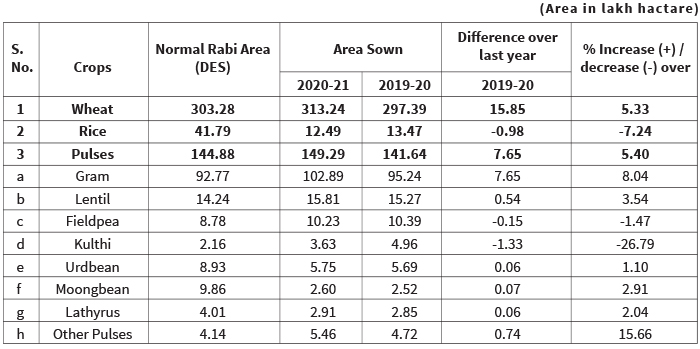

Pulses Production in Rabi Season to Increase

Pulse production in India (gram especially) could increase significantly due to a higher sowing area during the current Rabi season and the favourable weather conditions so far.

The Government’s production target is 15.7 million tonnes of pulses in the Rabi season while analysts forecast around 1.5 million tonnes. This would be the third largest rabi production ever, following 2019-20’s production of 15.44 million tonnes and 2017-18’s 16.11 million tonnes.

Rabi pulse sowing reached 14.929 million hectares on December 24.

Analysts estimate production of 10.5 million tonnes of gram, 1.3 million tonnes of lentils and 0.6 million tonnes of moong during the current Rabi season. However, a senior NAFED official pointed out that lentil production could be more than 1.3 million tonnes: The government’s lentil production target is 1.6 million tonnes for the 2020-21 current Rabi season of 2 million tonnes for next year. If this target is achieved, the country's dependence on lentil imports will decrease significantly.

8.50 lakh tonnes of lentils have been imported into India. Another 50,000 to 100,000 MT may be imported before the end of the duty reduction period on Dec 31. As of January 1, 2021, the import duty on lentils will again increase from 10% to 30%.

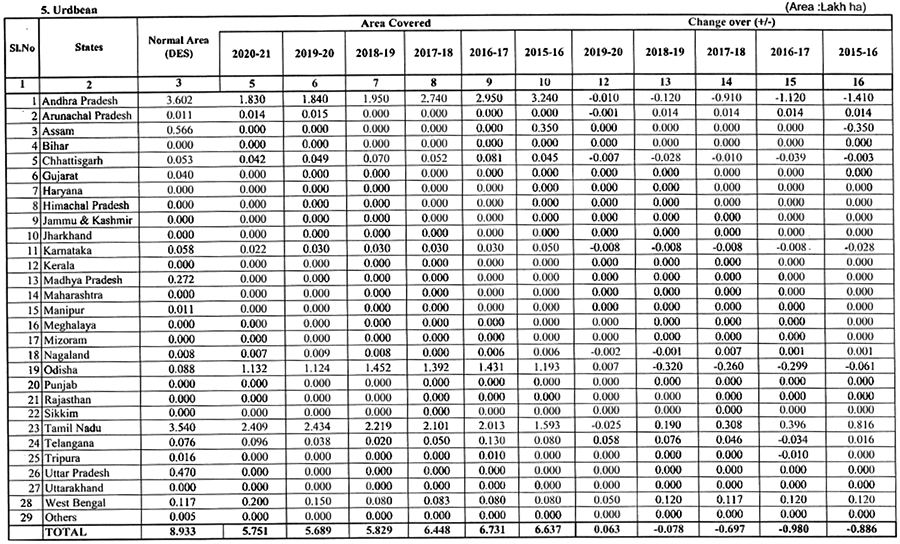

Urad sowing Lower than Average

The area under rabi urad reached only 5.75 lakh hectare this week compared to 5.69 lakh hectare in the same period last year and about 3.18 Lakh hectares behind the average area of 8.93 lakh hectare.

5.89 lakh hectares were recorded in 2018; 6.44 lakh hectares in 2017; 6.73 lakh hectares in 2016; and 6.637 lakh hectares in the Rabi season of 2015.

According to official figures, Urad area during the current Rabi season in Andhra Pradesh decreased from 1.84 lakh hectare to 1.83. In Tamil Nadu, it dropped from 2.43 lakh hectare to 2.40 lakh hectare.

During the Rabi season, urad is cultivated mainly in the southern and eastern states of the country.

Nafed Recorded a Profit of Rs. 670 Crores in Three Years

At the 63rd Annual General Meeting of the National Agricultural Cooperative Marketing Federation of India (NAFED), NAFED chairman informed that the agency’s total profit was Rs. 670 crores during the last three years.

According to the Chairman, the Board of Directors has approved a proposal to give the best dividend of 20% so far to the member federations and cooperatives. The Managing Director of NAFED said that the total business of the agency rose to Rs 16,281 crore during the financial year 2019-20 while the net profit was recorded at Rs 165.65 crore. This agency procures pulses and oilseeds from farmers under the price support scheme, maintains its buffer stock and helps regulate prices by selling both these categories of commodities in the domestic market as required.

During 2019-20, the agency procured over 33.03 lakh tonnes of pulses-oilseeds valued at Rs 16,066 crore nationally. NAFED also purchased about 1.12 lakh tonnes of pulses for buffer stock (reserved) worth Rs 648 crore. NAFED regularly supplies pulses to the Defence Department Army and various states. In addition, it sent humanitarian aid to Iran, Namibia, Myanmar and other countries.

Low Prices Raise Concern Among Government and Farmers

There is a growing concern by farmers and the government as well as stockists and pulses millers in view of the declining prices of pulses. Tuar Dal prices fell by Rs. 200, Chana Dal by Rs. 100 and Urad Mogar by Rs .200 per quintal in a single day. The price of New Tuar Dal for delivery from Maharashtra to Indore dropped to Rs. 9,000-9,200 per quintal.

Buyer interest on old Tuar has declined as cheap new Tuar Dal enters the market. As a result, dal millers and traders may be forced to sell their goods by reducing margins or in losses. The pressure on gram and other pulses is expected to increase pressure on prices of other pulses.

Pulses processors in Madhya Pradesh are running at only half the capacity.

The future of the pulse market will depend on government procurement. But the real problem is the lack of demand: Due to the sharp fall in the prices of vegetables, consumption of pulses is being affected.

Pulses, Oilseeds and Cotton Government Procurement Continues

During the current Kharif marketing season, Nafed procured around 1.96 lakh tonnes of pulses and oilseeds worth more than Rs.1050.08 crore from more than 1.08 lakh farmers in states like Tamil Nadu, Maharashtra, Gujarat, Haryana and Rajasthan. Products purchased is at minimum support price include moong, urad, groundnut and soybean.

URAD SOWING: DEPARTMENT OF AGRICULTURE, COOPERATION & FAMERS WELFARE

Abbreviations

Tuar/ Arhar: Pigeon Peas PP

Mung: Green Mung

Urad: Black Matpe

Chana: Gram

Matar: Pea

Masur: Lentil

Mandi: Market yard

Bhav: Prices

Dal/Daal: Processed Pulses (Directly for human consumption)

Rs: Indian Rupees (1$=Rs 73-74)

Rahul Chauhan

Director, IGrain India

igrainind@gmail.com

+91 9350141815

Twitter igrain_india

India / Myanmar / Rahul Chauhan / Mumbai / Chennai / New Delhi / Maharashtra / Uttar Pradesh / Madhya Pradesh / Tamil Nadu / Andhra Pradesh / urad dal / tuar dal

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.