September 15, 2021

IGrain’s Rahul Chauhan provides information on pricing and current inventories, as well as import figures and news from domestic and international markets.

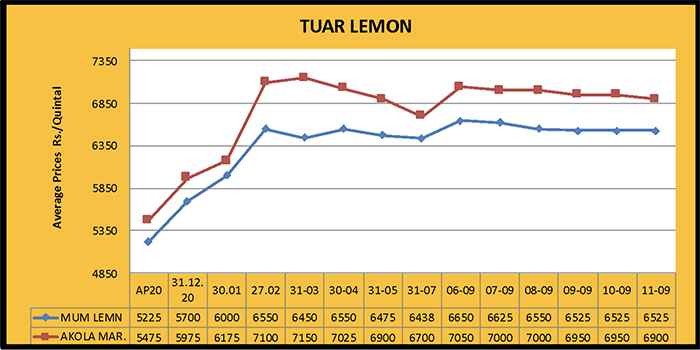

Prices down due to weak demand

Mumbai

Due to sluggish demand, Tuar prices remained down last week. Mumbai Tuar softened by Rs. 50, Tuar Lemon traded at Rs. 6,500/6,550, Arusa at Rs. 6,400, Gajri at Rs. 6,300 and Sudan at Rs. 6,700/6,750 per quintal. Similarly, in Chennai, tuar decreased by Rs. 50/100 and sold at Rs. 6500 per quintal at the weekend.

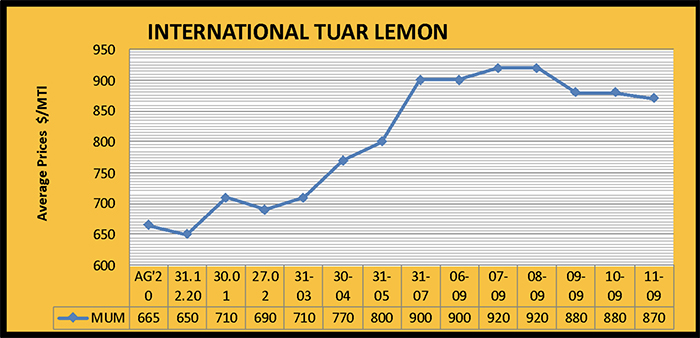

Burma

Due to weak demand from importers, Burma Tuar fell by $ 10/20 per tonne, With this drop, lemon tuar fell to $880 and linke tuar to $ 900 a tonne.

Delhi

Due to the decline in port prices, the Delhi market also reduced. Tuar Lemon prices decreased by Rs. 100, in Maharashtra they decreased by Rs. 100 and in Uttar Pradesh/Haryana by Rs. 200 per quintal. With this drop, the old lemon crop sold at Rs. 6,650 and the new crop at Rs. 6,850. In Maharashtra, prices were Rs. 6,850 and, in Uttar Pradesh and Haryana, Rs. 6,000 per quintal.

Maharashtra

In Maharashtra, tuar declined last week due to weak demand from pulses millers. In Latur, prices fell by Rs 100 and traded at Rs. 6,700/6,720. In Akola, prices fell by Rs 50 to Rs. 6,950, in Dudhni by Rs 50 to Rs. 6,550 and in Barshi by Rs. 100 to Rs. 6,300/6,500 per quintal.

Karnataka

Demand also remained sluggish in Karnataka and prices softened by Rs. 50 in Gulbarga, bringing the price down to Rs. 6,400/6,700 and to Rs. 6,500/6,800 per quintal for maruti tuar. In Bidar, tuar prices remained stable at Rs. 5,800/6,688 per quintal over the weekend.

Other

During the week, buying and selling remained sluggish in Katni. In Katni, tuar fell by Rs. 100 to Rs. 6,800/6,850 per quintal. Due to slow buying from pulse mills, there was no strong movement in Raipur this week and the local prices remained stable at Rs. 7,250 and in the Maharashtra line at Rs. 7,350/7,400 per quintal. Similarly, the prices in Kanpur remained at Rs. 6,700 per quintal over the weekend.

Tuar Dal

The demand for tuar dal remained slow. During the last week, there was a price decrease of Rs. 50/100, bringing the prices to Rs. 9,200/9,700 per quintal.

Extension of import period of tuar and urad

On September 13, the Union Ministry of Commerce announced its decision to extend the period of free import of pigeon peas (tuar) and mung beans (urad) with a BL date on or before December 31, 2021 and its clearance from ports until January 31, 2022. It is important to note that on May 15, 2021 the Commerce Department allowed the free import of these two pulses and included them under the ambit of the Open General License (OGL).

According to the announcement, the deadline for the free import policy of pulses has been extended until the end of December 2021 (BL date) while it should be cleared from the ports by January 31, 2022.

The government wants to check prices by increasing the supply and availability of pulses in the domestic division before and during the upcoming festival season. It is worth noting here that the arrival of the Kharif urad crop is likely to gain momentum in the domestic market as of next month, while in December and January the new crop of tuar will also be ready to harvest and will reach the mandis. If imports from abroad continue, the domestic market price of these two pulses may fall, making it difficult for Indian farmers to get high prices for their produce.

The price of these two pulses is high in the global market and the fares of ships and containers have also increased so imports are likely to be quite expensive. The good thing for the importers, however, is that, due to the extension, they will not have to make hasty contracts to purchase pulses at higher prices and can instead wait for prices to come down. Goods clearance is to be done by 31st January.

Slight change in retail and wholesale market prices of five major pulses

The wholesale retail market prices of five major pulses - chana dal, tuar dal, urad dal, mung dal and masur dal have seen slight fluctuations this month compared to last month. Data compiled by the Central Food and Consumer Affairs Department shows that the average retail market price of chana dal fell from Rs 75.73 per kg to Rs 75.31 per kg on September 6 2021, compared to 6 August. Tuar dal decreasd from Rs. 105.18 to Rs 105.15 per kg, urad dal from Rs 106.35 to Rs 106.13 per kg and mung dal from Rs. 101.54 to Rs. 101.24 per kg.

Masur dal was the only pulse that showed an increase, from Rs. 88.07 per kg to Rs. 91.17 per kg.

Last year on September 6, the average retail price was Rs. 67.62 per kg for chana dal, Rs 93.11 per kg for tur dal, Rs 96.62 per kg for urad dal, Rs. 101.43 per kg for mung dal and Rs. 77.40 per kg for masur dal.

The average wholesale market price of the above pulses also registered some fluctuations. Between August 6 and September 6, the price of gram dal increased from Rs. 6,711.05 to Rs. 6,941.85 per quintal, tuar dal from Rs. 9,540.98 to Rs. 9,566.50 per quintal and masur dal jumped from Rs. 7,829.47 to Rs. 8,307.32 per quintal. On the other hand, the average wholesale market price of urad dal declined from Rs. 9,593.89 per quintal to Rs. 9,575.61 per quintal and of mung dal from Rs. 9,101.06 to Rs. 9,051.90 per quintal.

On September 6, 2020, the wholesale price of gram dal is Rs. 6,123.02 per quintal, tuar is Rs. 8,618.31 per quintal, urad dal is Rs. 8,855.56 per quintal, mung dal is Rs. 9,288.06 per quintal and masur dal is Rs. 7,037.43 per quintal. Festive demand in pulses has not picked up yet but due to low stocks of gram, tuar, urad and masur, it is difficult to control the prices.

Permission to import 50,000 tonnes of tuar from Malawi at five ports

The Directorate General of Foreign Trade (DGFT), a body subordinate to the Union Ministry of Commerce, has determined the process of importing 50,000 tonnes of tuar from the African country of Malawi, according to a notification issued on September 6, 2021. Under this, Indian trading firms can import 50,000 tonnes of tuar from Malawi during the current financial year. It will be imported at five ports: Mumbai, Tuticorin, Chennai, Kolkata and Hazira.

Importers will have to produce a 'Certificate of Origin', from the Customs & Excise Division of Revenue Authority of Malawi and the same will be produced before the Stamp Department officials and the CBIC. This certificate of origin should include full details of the exporter, the importer and the quantity of pulses. After production of this certificate, the authorized officer will send a scanned copy of the same to the DGFT via e-mail. Importers in India will send a copy of this certificate to the DGFT, along with the details of the IEC so that an NOC (No Objection Certificate) can be granted.

The DGFT will reconcile these two documents and, based on that, the NOC will be issued to the applying importer. Then, the consignment of pulses imported from Malawi will be given clearance by the Customs Department. A five-year agreement has been signed between the Indian and Malawian governments for the import of tuar.

Process to import 2.50 lakh tonnes of urad and 1 lakh tonnes of tuar from Myanmar

New Delhi. The Directorate General of Foreign Trade (DGFT) has also laid down the procedure for allowing the import of 2.50 lakh tonnes of urad and 1.00 lakh tons of tuar from Myanmar during the current financial year for private traders. Under this, private traders can order consignments of these pulses at five major ports: Mumbai, Tuticorin, Chennai, Kolkata and Hazira.

The government has signed an agreement with Myanmar under which India will issue an import quota of 2.50 lakh tonnes of urad and one lakh tonnes of tuar from Myanmar for every financial year. This cycle will start from the current financial year (2021-22) and continue until 2025-26. Certain conditions have been prescribed for importers, such as that importers will have to submit an official Certificate of Origin before the Trade Department of the Ministry of Commerce in Myanmar. This certificate should also be presented to the Custom Department officials and the CBIC upon arrival at the Indian ports.

After scanning this certificate, the officials of the Customs Department will send a copy of it to the Directorate General of Foreign Trade. Importers will have to send a copy of their original certificate of origin to the Directorate General at their own level. Then, both the copies will be reconciled and a No Objection Certificate will be issued to the importers, on the basis of which the Customs Officer will provide clearance to the imported consignment of pulses at the ports.

Center approves procurement of 40 thousand tonnes of pulses under PSS in Karnataka

New Delhi. Before the start of the steady arrival of Kharif crops, the Central Government has approved the purchase of 40,000 tonnes of pulses from farmers in Karnataka under the Price Support Scheme (PSS). The government will already increase the minimum support price of pulses to 5 percent. These 40,000 tonnes of pulses will be procured by the central agency, NAFED. However, the arrival of new mung crops in Karnataka has already started. A statement by the Union Food Ministry said that the arrival of Kharif crops will start soon in various states of the country.

Strong supply is expected to start in Karnataka from mid-September, while prices are currently hovering around Rs 6,200 per quintal, well below the minimum support price of Rs. 7275 per quintal. The average price of mung at the national level is estimated at around Rs. 6,420 per quintal. In the current season of 2021-22, the support price of urad and tuar has been increased by 5 percent and that of mung by 1.1 percent, as compared to last year. During the 2020-21 season, about 12 lakh tonnes of pulses and oilseeds were procured by the Center and more than 700,000 farmers of the provinces were benefitted.

Stock of pulses in the Free Ted Zone expected to get clearance

New Delhi. As the festive season approaches, the central government is showing a propensity to increase the supply and availability of pulses in the domestic division and to both ease the rules and conditions and liberalize policies to curb prices. The stock of pulses that has been waiting for clearance in the Free Trade Zone at the ports for a long time is expected to be allowed soon. According to experts, last week there was a long discussion between a well-known organization and the Central Government on the issue of giving clearance to the consignment of these imported pulses. Although nothing has been confirmed about the outcome or details of that meeting at the moment, it seems that the government is adopting a liberal approach. According to rough estimates, there is currently a stock of about 12,000 tonnes of pulses in the Free Trade Zones of various ports, due to which vigorous efforts have been started to get clearance.

In another development, Russia has expressed its desire to export lentils into India. Russian lentils have not previously been allowed into India due to the high pesticide content and the presence of some banned insects and pests. A few days ago, Pradeep Jindal and Vivek Agarwal started a campaign to open the import of lentils from Russia on a one-time basis for 6 months due to the decreased Canadian production and prices jumping to record highs. The government is understood to have agreed to the proposal in principle but no official announcement has been made yet.

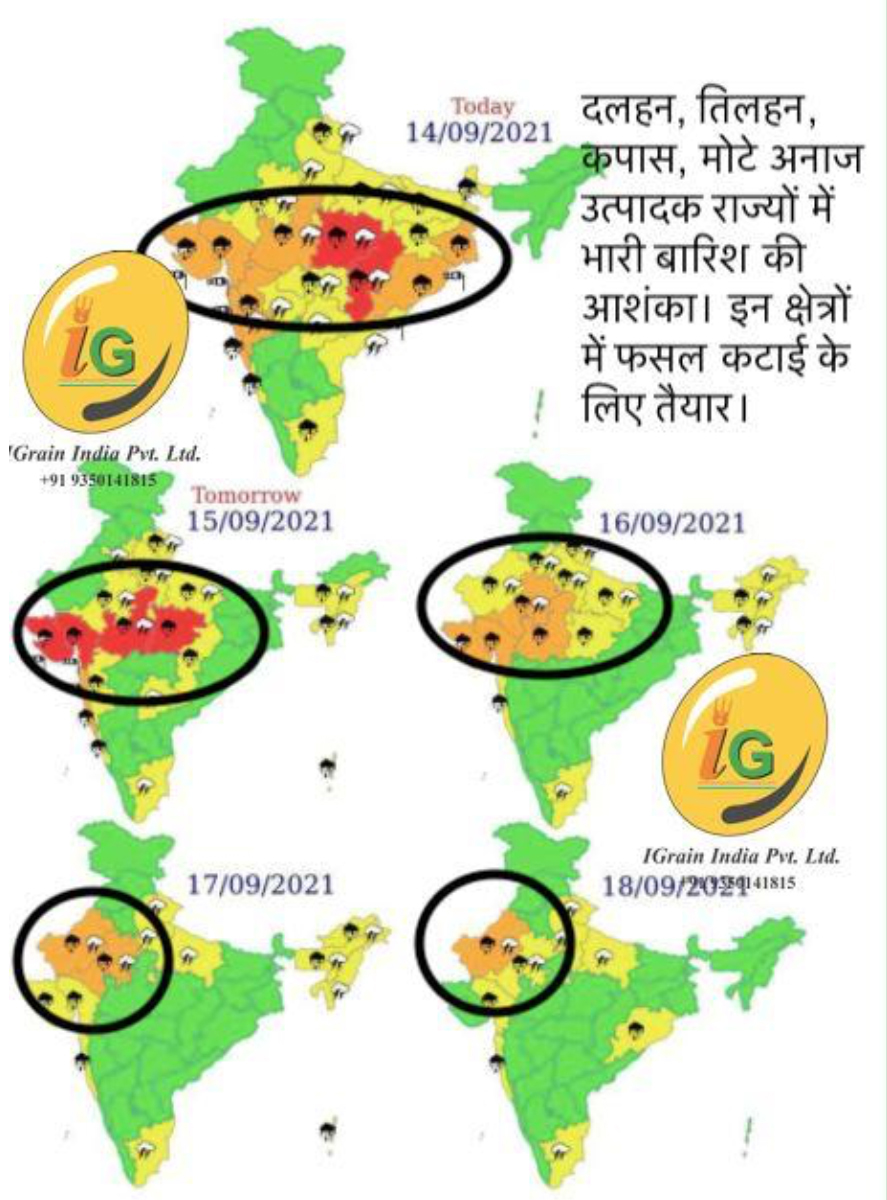

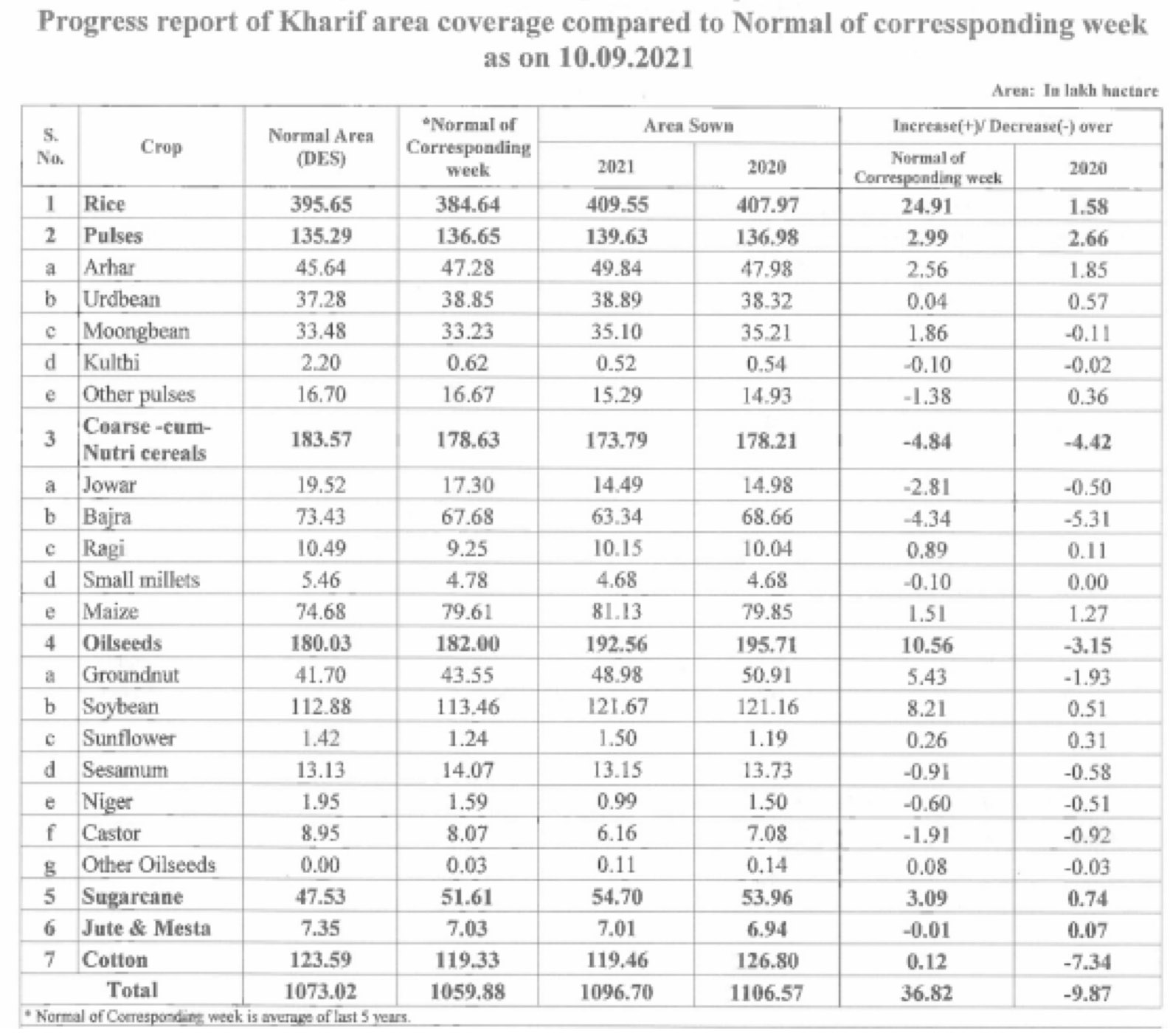

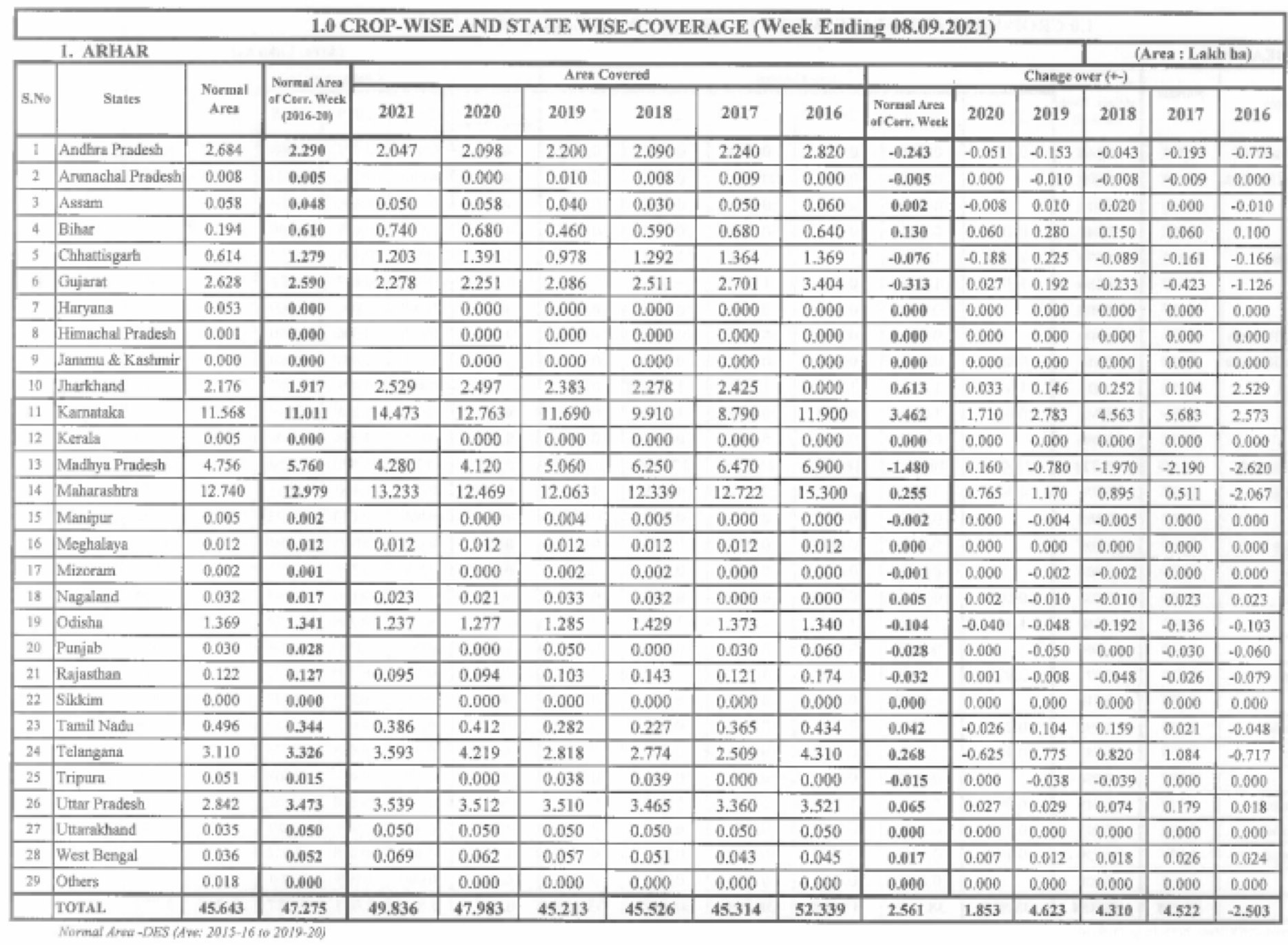

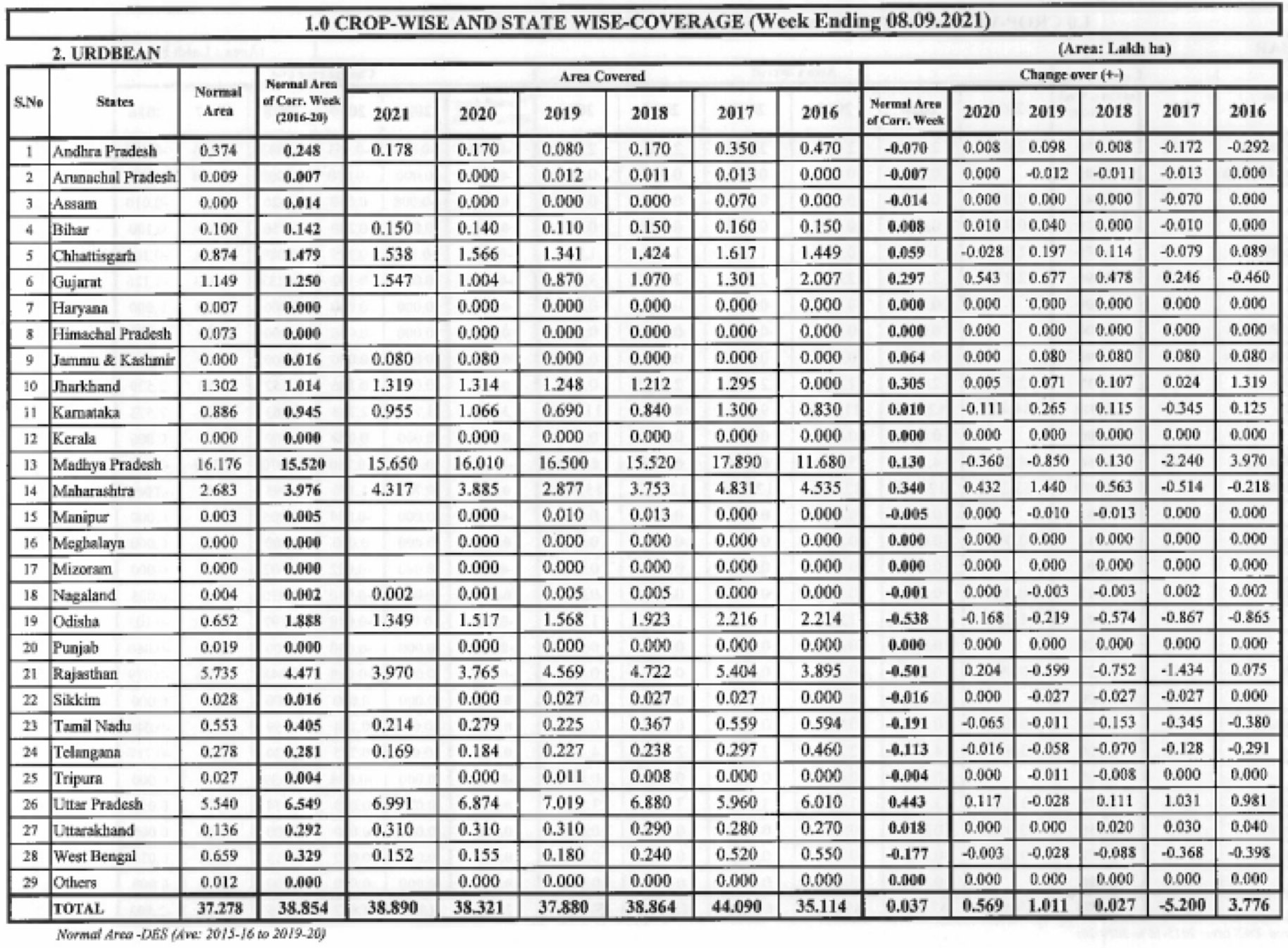

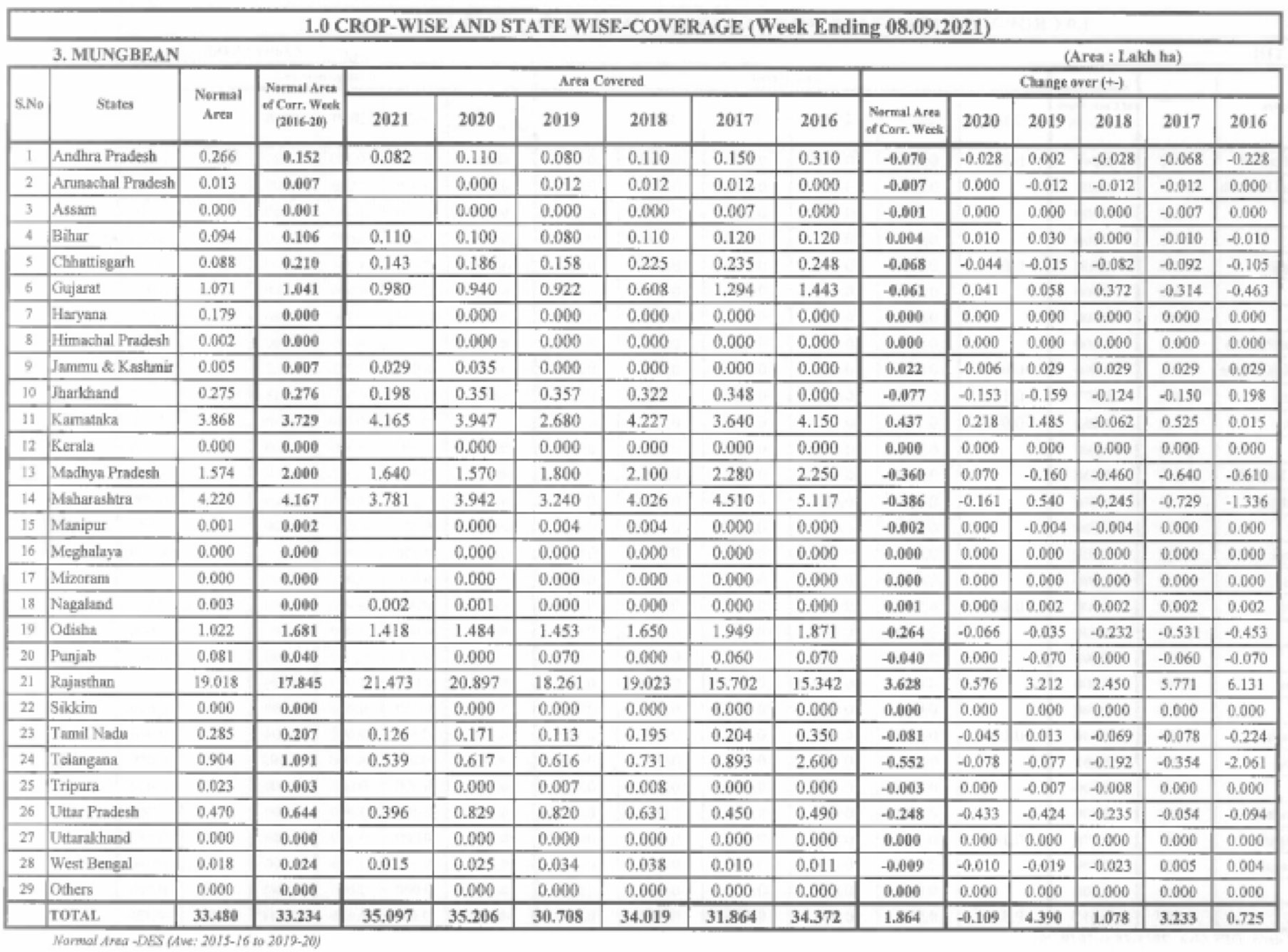

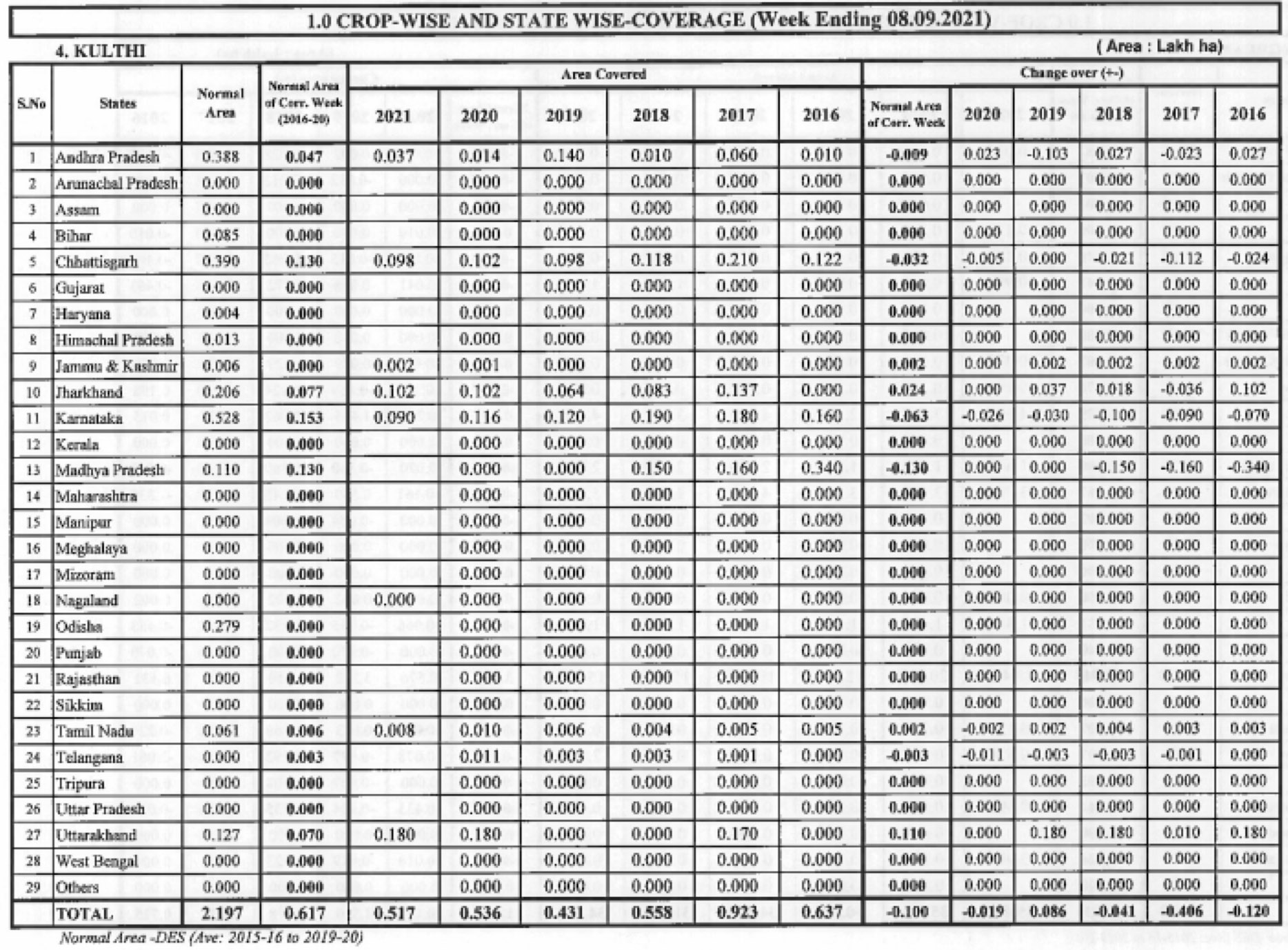

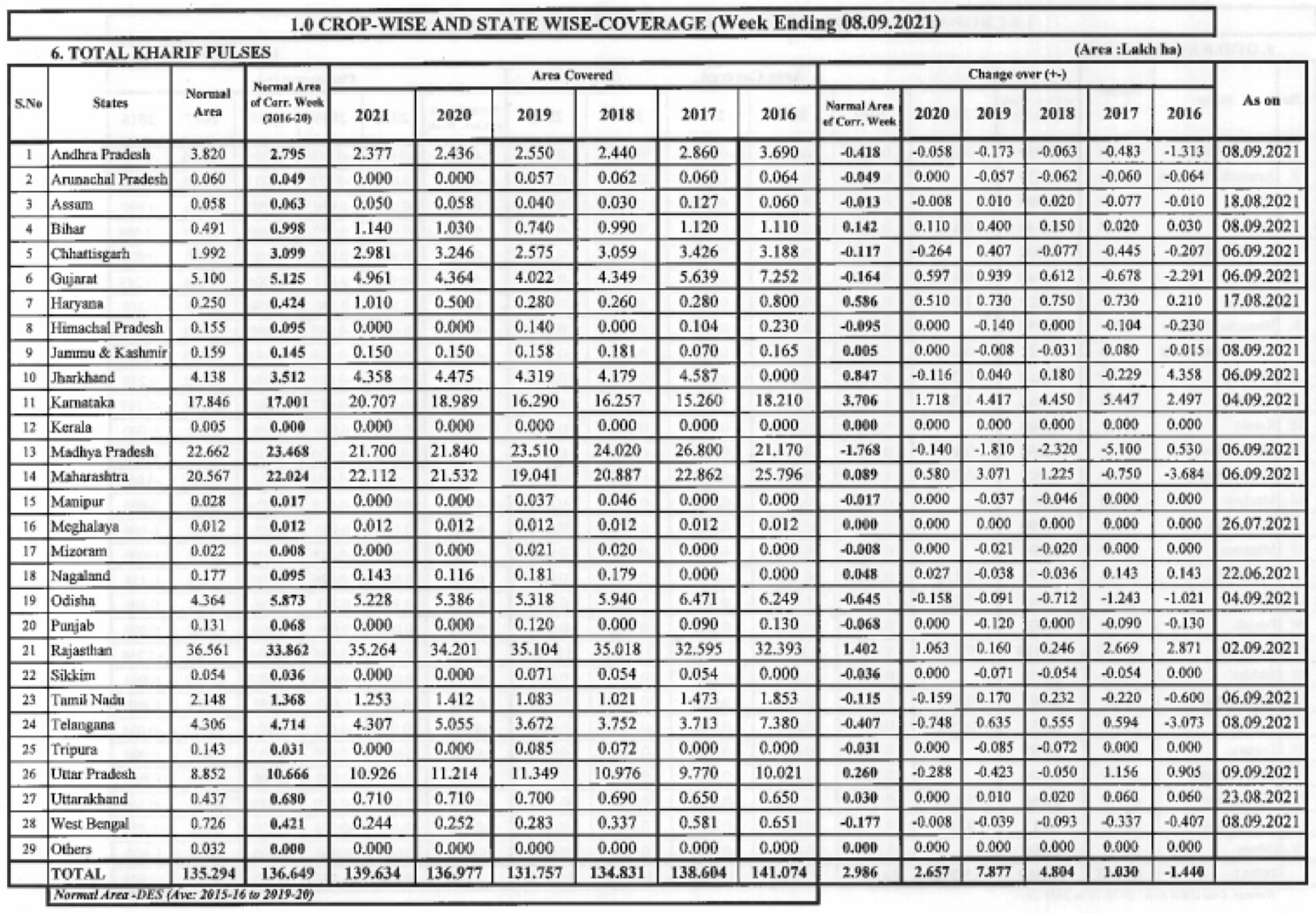

Despite increase in sowing, production of pulses likely to decline

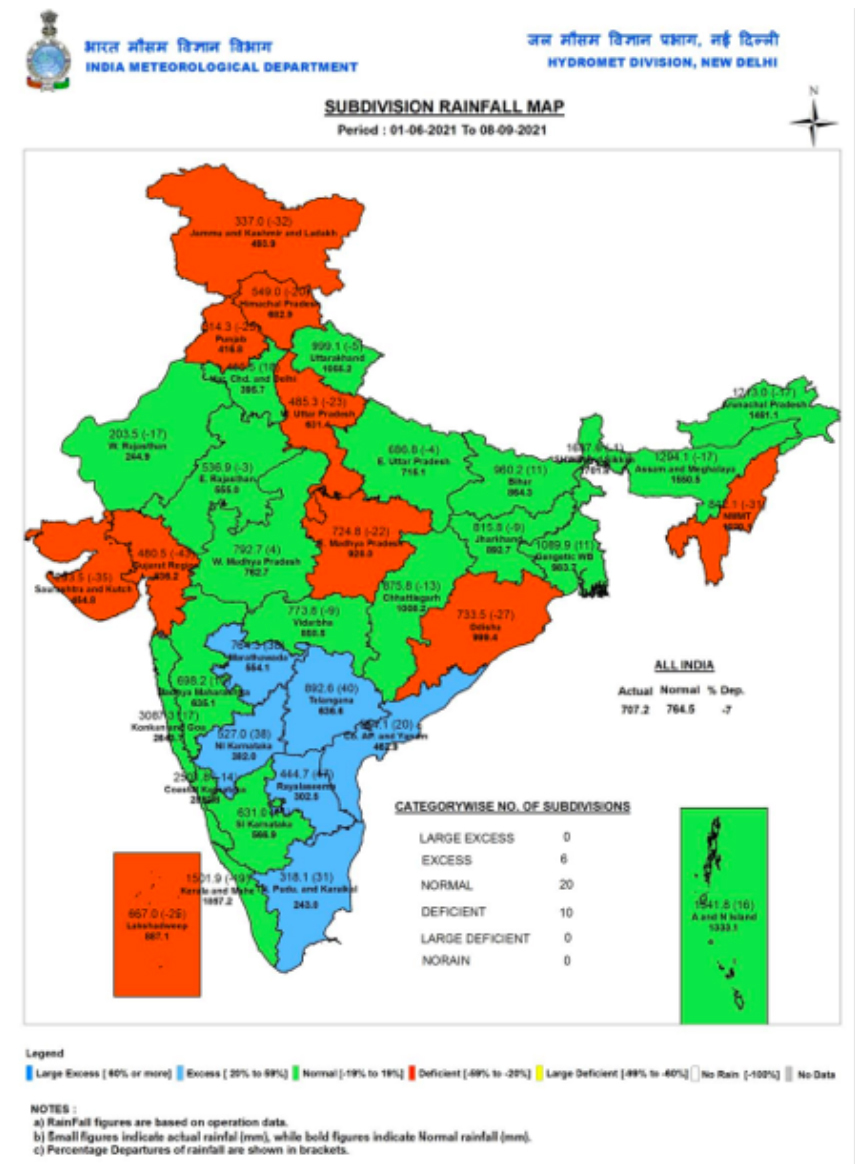

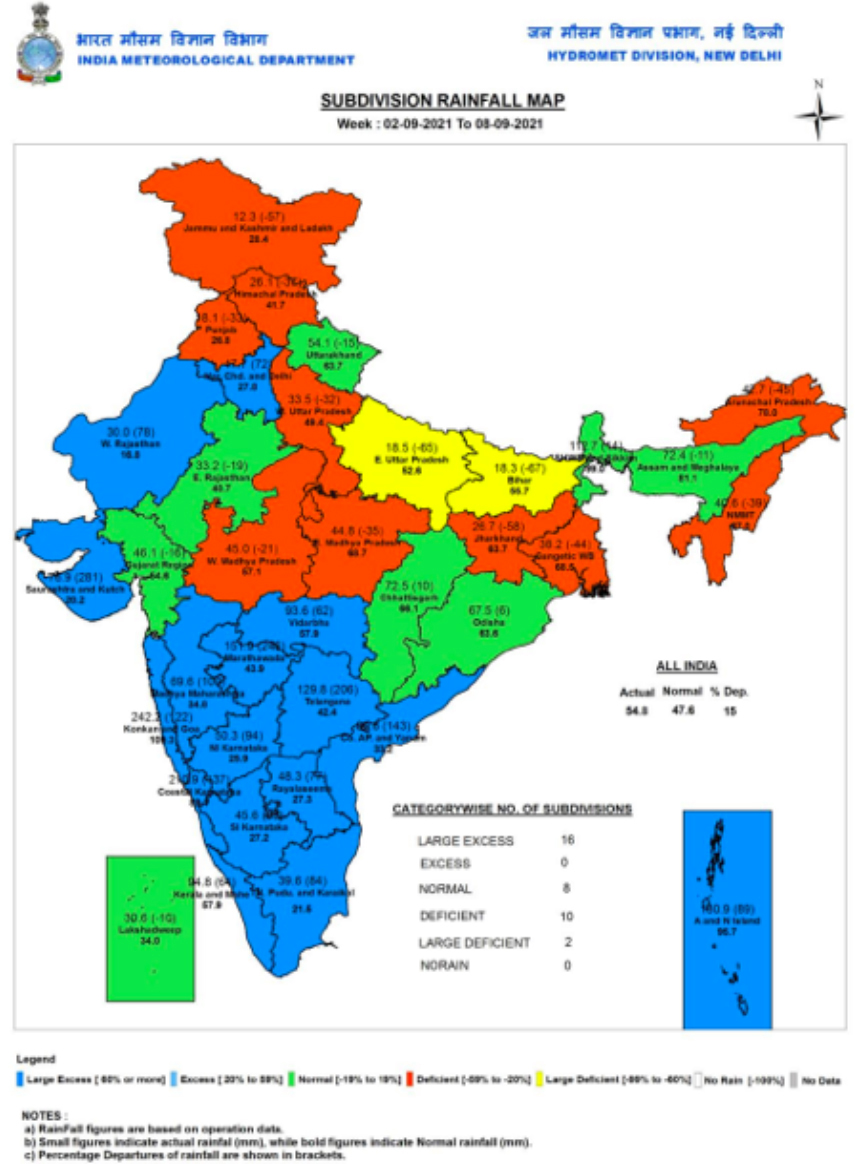

New Delhi. Although sowing of pulse crops has increased from last year, in view of the weather and monsoon conditions, there are concerns about production. The government has set a target of 98 lakh tonnes of Kharif pulses production but this seems difficult to reach given the actual production of around 80 lakh tons. According to government data, 79 lakh tonnes of pulses were produced in the Kharif season of 2019-20, which increased to 87 lakh tonnes in 2020-21.

This production figure is much higher than the industry trade sector estimates. However, this year the sown area of Kharif pulse crops is slightly lower than average. Due to heavy rains in some areas and drought in others, the sowing of pulses was stopped before the appointed time and many crops have suffered damage. States like Maharashtra, Andhra Pradesh and Karnataka are still in the rainy season, which can prove to be very harmful for mung and urad crops. Gujarat and Western Rajasthan had lower than average rainfall for a long time causing crops to dry up in some places. Tur, urad and mung are produced on a large scale during the Kharif season. In Karnataka and Maharashtra, a new crop of mung is ready and is arriving in the mandis, while in other states, including Madhya Pradesh, a new crop of urad is likely to arrive soon. The chances of rain damage are increasing.

The arrival of new mung has also started in the Kishangarh line of Rajasthan. The supply of summer mung is still going on in Uttar Pradesh, Madhya Pradesh and Karnataka.

In the case of crop damage, the market price of pulses will remain high. The price of gram, tuar, masur and urad is already high, and now some ideas around mung prices have also started forming.

The first production estimates released by StatsCan show that there has been a sharp decline in this year’s yield of pulse crops in Canada compared to last year. The harvesting of the crops has reached the final stage and is likely to be over by mid-September. In Canada, pulses are mainly produced in the Western part with Saskatchewan, Alberta and Manitoba being the top three producing states. In some other provinces, including Quebec, there is a small production of pulses. It is interesting to note that, for the first time, the August StatsCan crop production report is not based on surveys of farmers. Instead, the agency has used a model-based approach in which the overall condition and progress of crops are closely monitored under satellite images, based on which the production is depicted. The production figure has been fixed on the basis of the condition of the crop until July 31, 2021, however in August the weather conditions continued to be poor.

On September 14, the production estimate will be re-evaluated and will include a review of the condition of the crop until August 31. The final production report for the whole year will be published in December and will be based on the farmer surveys. Canada is the largest producer and exporter of lentils and peas in the world and production for both has seen a sharp decline this year. After a prolonged period of severe drought, it started raining at the time of harvesting and the weather became cold. In Saskatchewan, the most prominent producing province, 76 percent of lentils and 81 percent of peas had been harvested by August 23, while chickpea harvesting was done in less than 20 percent of the area.

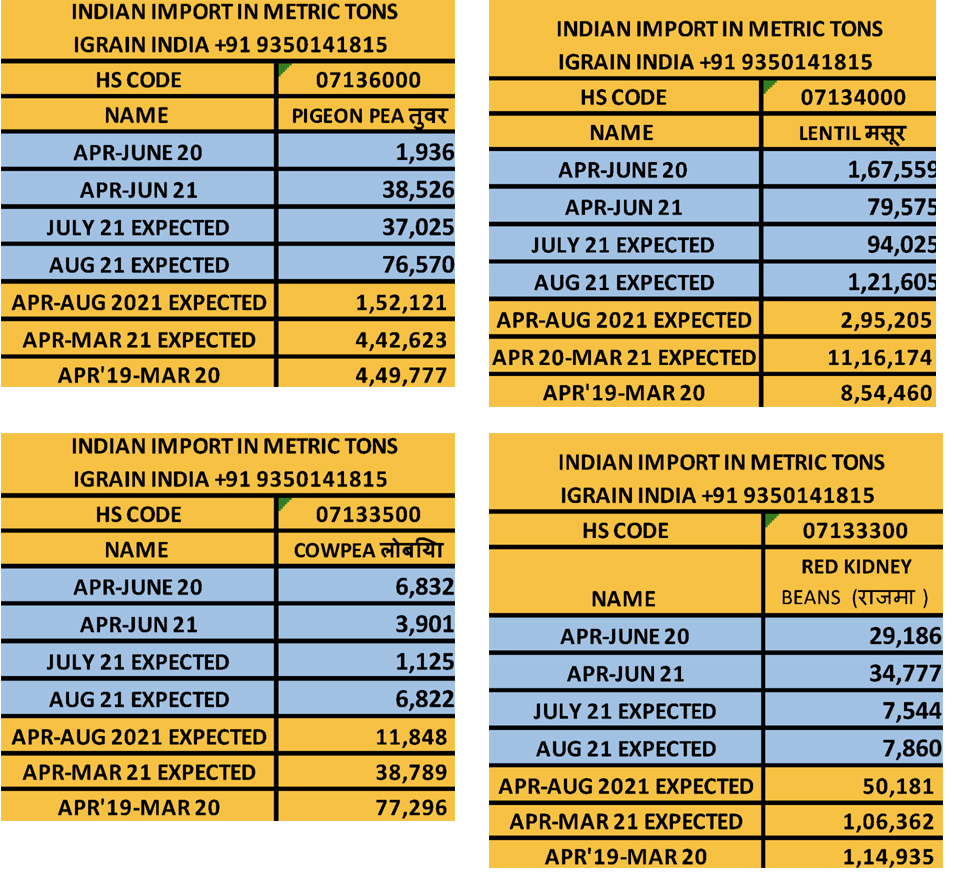

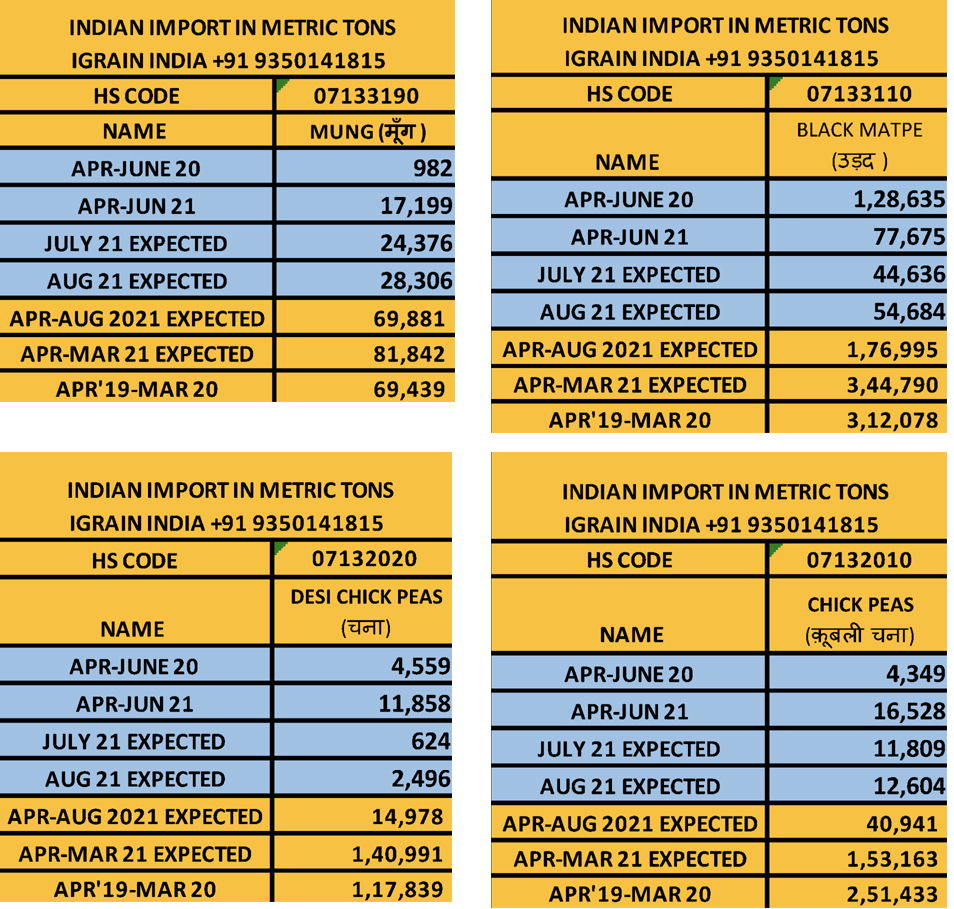

IMPORT FIGURES

Abbreviations

Tuar/ Arhar: Pigeon Peas PP

Mung: Green Mung

Urad: Black Matpe

Chana: Gram, Desi Chickpea

Matar: Pea

Masur: Lentil

Mandi: Market yard

Bhav: Prices

Dal/Daa: Processed Pulses (Directly for human consumption)

Rs: Indian Rupees (1$=Rs 73.43)

Rahul Chauhan

Director, IGrain India

igrainind@gmail.com

+91 9350141815

Twitter igrain_india

IGrain / Rahul Chauhan / India / Tuar / Pigeon Pea / Lentil / Mumbai / Burma / Delhi / Maharashtra / Karnataka / Tuar / Urad / Malawi / New Delhi / Myanmar

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.