January 5, 2022

IGrain India wishes you a Happy New Year. IGrain’s Rahul Chauhan provides information on pricing and current inventories, as well as import figures and news from domestic and international markets.

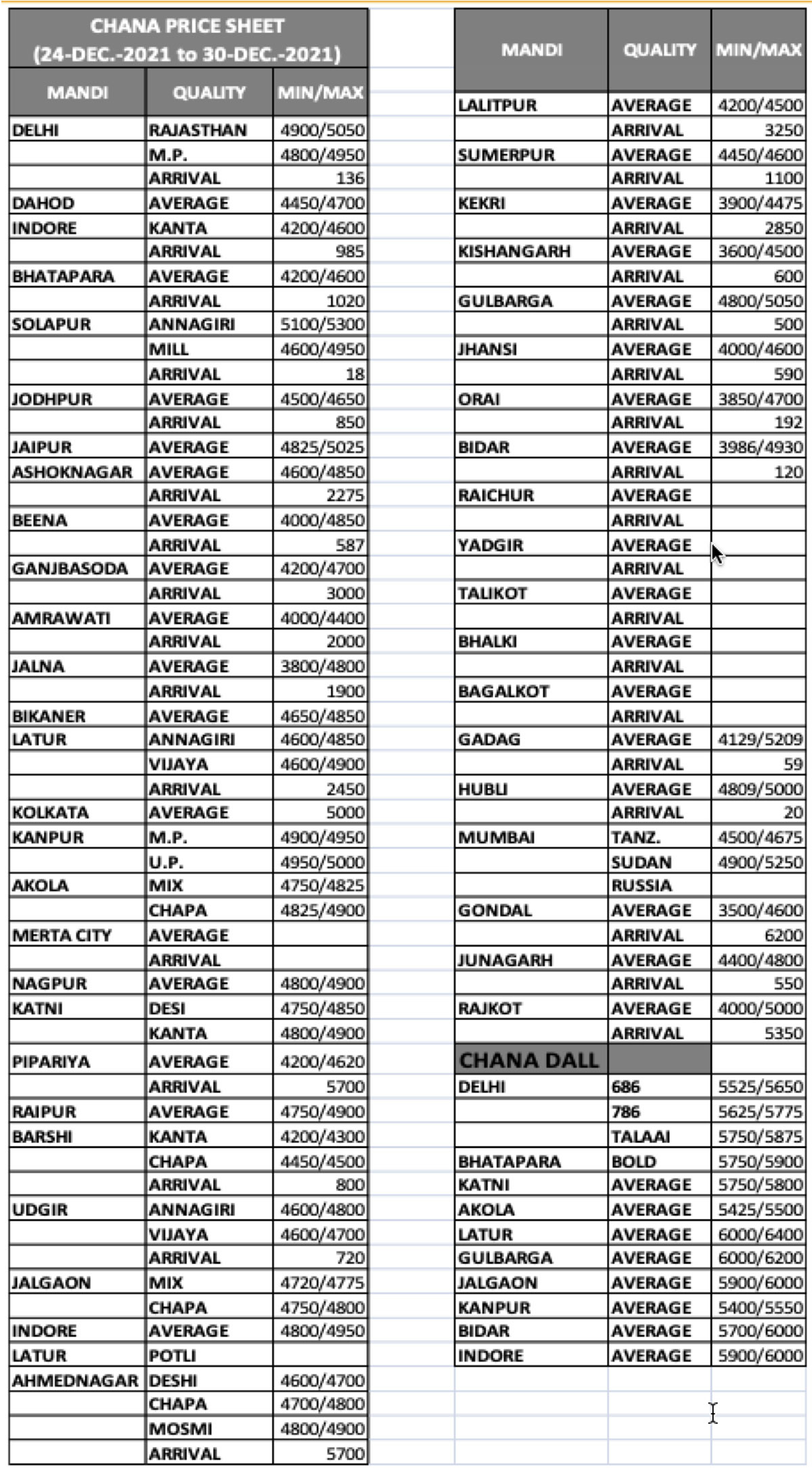

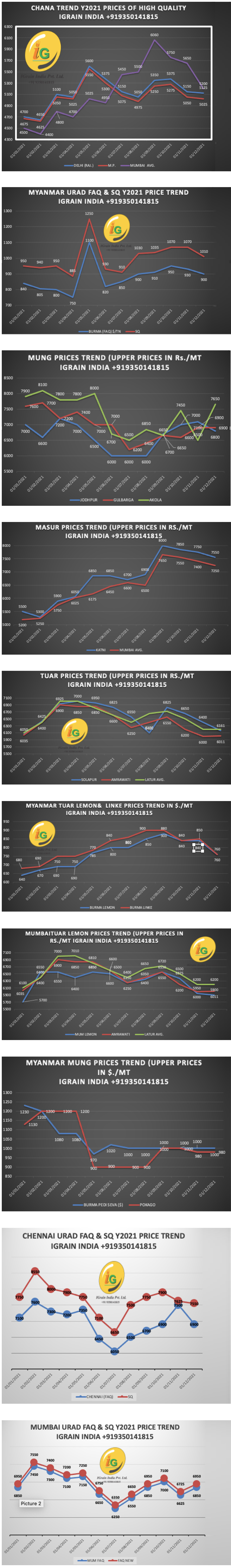

Chana prices improved over the weekend after continuous downfall

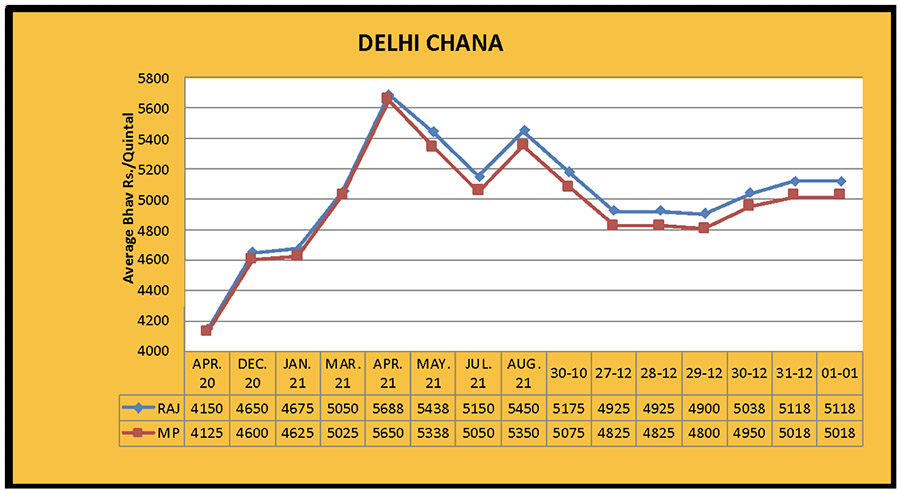

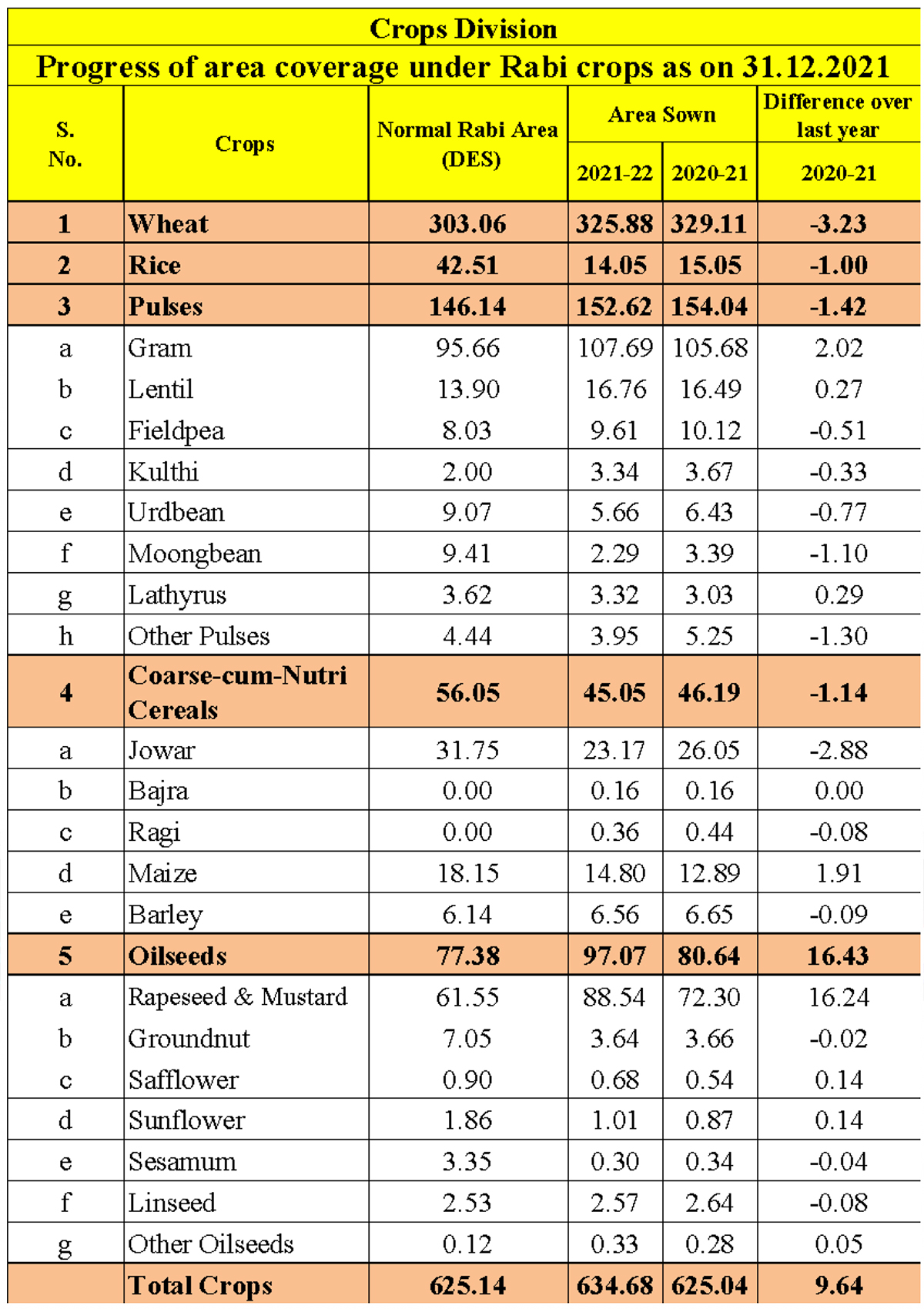

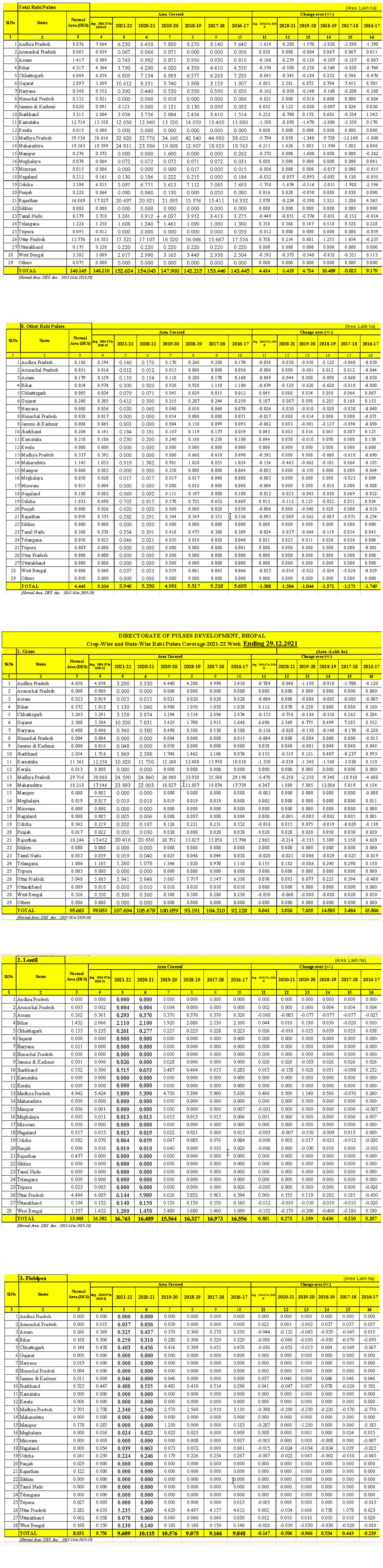

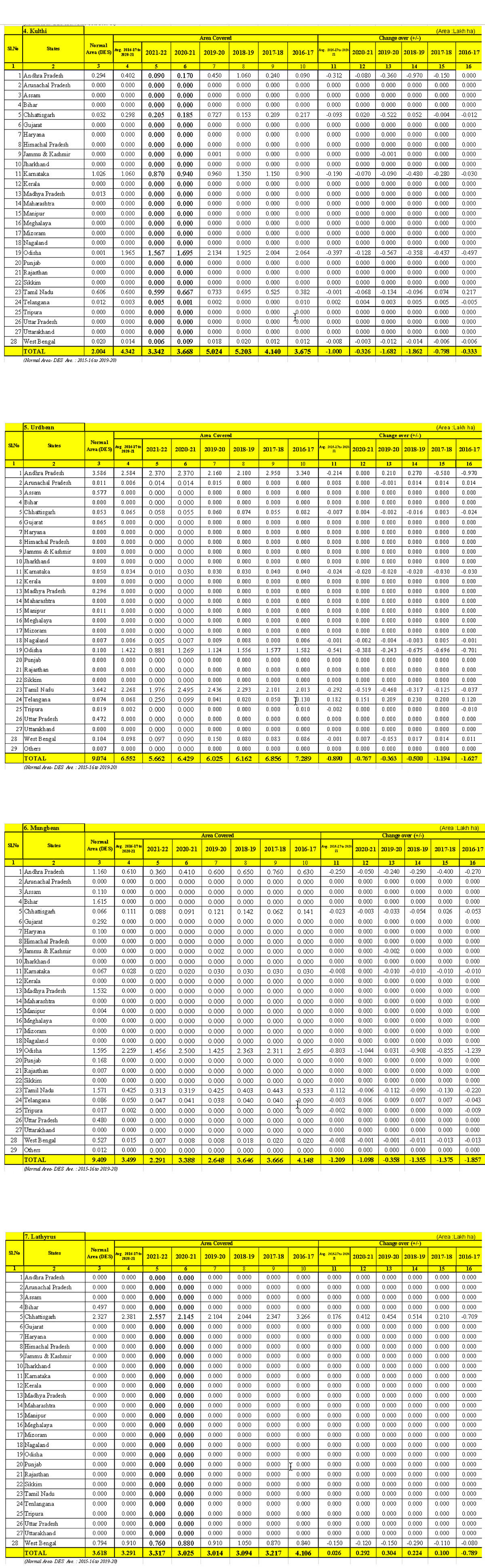

New Delhi. Chana prices registered a correction during the last week, due to weak selling at low prices and weak availability of good quality products. During the first half of the week, a steep downfall was seen in prices but miller activity increased over the weekend and some demand was seen. The new crop is 2 months away in the largest producing states. In the current season, the sowing area of gram has increased by 2 lakh hectares from last year, to 107.7 lakh hectares. Due to good demand, an increase of Rs. 75 per quintal has been registered in Delhi prices in the previous week and the Madhya Pradesh line traded at Rs. 5,000-5,025 and the Rajasthan line at Rs. 5,100/5,125 per quintal.

Port

Demand for imported gram was weak last weekend and remained stable. Old Tanzania product remained stable at Rs. 4,500 per quintal and the new product at Rs. 4,650 per quintal. Sudan prices decreased by Rs. 100/150 per quintal and old crop prices reduced to Rs. 4,900/4,950 while new product traded at Rs. 5,050/5,100 per quintal.

Rajasthan

Due to increased buying, an improvement of Rs. 50 per quintal was recorded in Rajasthan.

At the weekend, the Jaipur prices increased to Rs. 5,025/5,075, Jodhpur to Rs. 4,550/4,600, Kekri to Rs. 4,500 and Kishangarh to Rs. 4,000/4,550 per quintal. In Rajasthan, the sown area of gram has come down from 20.63 lakh hectares to 20.41 lakh hectares this season as compared to last.

Maharashtra

In the first half of the week, prices were under pressure but improved by the end, due to increased buying at lower prices. By the weekend, Nagpur prices were Rs. 4,850/4,925, Jalgaon remained stable at Rs. 4,775/4,825 and Ahmednagar at Rs. 4,700/4,900 per quintal. In Maharashtra, the sown area of gram has increased from 18.9 lakh hectares to 23.89 lakh hectares this year.

Madhya Pradesh

In Madhya Pradesh, the sown area of gram fell to 24.59 lakh hectares this year compared to 24.84 lakh hectares last year. Madhya Pradesh gram registered an improvement of Rs. 50/75 per quintal, due to the support of Delhi gram and increased buying. The traded prices in Katni were Rs. 4,900/4,950, Indore Rs. 4,950, Ashoknagar Rs. 4,700/4,825. Ganjbasoda Rs. 4,400/4,700 and Bina Rs. 4,000/5,000 per quintal.

Other

Raipur prices registered an improvement of Rs. 125 per quintal this week due to all-round support and improved demand, rising to Rs. 4,925/5,025 per quintal at the weekend. Similarly, in Kanpur, prices improved by Rs. 50 per quintal to Rs. 5,000/5,050 per quintal.

Chana Dal

Chana dal registered an improvement of Rs. 50/75 per quintal last week due to increased prices and improved demand. Delhi chana dal sold at Rs. 5,650/5,750, Katni at Rs. 5,750, Akola at Rs. 5,550, Gulbarga at Rs. 6,000/6,100, Bidar at Rs. 5,700/5,800, Indore at Rs. 5,950 and Kanpur at Rs. 5,550/5,600 per quintal.

News Blurbs

Government extended import timelines of three major crops- tuar, urad and mung

New Delhi. In view of the off-season supply of urad and mung and damage caused to the tuar crop in Karnataka, the government has extended the free import of these three pulses from December 31, 2021 to March 31, 2022 in order to keep prices under control.

On December 20, The Union Commerce Ministry issued two separate notifications indicating that importers can order their goods at Indian ports until June 30, 2022 but the bill of lading date should be on or before March 31, 2022. On May 15, 2021, the government had issued a notification to include the import of tuar, urad and mung in the list of free imports by moving them out of the annual quota system.

The government is making a significant effort to curb the prices of pulses and edible oils. For this, futures trading in chana, mustard, soybean, refined soybean oil and crude palm oil has been banned for one year, while the stock limit is also applicable on pulses and oilseeds.

This new pulses import policy is being strongly welcomed in Myanmar. The President of the Overseas Agro Traders Association of Myanmar says that the Indian government’s decision will stabilize the pulse industry and help in maintaining a regular supply of pulses to India from Myanmar. African countries have also expressed their support of the decision with Tanzanian exporters saying there will be no problem in continuing exports of tuar to India.

Gulbarga. In Karnataka, the tuar crop suffered severe damage due to heavy unseasonal rains and, as a result, the yield and quality have both been affected and prices of new goods have come down below the Minimum Support Price (MSP). Moreover, government procurement has not yet started and small farmers are being forced to sell their goods at very low prices. The Karnataka growers’ association has thus written a letter to the PM asking for the withdrawal of the permission of free imports of tuar.

In the letter, it was also mentioned that the central government has extended the time period for free import of tuar with urad and mung, which is having a psychological effect on the domestic market price.

The letter says that either import of tuar should be stopped completely or quantitative restrictions should be imposed in the interest of the farmers, who risk getting hurt by the free import situation.

The Karnataka growers’ association went on to say that free imports are not in the interest of Indian farmers and the continuation of imports, especially in the harvesting and preparation season of the new crop, will cause huge losses to the growers. The government wants to increase the income of the farmers but with such a policy, only losses are possible, particularly since tuar prices are already below the MSP.

The imposition of storage limits earlier on in the year may cause traders and stockists to only procure limited quantities as they fear a stock limit may be imposed at any time. From mid December, the arrival of new tuar crops started in the mandis of Karnataka and Maharashtra and, from mid January, arrivals will be at a peak across all producing states.

The model price of tuar has come down to Rs 4,500 from Rs 6,000 per quintal in various mandis, which is well below the Minimum Support Price of Rs 6,300 per quintal. Due to the adverse weather and outbreaks of insects and diseases, about 20 percent of the tuar crop was damaged. The sowing area reached 50 lakh hectares in the Kharif season and the Agriculture Ministry has estimated tuar production at 44.30 lakh tons, which is higher than last year's production of 42.80 lakh tons.

Rangoon. Data from the Ministry of Commerce of Myanmar (Burma) shows that from October 1 to December 17, 2021, approximately 2.91 lakh tons of pulses and beans were exported from, at a total of $242.67 million.

According to the ministry's report, 2,75,752.333 tons of pulses and beans, worth roughly $ 229.955 million were shipped and 15,477.517 tons of pulses worth $ 145.21 million were shipped through the border trade route to neighboring countries.

According to the Ministry of Commerce, the Government of India has signed an agreement with Myanmar for the import of 2.50 lakh tons of urad and 1 lakh ton of tuar through the private sector during the financial years 2021-22 to 2025-26.

During the financial year 2019-20, Myanmar earned $1.20 billion by exporting more than 1.6 million tons of pulses and beans. Of this, India was the largest importer of pulses. Although many varieties of pulses and beans are produced in Myanmar, it is principally tuar, urad and mung that are exported. Urad and tuar are mainly exported to India while mung is imported by India as well as China and some European Union countries.

In Myanmar, 18 varieties of pulses and beans were produced in an area of more than 11 million acres and the export market, particularly to India, is huge. The Government of India has extended the period of free import of tuar, urad and moong to March 31, 2022, while shipments will be accepted at Indian ports until June 30, 2022.

Bhopal. The pulse mills in Madhya Pradesh have now been taken out of the jurisdiction of the Pollution Control Board, which will bring a huge relief to the pulse industry. An order to this effect has been issued by the Board.

Madhya Pradesh is the top producer of urad, gram and lentils as well as being a major player in other pulses including mung, tuar and peas.

The state’s pulses industry is huge and contains a large number of pulse mills. With the new decision by the board, the old units will see a huge relief. The decision has been strongly welcomed by the pulse industry, which had been asking for an order to this effect for a long time.

New Delhi. The interim Free Trade Agreement (FTA) between India and Australia was scheduled to be held by Christmas but had to be postponed. Now, both countries have decided to work quickly to complete the agreement by the first days of the new cargo. What is currently a limited trade agreement will be succeeded by a fully integrated economic cooperation treaty. India is not ready to make any major concessions to Australia in the agriculture and dairy sector under this limited trade agreement and negotiations will be based on this point. Australia, on the other hand, has its eyes focused on India's vast agricultural produce market and wants to increase exports of dairy, processed food products, pulses and oilseeds from India.

Australia has a huge exportable production of wheat, canola, barley, gram and lentils, among others, and is looking for new markets in which to promote them. Several rounds of talks have been held for this interim agreement between the chief negotiators of the two countries and efforts are being made to finalize the treaty as soon as possible. Both sides have expressed satisfaction at the progress made so far.

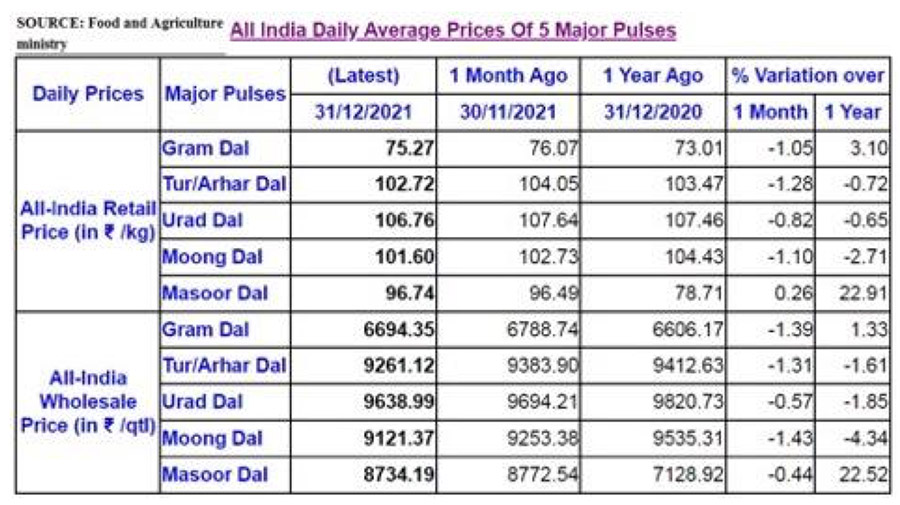

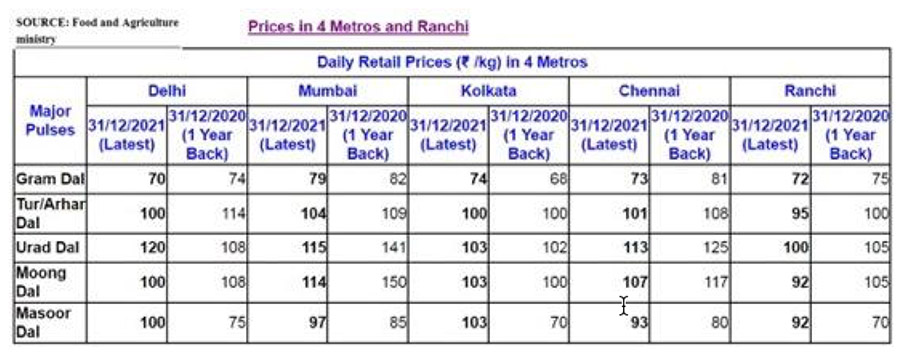

New Delhi. In the 2021 Kharif season, total production of pulses may decline on account of heavy damage to the crops especially urad and mung, which were affected by adverse weather conditions and outbreaks of insects and diseases.

Consequently, the government imposed storage limits on pulses and has now deregulated imports of tuar, urad and mung out of the annual quota system. As a result, the imports of these pulses from Myanmar and African countries started increasing rapidly, thereby normalizing the supply and availability situation in the domestic market. Even now, importers and stockists as well as big producers have ample stocks of all three pulses. The government has further extended the import period until March 2022, which can be imported at ports by June 30, 2022.

After March, with the arrival of the new crop in Myanmar, the import of tuar and urad will increase. The government is wary of a sharp decline in Kharif pulse production and has therefore decided to continue imports. In the period between April and November 2021, 4.12 lakh tons of tuar were imported from Myanmar and African countries.

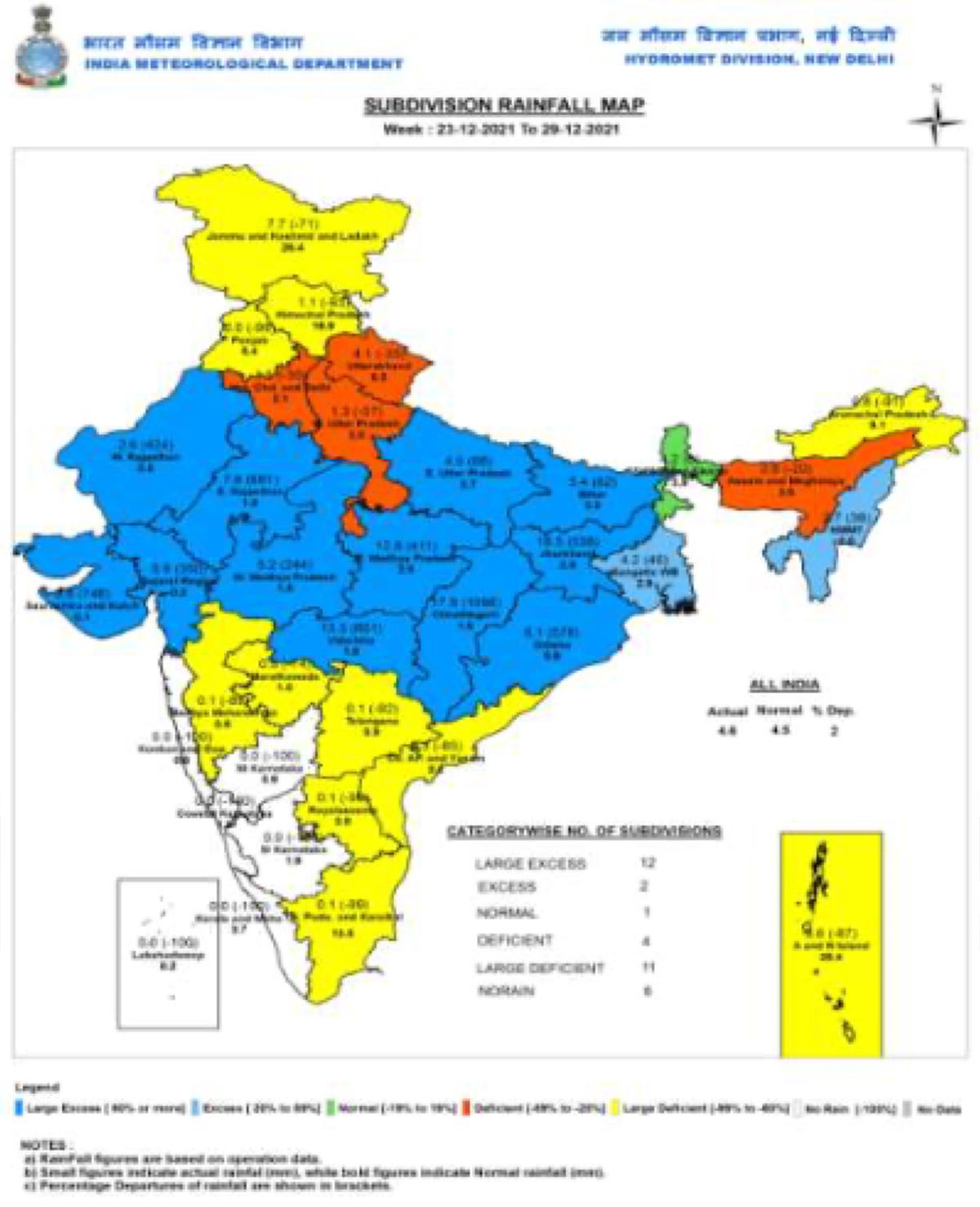

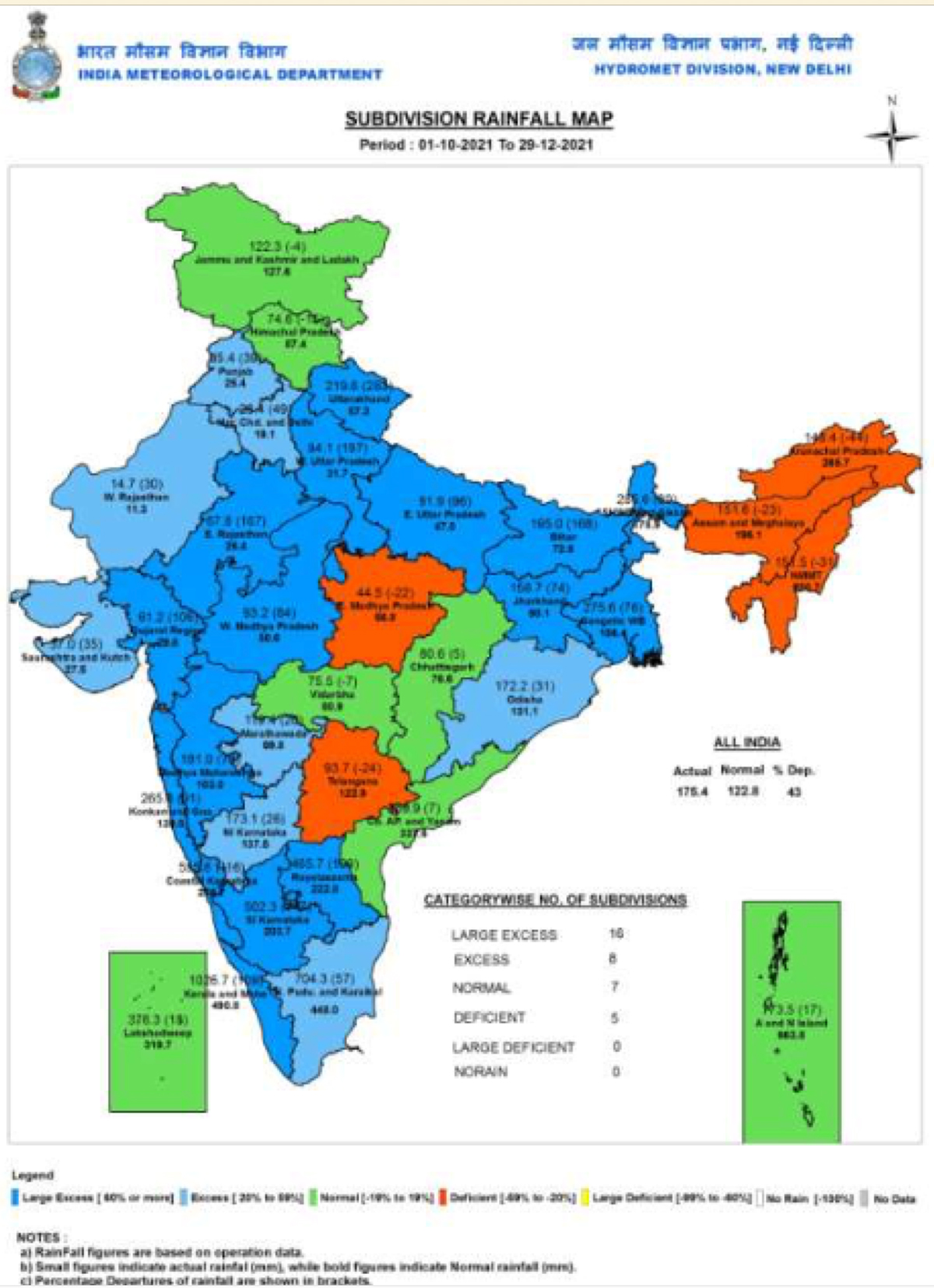

Thiruvananthapuram. According to the Meteorological Department, in October to December 2021, there was a 42 percent increase in rainfall compared to the national average.

Rajasthan, Orissa, West Madhya Pradesh and Gujarat (including Saurashtra) recorded extremely heavy rainfall early last week. In the last 2 weeks, only a few divisions had low rainfall, including Northeast India (Arunachal Pradesh, Assam, Meghalaya, Nagaland, Mizoram, Manipur and Tripura), East Madhya Pradesh, Vidarbha and Telangana.

On December 28, a Western Disturbance reached Pakistan and adjoining Jammu and Kashmir, while another side moved from South-West Madhya Pradesh to South Bihar via North Chhattisgarh and Jharkhand. A Cyclonic Circulation is present over Central Uttar Pradesh.

On the second day of last week, heavy rain fell in Jodhpur, Varanasi, Bharatpur, Pachmarhi, Mandla, Sagar, Jabalpur, Satna, Daltonganj and Akola. Thunderstorms and rains occurred in West Rajasthan, Madhya Pradesh, Vidarbha, Chhattisgarh, Orissa, Jharkhand, Bihar and East Uttar Pradesh. Some parts received also hailstorms.

Rajkot. Rabi crops in more than 30 talukas (blocks) are expected to be damaged due to rain on the first two days of last week in Gujarat, including in Saurashtra and Kutch. Officials from the Department of Agriculture say that if the weather remains clear and there is good sunshine as of this week, the rain may prove beneficial to the crops. However, if the rainy season continues, the sky remains cloudy or the weather remains moist then some other crops, including gram, cumin and coriander, may be damaged. Last week, from Monday night to Tuesday morning, heavy rainfall occurred in the Banaskantha and Sabarkantha districts, located in the northernmost part of Gujarat and bordering Rajasthan. Apart from this, almost all the districts of the Saurashtra and Kutch regions have reported surplus or normal rainfall.

According to the Department of Agriculture, there is not much danger to the crops at present and the matter of profit and loss will depend on weather conditions in the coming weeks. Rain was recorded in all parts of the Rajkot district. Agriculture officials and experts say that if there is further rain, the acid may dissolve from the leaves of the gram, which will hinder the vegetative growth of the plants and may cause problems in flowering. In Gujrat, the area of gram has jumped to a new record level.

New Delhi. A total of 3,33,256 tons of pulses were procured in Kharif and Rabi seasons from 2015-16 to 2019-20 under the Price Stabilization Fund (PSF) by the Food Corporation of India (FCI), out of which 3,23,902 tons were sold, leaving stocks of 9,796 tons. 67,466 tons of pulses were sold to the states while 2,56,436 tons of pulses were sold through e-auction/spot auction.

As per the available data, 20,274 tons of tuar were procured by the Food Corporation during the Kharif season of 2015-16, all of which was sold. Similarly, in the 2016-17 Rabi season, a total of 39,810 tons of pulses, including 15,201 tons of gram and 4,336 tons of masur were purchased, all of which was also sold.

During the 2016-17 Kharif season, 2,58,317 tons of pulses were procured, which included 1,75,343 tons of tuar, 18,237 tons of urad and 64,737 tons of mung. All of the stocks procured were also sold

In the Kharif marketing season of the year 2018-19, a quantity of 15,334 tons of tuar, 4,035 tons of urad and 5,972 tons of mung were procured: a total quantity of 25,341 tons, all of which was sold.

In the 2019-20 Kharif season, 9,789 tons of tuar was procured by the FCI, which was not all sold and has resulted in some leftover stock. Overall, in the 2018-19 season, out of the available stock of Mung, the entire quantity of 5,972 tons was sold. Similarly, 4,035 tons of urad were sold through auctions.

A total of 35,129 tons of tuar were procured, including 15,334 tons in 2018-19 and 9,789 tons in 2019-20. Out of this, 5,079 tons of tuar was distributed under Pradhan Mantri Garib Kalyan Anna Yojana and 10,255 tons were sold through e-auction. Thus, a total of 20,261 tons of tuar was sold, leaving 9,796 of carry-over.

Under the Price Support Scheme (PSS), about 1.11 lakh tons of pulses were procured during the Kharif and Rabi seasons from 2018-19 to 2021-22, out of which 35,129 tons were transferred to the PSF. There are 75,808 tons of available PSS pulse stocks.

A little more than 21,000 tons of gram were procured by the Food Corporation under the PSS, including 46.10 tons in 2019-20, 15,160 tons in 2020-21 and 6,331 tons in the Rabi marketing season of 2021-22.

Abbreviations

Tuar/ Arhar: Pigeon Peas PP

Mung: Green Mung

Urad: Black Matpe

Chana: Gram, Desi Chickpea

Matar: Pea

Masur: Lentil

Besan: Gram Flour

Mand: Market yard

Bhav: Prices

Dal/Daa: Processed Pulses (Directly for human consumption)

Rs: Indian Rupees (1$=Rs 74.29) 03 Jan. 22 at 01:09 PM IST

Rahul Chauhan

Director, IGrain India

igrainind@gmail.com

+91 9350141815

Twitter igrain_india

IGrain / Rahul Chauhan / India / New Delhi / Port / Rajasthan / Maharashtra / Madhya Pradesh / Chana Dal / Gulbarga / Myanmar / Bhopal / Chickpeas / Desi Chickpeas / Black Matpe / Mung / Red Kidney / Cowpea / Lentil / Pigeon Pea

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.