Export demand increases in consumer markets but downside in producing states

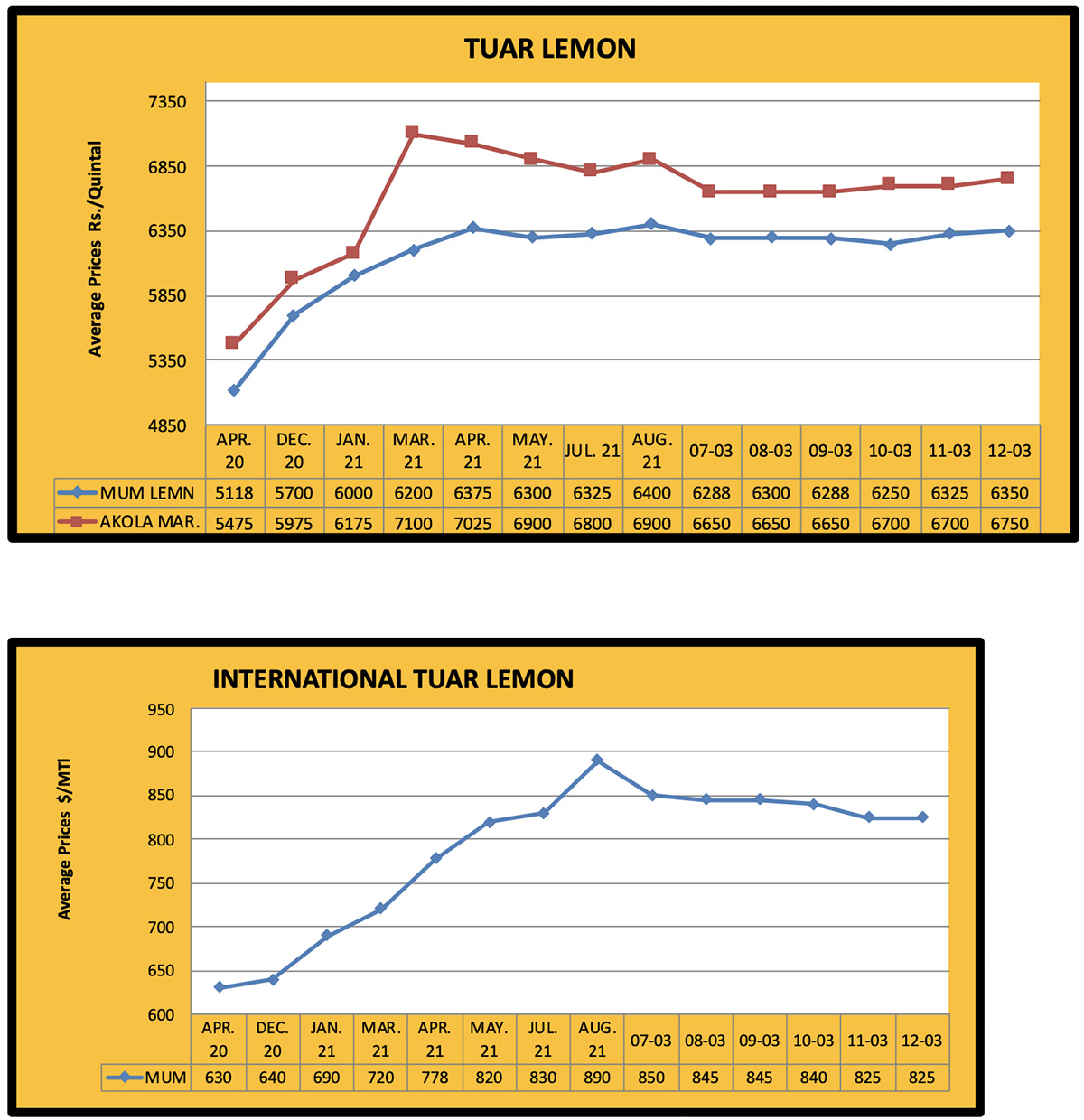

Mumbai

In many markets, tuar arrivals have declined. As a result, imported tuar saw sporadic buying during the week. On increased buying, imported tuar prices increased by Rs. 50/quintal and Lemon at Mumbai port traded at Rs. 6300. The price per quintal rose to Rs. 5500-5550 in Arusa, Rs. 5500-5550 in Gajri, Rs. 4900-4950 in Malawi and Rs. 5350 in Mtwara.

Burma

Due to a slight increase in export demand, Burma tuar prices rose by $5 to $825 per MT for lemon and $825 per MT for Linke by the weekend.

Delhi

Delhi tuar prices registered an increase of Rs. 25-50 and lemon old traded at Rs. 6300, new at Rs. 6600, Maharashtra line reached Rs. 6650, Haryana/North line traded at Rs. 5750 and Madhya Pradesh tuar touched Rs. 5950 per quintal.

Maharashtra

But in Maharashtra, due to weak offtake of miller prices, tuar traded lower during the week. In most markets, prices fell by Rs. 50-100 per quintal. By the weekend, a quintal of Latur Tuar sold at Rs. 6550-6570, Jalna Rs. 5500-6200, Akola Rs. 6650-6700, Dudhni Rs. 6100-6300, Nagpur Rs. 6650-6700, Barshi Rs. 5600-6150 and Ahmednagar Rs. 6000-6200.

Karnataka

Due to increased selling and weak buying in Karnataka, tuar prices dropped by Rs. 50-100 per quintal. Gulbarga Pink variety traded at Rs. 6000-6350, Maruti at Rs. 6200-6600, Bidar at Rs. 5800-6675, Yadgir Rs. 5684-6429, Talikot Rs. 5611-6250 and Bhalki Rs. 6130-6250 per quintal.

Madhya Pradesh

Due to continued buying by pulse millers, Madhya Pradesh Tuar increased by Rs. 100 per quintal in most markets. The price of Katni tuar touched Rs. 6900-7000 and Pipariya at Rs. 5000-6740 per quintal over the weekend.

Other

Due to sluggish buying and selling, there was no bearish movement in Raipur and the prices remained stable at Rs. 6750 per quintal, Maharashtra line Rs. 6900-6950 and Karnataka line at Rs. 6850 per quintal. In Kanpur, tuar prices fluctuated up and down some Rs. 50 and, by the weekend, prices had fallen to Rs. 6300 per quintal and Rs. 6200-6350 per quintal in Madhya Pradesh line.

Split Tuar/ processed Tuar Dall

Buying in Toor Dal remained sluggish. Prices fluctuated. By the weekend, prices fell by Rs. 50-100 per quintal and Delhi traded at Rs. 9050-9425, Katni Fatka Rs. 9025-9125. By the weekend, Akola Fatka traded at Rs. 9100-9200, Gulbarga Rs. 9000-9600, Jalgaon Fatka Rs. 9150-9250 and Kanpur Fatka Rs. 8800-9200 per quintal.

Government to formulate a comprehensive and integrated long-term pulse policy

New Delhi. With a view to ensure the adequate supply and availability of domestic pulses and reduce the need for imports, the Central Government may formulate a comprehensive and integrated long-term policy.

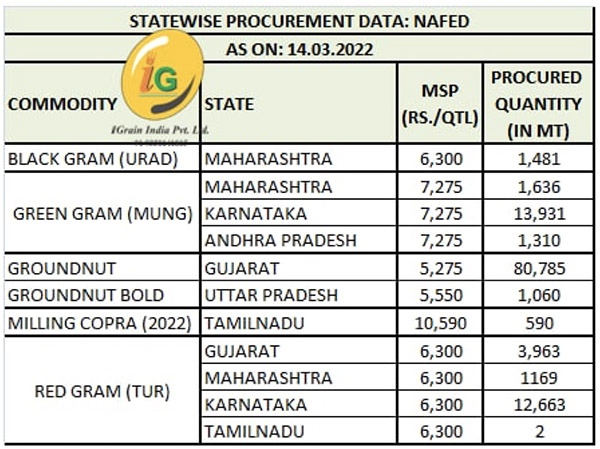

Special attention will be given to increasing domestic pulse production, improving processing technology, controlling post-harvest losses and making it easier for crushers-processors to buy pulses directly from farmers. Simultaneously, the new policy aims to stabilize import duties in order that importers may be spared the impact of frequent changes in the customs duty structure, and also so that domestic production is not adversely affected. Additionally, the price of imported pulses will remain around the minimum support price announced by the government.

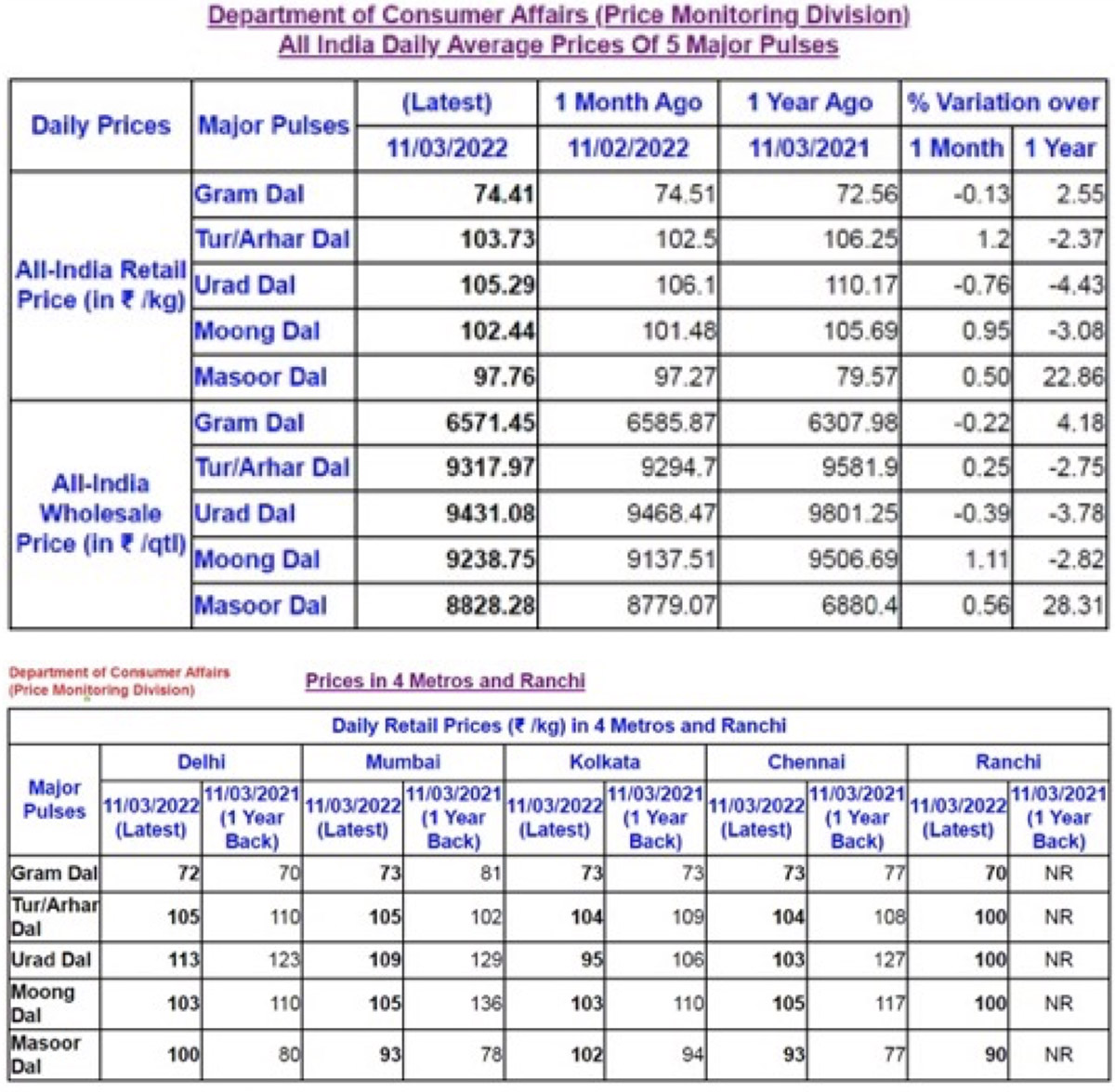

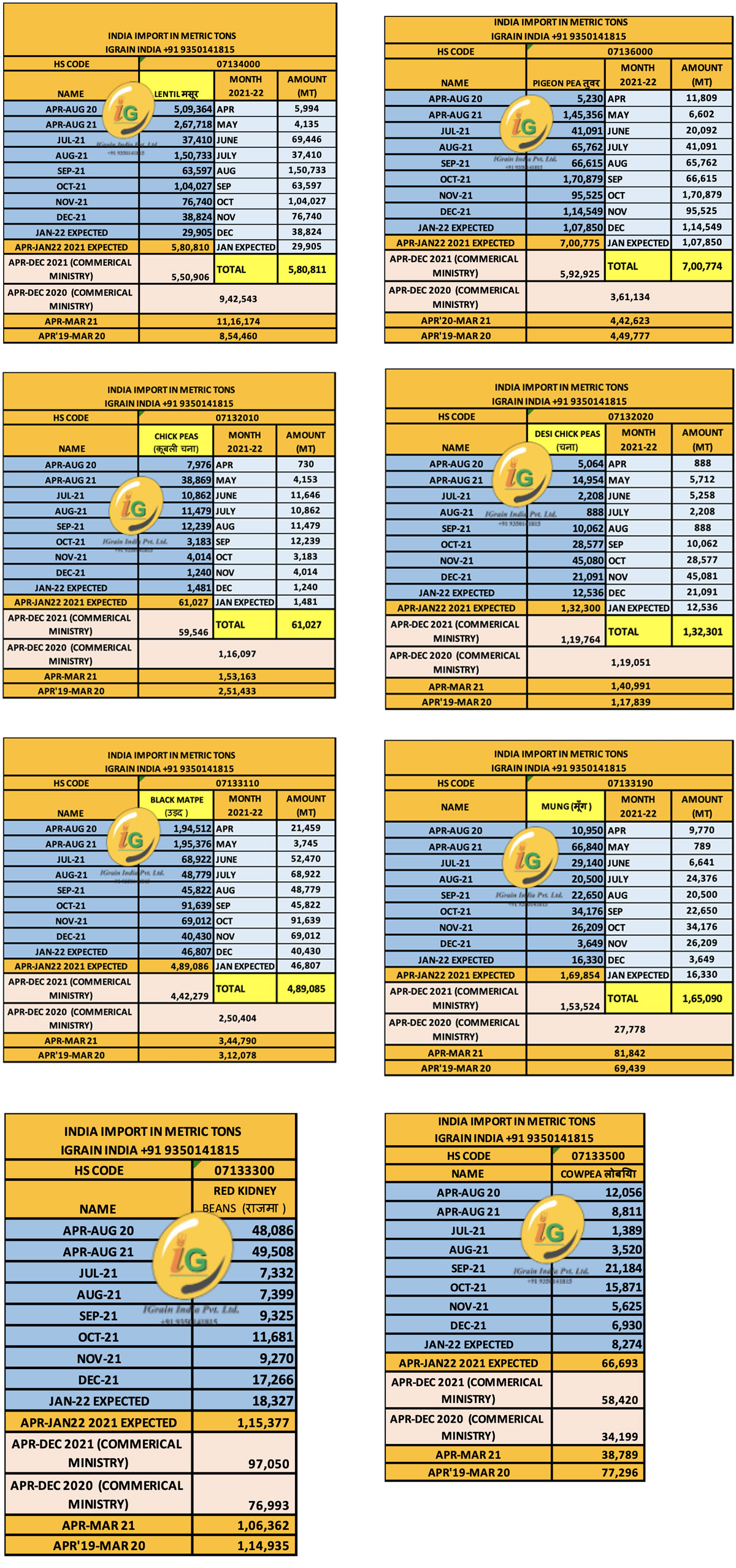

Presently, India meets about 10% of its pulse demand via imports. India’s total pulse production for MY 2021-22 is estimated at 26.96 million MT; during the current fiscal year, pulse imports are likely to amount to 2 million MT.

According to trade analysts, frequent and abrupt changes in policy create difficulties and disrupt the value chain.

A meeting was convened by the Central Consumer Affairs Department on March 10 to discuss pulse policy. The IPGA, the Agri Farm and Trade Association, traders and millers participated. Many valuable suggestions were provided to the government.

Rabi season sowing area declined in Odisha

Bhubaneswar. In Odisha, the area under rabi crops was 26.08 lakh hectares last year and is 25.46 lakh hectares in the current year through February 26. According to the latest data from the State Agriculture Department, the area under paddy declined from 3.15 lakh hectares to 2.53 lakh hectares, while the area sown to maize, ragi and wheat remained almost the same as last year. The area under maize remained close to 26,000 hectares. The area under pulses increased from 12.59 lakh hectares last year to a little above 12.60 lakh hectares this year. The moong area declined from 6.70 lakh hectares to 6.35 lakh hectares, but the lentil area increased from 9,000 hectares to 11,000 hectares.

Push to remove Mandi tax on Pulses

Indore. The pulse milling industry in Madhya Pradesh has urged the state government to cut the mandi fee on the purchase of pulses coming from other states. The tax makes raw pulses more expensive, which decreases millers’ profits.

Madhya Pradesh applies a 1.70% mandi fee on pulses, while in Maharashtra it is 0.8% and in Gujarat it is only 0.5%.

The state government implemented a mandi fee of 1.70% in 2020 during the COVID-19 pandemic.

The Katni miller association says that before 2020, pulses mills were completely exempted from mandi fees. Even at present, in states like Bihar and Delhi, there is no mandi fee, whereas in Uttar Pradesh, a 1.5% mandi fee is charged; even this is less than Madhya Pradesh’s 1.70% fee.

The pulse mills in Madhya Pradesh are facing great difficulty by facing tough competition from other provinces.

In Madhya Pradesh, the cost of pulses produced by processing tuar, gram and other pulses increases approximately by Re 1 per kg which is costlier than Maharashtra, Gujarat, Karnataka and Andhra Pradesh.

Millers’ processing capacity is underutilized.

In a local meeting, Madhya Pradesh announced changes/elimination of the Mandi tax. Millers are waiting enthusiastically for this circular. If notification comes, it will be implemented from 1 April 2022 i.e., next financial year.

Bilateral trade talks between India and Canada held from March 10 - 13

New Delhi. Trade talks between India and Canada were held from March 10 to 13. Emphasis was given on strengthening bilateral agreements, increasing the economic partnership and negotiating free trade treaties between the two countries.

Canada's Minister visited India to participate in the fifth round of ministerial talks on trade and investment between the two countries. From the Indian side, the Minister of Commerce and Industry participated.

The commerce minister had earlier said that India could propose an interim trade deal with Canada to be followed later with a full trade pact. In 2021, bilateral trade between the two countries increased significantly and the trade in goods increased by 12% over the previous year to $ 6.29 billion. Total bilateral trade in goods and services also increased to more than $11 billion. Exports from India to Canada reached $3 billion, an increase of about 25%. Exports from India include mainly pharmaceuticals and drugs, iron, steel, marine products, cotton fabrics and readymade garments and chemicals. Canada’s major exports to India are pulses (lentils), fertilizer, coal and crude mineral oil.

India and Canada have been in talks for the Integrated Economic Partnership Treaty (CEPA) since 2010. The last round of talks was held in August 2017. India is focused on increasing exports of its various products in order to reduce its trade deficit with Canada. Canada has certain non-tariff restrictions that make it difficult to ensure free access to Indian products. This barrier needs to be removed. It is expected that some progress will be made in this direction during the current trade talks and Canada may try to increase imports of many Indian products in the next financial year.

Canada’s Minster expressed appreciation for India’s waiving of a fumigation penalty.

BHATAPARA New Gram Rs. 4,800-4,875 per quintal

Abbreviations

Tuar/ Arhar: Pigeon Peas PP

Mung: Green Mung

Urad: Black Matpe

Chana: Gram, Desi Chickpea

Matar: Pea

Masur: Lentil

Besan: Gram Flour

Mandi: Market yard

Bhav: Prices

Dal/Daal Processed Pulses (Directly for human consumption)

Rs: Indian Rupees (1$=Rs 76.6) 15 March, 22 at 03:22 PM IST

Rahul Chauhan

Director, IGrain India

igrainind@gmail.com

+91 9350141815

Twitter igrain_india

IGrain / Rahul Chauhan / India / Mumbai / Burma / Delhi / Maharashtra / Karnataka / Madhya Pradesh / New Delhi. Chick Peas / Desi Chick Peas / Black Matte / Mung / Red Kidney / Cowpea / Lentil / Pigeon Pea

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.