Ports

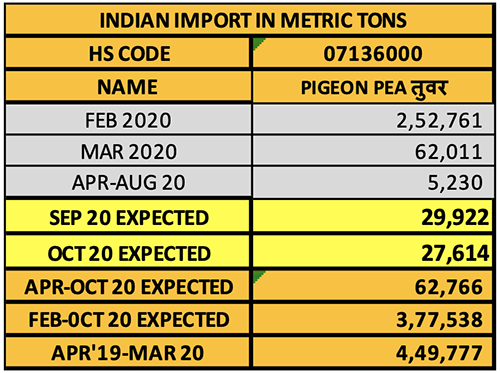

The government extended the pigeon pea import deadline from 15 November to 31 December. This led to a decline in domestic tuar prices. NAFED also began selling large quantities of tuar at low prices. For at least two months, there has been weak demand for pulses overall.

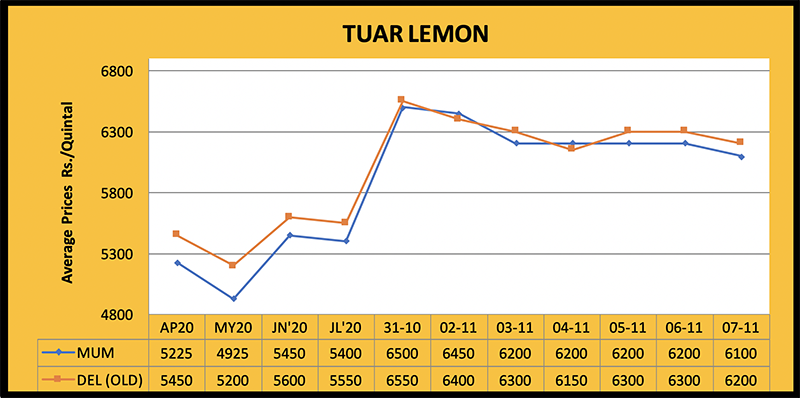

By the end of December, large quantities of new crop tuar will arrive in Karnataka and Maharashtra market yards. Arrivals will peak from January through March. During the past week, pigeon pea prices fell by Rs. 200-250. Lemon tuar prices dropped to Rs. 6,200 per quintal and November delivery further reduced it to Rs. 6,050. Burma tuar at Mumbai C&F quoted at $800/MT.

Delhi

Miller interest in tuar was low due to less tuar dal demand in the domestic market. Over the past week, tuar prices fell by Rs. 100-200 and stood at Rs. 6,200 by the weekend. Prices in UP-MP and Haryana stood at Rs. 5,800-5,900 per quintal. Demand is expected to remain normal.

Maharashtra

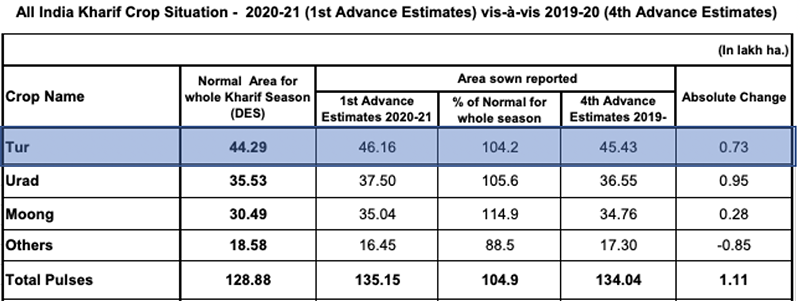

Selling pressure due to weak demand is notable at Maharashtra market yards. Prices were stressed due to selling by NAFED. Tuar prices in Maharashtra declined by Rs. 500-1,000 per quintal and by the weekend stood at 6,300-6,400 in Solapur, Rs. 5,700-6,400 in Amravati, Rs. 5,500-6,000 in Latur, Rs. 6,600 in Akola and Rs. 6,600-6,700 in Nagpur. Demand is expected to remain normal. In Maharashtra and Karnataka, rain caused some crop damage, but crop conditions improved over the past 15 days. The crop is late, but prices should not be impacted thanks to the arrival of imports.

Karnataka

There was observable movement on tuar in the market yards of Karnataka, but due to weak buying, prices fell by Rs. 200-500. By the weekend, prices in Gulbarga stood at Rs. 6,400-6,800, Yadgir Rs. 6,351 and Raichur Rs. 5,263-5,966. Demand is expected to remain at these levels.

Other

Raipur tuar prices dropped by Rs. 400 to Rs. 6,600-7,000. Similarly, Kanpur prices fell by Rs. 400 and Katni by Rs. 200. Over the weekend, Kanpur prices stood at Rs. 5,800-6,000 and Katni prices at Rs. 7,300-7,500. Trading at other mandis also took place at low prices.

Processed Tuar (Tuar Dal)

Tuar dal prices declined by Rs. 400-700 during the week and stood at Rs. 8,000-9,500 over the weekend.

Millers worried: decline in pigeon pea prices cut into their margins

Pigeon pea prices have softened because of the import deadline extension to 31 December and increased sales by NAFED. Prices declined for whole and processed tuar, which worried and upset millers who purchased stocks at higher prices.

According to industry members, the government’s actions have thrown about 500 pulse processors/millers into a crisis. The market is also feeling the heat in the absence of demand.

Prices for raw and processed pigeon peas is falling as the market suffers a profound psychological impact. Pressure on domestic prices may increase further as imports from Myanmar and African countries arrive at Indian ports

Millers and processors in the top tuar producing states, including Maharashtra and Karnataka, are likely to suffer heavy losses.

Heavy rains in the pulse growing areas have deteriorated the condition of the crop and there is more waste at processing. In addition to tur, urad and lentil imports are also being encouraged, and this is bound to affect the market.

Rabi season sowing progress at 16% nationally

Thanks to favourable weather conditions and adequate moisture, the sowing of rabi crops is progressing at a good pace. According to official data, through 6 November, rabi sowing has advanced to 100.95 lakh hectares, up from 84.95 lakh hectares from the same time last year.

According to the latest weekly data from the Union Ministry of Agriculture, wheat seeding is up from 9.72 lakh hectares last year to 16.94 lakh hectares. The paddy area increased from 5.87 lakh hectares to 5.79 lakh hectares. Pulse seeding increased from 24.80 lakh hectares last year to 36.45 lakh hectares.

In terms of the breakdown by pulse crop, gram seeding is up from 17.50 lakh hectares to 25.10 lakh hectares. Lentil seeding is up from 1.95 lakh hectares to 3.70 lakh hectares. Pea sowing is up from 1.45 lakh hectares to 2.85 lakh hectares. Kulthi sowing is up from 1.45 lakh hectares to 1.60 lakh hectares. Khesari seeding is up from 50,000 hectares to 1.25 lakh hectares. Urad seeding is at 95,000 hectares, unchanged from last year. The moong area is at 10,000 hectares compared to 20,000 hectares last year. The area under other pulses is at 90,000 hectares, up from 85,000 last year.

As expected, the area seeded to gram has expanded dramatically and farmers are showing great enthusiasm in growing wheat, as well. The area seeded to mustard and lentil is also expected to expand notably in the coming days.

Despite government intervention, pulses markets are unlikely to fall drastically

While the government has recently taken some measures to curb rising pulse prices, trade analysts believe that results will not be seen in the near future. There will not be a significant fall in prices, but a minor correction may occur.

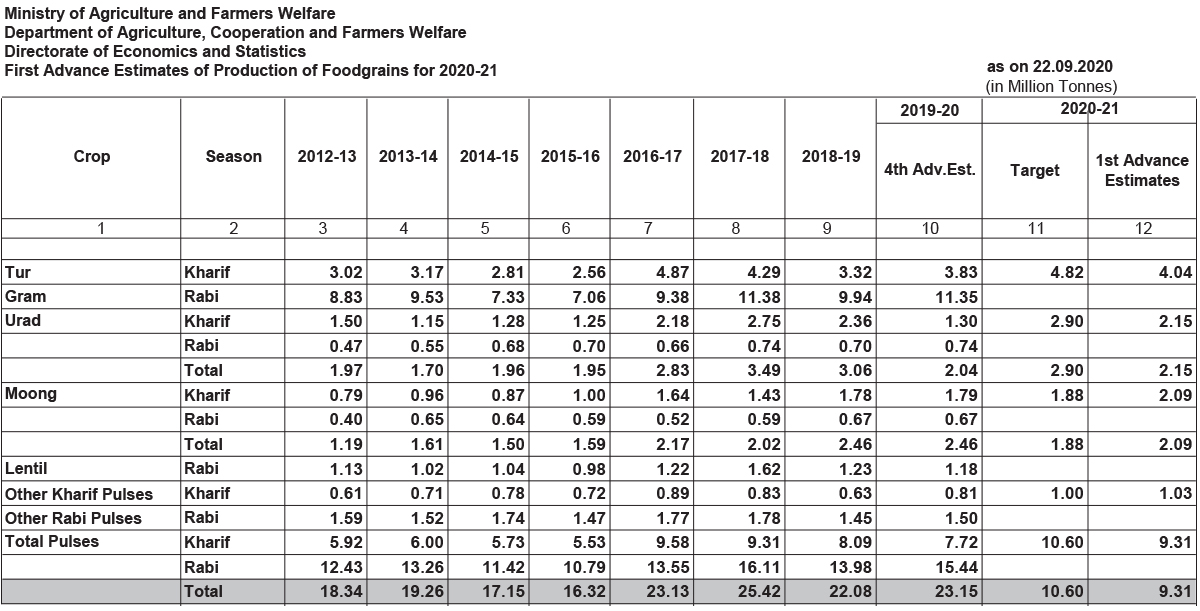

In domestic wholesale and retail markets, there was a regular uptrend in the market over the past few months. There were several reasons for this. Domestic inventories of pulses are running low and consumption is up. Natural calamities caused heavy losses of kharif moong and urad crops, affecting quality and yields. Pigeon pea crops suffered in all the major growing states and production is likely to decrease. Earlier this rabi season, gram and lentil crops suffered losses. Carry-in volumes were also low.

To control rising prices, the government began to issue import licenses for 4 lakh MT of tuar and 1.50 lakh MT of urad. Only pulse millers and processors are eligible for these licenses. NAFED’s selling of large quantities of tuar and gram at low prices psychologically impacted the market; arhar and gram prices fell slightly below their peak levels. But it seems unlikely they will fall farther. The market price is expected to remain above MSP until new crop tuar arrives at the mandis. The MSP for tuar has been increased from Rs. 5,800 per quintal in 2019/20 to Rs. 6,000 per quintal for 2020/21.

In order to check prices, the government has offered states urad and tuar dal in packs of half or 1 kg at discounted prices from the buffer stock.

Pea and mung import licenses remain in doubt

Although the government fixed import quotas of 4 lakh MT for tuar and 4 lakh MT for urad, as well as 1.50 lakh MT for mung and 1.50 lakh MT for peas for this financial year, it has only allowed the import of urad and pigeon peas. Millers and processors have not been issued import licences for moong and peas. It should also be noted that heavy rains and floods severely damaged kharif mung crops, decreasing availability.

The MSP for mung has been fixed from Rs. 7,050 per quintal to Rs. 7,196 per quintal. The price of top-quality moong is hovering around Rs. 8,000 per quintal, but inventories are tight. The price for light discolored goods is close to Rs. 7,000 per quintal.

High quality mung is produced in Myanmar and Australia, but China is a major buyer. Ample supplies are also available in Tanzania and Uzbekistan, but Indian millers are unable to import them because they have not been issued licences. Meanwhile, importers from China are becoming active at those origins.

With five months left in the financial year, there is no indication from the Directorate of Foreign Trade as to the issuance of import licences for moong and peas. It appears that, given the sowing of peas this rabi season, imports will be put off. Moong imports look to remain intact.

International market moong prices are still falling and importers from China are taking advantage of this. The price of Pedeseva moong is being reported at $ 1,100–1,150 per MT and Australian moong at $ 1,300 per MT. New crop is becoming available in Uzbekistan and Tanzania. If there is a delay in the issuance of import licenses, the international market price may increase and millers in India will be forced to import it at a higher price.

Industry members argue that the government should determine the import quota for all pulses and issue licenses simultaneously in order that millers and processors can do business at their convenience. Mung crops in Maharashtra and Karnataka were badly damaged, while in other states, including Rajasthan, there were also losses. Prices are likely to remain stable.

Abbreviations

Tuar/ Arhar: Pigeon Peas (PP)

Mung: Green Mung

Urad: Black Matpe

Chana: Gram

Matar: Pea

Masur: Lentil

Mandi: Market yard

Bhav: Prices

Dal: Processed Pulses (Directly for human consumption)

Rs: Indian Rupees (1$=Rs 73-74)

Rahul Chauhan

Director, IGrain India

igrainind@gmail.com

+91 9350141815

Twitter igrain_india

Pigeon Pea / Tuar / Arhar / Rahul Chauhan / India / Karnataka / Maharashtra / China / Uzbekistan / Tanzania

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.