Ports

Mumbai

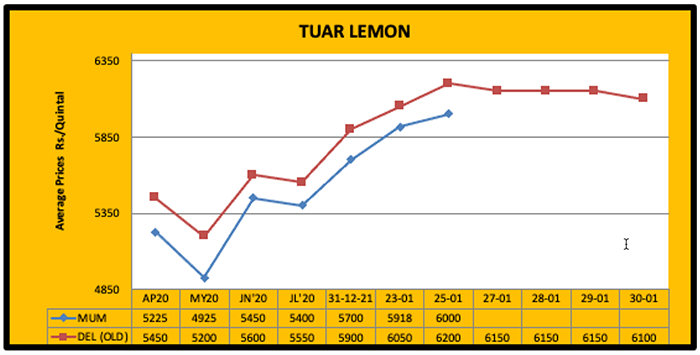

Pigeon pea (tuar) arrivals at market yards is below expectations despite harvest being in full swing. The quality of the crop is good but there is a possibility of decreased production and small seed size. Because prices are low, farmers are holding onto stocks and selling small quantities. Stockists have started purchasing stocks on the possibility of lower production. Prices have started to increase on the buying by stockists. Importers put a hold on their selling, also causing prices to rise. Last week, prices at Chennai Port rose by Rs. 200 to Rs. 6,000 per quintal. Mumbai port has negligible stocks. Myanmar Lemon stock is reduced or much less. The price of Arusa Tuar rose to Rs. 5,150/quintal. The price of new Tuar Lemon at Mumbai port was $700, the price for old crop was $670 and Linke $680 per MT. The market may surge and remain at a higher level.

Delhi

As prices increased at Mumbai port, Delhi prices were supported. Last week, there was a sharp increase and decrease of Rs. 50. Delhi Lemon fell to Rs. 5950, New Rs. 6150, Maharashtra Rs. 6250, Haryana, UP and MP lines Rs. 5450-5550 per quintal. Demand is expected to increase further.

Maharashtra

The arrival of new tuar started increasing in market yards. Prices increased by Rs. 100-200 due to increased procurement by stockists. With this increase, Solapur prices rose to Rs. 5700-6225, Amravati Rs. 5200-6100, Latur Rs. 6000-6200, Akola Rs. 5900-6150 and Nagpur Rs. 6150-6200 per quintal. Demand may improve further. NAFED stopped selling tuar, and this is expected to boost the market.

Karnataka

With an increase in prices, the arrival of new crop increased in the yards of Karnataka. Earlier, fewer arrivals were reported as farmer’s held stocks anticipating improved rates. There was an increase in buying by millers and stockists, and by the weekend prices had increased by Rs. 50-150. The price at Gulbarga rose to Rs. 5400-6000, Bidar Rs. 5800-6262, Raichur Rs. 5407-6011 and Yadgir Rs. 5811-6520 per quintal.

Madhya Pradesh

In MP market yards, an improvement of Rs. 50-100 was recorded. With this improvement, prices in Ganjbasoda rose to Rs. 4,800-5,500, Katni to Rs. 6,150 and Pipariya to Rs. 5,000-6,200 per quintal.

Uttar Pradesh

Prices in Uttar Pradesh also rose due to support from other markets. Prices improved by Rs. 100-200. With this increase, the price at Bareilly rose to Rs. 6,000 and Kanpur to Rs. 5,850 by the weekend.

Others

Raipur, Chhattisgarh Tuar recorded a jump of Rs. 100 and the price rose to Rs. 6,250-6,300. Dahod Tuar was stable at Rs. 5,150-5,700. In other markets, trading occurred at increased prices.

Processed Pigeon Pea or Tuar Dall

Inquiries for processed tuar increased due to demand from stockists. During the week, Tuar Dal/ Processed Pigeon pea both saw a sharp increase and decrease of Rs. 100-200 and the quintal traded at Rs. 8,050-8800, Rs. 8450-8650 in Katni, Rs. 8325-8525 in Raipur, Rs. 8800-9000 in Latur, Rs. 8600-9100 in Gulbarga and 8200-8550 in Kanpur. Demand is expected to increase.

DOMESTIC & INTERNATIONAL CROP EXPECTATIONS

Harvesting is in full swing, but due to low prices, traders and farmers are holding onto stocks knowing that there will be fewer new crop arrivals. Because of reduced arrivals, traders have become active and there has been increased buying.

The crop in Karnataka is reported to be normal. In Raichur belt crop is in good condition.

In Maharashtra, another major producing state, arrivals are at peak levels. In Latur, Amravati, Akola districts the crop is normal, but seed size is smaller. In Maharashtra, the crop is more or less like last year, but the quality concerns may increase demand for good quality seed in the future.

In Madhya Pradesh new crop has started arriving. The crop is in good shape and the quality is better.

In summary, this year’s production seems to be equivalent to last year’s, but the quality is not better. Once arrivals finish, there may be fresh demand.

If the quality is too deteriorated, NAFED’s procurement may be lower than last year. NAFED held a stock of 1.32 lakh MT as of January 7, but they appear to have cleared out since.

Through January 21, NAFED procured 1,361 MT from Karnataka and 44.44 MT from Maharashtra, for a total of 1,405 MT. Procurement is behind last year’s pace.

This year, production is estimated at 38 lakh MT and consumption at 45 lakh MT; India will need imports to cover the gap.

But there are concerns at exporting countries, as well. Myanmar farmers reduced their seeded area due to constant demand for mung and good prices throughout the year. This year, pigeon pea production may fall to 90,000 compared to +1.50 lakh MT three years ago.

Myanmar’s carry-forward stock is 1.10 lakh MT, some of which will be exported as processed product to other countries. India’s take may amount to 60,000 MT. India can also turn to Africa to additional supplies. The government of India signed an agreement to procure 2 lakh MT from Mozambique over the next five years. But these two origins will not be able to supply enough to fill the supply-demand gap. In the second half of the year, the market will be in good shape.

The government may open up the market to imports earlier than last year.

Government agencies holding stocks of more than 1.5 million MT of pulses

Pulses were procured from major producing states at minimum support price under the Price Support Scheme (PSS) by the two Central Government authorized agencies - National Agricultural Cooperative Marketing Federation of India (NAFED) and Food Corporation of India (FCI). Later these pulse stocks were used for various purposes, ie. in rations for the military, in mid-day school meals, and sold through tenders. Based on exclusive information available at IGrain India, on January 7, these agencies held pulse stocks of more than 1.5 million MT. These stocks included 1,310,421 MT of gram, 134,481 MT of aarhar (tuar-pigeon pea), about 62,559 MT of mung and 11,386 MT of lentils. Part of the pulses purchased under PSS is being transferred to the stock of purchases made under the Price Stabilization Fund (PSF) in order to maintain pulse buffer stocks at a reasonable level. It is worth noting that NAFED regularly releases gram, pigeon pea and lentil stocks to ease supply and availability issues in the domestic market and to control prices. From April to November 2020, under the Pradhan Mantri Garib Kalyan Anna Yojana, processed pulses and whole gram were distributed for free to ration card holders. Additionally, pulses are supplied to schools under the mid-day meal scheme. Pulses are also supplied to the security forces. The government procures pulses during both the kharif and rabi seasons.

Rabi season pulses production target of 157 lakh MT

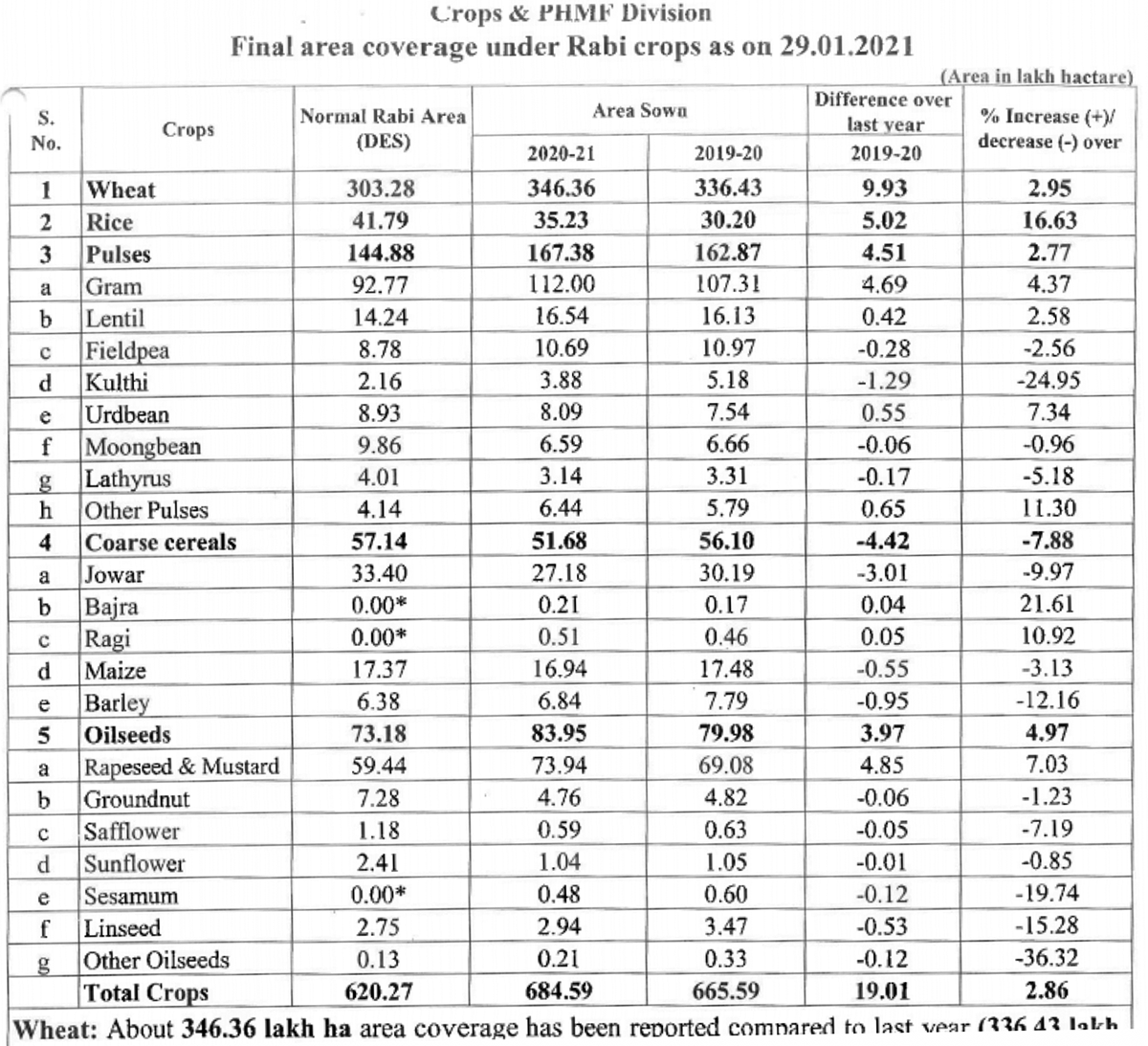

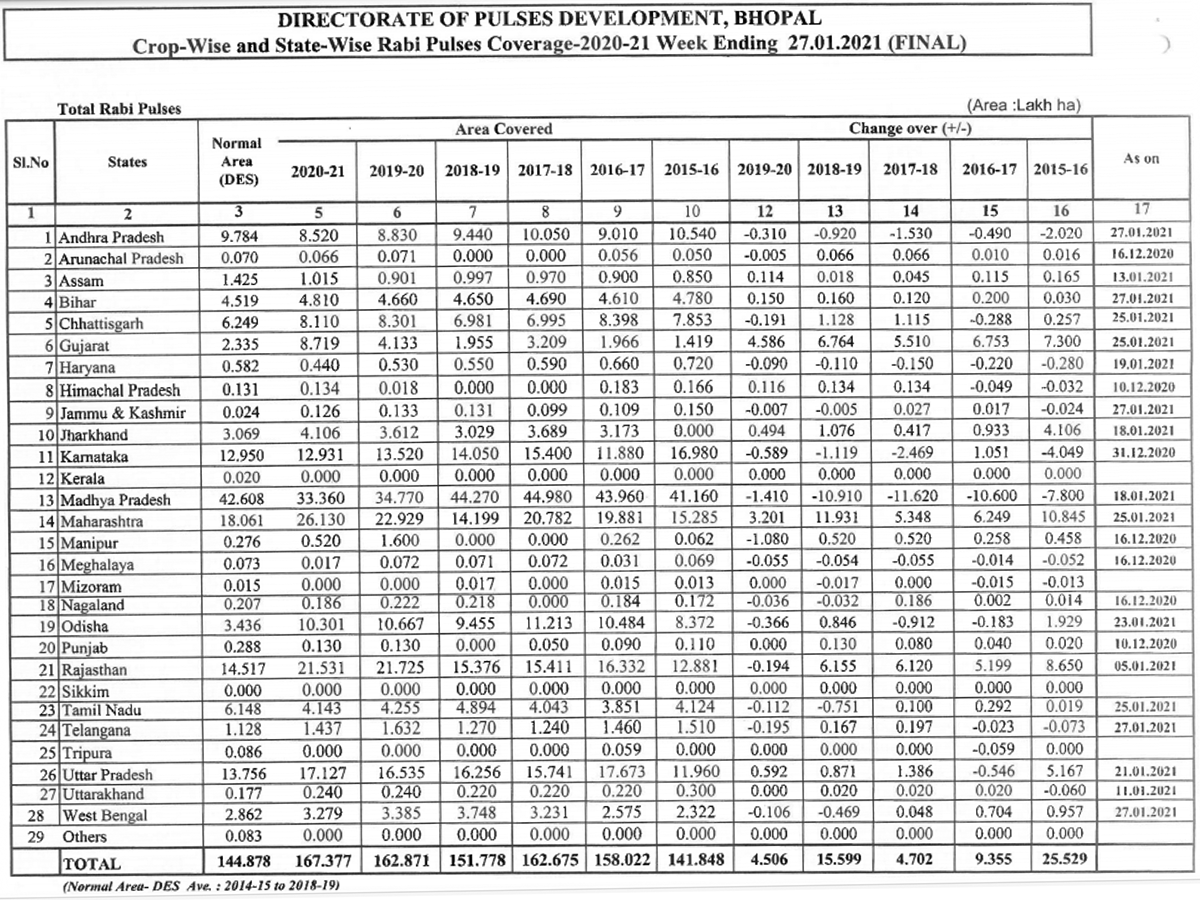

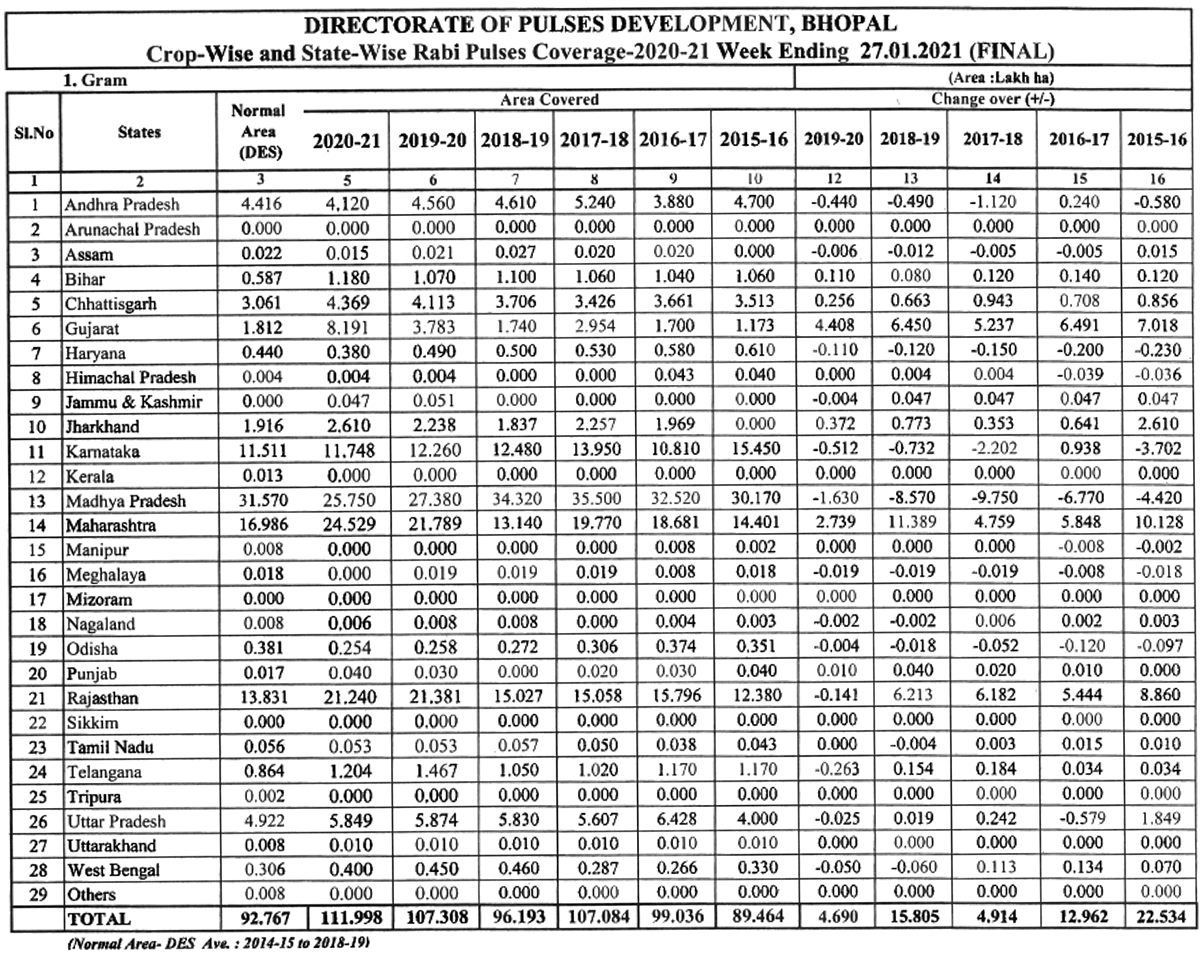

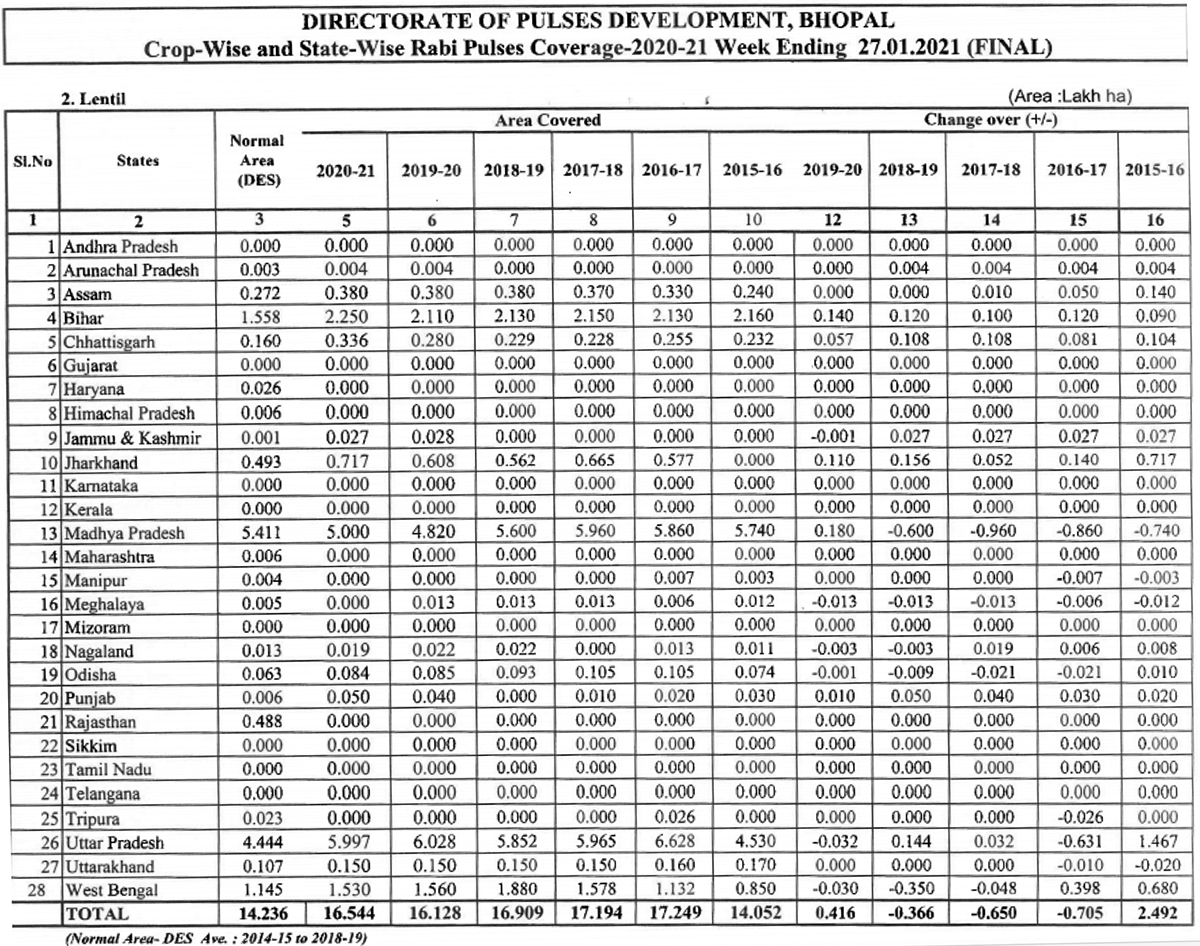

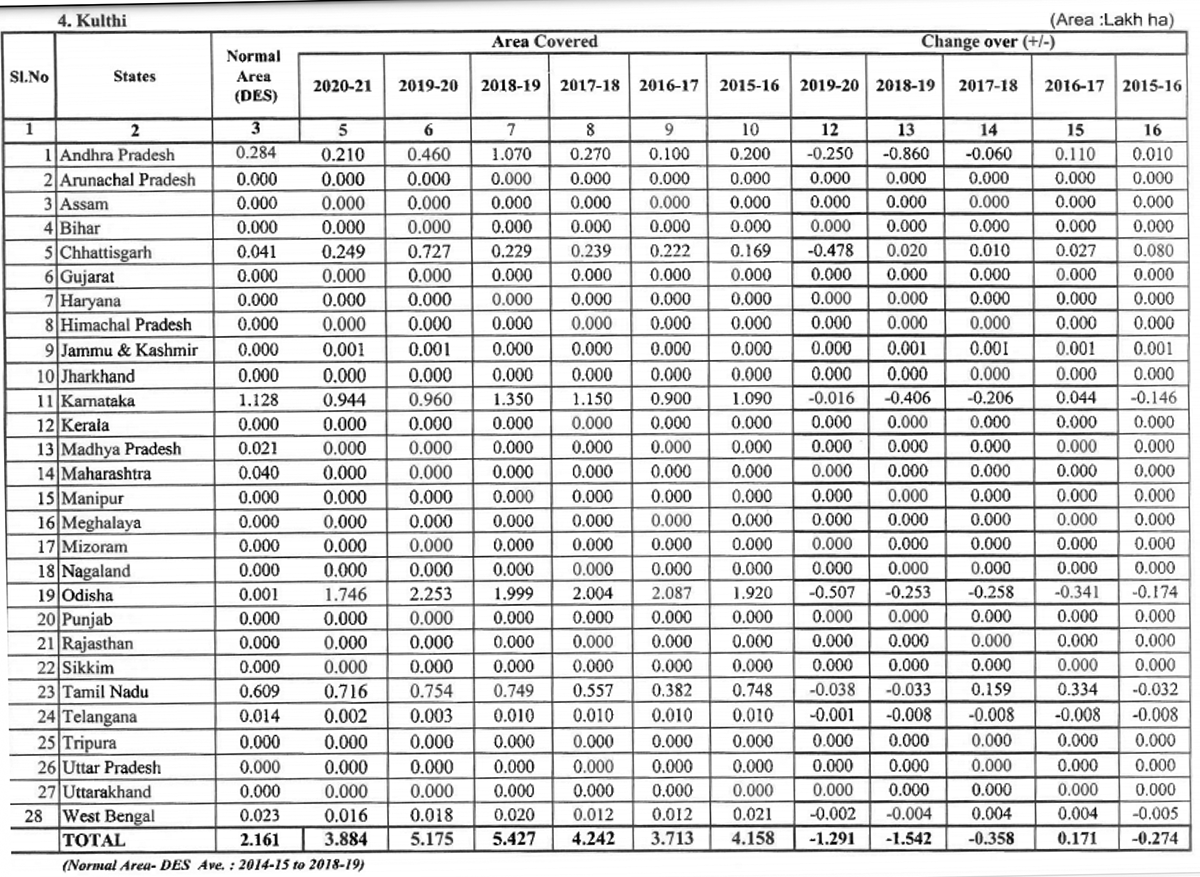

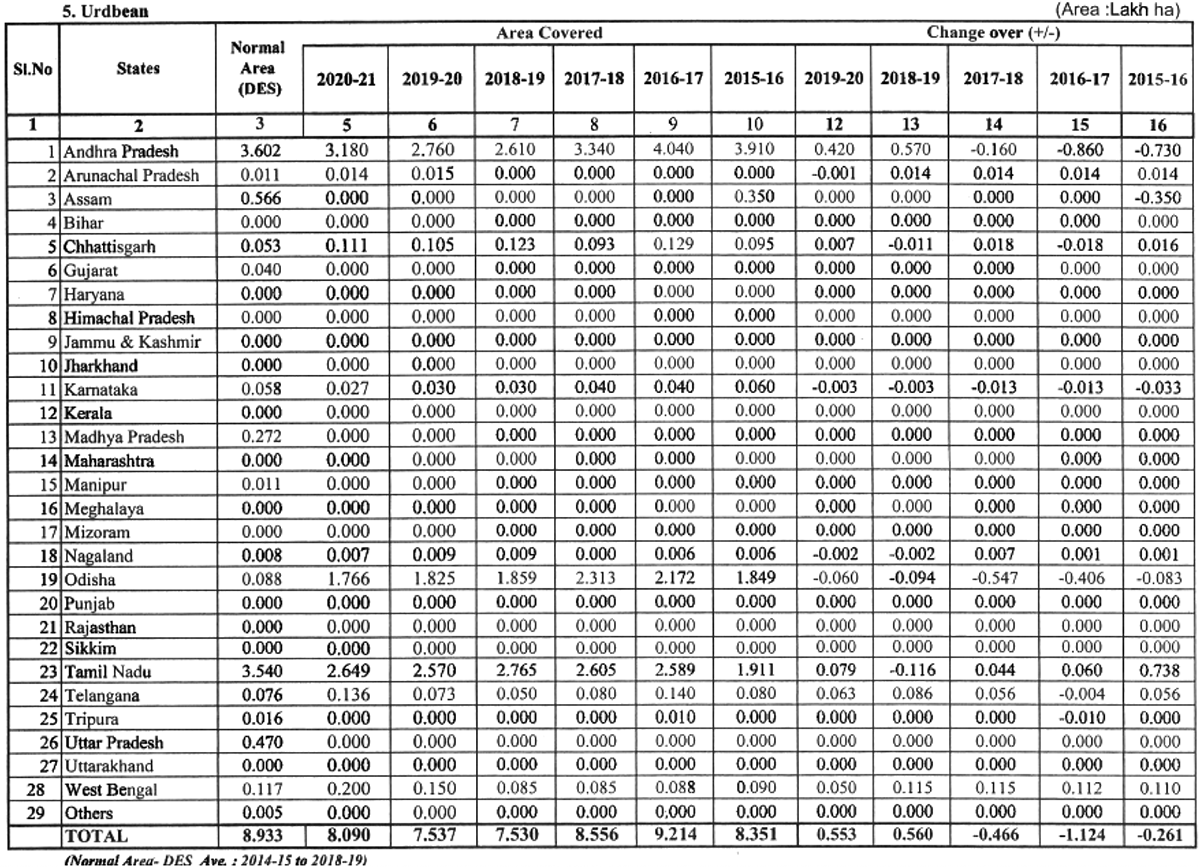

The Union Agriculture Ministry has set a pulse production target of 157 lakh MT for the 2020/21 rabi marketing season. The rabi pulse crop sowing area has reached 165 lakh ha., including 111 lakh ha. of gram, 16.50 lakh ha. of lentils and 11 lakh ha. of peas. Other pulses, including urad, moong, khesari and kulthi are also grown during the rabi season. Urad and mung are also grown in the kharif season.

Looking at current crop and weather conditions, it appears pulse production may fall shy of the target. It could amount to 140 lakh MT, which would be more than last year’s 130 lakh MT. Gram and masur yields are expected to be better, while the MSP for both has been fixed at Rs. 5,100 per quintal. MSP for urad and mung is fixed for the kharif season only.

Chana production may increase by 5-7 lakh MT

At the national level, the area seeded to gram increased to 112.00 lakh ha., up 4.70 lakh ha. or 4.35% from last year’s 107.30 lakh ha. and above the average of 92.75 lakh ha. The weather remains favorable and barring a serious outbreak or natural disaster in the next 4-6 weeks, gram production could exceed the previous season’s crop by 5-7 lakh ha. According to government data, in the 2019/20 rabi season, gram production amounted to 113.50 lakh MT. Based on this figure, this season’s production could be slightly above 118 lakh MT. According to industry trade reviewers, the last rabi season produced 80-85 lakh MT of gram and this season’s gram crop could hit 9 million MT, which is nearly equal to domestic annual demand and consumption. The sowing of gram has increased significantly in Maharashtra and Gujarat, but decreased in Madhya Pradesh, Karnataka and Rajasthan. The arrival of new crop has begun in Maharashtra-Karnataka and the pace of arrivals may pickup in other states next month. The MSP for gram has increased from Rs. 4,875 to Rs. 5,100 per quintal. Earlier, the market price was moving higher than the support price, but now it has fallen considerably. In the peak season for new arrivals, the price may increase in the off season after softening further.

Pulses exports from India are increasing

Except for lentils, India is importing limited volumes of other pulses from other origins. There is a quantitative restriction on arhar pigeon pea, urad (black matpe), mung and pea imports, while indigenous gram has a customs duty of 60% and kabuli gram a 40% duty. Rajma-Lobia imports are also less.

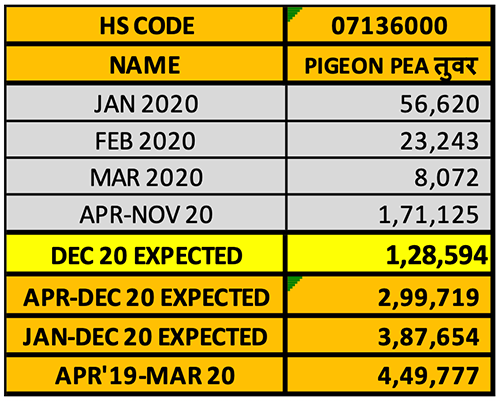

Interestingly, India also exports pulses, mainly organic product and product packed in small consumer packs. According to government data, 2.15 lakh MT of pulses were exported from April-December 2020. That is up from 1.66 lakh MT over the same period in 2019. During this period, the value of pulse exports rose by 27.50% to $ 20.50 million from $16.1 million in Indian currency. The average unit FOB export offer price for pulses fell from $970 per MT last year to $ 952 per MT.

It is worth noting that the price of organic pulses is much higher than that of the general category. Organic pulses are preferred in the markets of the European Union and America. These prices are higher than for whole pulses. It is exported extensively to neighboring countries. There is also demand from many other countries in Asia and Africa.

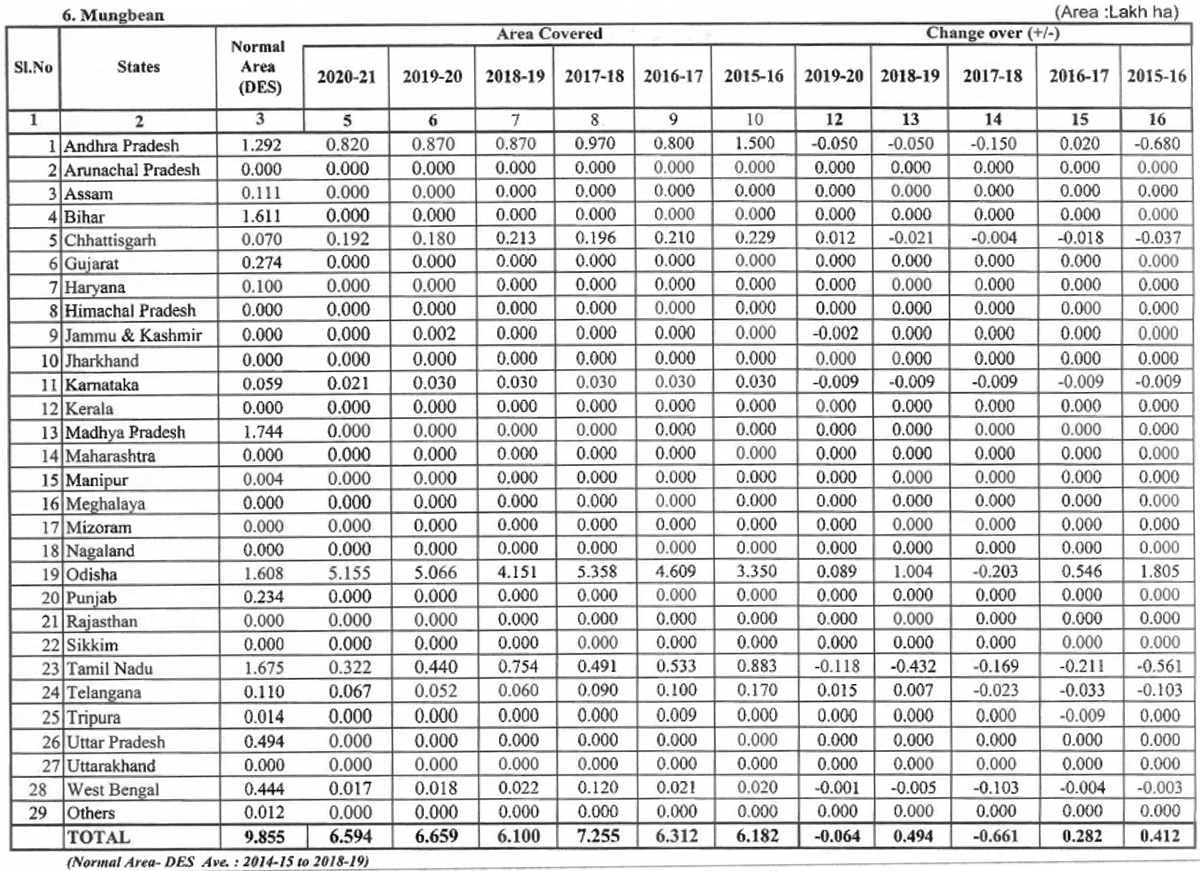

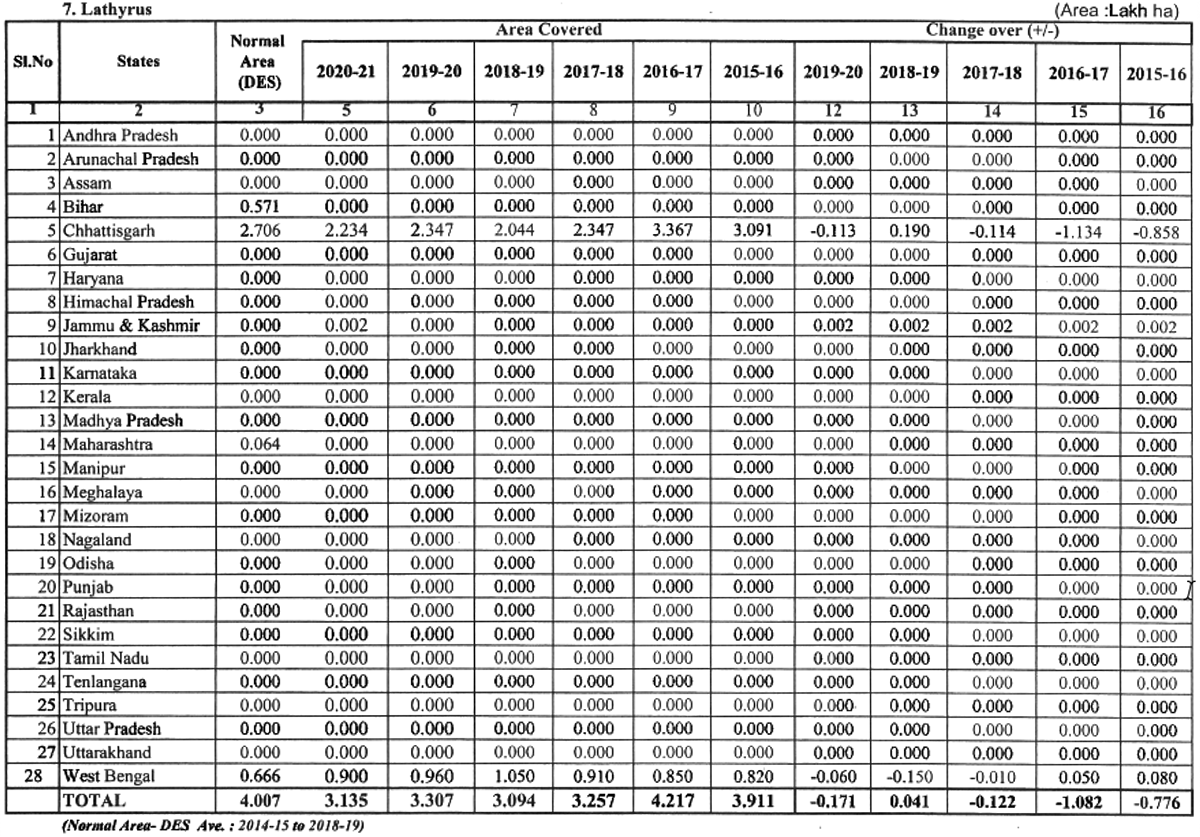

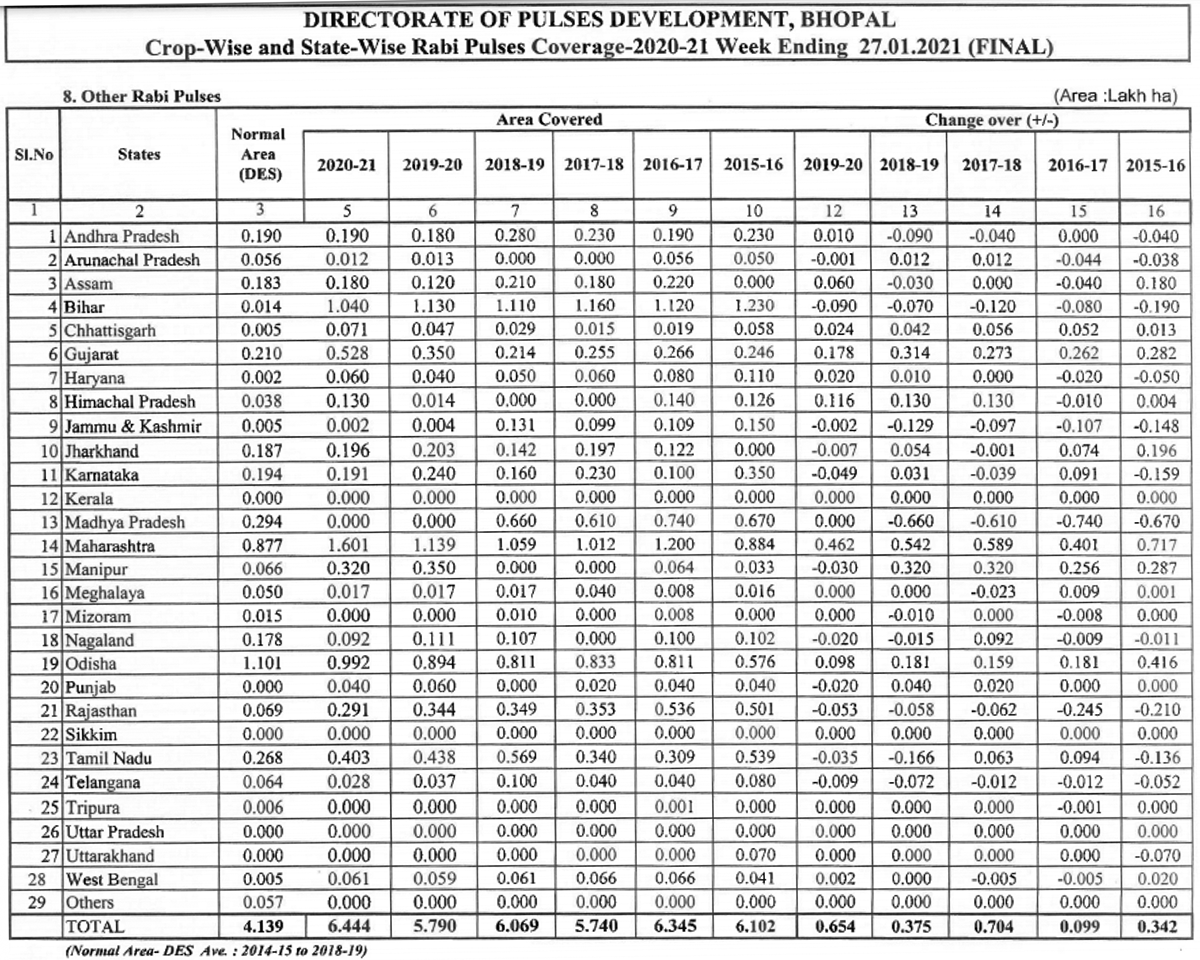

RABI SOWING: DEPARTMENT OF AGRICULTURE, COOPERATION & FAMERS WELFARE

Abbreviations

Tuar/ Arhar: Pigeon Peas PP

Mung: Green Mung

Urad: Black Matpe

Chana: Gram, Desi Chickpea

Matar: Pea

Masur: Lentil

Mandi: Market yard

Bhav: Prices

Dal/Daal: Processed Pulses (Directly for human consumption)

Rs: Indian Rupees (1$=Rs 72.95)

Rahul Chauhan

Director, IGrain India

igrainind@gmail.com

+91 9350141815

Twitter igrain_india

India / Myanmar / Rahul Chauhan / pigeon peas / NAFED / Karnataka / Ganjbasoda / Maharashtra / Madhya Pradesh / Rajasthan

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.