Rundown of Indian Markets

Slow demand in peas (matar)

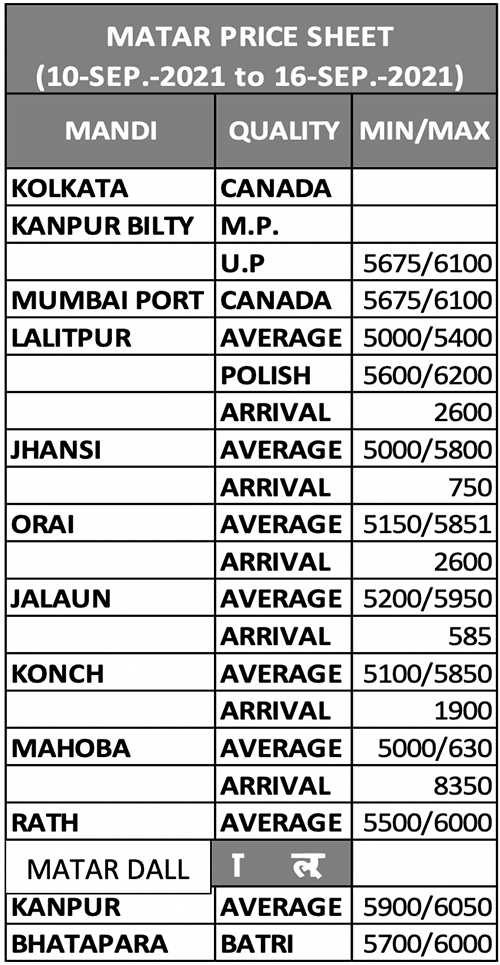

During the past week, buying in peas remained weak and prices declined. Because of the sluggish demand, pea prices in Kanpur fell by Rs. 50 and sold for Rs. 5700-6050 per quintal by the weekend. Constant rains were recorded in pea growing areas during the week and new crop arrivals at mandis were few. Even so, prices fell on slow buying.

Uttar Pradesh

In Jhansi, a bearish fall of Rs. 200 per quintal was recorded and peas traded at Rs. 5,000-5,600 per quintal. Due to slow movement, the price of Jalaun peas declined by Rs. 150 over the course of the week and traded at Rs. 5,811 per quintal. Similarly, the price of Konch peas fell by Rs. 250 and traded at Rs. 5,100-5,600 per quintal over the weekend. In Lalitpur market, prices rose by Rs. 300 by the weekend and stood at Rs. 5,200-5,400, with polish grade at Rs. 5,900-6,200 per quintal.

Matar Dall

Demand remained sluggish as pea prices fell. As a result, no changes were recorded in matar dal and the price of Kanpur matar dal remained stable at Rs. 6,000-6,050 per quintal.

Possibility of heavy damage to kharif pulse crops as states face drought and floods.

The Vice Chairman of the India Pulses and Grains Association (IPGA), a leading body of the domestic pulses industry and trade, said that although there was some increase in the area sown to kharif pulses, crops were impacted by natural calamities in the major producing states. The true production figure will become known during the harvest season.

If heavy rains continue during harvest, there may be damage to urad and mung crops. In Rajasthan, the main producer of kharif season mung, the weather remained dry in August and therefore there is a possibility of a steep drop in yields. The picture will become clear after September. Rajasthan alone produces about 70% of kharif season mung. A small increase was recorded in the sowing of mung, but due to rains, some analysts are predicting up to a 50% decrease in yields.

Initially, the weather in Rajasthan was dry and hot on account of the monsoon’s late arrival. Later, many areas received heavy rains. Based on information received from traders and market sources, moong production there is estimated to fall to about 7-8 lakh MT this year compared to 12-13 lakh MT the previous kharif season. Total mung production in India is usually around 22-23 lakh MT, but may fall to 18-19 lakh MT or less this kharif season.

The crop condition is relatively good in Karnataka and Maharashtra. According to the chairman of the All India Dal Millers Association, the urad crop is good in Madhya Pradesh as well as in some parts of Maharashtra, but some parts were impacted by natural calamities. The tuar crop is not under much threat as of now and has benefited from the rains. The mung crop received some relief due to rain in Rajasthan.

In Karnataka's major pulse producing districts—Kalburgi and Bidar—fields were flooded due to extremely heavy rains, threatening 80% of the area seeded to tuar. If the water remains stagnant in the fields for more than two days, outbreaks of insects and diseases can rapidly impact the crop. In Kalburgi, 10% of the crop has been affected. Rain in Maharashtra will affect the quality of urad but will benefit the tuar crop. Harvest will take place in December.

Increase in area sown to pulses recorded

Despite the delayed and erratic southwest monsoon, the area under pulses (mainly tuar, urad and mung) increased by about 2% this kharif season. However, the erratic rains are adversely affecting pulses.

According to a leading analyst, moong yields are expected to be affected by late sowing in Rajasthan, and excessive rains in parts of Karnataka and Maharashtra may impact the quality of urad. It is too early to estimate production at this time. Heavy rains and flooding in the first week of September may damage tuar crops in parts of Karnataka, where the sown area has been maximum. Another analyst, however, predicted an increase in the average yield of pulses. Pulse yields are expected to be better across all states because of the rainfall received through August and the rains forecast in September. The average yield for pulses at the national level is expected to increase by 14 kg to 702 kg/ha., up from 688 kg/ha. last year. Total pulse production may also increase from 93.10 lakh MT to 102.40 lakh MT. Another source believes that although the area sown to pulses increased somewhat this kharif season, production will be known only once the harvest begins next month.

Kharif season food grain production estimated to reach a new record level of 150 million MT

According to the Union Agriculture Secretary, good rains helped India’s food grain production hit a new record high of more than 150 million MT this kharif season. The seeding of paddy continues and the crop will start to be harvested in many states next month. According to the Agriculture Secretary, 149 million MT of food grains was produced in kharif season 2020-21. This kharif season, there are indications that more paddy and pulse crops were sown; therefore, total food grain production will definitely surpass last year’s level. The Ministry of Agriculture estimated production at more than 155 million MT, up from 149.56 million MT last year. The food grains category includes rice and pulses, as well as coarse cereals.

The first advance estimate for kharif season crops will likely be released by the ministry around September 15th. Although the total area under kharif crops is down about 1 million hectares from last year, the ministry expects the gap to be closed significantly by the end of September. According to the data received, the total area sown to kharif crops through September 10th was 1096.70 lakh ha.; that compares to 1106.57 ha. sown at the same time last year. The area under paddy and pulses has increased slightly, but the area sown under coarse cereals, cotton and groundnut has declined.

According to the Agriculture Secretary, state governments have been asked to take the steps necessary to ensure the procurement of kharif crops. New crop has begun to arrive in some states. Permission has been granted to purchase 40,000 MT of pulses in Karnataka, where new crop moong is arriving to market.

Application fee paid for pulse imports under quota system will be refunded

The Directorate General of Foreign Trade (DGFT) has started the process of refunding the application fee deposited by traders and millers under the fixed import quota of pulses for the financial year 2021-22. In a trade notice issued by the Directorate General, it was stated that through a notification on March 19, 2021 by the Union Ministry of Commerce for the financial year 2021-22 (April-March), 1.50 lakh MT of mung and 4.00 lakh MT of tuar have been imported. The import quota was fixed. After this, import of 4.00 lakh MT of urad was allowed through another notification on March 26, 2021.

Based on this, the Directorate General issued a notification on March 30 and published the details of the terms and conditions (modalities) of import of pulses for the importers. Consequently, many millers-processors and traders deposited the fee along with the application form. Later, on May 15, 2021, the Ministry of Commerce issued a notification announcing the suspension of the quota system of import of pulses and the deregulation of imports. This included the import of all three pulses – tuar, urad and mung –in the open general license (OGL) limit. The duration was fixed at October 31, 2021. In view of this, the importers who have deposited the duty for import of pulses under the quota system should apply afresh for its refund. For this, some procedural steps have been prescribed. Importers have been urged to keep certain things in mind while applying for the duty refund. They should request the withdrawal of their Controlled Import Authorization application after logging on to the DGFT website and after withdrawing the application, they should submit the request for a duty refund on the DGFT website. The controlling import authority's file number of the application will be required to be given in the request for refund of duty. Similarly, it is necessary to provide a valid bank account number in the name of the IEC holder. For any further assistance, the procedure described on the website of DGFT may be visited. The fee refund process is not very complicated but applicants should apply for it carefully.

In the past week, Extension to import of Tuar and Urad import to 31 January 2022 for Pulses having BL date on or before 31 December,2021 given. No change in importing dates of mung.

No change in the clearance rules for pulses imported from SEZs or FTWZ

The Union Ministry of Commerce has sent a letter informing the Development Commissioners of various SEZs and other concerned departments/officers that there is no change in the terms and conditions related to clearance of imported pulses in SEZs/FTWZs. A letter to this effect was issued on August 11, 2021, but some importers had requested a re-examination of the positions mentioned therein. Accordingly, the position was checked. It is to be noted in this context that an order was issued by the Hon'ble Supreme Court on 17 June 2021. In this, the order was given on the matter related to the clearance of pulses ordered during the period prior to 15 May 2021. It is to be known that on May 15, the government had deregulated the import of pulses by coming out of the quota system. The order of the Supreme Court was in respect to certain consignments of pulses which were in excess of that of the Additional Commissioner of Customs. The Supreme Court in its order had directed the complete confiscation of these pulses but at the same time gave some relief. According to this, re-export of that consignment of pulses would be allowed within two weeks from the date of the court order, but for this the importers would have to pay the necessary redemption fines and comply with other statutory obligations. The letter said that keeping in view this order of the Supreme Court, the date of Bill of Landing implemented by the Department of Commerce vide notification dated 15 May 2021 and Directorate General of Foreign Trade (DGFT) dated 25 May 2021 and Revenue on 27 May 2021. It has been decided to retain the conditions and rules recorded in the clarification issued by the Department (DoR). This means that the consignment of pulses ordered before 15 May 2021 will not be counted as free import nor will there be any change in its status. This decision of the Commerce Department will be a huge blow to the importers of pulses whose goods are present in the Special Economic Zone (SEZ) or Free Trade Warehouse Zone before 15 May 2021.

Container shortage hampers Canadian pulse exports

Canada’s pulse harvest is in its final stage, but the pace of exports is slow. The main reason is the acute shortage of containers and vessels, and the extremely high shipping rates, which continue to be increased regularly. Exporters are reluctant to contract pulses on C&F basis, preferring to deal on an FOB basis. A logistics company said that this year it will only be possible to ship a quarter of the typical export volume out of Vancouver. It is becoming difficult to ship pulses in containers, even from west coast ports. As a result, exporters are being encouraged to look for alternatives. Vancouver is considered Canada’s most important port; pulses, oilseeds and specialty crops, as well as other commodities, are commonly shipped from there on a large scale. Due to the harvest of the crop in Canada, there is still a good stock of pulses. There is good demand from export markets, including India, and prices are high. But because of the logistics issues, exporters are unable to accelerate shipments. Given the acute container shortage at Vancouver, the primary alternative is the port of Montreal on the east coast. But exporting pulses from there will not be easy. East coast ports are becoming overcrowded. These ports are already overloaded with large shipments of wheat, maize, etc. Over the past 10 years, most of Canada’s pulse exports have shipped from Vancouver. Exporters are fully aware of the situation there and want to find alternative ports, where new challenges may arise.

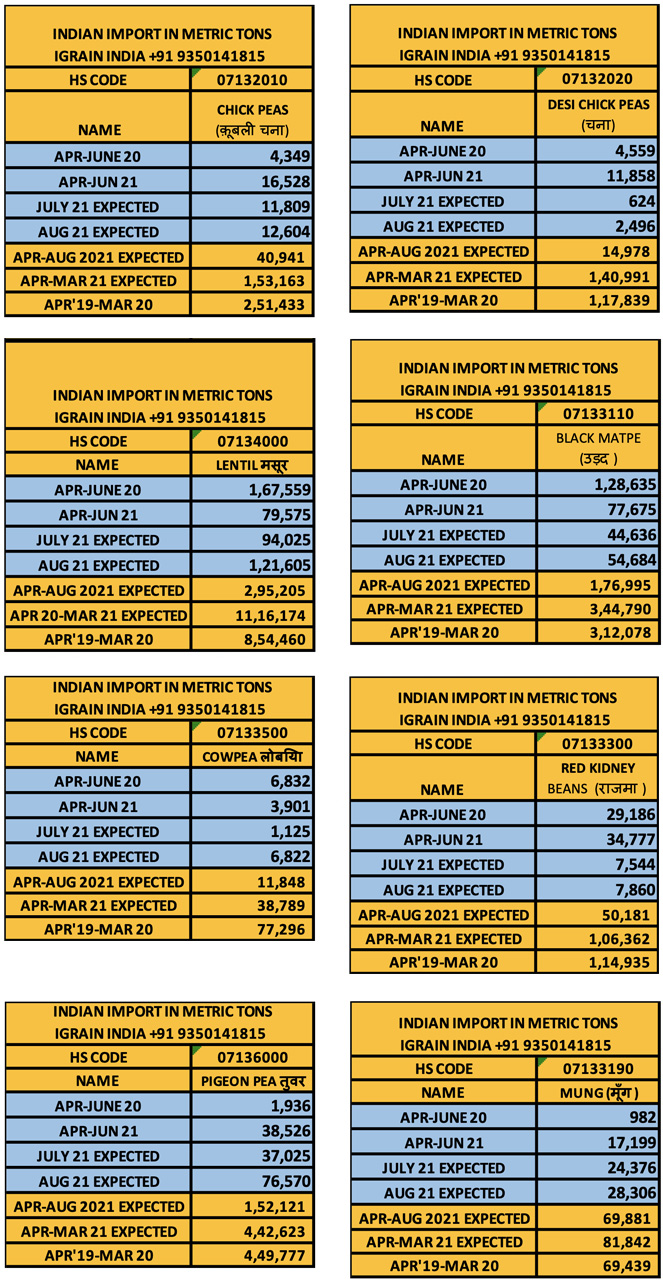

IMPORT FIGURES

Abbreviations

Tuar/ Arhar: Pigeon Peas PP

Mung: Green Mung

Urad: Black Matpe

Chana: Gram, Desi Chickpea

Matar: Pea

Masur: Lentil

Mand: Market yard

Bhav: Prices

Dal/Daal: Processed Pulses (Directly for human consumption)

Rs: Indian Rupees (1$=Rs 73.61)

Rahul Chauhan

Director, IGrain India

igrainind@gmail.com

+91 9350141815

igrain_india

India / IGrain / Rahul Chauhan / Uttar Pradesh / Vancouver / Karnataka / Rajasthan / Maharashtra / Chickpeas / Desi Chickpeas / Black Matpe / Mung / Red Kidney / Cowpea / Lentil / Pigeon Pea

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.