January 5, 2021

IGrain’s Rahul Chauhan provides information on pricing and current inventories, as well as import figures and news from domestic and international markets.

Rundown of Indian Markets

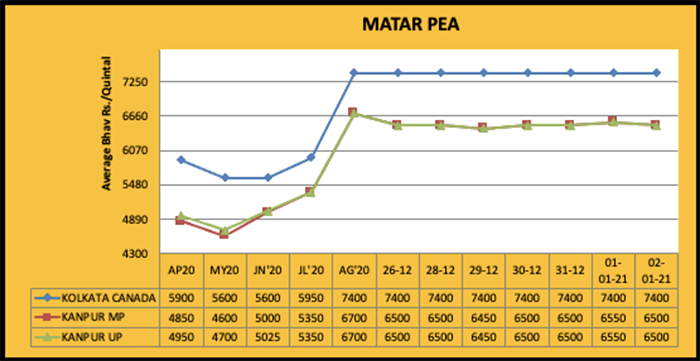

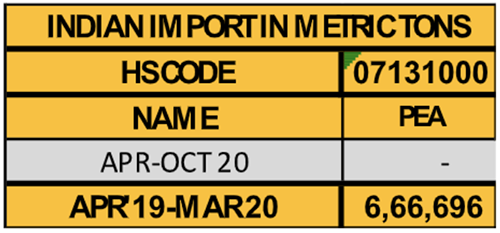

Pea Imports Closed; Bullish Market Compared to Last Year

Mumbai Port

Higher gram area and favorable weather conditions may result in more production. In terms of peas, import restrictions remain in place. Pea sowing figures dropped from last year despite good returns for growers. Good weather conditions could result in higher production—mainly due to a higher output in major pea-producing states Uttar Pradesh and Madhya Pradesh.

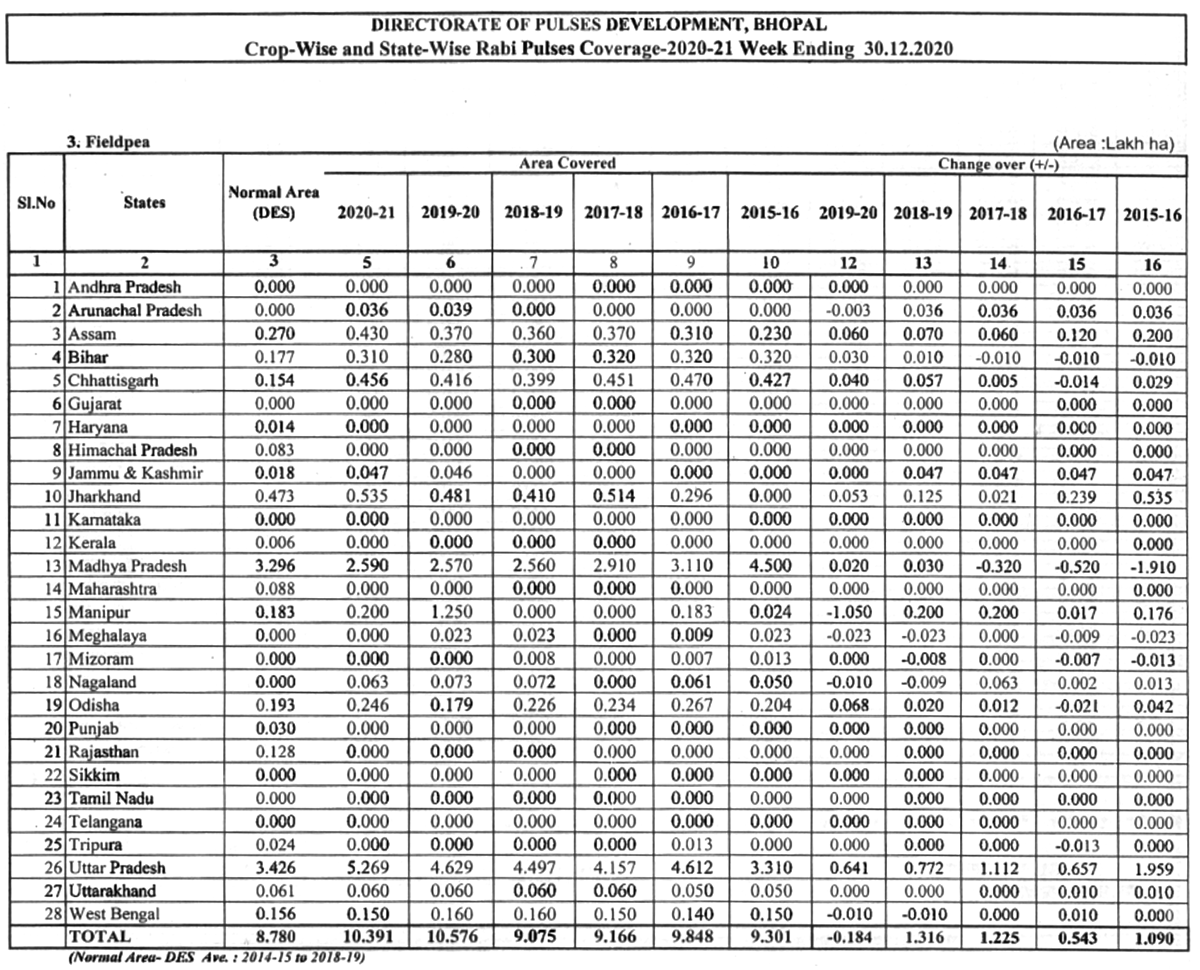

As of Jan 1, peas have been sown in 10.39 lakh, which is just 19,000 hectares less than 10.58 lakh hectares in the same period last year. The availability of peas at the ports is low and sales remain at good pace amid increased prices.

Mumbai Port reported an increase of Rs. 475, which drove prices to Rs. 7,525 per quintal. Current market conditions indicate we may see prices rising to Rs. 8,000 before the arrival of the new crop.

Prices could drop slightly only with the arrival of the new crop. But the pipeline is empty, and everyone has seen record prices so growers could hold their crop in expectation of higher prices.

Uttar Pradesh

Weak demand reported in the market yards. Quality is normal but prices remain strong due to the low current stocks. During last week, Kanpur pea recorded a jump of Rs. 50 to Rs. 6,550 per quintal. In Orai, 50-100 bags arriving in yards at Rs. 5,500-5,800 per quintal. Peas in Jhansi remained at Rs. 5,500-5,800 per quintal. 150/200 bags arrival recorded in Lalitpur mandi. Price stood at Rs. 5,500-6,200 (Rs. 6,200-6,500 per quintal for polished peas). However, stocks of polished peas is even less.

Pea demand is expected to remain normal.

Processed Pea

Processed pea rose by Rs. 100 to Rs. 7,250-7,300/quintal last weekend with the higher raw material costs. There has been a sharp decline in consumption of pea gram flour used as a substitute in gram flour. Due to the shortage, prices of processed peas are expected to remain strong.

Crop Status

Weather is favorable and yields may increase. Recent rains on Sunday favored this trend (not just for peas but also for Gram, Lentil, Urad, Mung, Kulthi, etc).

April-November India’s Pulse Exports at 1.94 Lakh Tonnes

Pulses exports from the world's largest pulse producer and consumer during the first eight months of the current financial year (April-November 2020) increased to 1.94 lakh tonnes worth Rs 1,381 crore or 18.40 crore USD compared to 1.46 lakh (worth Rs. 1,012 crore or USD 14.30 crore) in the same period last year. Exports value increased by 36.4% in Indian Rupees and 29% in USD. Average price per tonne dropped from $ 975 to $ 947. Along with common varieties, organic pulses are also largely exported from India in small consumer packs. In some neighbouring countries demand is good.

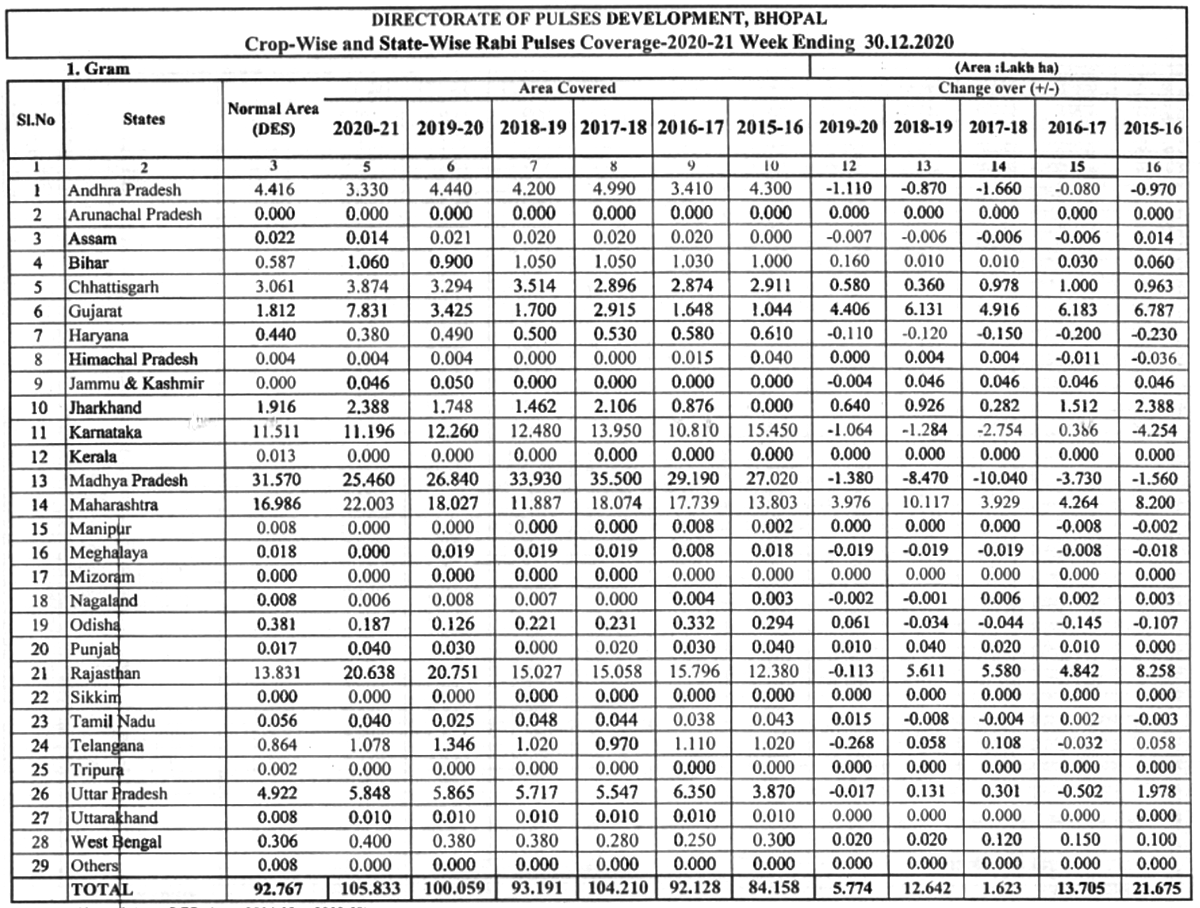

Rabi Pulses Production Estimated to Reach 15 million Tonnes

Analysts estimated total production of pulses to reach 15 million tonnes during the current Rabi season, compared to 15.44 million tons in 2019-20 and 16.11 million tonnes in 2017-18. It may be the third largest production.

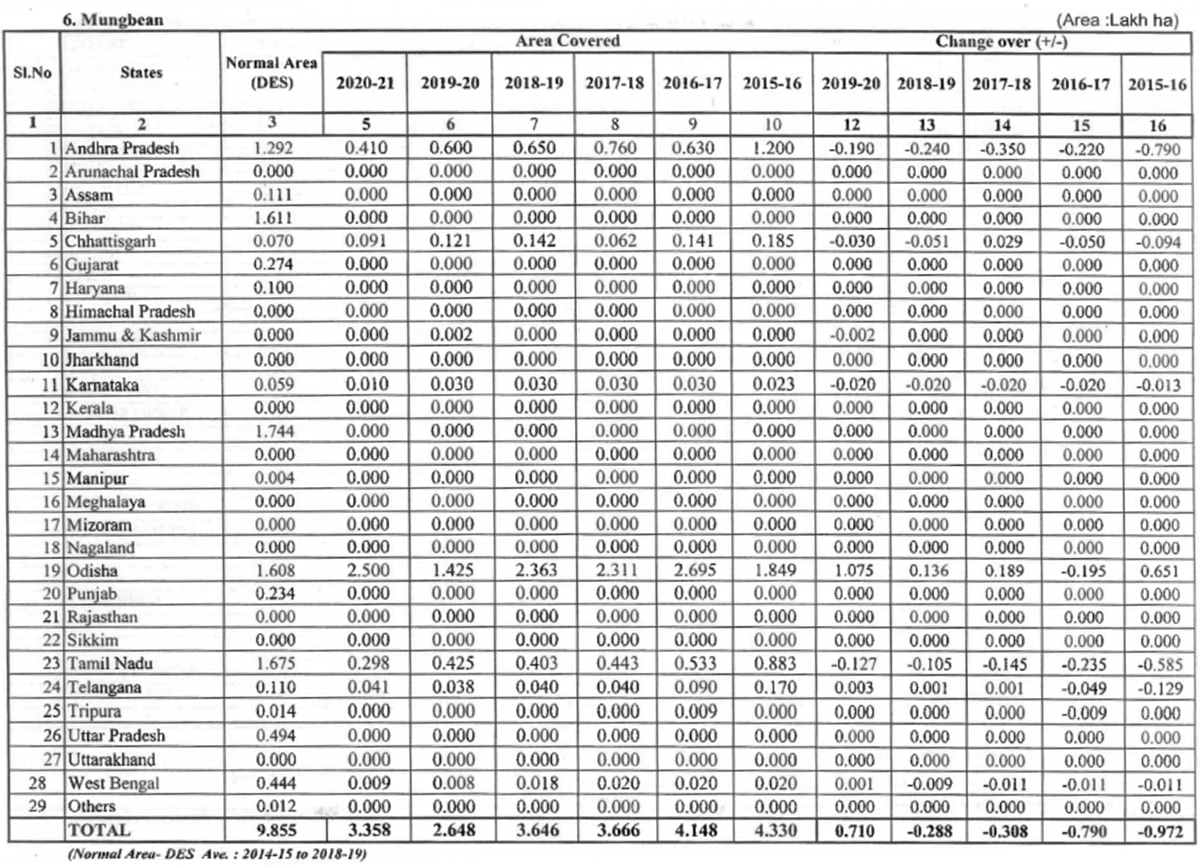

Breakdown by class has been estimated as follows: 10.5 million tonnes of gram, 1.3 million tonnes of lentils and 0.6 million tonnes of moong.

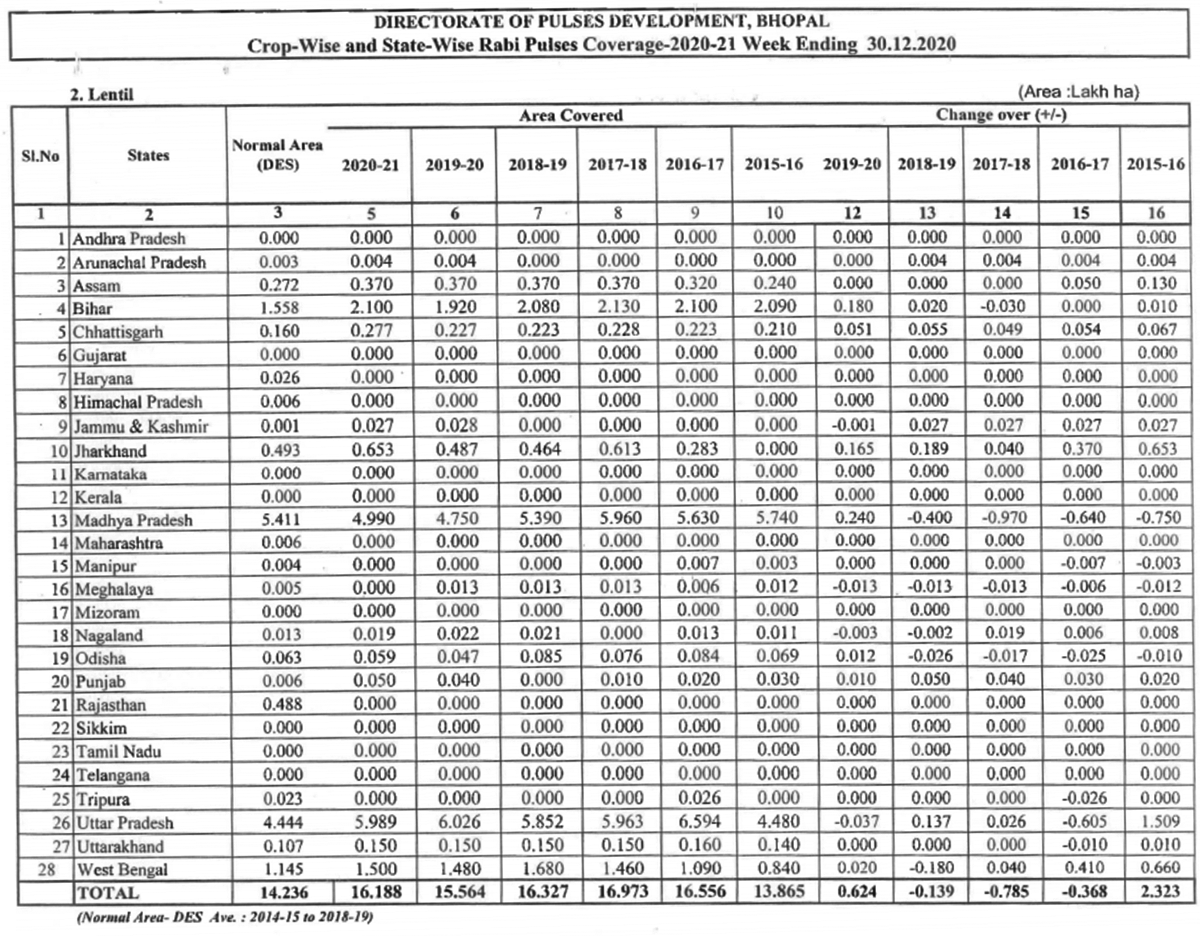

Lentil 2020-2021’s production target has been pegged at 1.6 million tons for the 2020-21 season and 2 million tons for the 2021-22. If the 2 million tonnes target is achieved, then imports will not be required.

India remains the main importer of lentils: around 0.85 million tonnes of lentils have been imported, while by the end of the year there may be an additional import of 50 thousand to one lakh tonnes.

Area of Rabi Crops Above Average

Sowing of rabi crops increased to 62.071 million hectares as of January 1, compared to 60.315 million hectares last year and an average area of 62.027 million hectares.

The latest data from the Union Ministry of Agriculture shows that while sowing of wheat jumped from 31.395 million hectare to 32.535 million hectares, the sowing area of pulses increased from 14.79 million hectares to 15.48 million hectares. The area of oilseeds crops increased from 7.593 million hectares to 8.061 million hectares. Conversely, land under paddy fell from 1.547 million hectares to 1.483 million hectares and coarse cereals area decreased from 4.99 to 4.512 million hectares.

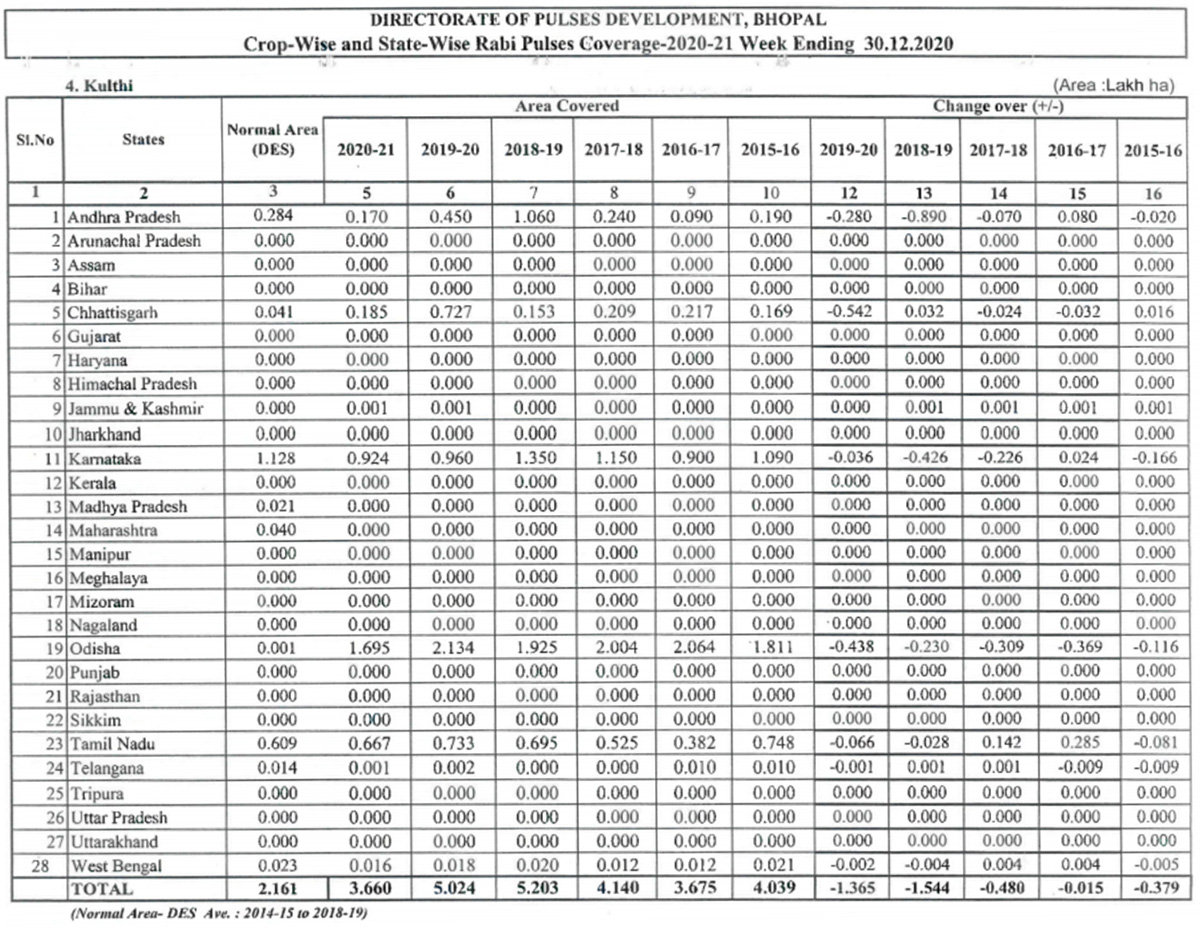

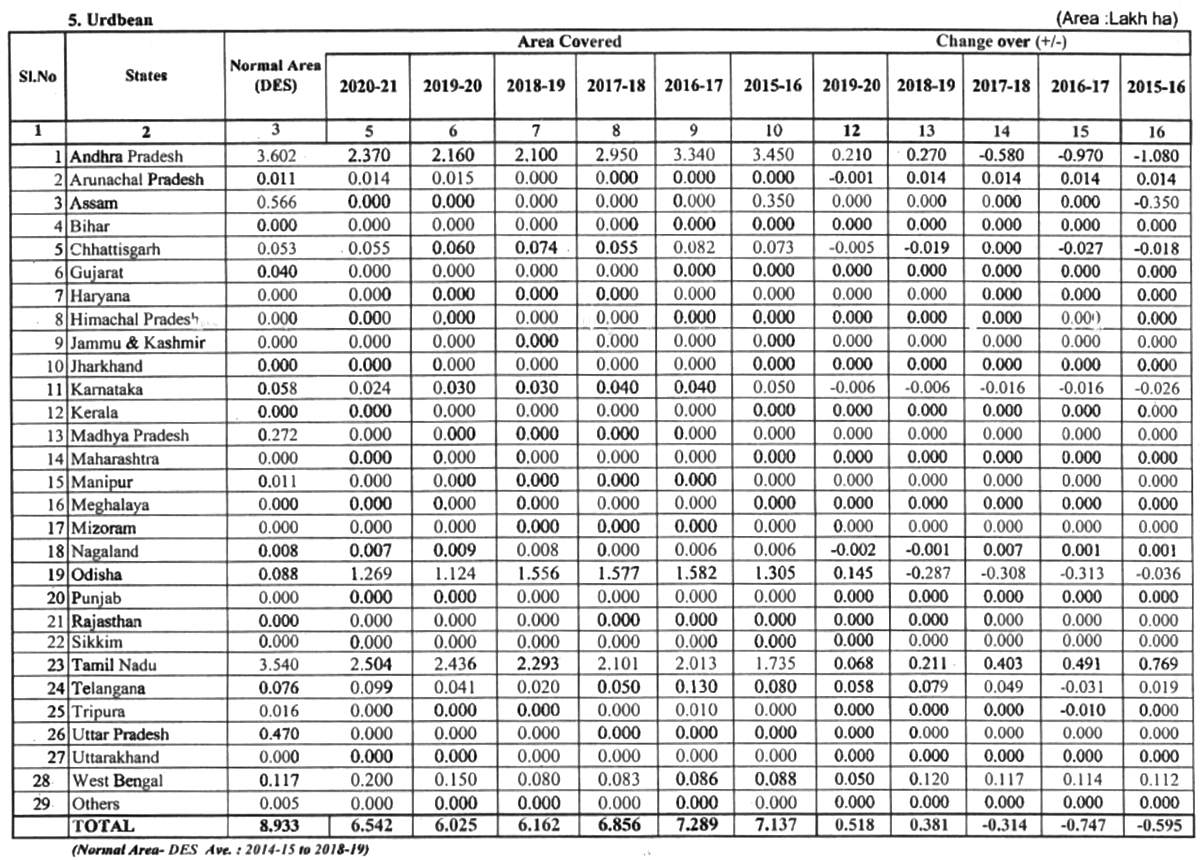

Gram sowing in pulses crops increased from 10.006 million hectares to 10.58 million hectares, lentil sowing area improved from 1.556 million to 1.619 million hectares, urad from 0.602 million to 0.654 million hectares and moong acreage increased from 0.265 to 0.336 million hectares. But the area of pea and Kulthi (Horse gram) decreased. The production area of peas fell from 1.058 to 1.039 million hectares and the seed area of Kulthi decreased from 0.502 million hectare to 0.366 million hectares. Khesari's acreage reached 3.05 lakh hectares, which is almost the same as last year.

RABI SOWING: DEPARTMENT OF AGRICULTURE, COOPERATION & FAMERS WELFARE

Tuar/ Arhar: Pigeon Peas PP

Mung: Green Mung

Urad: Black Matpe

Chana: Gram

Matar: Pea

Masur: Lentil

Mandi: Market yard

Bhav: Prices

Dal/Daal: Processed Pulses (Directly for human consumption)

Rs: Indian Rupees (1$=Rs 73-74)

Rahul Chauhan

Director, IGrain India

igrainind@gmail.com

+91 9350141815

Twitter igrain_india

Rahul Chauhan / India / Myanmar / Uttar Pradesh / Madhya Pradesh / Yellow pea / Gram / Lentil / Urad / Mung / Kulthi

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.