MARKET STABLE DURING PAST WEEK

Delhi

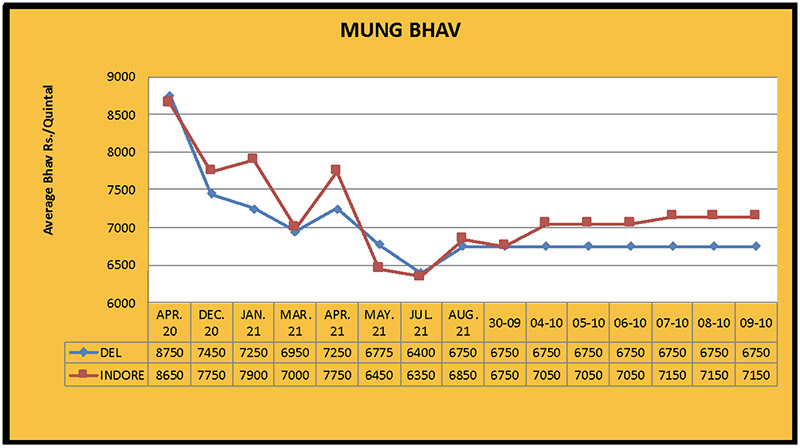

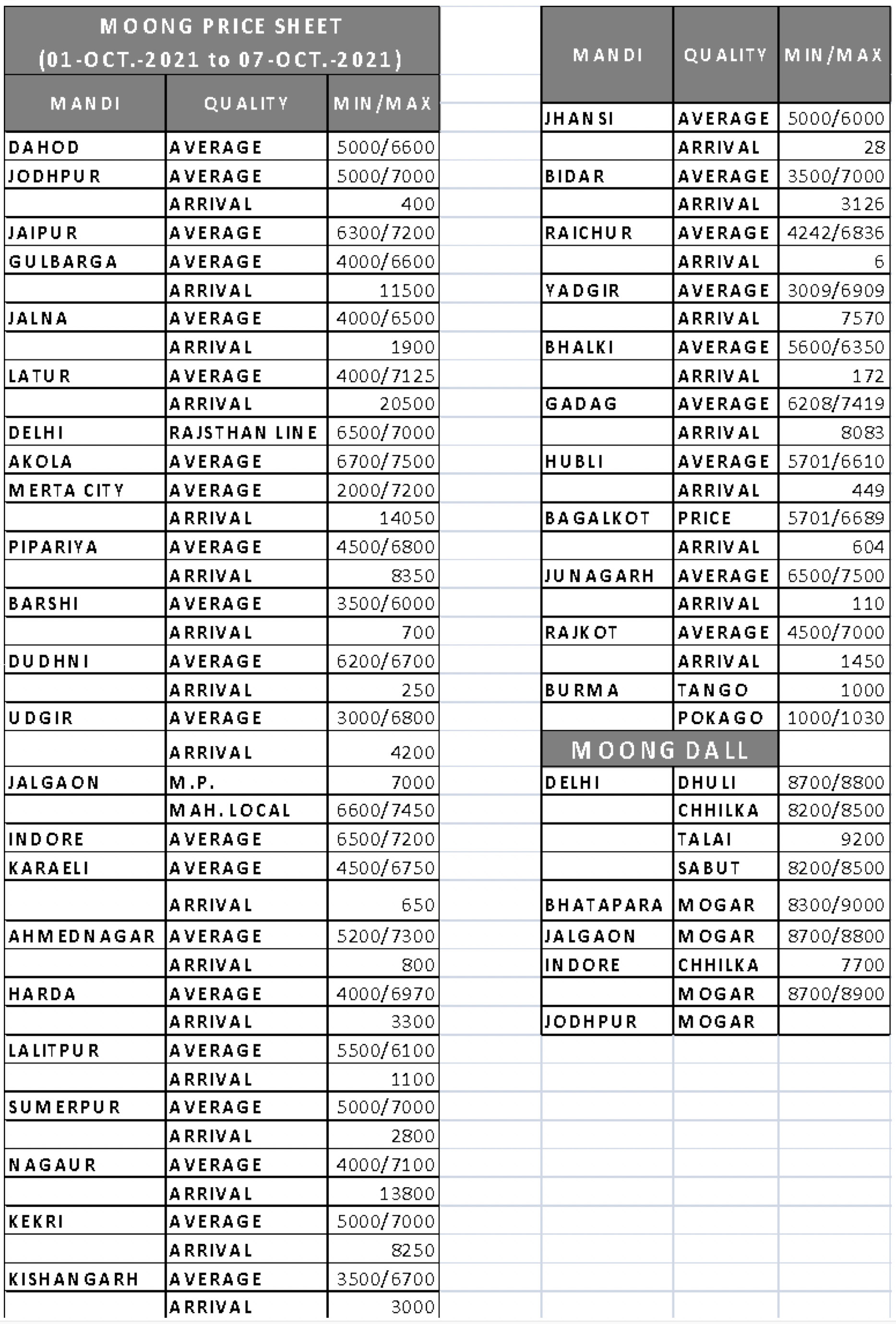

Mung demand remains sluggish and prices remained stable throughout the week. Quality was affected due to continuous rains in growing areas during harvesting. The arrival of tainted/discoloured goods in market yards is increasing. Due to normal buying and selling, there was no bearish movement in Delhi last week and prices remained stable at Rs. 6,500/7,000 per quintal.

Rajasthan

This week, the arrival of mung increased in the mandis of Rajasthan. Due to inward pressure and weak buying, Merta prices reduces by Rs. 200, Nagaur by Rs. 300, Kekri by Rs. 400 and Kishangarh by Rs. 300 per quintal. By the weekend, Merta was traded at Rs. 3,000/7,000, Nagaur Rs. 3,500/6,700, Kekdi Rs. 5,000/6,600 and Kishangarh 3500/6400 rupees per quintal.

Madhya Pradesh

Last week, the inquiries of millers in Madhya Pradesh increased. An increase of Rs.250 per quintal was recorded in Harda and Rs.200 per quintal in Indore. In Harda, mung sold at Rs. 4400/7220 and in Indore at Rs.7100/7200 per quintal. In Pipariya, yard prices remained stable at Rs. 4,500/6,800 per quintal.

Maharashtra

Due to weak sales of mung dal last week, demand from pulses mills remained cool and there was no big change in prices. In the markets of Maharashtra, Latur prices were Rs. 5,000/7,000, Akola Rs. 6,650/7,500, Vashi Rs. 4,000 /6,500 and Ahmednagar Rs. 5,200/7,200 per quintal.

Karnataka

As demand was sluggish, there were no big trends in Karnataka and prices remained stable. In Gulbarga, mung was traded at Rs. 4,000/6,600, Bidar at Rs. 4,000/6,900, Yadgir at Rs. 6,000/6,877 and Gadag at Rs. 6,114/6,801 per quintal over the weekend. The arrival of mung is following a decreasing trend.

Other

Dahod recorded a fall of Rs. 100 per quintal last week due to weak buying, falling to Rs. 6,000/6,500 per quintal. In the Lalitpur mandi, prices increased by Rs. 200/300 per quintal to Rs. 6,300/6,500 per quintal this week.

Mung Dal

Last week, demand remained subdued and prices remained stable at Rs. 8,500/9,300 per quintal.

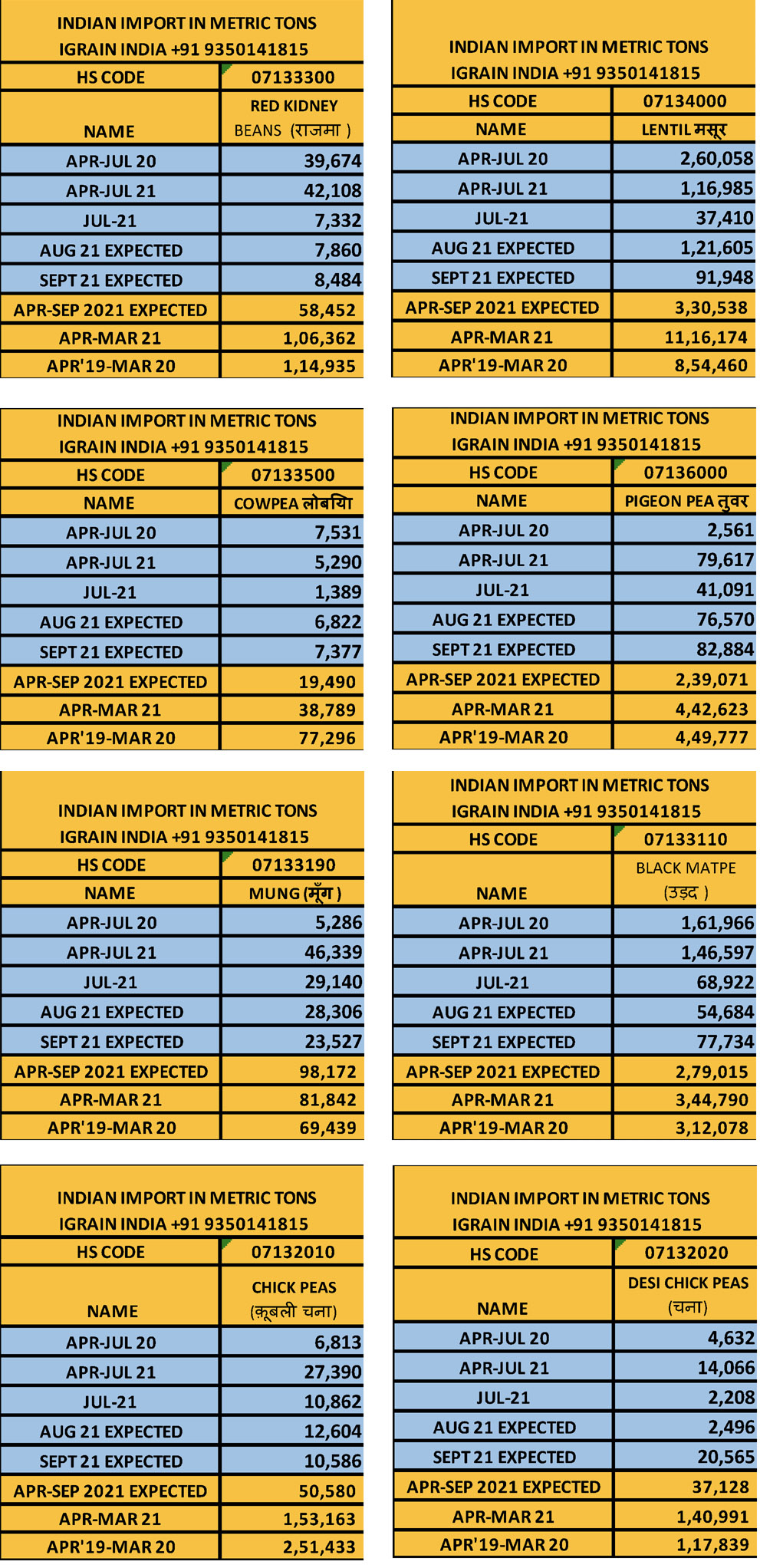

Import of various pulses continued in the month of September

Like the previous months, heavy imports of various pulses continued in September 2021. According to rough estimates, about 92,000 tons of lentils, 83 thousand tons of tuar, 24 thousand tons of Mung, 78 thousand tons of urad, 21 thousand tons of desi gram, 11 thousand tons of kabuli gram, 8500 tons of rajma and 7400 tons of cowpea were imported in September.

Lentil imports comprised 75330 tons from Canada, 16411 tons from Australia and 207 tons from the US, while the tuar imports comprised 2484 tons from Malawi, 8069 tons from Mozambique, 21633 tons from Myanmar, 5987 tons from Sudan, 865 tons from Uganda and 43846 tons from Tanzania. Similarly, 5887 tons of cowpea were imported from Brazil, 96 tons from Kenya, 948 tons from Madagascar, 115 tons from Mozambique, 188 tons from Tanzania and 145 tons from Uganda.

As far as kidney beans are concerned, imports were made up of 987 tons from Brazil, 384 tons from China, 1544 tons from Ethiopia, 2487 tons from Kenya, 160 tons from Kyrgyzstan, 41 tons from Madagascar, 432 tons from Myanmar, 337 tons from Tanzania and 1113 tons from Uganda.

Mung imports comprised 890 tons from Afghanistan, 2352 tons from Argentina, 264 tons from Australia, 4063 tons from Brazil, 240 tons from Kenya, 258 tons from Madagascar, 10949 tons from Mozambique, 2183 tons from Myanmar, 289 tons from South Africa, Tanzania 1241 tons from Uganda, 52 tons from Uzbekistan, 199 tons from Uzbekistan and 548 tons from Venezuela.

Urad was imported from only three countries: 77456 tons from Myanmar, 158 tons from Argentina and 120 tons from Tanzania. Along with this, 19701 tons of desi chickpeas from Tanzania, 625 tons from Uganda and 240 tons from Ethiopia were imported while 509 tons of Kabuli chickpeas were imported from Argentina, 376 tons from Australia, 240 tons from Canada, 120 tons from Myanmar, 9295 tons from Sudan and 46 tons from the US.

The above data show that India is getting special imports of pulses from African countries and Myanmar, while special pulses are being imported from Canada, Australia, South American countries and former Soviet republics. All pulses except peas have import control prices.

Tuar imports are estimated to be 2.39 lakh tons in the April-September period.

During the first half of the current financial year (April-Sept 21), a good quantity of tuar was imported into the country from Myanmar and the African countries of Mozambique and Malawi. The government has suspended the quota system of tuar imports for the time being.

According to the available data, only 2561 tons of tuar were imported during the April to July period last year, which jumped to 79,617 tons in the same months of 2021. This also includes imports of 41,091 tons in July 2021. This indicates that the pace of imports was slow in the April-June 2021 quarter.

Imports are expected to increase to 76,570 tons in August 2021 and jump to 82,884 tons in September. Thus, the total import of tuar is likely to reach 2.39 lakh tons in the first half of April-September 2021. The September figure is provisional but the rough estimate is only around 83 thousand tons. Imports from other countries, including Mozambique and Malawi, are continuing steadily. During the last FY, April 2020 to March 2021, a total of about 4.43 lakh tons of tuar was imported in the country, whereas in the financial year of 2019/20, quantity was close to 4.50 lakh tons. There is still a delay of two months in the arrival of new crops and until then the market will continue to depend on imports as there is very little domestic stock. It is understood that due to the need for imports in India and the increasing activity of importers, the price of tuar in exporting countries has become higher and as a result the import parity is expensive.

Haryana Farmers opting for pulses.

The crop diversification scheme is now showing its colors. The farmers of Haryana state have started paying more attention to the cultivation of pulses and oilseeds instead of paddy and millet. It is worth noting that in the traditional Kharif season in Haryana, paddy and coarse cereals are produced on a large scale. Compared to the year 2020, there has been an increase of 74% in the sown area of pulses (tuar, mung and urad) in 2021 and, as a result, the production is expected to increase by 67% in the state.

The production area of mung jumped from 1.14 lakh acres to 1.98 lakh acres. Similarly, the sown area of oilseeds increased by 42% and production is expected to increase by 48%. On the other hand, the sown area of paddy decreased by 18% from 37.70 lakh acres in 2020 to 30.80 lakh acres in 2021 and the sown area of millet fell by 41 percent from 14 lakh acres to 8.30 lakh acres.

According to senior official sources, the state government is regularly making serious efforts in this direction. Cash assistance is given by the government to the farmers who choose to plant pulses and oilseeds instead of paddy and bajra. Under the 'Mera Pani Meri ViaSat' scheme, an incentive of Rs. 7,000 per acre is given to farmers cultivating alternative crops and Rs. 4,000 per acre to farmers who choose pulses and oilseeds. This scheme has started giving fruitful results but it will take a long time to reach its final goal.

Need to increase the production of pulses in line with the increase in domestic use.

Mumbai. After nearly stabilizing the sown area and production of pulses in the domestic division for the last three decades, some improvement has been seen in recent years but average yield rate has not yet shown the expected increase. As a result, despite the huge area, the production of pulses in the country is less than the domestic demand and consumption and the need for imports remains significant. Although India is the largest producer and consumer of pulses in the world, it is also a huge importer. In the 1980s, the sown area of Kharif pulses was increasing at the rate of about 8 percent per annum, but due to the lack of attractive prices for farmers, the area started declining at almost the same rate in the 1990s. The situation thus arose that pulse production stagnated while demand and consumption continued to increase strongly. As a result, the import of foreign pulses at one time jumped to a record high of more than 6 million tons. Later, it started declining. The production of gram, tur, urad and mung started increasing but the expected increase in the production of lentils and peas could not be achieved. According to a CII report, between 1951 and 2008, the production of pulses in India increased by only 45 percent, while wheat production increased by 320 percent and rice by 230 percent. Although the production of pulses increased by 65 per cent during the last decade i.e., between 2009-10 and 2020-21, it is still not enough to meet the consumption growth of domestic demand. About 40 percent of pulses are produced in the country during the Kharif season (including Zaid) and 60 percent in the Rabi season.

This causes an inconvenience to the government when formulating an import policy. The import of gram and peas has almost stopped but the huge import of lentils continues. Now, the government has also made a plan to import one million tons of pulses from its level, whereas according to the data of the Ministry of Agriculture, the country is producing more pulses than the domestic demand and consumption.

Need to guarantee unlimited purchase of pulses at MSP

New Delhi. India remains the largest producer of pulses in the world. Since the average income of the population is low and the majority of the population is vegetarian, pulses remain a good source of protein for natives and play an important role in ensuring national nutritional security. In India, pulse crops are cultivated in a vast area in both the Kharif and Rabi seasons, which includes tur, urad, moong, gram, lentil, peas, moth, Khesari, kulthi, chaula, rajma, etc. The Central Government fixes the Minimum Support Price (MSP) for pulses every season, but they are procured in limited quantities. In each state, only 20-25 percent of the total production is procured at MSP while farmers are forced to sell the remaining pulses in the open market. The price of pulses keeps fluctuating in the open market (wholesale market) due to various reasons. Government policies do not allow the price of pulses to rise above a certain limit, nor do government agencies procure the total marketable quantity of pulses. This kills the enthusiasm of the farmers.

Analysts say that if the government provides a guarantee to buy an unlimited quantity of pulses like paddy (rice) and wheat at a support price, then agriculture law and the farmers' movement can help to a great extent in solving the crisis. Government procurement of coarse cereals and oilseeds is also very little or negligible in comparison to national production. Despite being the world’s largest producer of pulses, India is forced to import large quantities of various pulses every year. The country is expected to import 3 million tons of pulses worth about $1.50 billion during the current financial year. Except for peas, imports of all pulses have been 'deregulated', which clearly indicates that domestic production will decline. The agriculture ministry, however, is not ready to accept this reality. The average yield rate of pulses in India is very low - just 755 kg per hectare -, while in America and Canada it has reached a high level of 1900 kg per hectare. One reason for this is the cultivation of pulses in non-irrigated areas. Pulses are dependent on rainfall and have to face many natural calamities.

More shipments of pulses and soybeans arrived from Mozambique and Malawi

Mumbai. Two ships laden with pulses and soybeans from the countries of the African continent - Mozambique and Malawi - reached Indian ports last weekend.

According to the available information, the first ship that arrived from Mozambique - the MV Eternity -, had a stock of 23,384 tons of Mozambican tuar, 6001 tons of Malawi tuar, 1002 tons of Chowla (cow pea) and 854 tons of Malawi soybeans. Another ship - the MV PORTHOS - was loaded from Mozambique. Tuar is being imported regularly, especially from these two countries of Africa and is also being imported from Myanmar.

In the domestic market, there is a shortage of tuar due to lower production in the last Kharif season. Demand for pulses is expected to remain strong. In Mozambique and Malawi , the crop is harvested during August-September so export shipments may pick up from September. As far as mung is concerned, it is not likely to be imported much in the coming days as the new domestic crop has started arriving in mandis. Although there is news of heavy losses due to torrential rains in September, until the arrival of new goods continues, prices may remain under pressure. Earlier, crops were also damaged due to dry weather in August. Tuar imports are likely to continue.

Festive demand and crop loss expected to improve the price of pulses

New Delhi. Although, pulse prices are at a standstill or reduced due to government restrictions, the market atmosphere is gradually getting stronger. This is a consequence of both the fact that old stocks are running out and the new Kharif season pulse crops have suffered due to natural calamities and that strong demand has become in anticipation of the festive season. Pulses are being imported regularly from abroad but quantities are limited. The new Kharif crop of mung and urad is of low quality due to damage to the grains and high moisture content.

In some other provinces, including Rajasthan, Madhya Pradesh, Maharashtra and Gujarat, there have been reports of significant damage to mung and urad crops. Stockists have started showing interest in procuring good quality pulses while pulse millers and gram flour manufacturers are actively procuring. In view of this, the possibility of domestic market prices softening in the near future has dimmed. There is a shortage of tuar stock and despite large import volumes from Mozambique, Malawi and Myanmar, it is not enough to meet domestic demand and the new domestic crop will not be harvested for another two months. Lentil prices are firmly anchored at higher levels while gram prices are gradually climbing higher. The sowing of these two pulses will also start soon. The consumption of gram is increasing due to limited stocks of peas and import restrictions. The pulses market may remain strong until Diwali. Prices of pulses are high in exporting countries and imports are becoming expensive due to increased shipment costs. This domestic market is expected to be impacted.

Abbreviations

Tuar/ Arhar: Pigeon Peas PP

Mung: Green Mung

Urad: Black Matpe

Chana: Gram, Desi Chickpea

Kabuli Chana : Chickpea

Matar: Pea

Masur: Lentil

Mandi: Market yard

Bhav: Prices

Dal/Daal: Processed Pulses (Directly for human consumption)

Rs: Indian Rupees (1$=Rs 75.03)

Rahul Chauhan

Director, IGrain India

igrainind@gmail.com

+91 9350141815

Twitter https://twitter.com/IGrain_India

IGrain / Rahul Chauhan / India / Mung / Maharashtra / Madhya Pradesh / Delhi / Rajasthan / Karnataka / Mung Dal / Mumbai / Chickpeas / Desi Chickpeas / Black Matpe / Red Kidney / Cowpea / Lentil / Pigeon Pea

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.