November 18, 2020

IGrain’s Rahul Chauhan provides information on pricing and current inventories, as well as import figures and news from domestic and international markets.

Wishing you all a very happy and prosperous Deepawali.

Highlights from the week:

Due to decreased mung production, the government finally allocated import quotas to mills/processors. This decision pushed mung prices downwards. Mung arrivals at mandis (market yards) are decreasing. Mung demand remains normal. Unseasonal rains in Karnataka, Maharashtra and Rajasthan damaged kharif mung crops and impacted production. The situation in Karnataka was especially bad. The sowing of moong in Karnataka was spectacular this year, but 25-40% of the crop was lost to the rains. The quality of the crop was also affected. Abundant supplies of Mogar quality is available on the market. The quality of the mung crop has also been affected in Rajasthan and Maharashtra.

The decrease in production resulted in a shortage and traders are buying green mung beans in any quantities they can find and at any price. Stockist prefer to stock Mogar quality green Mung inventories.

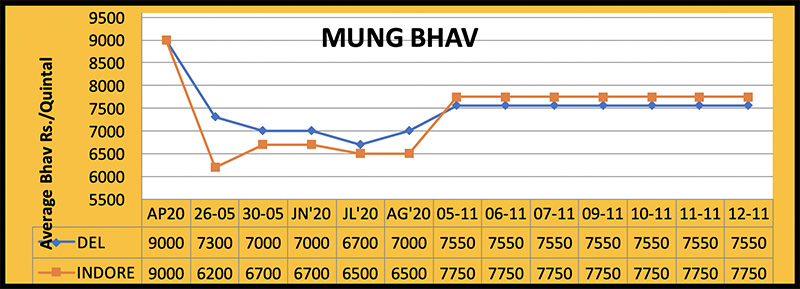

Mung availability is low globally and prices may rise on Indian demand. Should that occur, the cost of imports would increase. Markets may decline temporarily because of the news that imports are being allowed, but prices look to surge again in the future. Last week, a sharp slowdown was not seen in Delhi. The price was recorded at Rs. 7,300-7,800 per quintal. Demand is expected to remain normal.

Rajasthan

Mung prices in Rajasthan fell by Rs. 100-200 last weekend. The decrease saw prices per quintal drop to Rs. 6,500-7,300 in Jodhpur, Rs. 7,000-7,600 in Jaipur, Rs. 5,000 in Sumerpur Rs. 5,800 – 7,300 and Kekri market yard. Demand is expected to increase.

Maharashtra

Mung arrivals in Maharashtra are gradually decreasing. Prices fell due to weak buying. Over the weekend, prices per quintalstood at Rs. 5,000-8,100 in Latur, Rs. 4,200 in Akola, Rs. 4,000-8,500 in Ahmednagar. Selling may decrease further.

Karnataka

In Karnataka, Gulbarga Mandi prices held at Rs. 4.000 - 8,000. Mung in Gadag traded at Rs 6,052-8,019. The big difference in price is due to variations in mung quality.

Madhya Pradesh

Mung prices declined by Rs. 200 on weak demand. Over the weekend, prices per quintal fell to Rs. 7,000 in Pipariya, Rs. 7,500-8,000 in Indore and Rs. 5,500-8,260 in Harada.

Other Markets

During the past week, there was no sharp decline in Dahod Mung prices due to good movement.Prices remained stable at Rs. 7,000-7,500. Mung prices in Lalitpur mandi, Uttar Pradesh decreased by Rs. 200 to Rs. 4,000-7,000. Movement in other mandis was also weak.

Mung dal

Little demand was seen in Mung daal. The impact of the fall of raw mung was also felt on the market. Moong dal declined by Rs. 100-200 and stood atRs. 8,800 - 9,800 per quintal over the weekend. Demand is expected to remain normal.

Total arrivals atmajor markets (in lakh MT)

(From November 2 - 17)

States- Arrival

Karnataka

Gulbarga 1,77,00

Bhalki 1,367

Gadag 14,842

Maharashtra

Barshi 2,150

Udgir 4,750

Ahmednagar 3,900

Madhya Pradesh

Pipariya 28,000

Rajasthan

Kekadi 6,900

Uttar Pradesh

Lalitpur 1,030

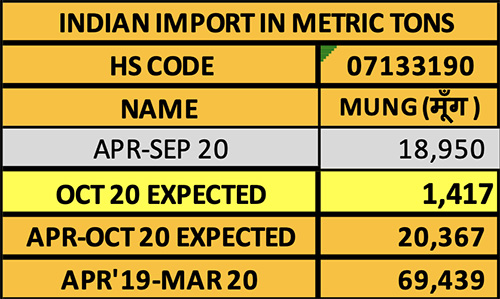

Mung imports allowed through 31 March 2021

For the current fiscal year, an import quota of 1.50 lakh MT of Mung was granted. Each of the 1,464 applicants (millers / processors) is allowed to import 103 MTthrough 31 March 2021.

The governmenthas now allowed the import of Tuar (4 lakh MT through 31 December), lentils (at 10% duty through 31 December) and urad (15 lakh MT through 31 March 2021, i.e. the end of the fiscal year). Only yellow pea imports remain restricted.

India’s mung imports come mainly from Myanmar (Burma). Following the announcement that imports would be allowed, Myanmar’s mung prices are likely to rise while in India they are starting to stabilize.

China is buying large quantities of mung from Australia, African nations and Black Sea countries at prices above $1,100/MT. Indian demand may lift international mung prices.

Rajasthan- More than 44% of rabi area sown

The state of Rajasthan, located in the western part of the country,is one of the top producers of mung, gram andurad.Rabi sowing there is in full swing.

According to official data, rabi seeding in the state has hit 43.94 lakh hectares as of November 10; the seeding target is 98.80 hectares.

According to the latest weekly report from the State Agriculture Department, the area under pulse crops has jumped from 9.74 lakh hectares last year to 13.52 lakh hectares this year. The area seeded to gram expanded from 9.68 lakh hectares to 13.36 lakh hectares, and the area seeded to other pulses has grown from 6,000 hectares to 16,000 hectares.

Government purchased 39,000 tons of pulses and oilseeds

In current kharif marketing season, NAFED has spent Rs. 208.81 crore to procure 39,000 MT of mung, urad, groundnuts and soybeans at MSP through November 8. These crops were purchased from 22,772 farmers. Thus far, the Central Government has approved the purchase of 45.10 lakh MT of pulses and oilseeds at MSP. The purchasing occurred in Tamilnadu, Maharashtra, Gujarat, Haryana and Rajasthan.

Because prices on the open market exceed MSPs, farmers preferred not to sell to the government.

Sowing of Mung and Urad may be higher

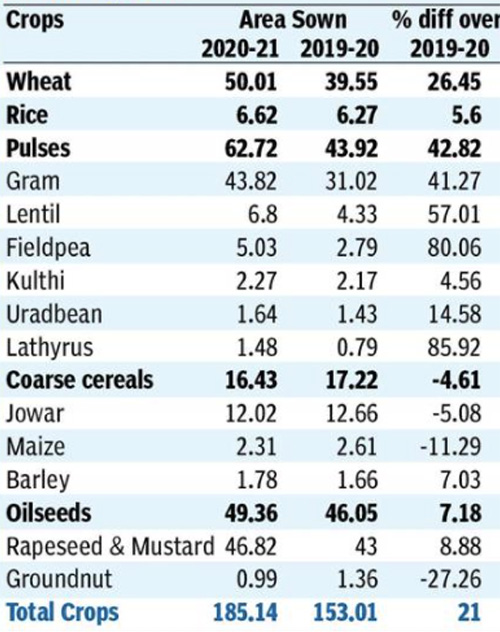

Mung and urad crops aresown in both the Kharif and Rabi seasons. The kharif cropis still arriving at market yards, while the rabi crop is being sown. At the national level, urad sowing progressed to 1.64 lakh hectares, which compares to 1.43 lakh hectaresat this time last year.

The mung area fell from 20,000 hectares last year to 11,000 hectares this year. The area seeded to these crops this rabi season is forecast at 8.93 lakh hectares for urad and 9.86 lakh hectares for mung.

Since wholesale market pricesfor these two pulses is still much higher than the minimum support price, sowing for both is expected to increase in the coming days.

The major urad producing states during the rabi season include Andhra Pradesh, Tamil Nadu, Uttar Pradesh and Madhya Pradesh. Mung is produced in states like Andhra Pradesh, Bihar, Gujarat, Madhya Pradesh, Odisha, Tamil Nadu, Uttar Pradesh and West Bengal.

Rabi crops sown in 185 lakh hectares

At the national level, the total sowing area for rabi crops increased to 185 lakh hectares, which is 21% or 32 lakh hectares more than the sowing area of 153 lakh hectares in the same period last year. Madhya Pradesh's participation in this increase is more than two-thirds. Strong sowing of rabi crops is still in progress.

According to the latest weekly report of the Union Ministry of Agriculture, during the current Rabi season, the production area of pulses has registered a tremendous increase of 43%.

The area of rabi pulses has increased to about 8.24 lakh hectares in Madhya Pradesh, 4.26 lakh hectares in Uttar Pradesh and 3.12 lakh hectares in Rajasthan. Apart from this, the area under pulses in Gujarat and Maharashtra also increased. This time, the area sown to gram, lentil and pea is increasing more than last year. Due to high and firm prices in the domestic market, farmers are motivated to increase the area sown to pulses.

The weather is currently favorable for sowing of rabi crops. Due to light rains in several northern states last weekend, soil moisture levels have increased and will benefit both crops that are already in the ground and those that have yet to be sown.

Abbreviations

Tuar/ Arhar: Pigeon Peas PP

Mung: Green Mung

Urad: Black Matpe

Chana: Gram

Matar: Pea

Masur: Lentil

Mandi: Market yard

Bhav: Prices

Dal/Daal: Processed Pulses (Directly for human consumption)

Rs: Indian Rupees (1$=Rs 74-75)

Rahul Chauhan

Director, IGrain India

igrainind@gmail.com

+91 9350141815

Twitter igrain_india

Mung beans / Rahul Chauhan / Andhra Pradesh / Bihar / Gujarat / Madhya Pradesh / Odisha / Tamil Nadu / Uttar Pradesh / West Bengal / China / kharif crop / rabi crop / Myanmar / Australia / Black Sea Region / NAFED

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.