June 10, 2021

IGrain’s Rahul Chauhan provides information on pricing and current inventories, as well as import figures and news from domestic and international markets.

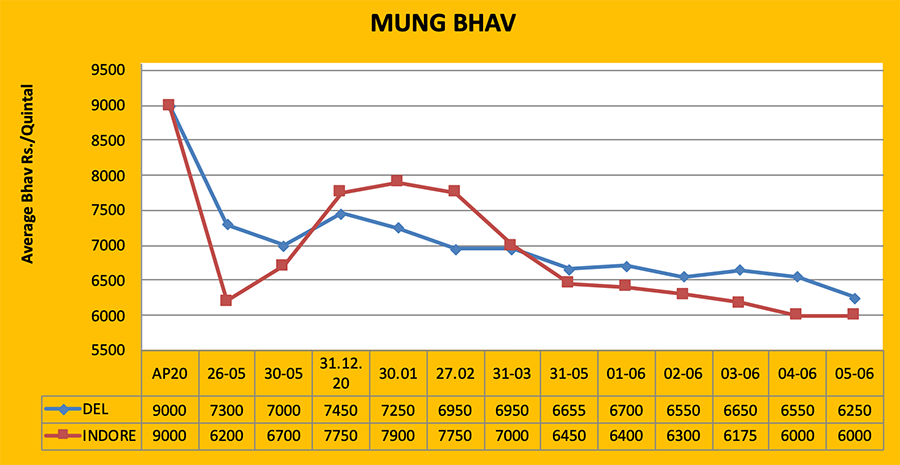

The arrival of new crop mung has started in Madhya Pradesh, Uttar Pradesh and other producing states. The demand for mung remains weak due to the lockdown, and prices are down as a result. This year, Madhya Pradesh seeded 150% more mung than last year. The area seeded to mung was also up in Gujrat. Due to favorable weather, both the quality and productivity are reported to be better. The demand for pulses remains weak in the papad industry. Selling by millers pressured market prices. On the other hand, stockists have invested heavily in anticipation of a rally. Prices at the mandis are running at more than Rs. 1200-2000, but still below the MSP of Rs. 7196 per quintal. Farmers are waiting for government procurement to start in Madhya Pradesh; it might start on June 15. Farmers need income to sow kharif crops and have no choice but to sell crops at reduced prices. Prices are likely to remain under pressure for some time, remaining at low levels until government procurement begins.

Delhi/ Mumbai

During the week, prices fell by Rs. 800 in Delhi to Rs. 5900-6400 per quintal (100Kg). The price of imported Mumbai C&F Pokako is being quoted at $900 and Tango Seva $1020.

Madhya Pradesh

The daily arrival of mung in the mandis of Madhya Pradesh is increasing at a fast pace and prices are falling as a result. This week, prices fell by Rs. 550-700. In Indore, prices fell by Rs. 600 to Rs. 5300-5780 and in Pipariya they fell to Rs. 5000-5820 per quintal by the weekend.

Maharashtra

Due to the lack of demand from pulse mills and panicked selling by stockists, mung prices declined by Rs. 100-300 and sold at Rs. 6500-6700 by the weekend. Prices stood at Rs. 6700 in Akola, Rs. 6400-6800 in Jalgaon and Rs. 6000-6500 in Ahmednagar.

Rajasthan

Mung demand was also down in Rajasthan. Due to normal selling, prices declined by Rs. 300-400 to Rs. 6700. By the weekend, prices per quintal stood at Rs.6700-7000 in Jaipur, Rs.5000-6000 in Sumerpur, Rs.5800-6200 in Nagaur and Rs.4000/5900 in Kekri.

Uttar Pradesh

Under pressure from new arrivals, mung prices fell by Rs. 500-600 in Uttar Pradesh. With this decrease, Lalitpur mung traded at Rs. 5500-5550 and Jhansi mung at Rs. 6000-6500 per quintal over the weekend.

Karnataka

In Gulbarga Mandi, the price remained stable at Rs. 4000-7000. Because it is the off-season, goods are not coming to the mandis. Karnataka buyers will start purchasing from Madhya Pradesh once the lockdown ends.

Gujarat

In Gujarat, good quality summer Mung is arriving. Due to sluggish demand, prices fell by Rs. 400 by the weekend. By the weekend, prices per quintal fell to Rs. 6000-6200 in Dahod, Rs. 5000-6500 in Rajkot and Rs. 6500-7300 in Junagadh. Demand is expected to remain normal.

Mung dal

The effect of declining moong prices was seen on moong dal. Subscription in pulses was weak and subsequently prices fell by Rs. 500-1200 to Rs. 7100-9000 by the weekend.

Government pulse stocks are below target.

At present, the Central Government holds pulse buffer stocks of about 1.25 million MT, which is 750,000 MT less than the target of 2 million MT. Because of high domestic market prices for most pulses as they arrived to market, government agencies did not have the opportunity to procure sufficient quantities during the kharif and rabi seasons.

According to official data, the central buffer stock currently holds 754,688 MT of gram, 343,940 MT of tuar, 87,309 MT of mung, 55,315 MT of urad and 3,457 MT of masoor (lentil). Last week, the Union Food Secretary said that the pulse buffer stock target would be achieved. In February, the government upped the target to 2.3 million MT, but later dropped it to 2 million MT.

The government often uses its buffer stocks to increase the supply and availability of pulses in the domestic market and thus control prices. India is the largest producer and consumer of pulses in the world. The Ministry of Agriculture projects MY 2020-21 pulse production at 25.6 million MT, but the trade believes actual production is much less.

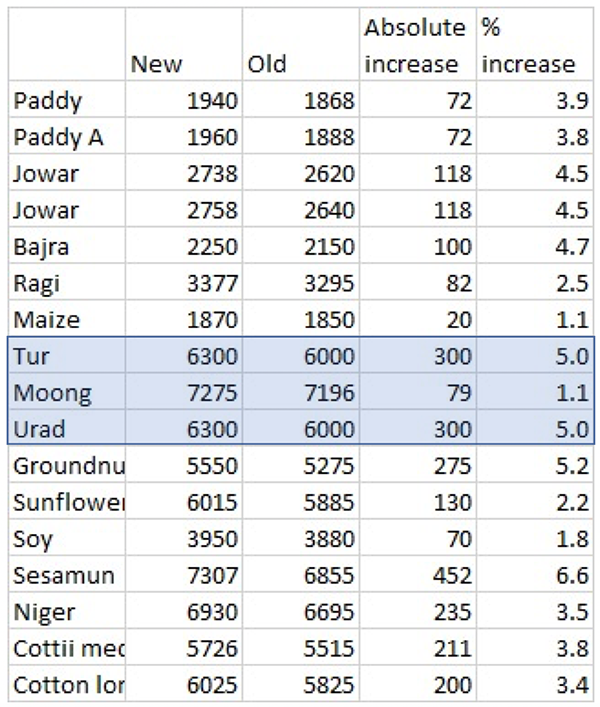

Due to rising prices in the domestic market, the government decided to allow the unrestricted import of tur, urad and moong. It is expected that the customs duty on lentil imports may be cut as it was last year. Rumours have also spread through the market that the government may liberalize its import policies for peas, but this could prove to be a significant misstep. With the government short on stocks, its agencies will be unable to effectively intervene in the market to control pulse prices.

India’s farmers may suffer from the free import policy on pulses, but it is necessary to facilitate imports in order to increase availability.

Four to five years ago, in order to control the large influx of lower-priced foreign imports and ensure higher prices for domestic farmers, the Central Government imposed heavy duties on imports, including 60% on gram, 50% on peas and 30% on lentils. Additionally, a quota system was implemented for tuar, urad and mung imports. Later, peas were also included. In 2020, the import duty on lentils was dropped from 30% to 10% on two occasions. And in 2021, tuar, urad and mung imports were changed to Open General License (OGL). Before this announcement, the price of pulses had been running higher than MSP and farmers were reaping some relief. The government, which had been attempting to increase the price of these pulses for the past two years, is now attempting to reduce it by encouraging imports of lower-priced product from abroad. This decision by the Central Government will discourage Indian farmers and have an adverse effect on the sowing of pulses during the kharif season.

It should be noted that in September-October, new crops of mung and urad will start arriving in some states, including Maharashtra, Karnataka, Rajasthan and Madhya Pradesh. Starting in December, there will also be new crop tuar arrivals. If a large volume has been imported before then, who will buy from farmers at high prices? The government agencies will only buy pulses at MSP, and farmers are getting higher prices now. Can the government’s pulse import policy prove to be effective in doubling farmers’ incomes?

On the other side, pulse production is down for the past two years and government stocks are lower than they have been in many years. Opening the Indian market to imports will increase availability and provide consumers relief, especially during the festive season.

Actual pulse production likely to be much lower than official estimates

The Union Agriculture Ministry has estimated domestic pulse production will hit a record 25.6 million MT in 2020-21, up from 23 million MT in 2019-20. At that level, production would exceed consumption. The production of gram is estimated at 12.61 million MT and tuar production at 4.14 million MT. The trade, however, estimates gram production at 8.5-9 million MT and tuar production at 3.1-3.5 million MT.

If the government estimates are correct and India has an adequate supply of pulses, then why did it authorize the free import of tuar, urad and mung through October 31? Previously, pulse prices never increased during a season of record production. Domestic demand and consumption are also not showing exceptional growth.

The reality is that prices have increased because of a production shortfall. The Agriculture Ministry recently issued its third advance crop estimate, but its figures may be revised for the fourth estimate. All eyes are on lentils; last year, the duty on lentil imports was lowered. The expectation of a duty reduction on desi gram remains low. Imports of tuar, urad and mung are expected to be normal, as in previous years, as production is limited, but lentil, pea and desi chana imports matter as availability outside of India is huge.

Sowing of pulses likely to be affected by the government's free import policy

Because of the Central Government’s decision to allow free imports of tur, moong and urad just before the start of the sowing season, the area seeded to these crops is likely to decrease somewhat this kharif season. These pulses are to be imported by the end of November. In September-October, new crop mung and urad will start arriving at mandis in many states. New crop tuar will begin to arrive in the southern states starting in December. The government has granted permission to import pulses from May 15 to October 31 under OGL.

In order to increase the supply and availability in the domestic market and lower prices, pulse imports have been deregulated. It may be known that there is already free import of pulses like lentil, desi gram, chickpea gram, cowpea and rajma kidney beans, but the import of peas is banned.

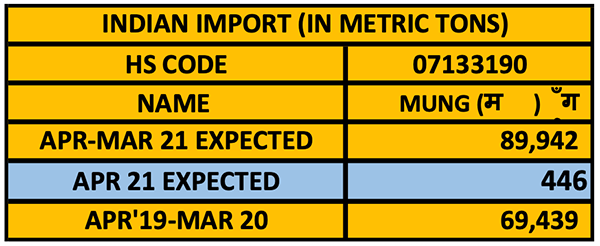

There is a decrease in the import of pulses

Data from the Union Commerce Ministry shows that in the 11 months from April to February of financial year 2020-21, urad imports increased to 320,000 MT from 312,000 MT the previous cycle. Desi gram imports increased from 118,000 MT. Lentil imports rose to 1.097 million MT from 854,000 MT. Mung imports declined from 69,000 MT to 48,000 MT. Rajma kidney bean imports went from 115,000 MT to 96,000 MT and chickpea imports from 251,000 MT to 150,000 MT. Earlier, the government had set import quotas of 600,000 MT of tuar, 400,000 MT of urad and 150,000 MT of mung for financial year 2021-22. The import quota for tuar also included a 200,000 MT quota for Mozambique. Imports from other countries will be in addition to this. Because there are no large inventories of tuar, urad and mung in the major producing and exporting countries, it appears India will find it difficult to increase its imports. The government should have made this decision in February or March or waited a month or two so as not to dampen grower enthusiasm to seed pulses. Farmers are now concerned that domestic pulse prices may remain soft for the coming months and this could see them sow fewer pulses in favor of high priced soybeans, groundnuts and cotton.

Desi Gram Chana 2021 Rabi (in Tons)

Gujrat 96,170

Maharashtra 1,30,148

Karnataka 22,021

Andhra Pradesh 10,026

Total including others 2,58,368

Kharif 2021

Total Pigeon Pea 11,310

Urad 137

Mung Kharif 12,601

Mung Rabi 2020

Tamil Nadu 3,967

Odisha 80

2019 season

Lentil 0

Pigeon Pea 184148

Urad 132

Mung 13879

Abbreviations

Tuar/ Arhar: Pigeon Peas PP

Mung: Green Mung

Urad: Black Matpe

Chana: Gram, Desi Chickpea

Matar: Pea

Masur: Lentil

Mandi: Market yard

Bhav: Prices

Dal/Daal: Processed Pulses (Directly for human consumption)

Rs: Indian Rupees (1$ = Rs 72.9)

Rahul Chauhan

Director, IGrain India

igrainind@gmail.com

+91 9350141815

Twitter igrain_india

Rahul Chauhan / mung bean / India / New Delhi / Mumbai / Madhya Pradesh / Maharashtra / Rajasthan / Uttar Pradesh / Karnataka / Gujarat

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.