February 3, 2022

IGrain’s Rahul Chauhan provides information on pricing and current inventories, as well as import figures and news from domestic and international markets.

IPGA- WEBINAR RABI AND KHARIF

Market down due to less demand

New Delhi

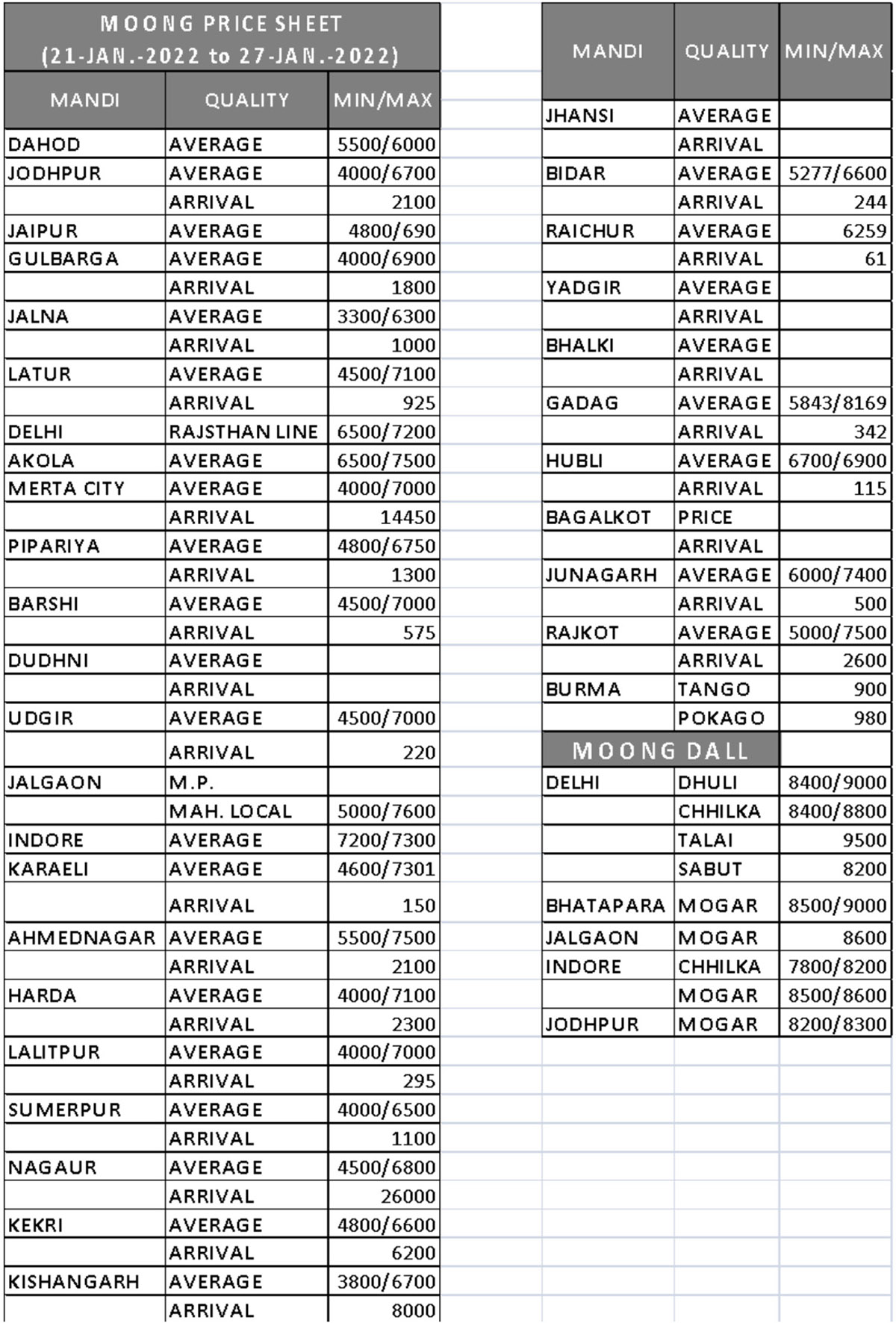

Mung prices declined during the last week due to subdued demand from millers. Due to sluggish buying and selling, Delhi prices did not see any bearish movement this week and remained stable at Rs. 6,500/7,200 per quintal over the weekend.

Rajasthan

There was a lack of demand for mung in Rajasthan last week, causing a declining trend. In the last week, Jaipur prices fell by Rs. 200, Merta by Rs. 200, Nagaur by Rs. 200, Kekri by Rs. 100 and Kishangarh by Rs. 200 per quintal and over the weekend, Jaipur traded at Rs. 4,800/6,700, Merta Rs. 3,500/6,600, Nagaur Rs. 5,000/6,600, Kekdi Rs. 5,500/6,400 and Kishangarh Rs. 3,500/6,500 per quintal.

Maharashtra

Due to weak demand, Maharashtra prices recorded a fall of Rs. 100 per quintal and in Latur, mung sold at Rs. 4,500/7,000, in Udgir at Rs. 5,500/6,800, in Jalgaon at Rs. 5,000/7,500 and in Akola at Rs. 6,500/quintal at the weekend.

Madhya Pradesh

A lack of demand in Madhya Pradesh last week caused Pipariya prices to fall by Rs. 250 per quintal and they remained at Rs. 4,800/6,500 per quintal. In Harda, however, prices remained stable at Rs 4000/7100 per quintal.

Other

Due to the impact of the general downward trend combined with weak demand, Gulbarga prices fell by Rs. 200 per quintal and sold at Rs. 4,000/6,700 per quintal over the weekend. Similarly, Lalitpur prices dropped by Rs. 500 per quintal and at the weekend, mung traded in the range of Rs. 6000 to 6500 per quintal.

Mung dal

Buying of Mung dal remained sluggish and prices remained stable at Rs.8200/9000 per quintal during the weekend in most of the markets.

Rajasthan mung procurement in process

Jaipur. According to the minister, government procurement of groundnut, urad and mung worth a total of Rs. 489 crore has already been done in the current Kharif marketing season of 2021-22 in Rajasthan. As per the rules of the Central Government, pulses and oilseeds can be procured for 90 days from the first day of procurement. Accordingly, the procurement process of mung, urad and soybean went on until January 29 and groundnut will continue until February 15. Farmers who did not have the opportunity to register earlier were given a second opportunity.

According to the data given by the minister, the total number of farmers registered so far in Rajasthan is 98,149. The quality of mung has been affected due to unseasonal rains and much of the goods arriving in the mandis is discoloured and damaged goods. Under the quality criteria of the Central Government, mung with up to 3 percent damage must be accepted. The Rajasthan government requested that the acceptance level increase to 10 percent but this was rejected.

According to official data, in the current Kharif marketing season 41,561 tons of moong worth Rs 302 crore have been procured from 21,900 farmers and 33,647 tonnes of groundnut worth Rs 187 crore from 14,814 farmers. Pulses and oilseeds are being procured from the farmers as per the norms set by the Centre.

Gujarat- Increase in Pulses, Oilseeds and Cotton production

Ahmedabad. The second advance estimate of agricultural production for the 2021-22 season has been released in Gujarat, a major agricultural producing province of western India. This estimate indicates a decline in the production of cereal and spice crops and an increase in the production of pulses and oilseeds compared to the 2020-21 season.

According to the available data, the production of rice in the state declined from 21.45 lakh tons to 20.38 lakh tons, wheat from 43.78 lakh tons to 39.18 lakh tons, jowar from 57 thousand tons to 51 thousand tons and millet from 10.49 lakh tons to 2.66 lakh tons. Maize production, however, will increase from 6.67 lakh tons to 7.25 lakh tons and ragi production is likely to remain stable at 12 thousand tons. The total production of cereal crops is expected to decline to 70.32 lakh tons from 83.24 lakh tons last year.

On the other hand, the total production of pulses is expected to jump from 19.67 lakh tons last year to 29.48 lakh tons. Gram production in particular is expected to greatly increase, to 24.90 lakh tons this year from 14.37 lakh tons last year. Production of tuar, however, dropped slightly from 2.85 lakh tons to 2.77 lakh tons, and mung production is expected to fall from 1.10 lakh tons to 45 thousand tons. The production of urad will remain stable at around 90,000 tons.

The production of oilseed crops is expected to increase from 62.29 lakh tons to 64.69 lakh tons. Groundnut production is expected to improve from 41.34 lakh tons to 41.66 thousand tons, mustard from 4.20 lakh tons to 6.18 lakh tons and soybean from 2.02 lakh tons to 3.48 lakh ton. Castor production, however, is estimated to drop from 13.45 lakh tons to 13.02 lakh tons and sesame from 1.22 lakh tons to 32 thousand tons. Sugarcane production will also fall from 169.54 lakh tons to 157.03 lakh tons.

According to the estimate, cotton yields may jump from 72.16 lakh bales to 85.17 lakh bales. (1 bale=170 kg.)

Karnataka- Second advance production estimate 2021-22 season released

Bangalore. Karnataka, an important agricultural producing state in South India, has released the second advance production estimates of various crops for the 2021-22 season. The Agriculture Department says that, due to heavy rains and severe floods in some districts of the state, crops have been damaged and there will be a resulting decline in production.

Rice production in Karnataka is expected to decrease from 47.17 lakh tons to 35.13 lakh tons, ragi from 13.69 lakh tons to 10.74 lakh tons, maize from 63.72 lakh tons to 52.83 lakh tons and tuar from 12.38 lakh tons to 10.30 lakh tons as compared to last year.

The total production of food grains in the state is expected to fall from 160.27 lakh tons to 128.73 lakh tons.

The gross production of oilseed crops is also likely to come down from 12.49 lakh tons last year to 11.29 lakh tons this year. Although soybean production is expected to marginally improve to 3.90 lakh tons from 3.77 lakh tons, groundnut production is likely to decline to 5.56 lakh tons from 7.20 lakh tons.

In the cash or commercial crops category, the production of cotton is estimated to fall from 23.17 lakh bales to 17.47 lakh bales and sugarcane production from 423.17 lakh tons to 407.48 lakh tons. Except for the aforementioned marginal increase in soybean yields, the production of all major crops is likely to decline drastically. The biggest production declines will be seen in rice, ragi, groundnut, tuar, maize and cotton. A sharp decline in the total production of food grains has also been estimated. The average yield rate of maize is expected to decline from 3689 kg per hectare to 3390 kg per hectare and of tuar from 759 kg to 637 kg per hectare.

Demand to abolish GST on branded pulses and cereals

New Delhi. Since its implementation in 2017, the 5% Goods and Services Tax (GST) on branded pulses and cereals has been causing problems in the trade sector as well as at the consumer level, causing many traders to exit the branded market. Since non-branded products of these commodities are free from the GST, manufacturers and traders of branded products are not able to trade competitively.

Because of the GST, retailers charge a higher price for branded goods to consumers, which they feel has increased the price of pulses.

In their pre-budget memorandum, grains and pulses traders have demanded the Union Finance Minister to remove the GST on branded products. Branded grains subject to the 5% GST include rice and wheat flour.

Both trade organizations and traders have been pushing the government to remove the GST for a long time, without success. Since the implementation of the GST, the business of branded food products has been continuously shrinking. For many consumers, branded products give an assurance of the quality of the product. The demand will most likely be considered this year as the government wants to discourage bulk and open form trading the reduce the risk of adulteration

The trade sector is arguing that these essential products should be kept out of the purview of tax. After the implementation of the GST, the export of branded pulses from the country was blocked and it is felt that the government should immediately reinstate this subsidy. It was also highlighted in the memorandum that, due to frequent changes on the import policy of pulses, there is an atmosphere of uncertainty in the market. Traders are urging the government to make a permanent policy for at least one year, even if a minimum import duty has to be imposed.

However, in the budget meeting held on February 1, this issue was not put on the table for discussion.

If economic sanctions are imposed on Russia, India will also be affected.

New Delhi. If economic sanctions are imposed on Russia by the US and its allies amid rising tensions with Ukraine, it can have both positive and negative effects on India. It would, for example, cause the global market price of petroleum to increase, meaning both that import costs would increase and the domestic prices of petrol would rise, impacting the trade and transportation of all commodities.

Ukraine is the largest producer and exporter of sunflower oil in the world and, in the event of a war with Russia, exports may be stopped. India is the biggest importer of Ukrainian sunflower oil and also imports from Russia and, if these imports are disrupted, prices will likely rise. On the other hand, India would be able to increase exports of wheat and maize to nearby areas, including countries in the Gulf region, South Asia and South-East Asia, where demand for Indian cereals would likely increase rapidly since shipping is cheaper and faster as compared to countries in North America and South America. In times of emergency, importing countries can also import wheat in small quantities from India.

However, if sunflower oil exports from Ukraine are disrupted, soybean oil prices may jump at a time when palm oil prices are already trading at record highs, causing yet more problems for India, which is a big importer of all three oils.

Despite record sowing in both Kharif and Rabi seasons, production of pulses is expected to be low.

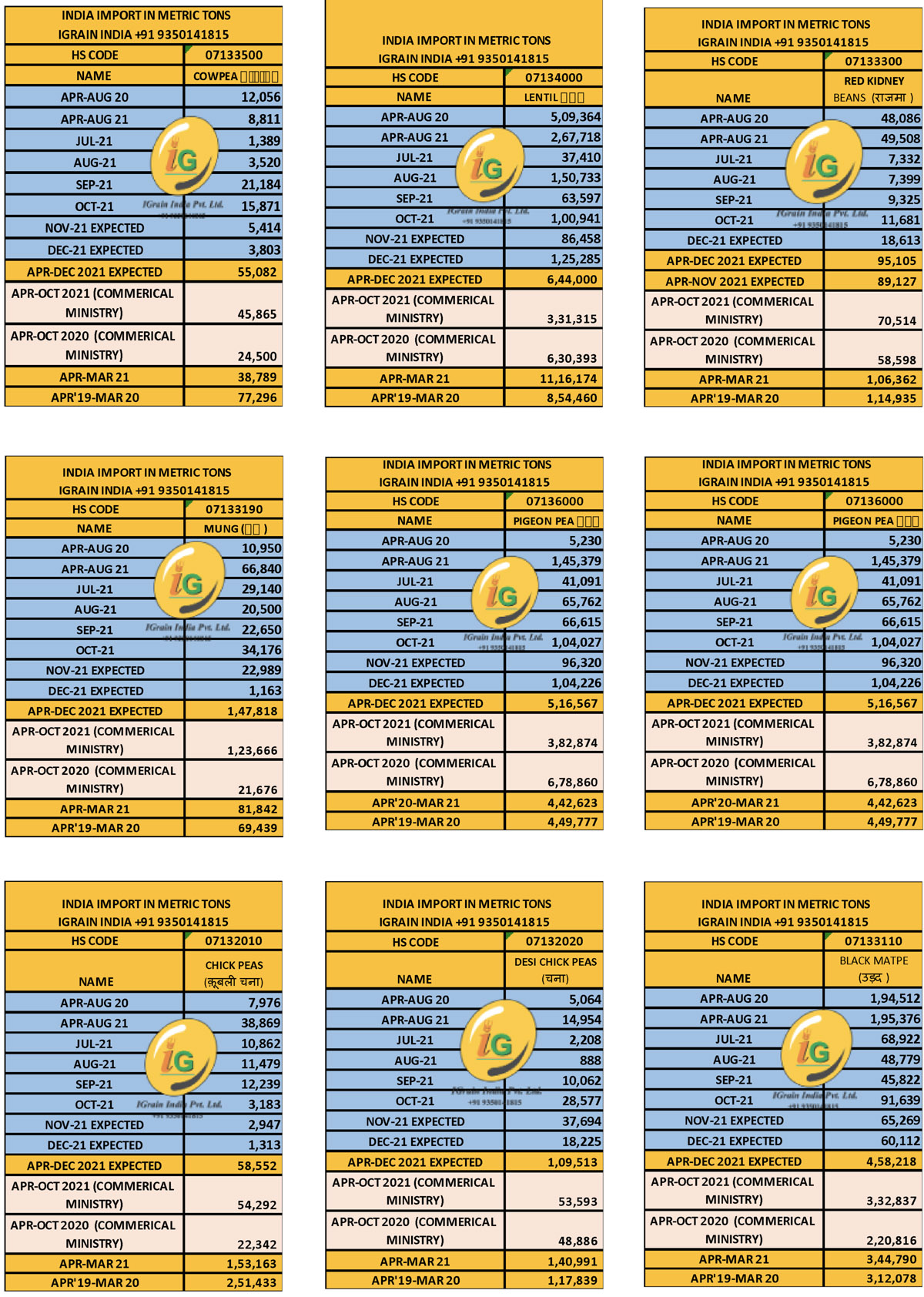

New Delhi. Although the sown area of pulses has increased to a new record level in the Kharif and Rabi seasons of 2021-22, the total production is unlikely to exceed 220 lakh tons. According to a leading analyst, the 2017-18 season was the first time that domestic production of pulses exceeded 200 lakh tonnes and, due to this improved production, the country was able to rely less on imports. Now, however, it is becoming clear that the annual domestic production of pulses has stagnated in the range of 210-230 lakh tons. The trade sector is aware that the government predictions are always 5-10 percent higher than the actual situation. The sown area of pulses has increased to 164 lakh hectares during the current Rabi season, which is slightly higher than last season. Under this, the sown area of gram jumped from 109 lakh hectares to 113 lakh hectares and that of lentils improved to about 17 lakh hectares. On the other hand, the sowing of other pulses including peas, urad and mung are lower than last year. Considering the factors of sowing area, weather conditions and yield rates, the total production of pulses is expected to be around 13.5 million tons, including 9 million tons of gram and 1.4 million tons of lentils. A production number of 8.5 million tons of pulses is expected in the ‘21 Kharif season as against the government estimate of 9.3 million ton although this may drop further as urad, mung and tuar crops were all damaged.

The total production of pulses in 2021-22 is estimated at around 215-220 lakh tons, including a maximum 85 lakh tons of Kharif and 130-135 lakh tons of Rabi. Considering the very high market price, the sown area of lentils was expected to increase, but this was not the case, showing that market price is not a strong enough motivator for farmers to increase the sown area of crops. Policy makers should learn from this; the total sown area of pulses is nearing saturation and will therefore be difficult to increase in the coming years. If production is to be increased, the focus must be on increasing the average yields of pulses to prevent increased dependence on imports. The upward trend in domestic demand and consumption will continue and the import policy must be stabilized to prevent future issues.

Abbreviations

Tuar/ Arhar: Pigeon Peas PP

Mung: Green Mung

Urad: Black Matpe

Chana: Gram, Desi Chickpea

Matar: Pea

Masur: Lentil

Besan: Gram Flour

Mandi: Market yard

Bhav: Prices

Dal/Daal: Processed Pulses (Directly for human consumption)

Rs: Indian Rupees (1$=Rs 74.84) 2 Feb, 22 at 06:09 PM IST

Rahul Chauhan

Director, IGrain India

igrainind@gmail.com

+91 9350141815

Twitter igrain_india

India / Rahul Chauhan / Mung / markets / IPGA / Rabi / Kharif / New Delhi / Rajasthan / Maharashtra / Madhya Pradesh / Jaipur / Ahmedabad / Bangalore / Karnataka / Chick peas / desi chick peas / black matpe / pigeon pea / red kidney / cowpea / lentil

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.