Record increase in prices

Ports

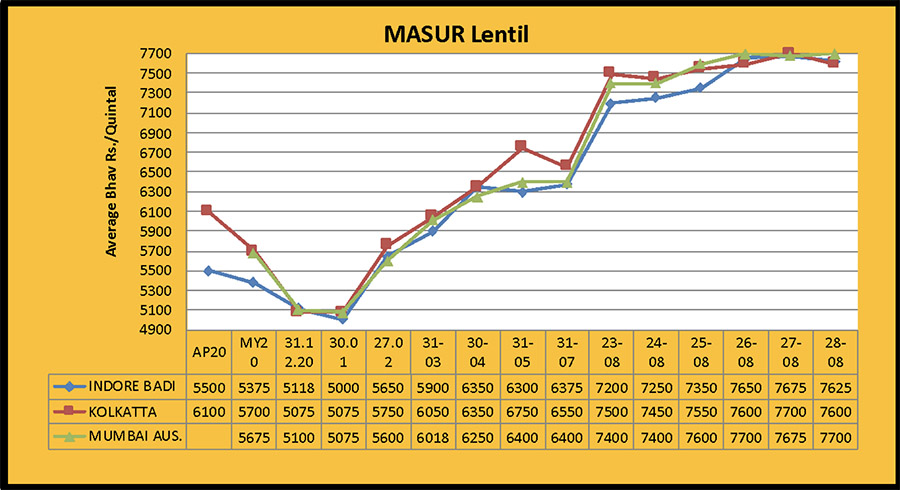

The upward price trend in lentils continued due to reduced availability and continued buying by stockists. Due to the continued demand, lentils in Mumbai registered an increase of Rs. 150/200 per quintal this week, bringing the price of Mundra lentils to Rs. 7,400/7,450, Hazira to Rs. 7,500/7,550 and Australia container lentils to Rs. 7,675 per quintal over the weekend. At the Kolkata Port, the demand was strong this week and over the weekend prices rose by Rs. 400 per quintal to Rs. 7,650 and Rs. 7,850 per quintal for Canada and Australia respectively.

Delhi

Due to the rise in demand at the port, an increase of Rs. 200 per quintal was registered in Delhi for Chhoti (small) lentils, Rs. 300 for Desi Big (large) lentils and Rs. 350 per quintal for imported lentils, bringing prices to Rs. 7,600, Rs. 8,050 and Rs. 7,700 per quintal, respectively.

Uttar Pradesh

A price increase was seen in most of the markets, with Bareilly Large lentils rising by Rs. 450 to Rs. 7,950, small lentils by Rs. 200 to Rs. 7600 and Kanpur lentils by Rs. 400 to Rs. 7900 per quintal in the last week, due to continued demand from stockists and millers.

Madhya Pradesh

Due to sparse arrivals and strong demand from millers, lentils in Katni rose by Rs. 400 to Rs. 8,100, in Indore by Rs. 500 to Rs. 7650/7700 and in Ashok Nagar and Ganjbasoda by Rs. 350/400 per quintal, bringing traded prices to Rs. 7,150/7,250 and Rs. 7,200/7,500 per quintal, respectively.

Other

Due to the effect of the all-round upward trend and continued buying, an increase of Rs. 200 per quintal was registered in Raipur this week, bringing the price to Rs. 7,500 per quintal over the weekend. Due to strong demand from millers, the price of lentils in Bihar increased by Rs. 200/300 per quintal this week, trading at Rs. 7,100/7,600 per quintal. Bearing in mind the strong demand from stockists and millers, it seems that lentils will soon reach prices of around Rs. 9,000.

Processed Lentils

|In masoor dal, this week the demand was normal and the price increased by Rs. 100/200 per quintal to Rs. 8,500/8,700 per quintal over the weekend.

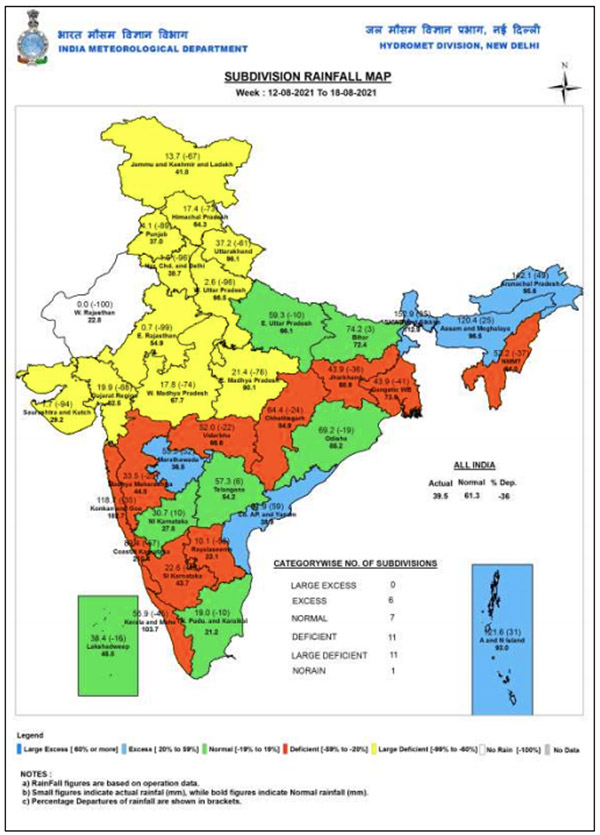

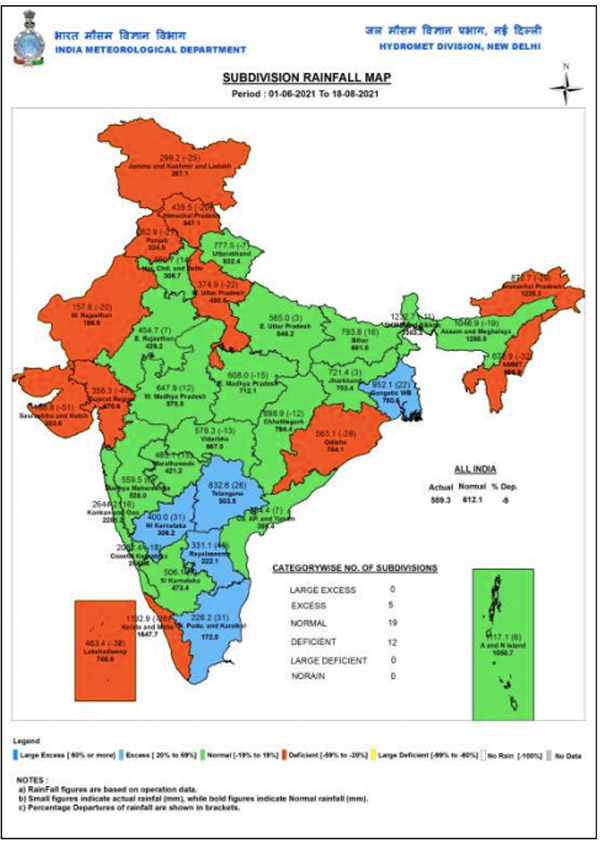

DS Pai, Office of Climate Research and Services said:

• According to the Meteorological Department, from August 1 to 25 rainfall remained very low in Madhya Pradesh, Chhattisgarh, Vidarbha, Maharashtra, Gujarat, Rajasthan, Punjab, Haryana, Delhi, Western Uttar Pradesh, Kerala and Saurashtra.

• There was good rain in August last year, but this year there was drought in August and floods in Karnataka and the hilly areas in July.

• Rainfall is likely to increase over Central India and Northwest India in the coming days.

• The Meteorological Department said that there is a possibility of rain in central India during the harvest in September.

Record breaking increase in the price of lentils

New Delhi. The central government has increased the minimum support price of lentils from Rs. 4,800 per quintal for the 2019-20 season to Rs. 300 per quintal for the current season of 2020-21, fixing it at Rs. 5,100 per quintal for the current season of 2020-21. Based on the government's production estimates, lentil prices should not have gone up so high but this subsidy is far from reality. The reality is that the industry trade sector has estimated production at between 9.50-10.00 lakh tonnes.

The government announced a cut in the import duty of lentils at a time when the prices in Canada jumped to the highest level and stocks in Australia fell significantly. Now, despite the duty cut, the import of lentils will remain expensive in India, which will reduce the chances of softening the domestic market price. Indian importers are trying hard to procure Canadian lentils but Canadian exporters are reluctant to sign bigger contracts as farmers are in no hurry to sell their produce, despite the harvest season threatening to bring a sharp drop in production. The major producing states of lentils in India include Uttar Pradesh, Madhya Pradesh, Bihar and Bengal, etc. In Chhattisgarh and Orissa, masur dal is being sent from Madhya Pradesh and Uttar Pradesh on a large scale. Notably, after the announcement of the reduction in import duty, there has been a strong increase in lentil production. About 14,000 tonnes of lentils are expected to be imported in July.

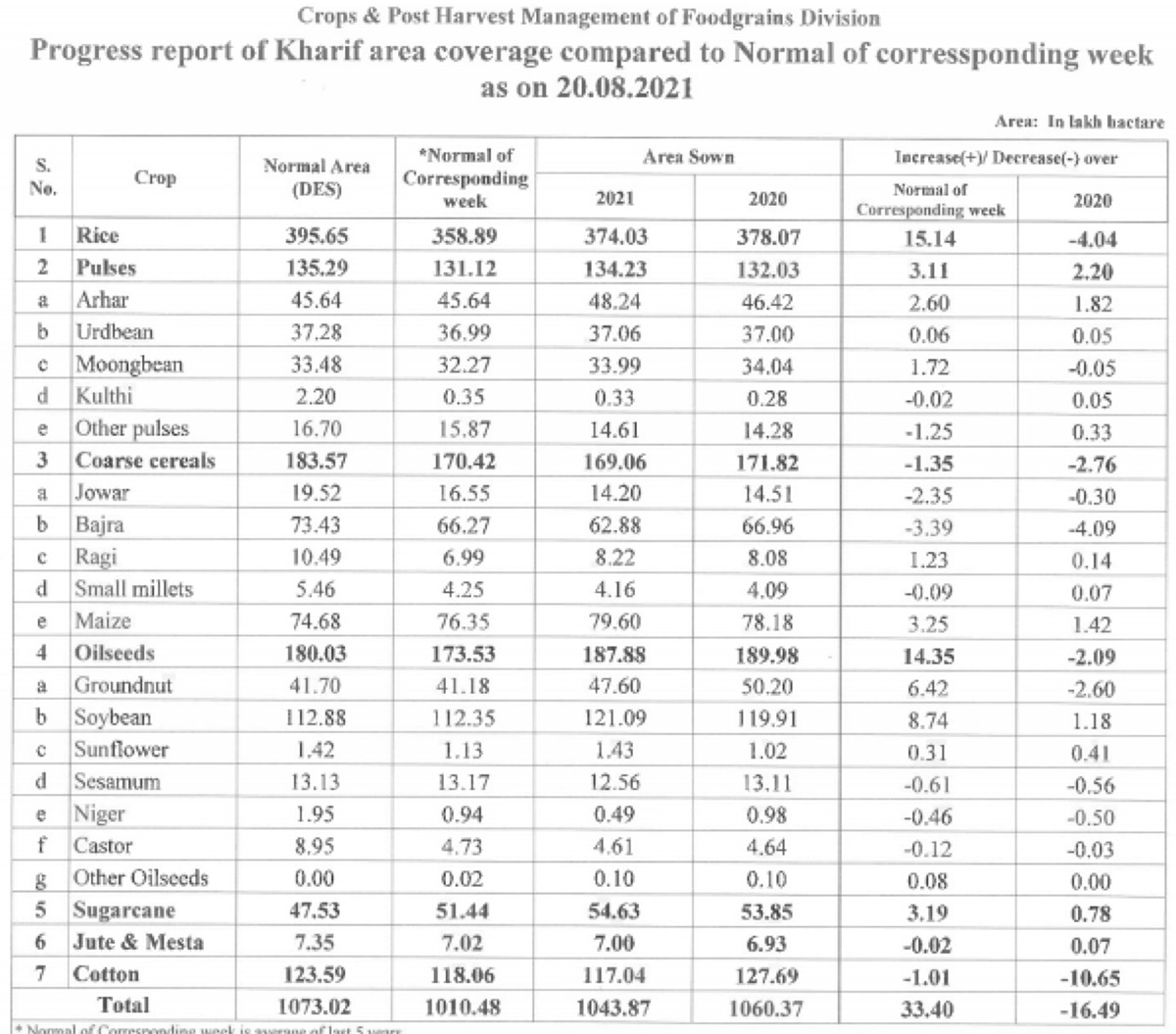

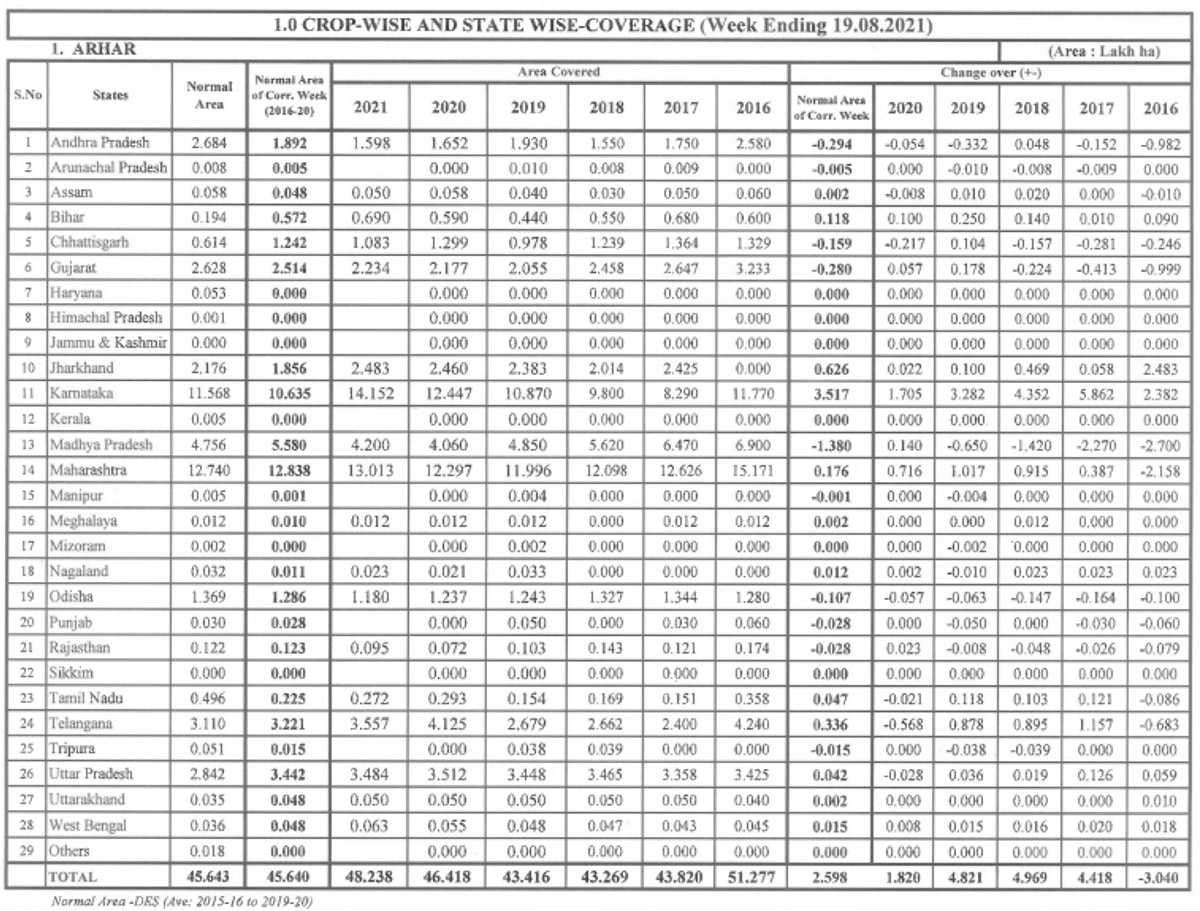

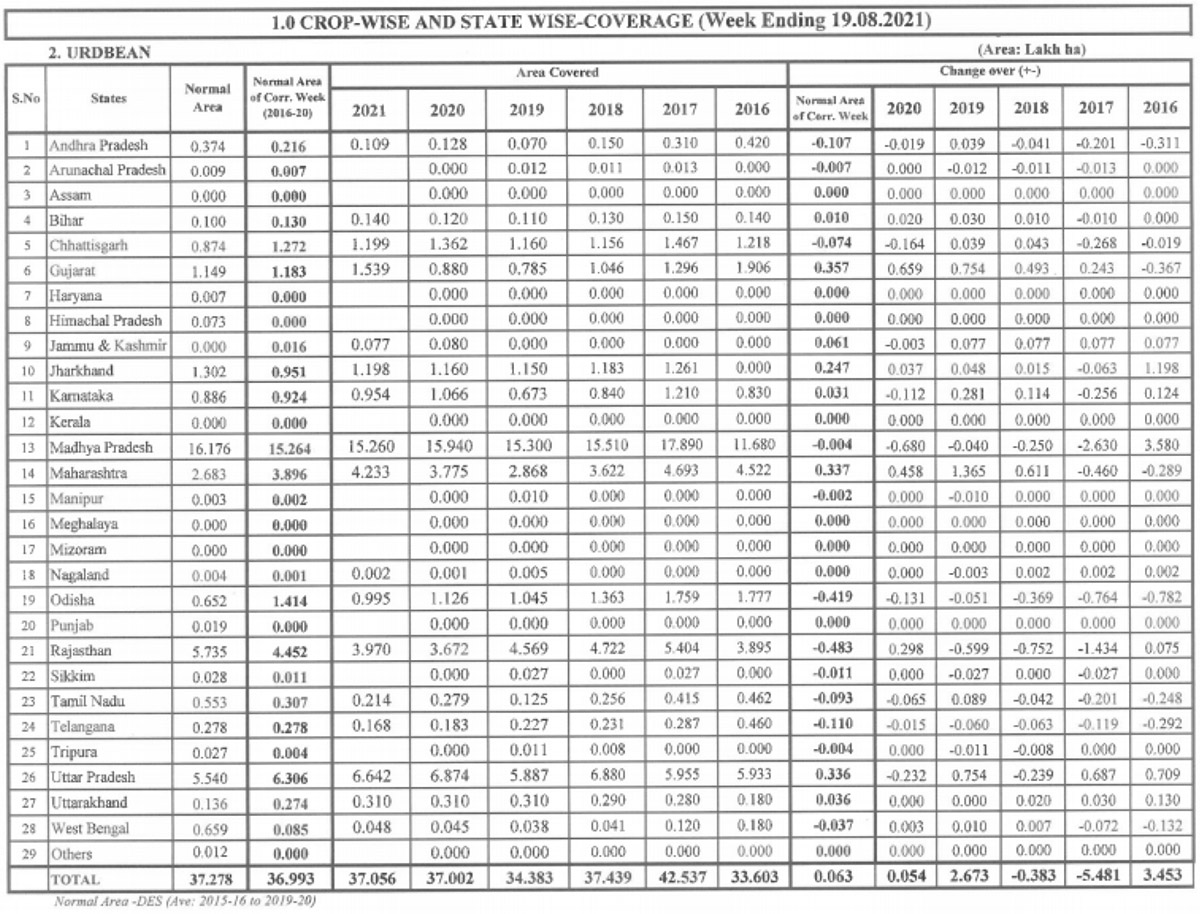

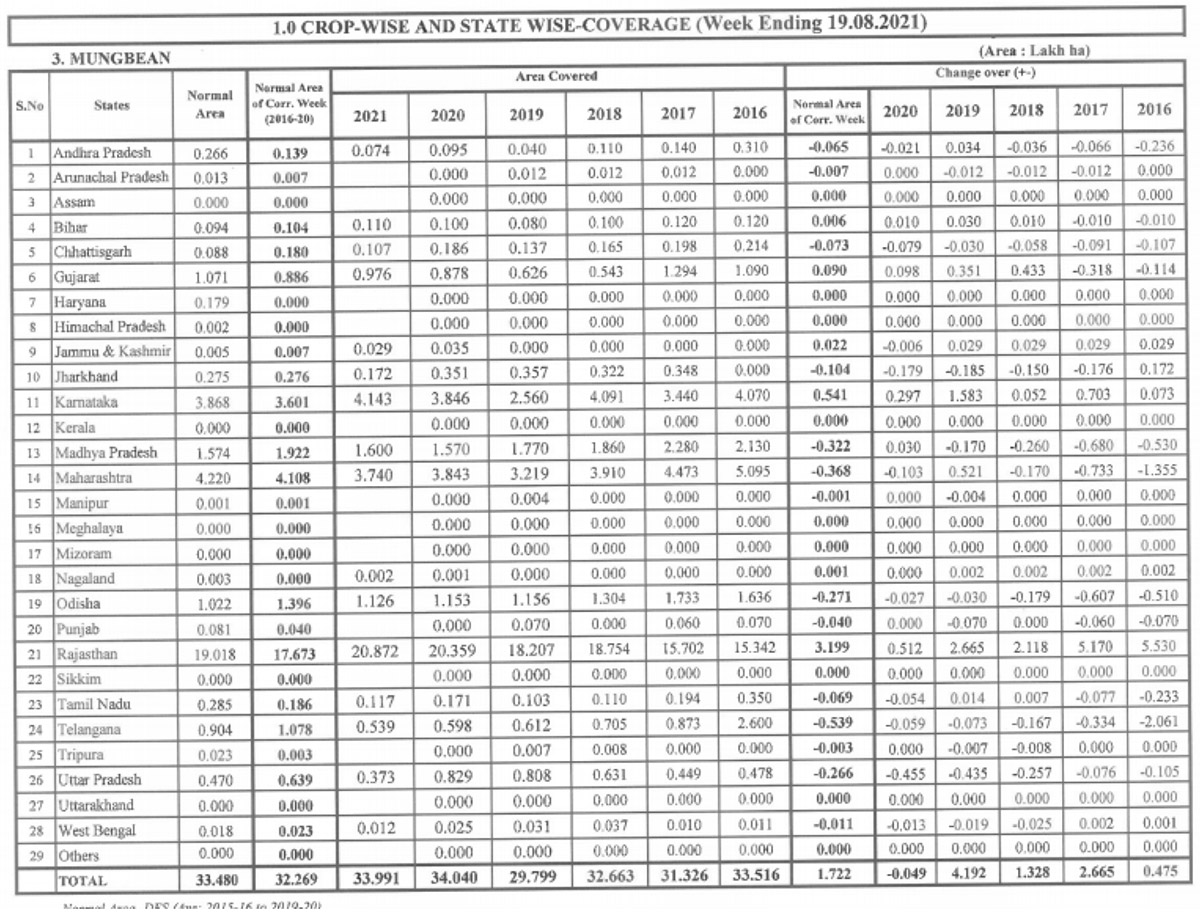

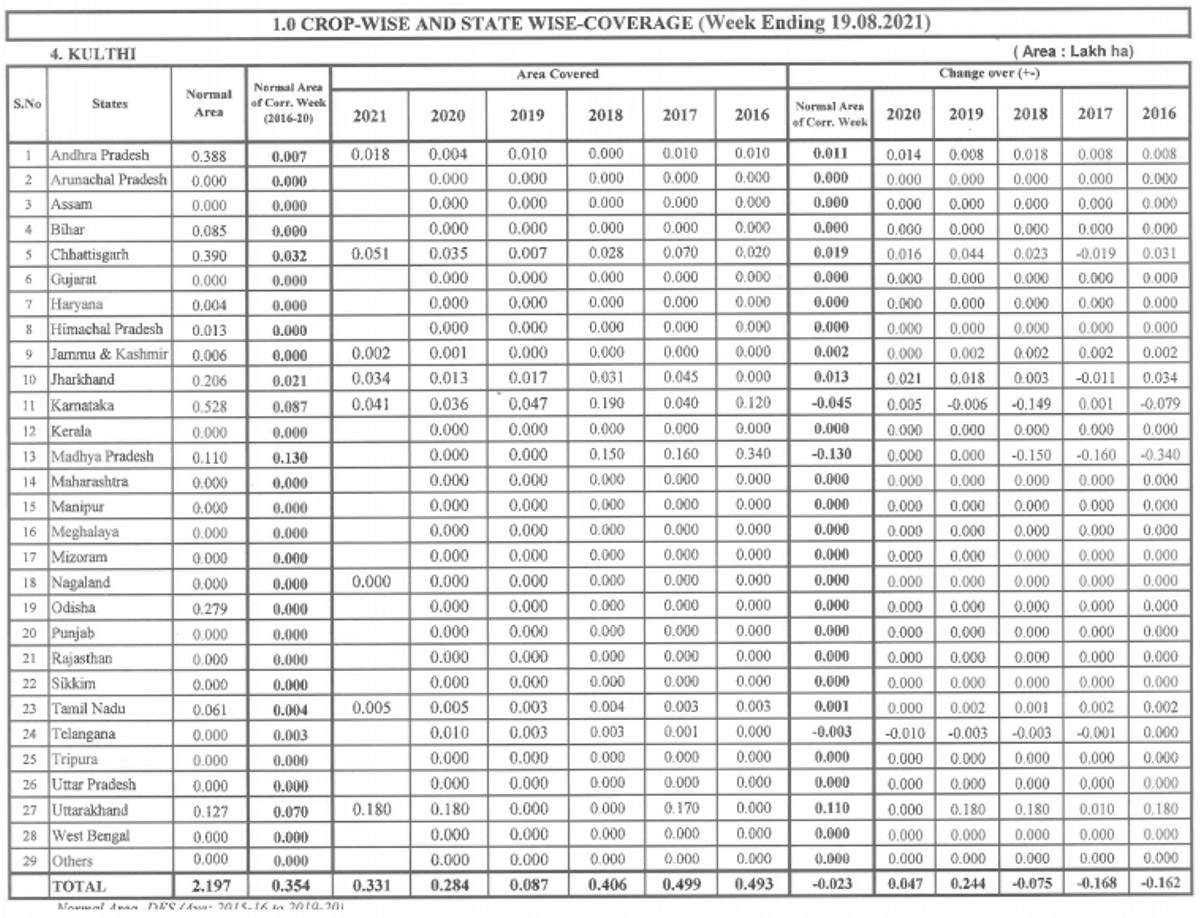

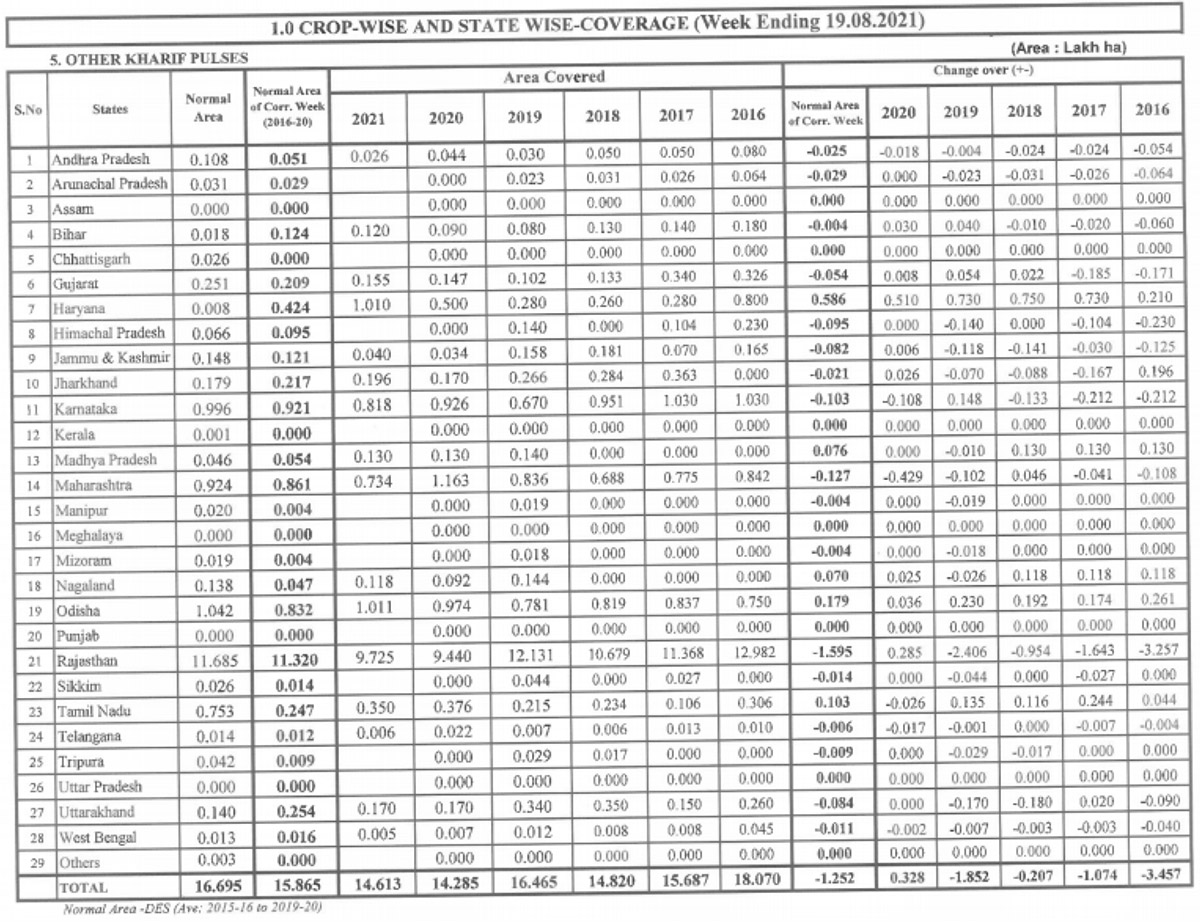

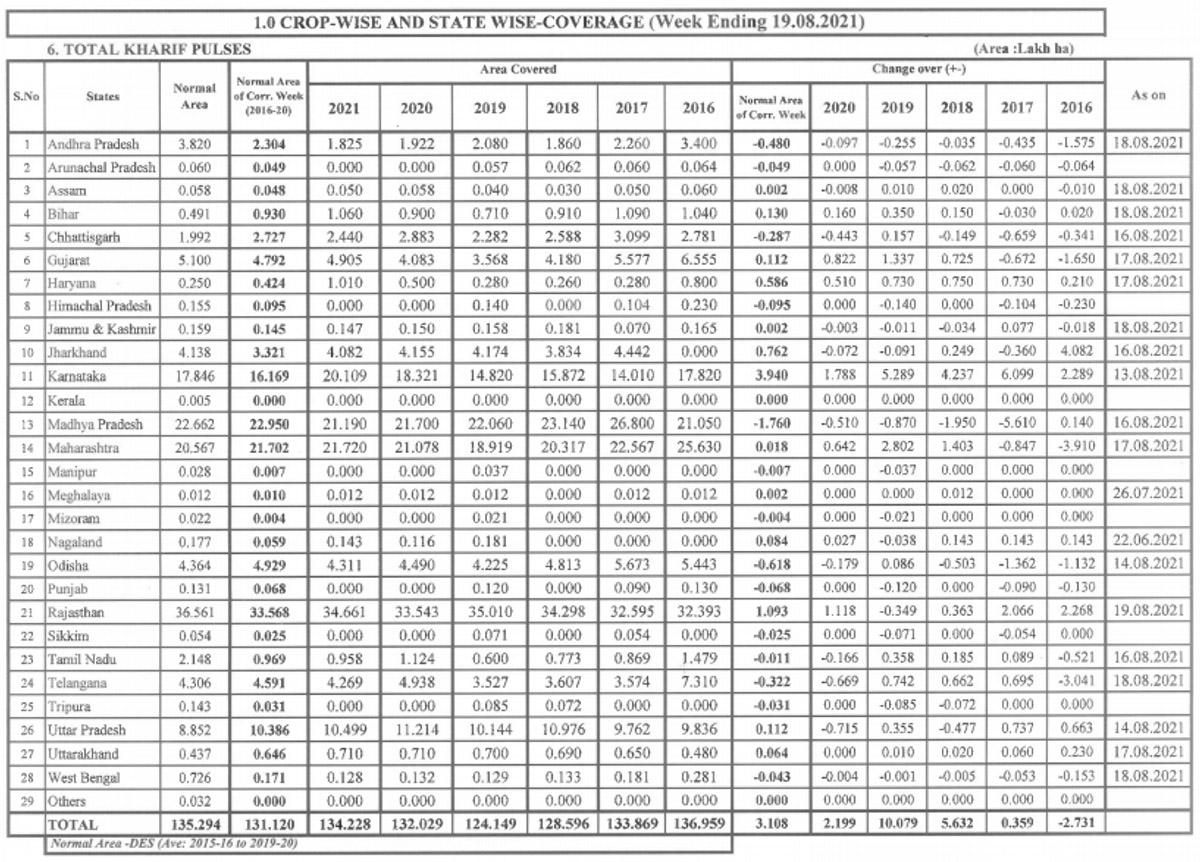

There is also not much import from abroad. Imported goods are with select firms only. The prices of other pulses are also increasing. This upward trend is supporting lentils. But the demand and consumption of masur dal is likely to be affected if prices rise excessively. Although the total sowing of Kharif pulses has increased, the crop is damaged in places due to unfavourable weather conditions.

Prices increased even after low business

Mumbai. Although the Central Government is making every effort to control the prices of pulses, including stopping future trading of chana, it is not entirely successful. Under this, traders were either given strict instructions that prices should not jump sharply or else a very high margin would be imposed to reduce the pace of business.

Chana is considered to be the king of pulses, so it naturally impacts the prices of other pulses. Generally, chana traders have been trading on the spot, keeping in mind the future exchange prices, however the current change in situation means there is no clarity or guidelines around the trading of chana and stock is continuously decreasing. Nafed also has less stock left this year than last. The situation in the domestic market is improving. Most of the country's major pulse markets have been opened in the aftermath of the COVID-19 pandemic and business is also recovering. Although demand in pulses is not very encouraging and the demand can still be considered quite low, prices are increasing and are expected to continue doing so.

Trading has improved by about 50 percent compared to last year. According to trade analysts, however big the official production figure may be, the reality is that the production of almost all major pulses decreased in the Kharif and Rabi seasons of 2020-21, creating a bullish trend in the market. Pulses are also not being imported in the required quantity from abroad, meaning stocks are low. Due to weak production in the exporting countries, prices are high and, as a result, imports are expensive in India. Although the demand for pulses is normal, the rise in import prices has meant that domestic prices have started increasing. The government is taking action but it has not yet been able to get the situation back under control.

Lentil prices remain firm in Canada as production drops

Vancouver. In Canada, almost 75% of the lentil crop has been harvested. Usually domestic prices soften during the harvesting season but, due to unforeseen circumstances, there has been a strong upward trend in the prices. These circumstances include a likely significant drop in lentil production in Canada due to the severe drought conditions as well at the reduced import duty in India from 30 percent to 10 percent. On the other hand, due to the drought crisis in Türkiye, there has been a sharp decline in the production of lentils and production in India has also been heavily reduced. It should be noted that India and Türkiye are the two major buyers of Canadian lentils. Apart from this, lentils are also imported on a large scale from Canada into Bangladesh and the United Arab Emirates. Early-stage harvesting indicates that the average yield rate of lentils in Canada has declined significantly and quality has been severely affected in many parts. Due to the extremely dry and hot weather, the lentils did not develop properly and started ripening when they were small. Most trade analysts are of the view that the production of lentils in Canada will be less than the requirement of the global market, causing prices to remain bullish for a long time. Importers in India and Türkiye are already active in the Canadian market but the big producers do not want to unload their stock in the mandis before going through the full production figures at a national level. This is adding to the difficulties of the exporters. Last week, in Western Canada the price of big green lentils jumped to 52-53 cents and small green lentils to 50 cents a pound in, clearly indicating a sharp decline in production upcoming. The price of red lentils has increased relatively less and production is also expected to be better than that of green lentils. Exportable stock of lentils in Australia is limited, so there is no other suitable option for importers from India and Türkiye. In the US and Canada, the pace of harvesting and preparation of the lentil crop is faster than last year, but the market is showing no signs of softening due to the strong possibility of a sharp decline in total production. The price of lentils has not yet reached the all-time high in the Canadian markets. Growers are expecting the market to become more bullish during the coming months and are not selling stocks.

Huge changes in import and export of lentils in Türkiye

Ankara. Imports of this vital pulse in Türkiye have picked up pace as domestic production fell sharply due to a severe drought in what is the world's second-largest importer of lentils, after India. There was also a sharp decline in the export of lentils from Türkiye in the month of June. Data from the Turkish Statistical Institute (Turk Stat) shows that Türkiye's export of lentils declined by 25%, from 20,331 tonnes in May to 15,204 tonnes in June. In addition, Türkiye only exported about 1.53 lakh tonnes of lentils during the first half of the current calendar year, much lower than the 2.45 lakh tonnes in the same period last year. In June, 2,785 tonnes of lentils were exported from Türkiye to Syria, 1,300 tonnes to Germany and 1,042 tonnes to England.

On the other hand, import of lentils in Türkiye increased from 290 tonnes in May to 681 tonnes in June, while imports of 4,000 tons were recorded in the first half of the year. After June, Turkish importers started buying heavily. According to rough estimates, Türkiye may import between 4.50 and 5.00 lakh tonnes of lentils overall during the current year as domestic production is expected to decline by as much as 40-50 per cent compared to last year. The increased activity of Turkish importers may cause problems for Indian importers. Türkiye mainly imports lentils from Canada and Australia and Indian traders also import goods from there. Due to the drought in Canada, lentil production is expected to drop drastically and this, combined with the signs of decreased quality, means there will likely be a decrease in supply and availability. However, there will be competition between buyers from India and Türkiye.

Importers from Bangladesh and the United Arab Emirates are also showing interest in procuring lentils. Although the import duty on lentils in India has been reduced from 30 percent to 10 percent, due to high prices in the exporting countries the import will nonetheless be expensive. Lack of containers and high shipping charges are also affecting the lentil market.

Increase in bulk export of lentils from Canada

According to the latest report from the Canadian Grain Commission (CGC), during the entire marketing season (August-July) of 2020-21, the total export of lentils from Canada was 11.86 lakh tonnes, which is 16,000 tonnes more than the gross shipment of 11.70 lakh tonnes for the 2019-20 season. As well as this, lentils were exported in containers. It should be noted that the Canadian Grain Commission's figures are based on details provided by exporters. Goods shipped by other exporters through other channels are not counted.

On the other hand, the export details of government agency StatsCan are more complete as they include shipments across all channels. According to the CGC, although bulk exports of lentils registered an increase throughout the marketing season, shipments declined in July. According to the data received, around 1.34 lakh tonnes of lentils were exported from Canada through all license-free facilities in July 2021, which was lower than the total shipments of 1.60 lakh tonnes in June 2021.

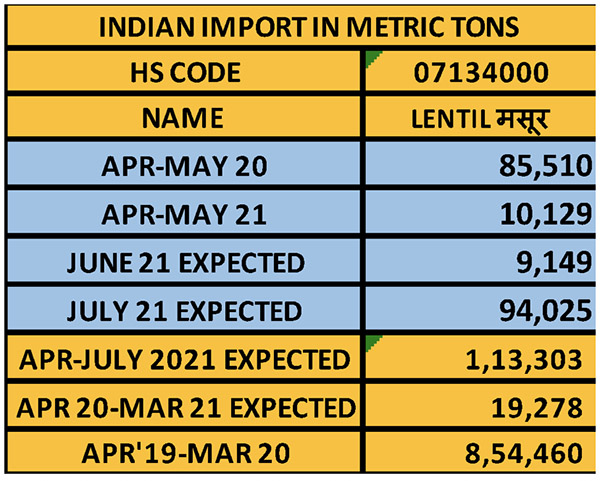

India is the largest importer of lentils, mainly from Canada and Australia, and Türkiye is the second-largest. Australia's prices have increased by 15-20 percent. India will need to import at least 5-6 lakh tonnes of lentils.

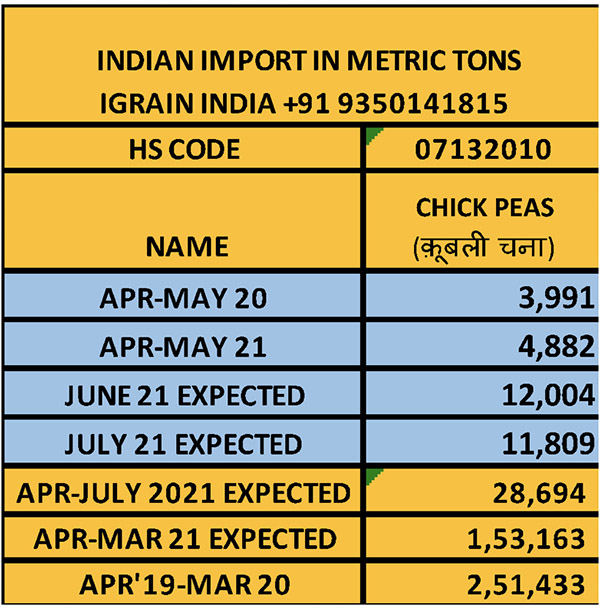

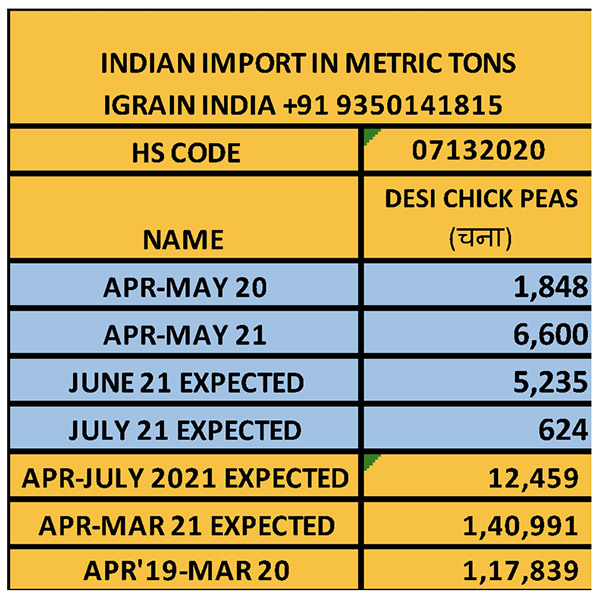

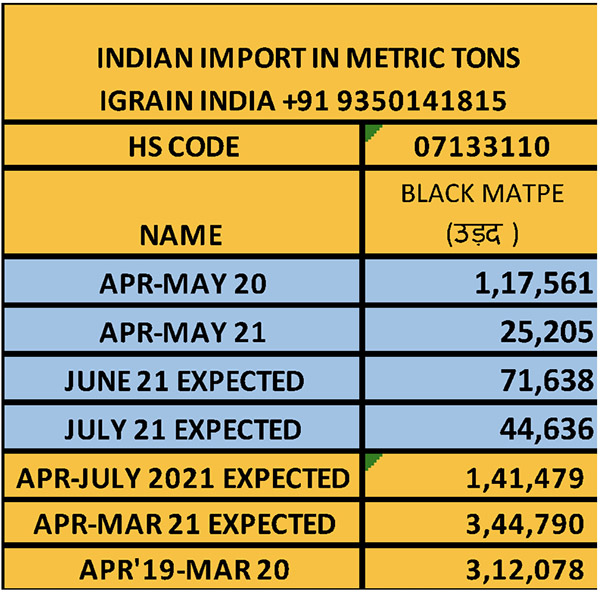

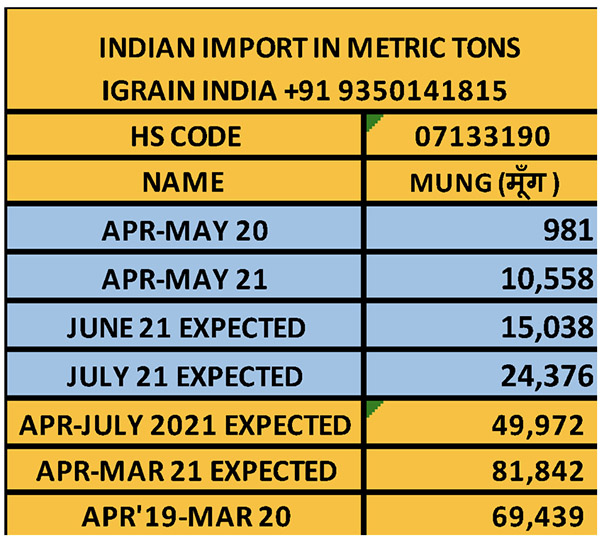

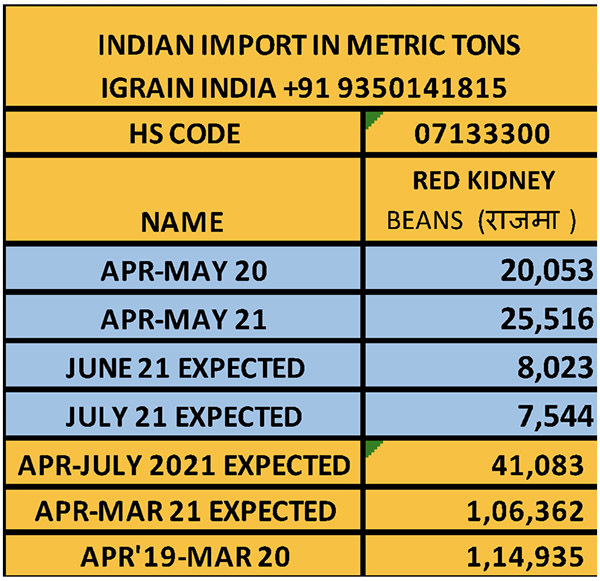

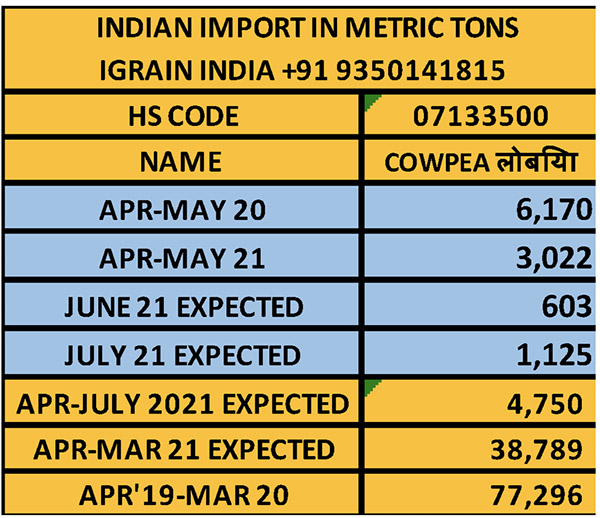

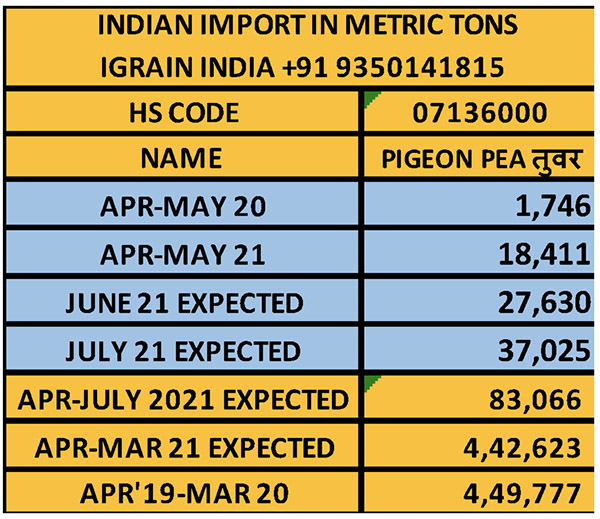

IMPORT FIGURES

Abbreviations

Tuar/ Arhar: Pigeon Peas PP

Mung: Green Mung

Urad: Black Matpe

Chana: Gram, Desi Chickpea

Matar: Pea

Masur: Lentil

Mandi: Market yard

Bhav: Prices

Dal/Daal: Processed Pulses (Directly for human consumption)

Rs: Indian Rupees (1$=Rs 73.05)

Rahul Chauhan

Director, IGrain India

igrainind@gmail.com

+91 9350141815

Twitter igrain_india

India / Masur / Lentil / Red Lentil / IGrain / Rahul Chauhan / Uttar Pradesh / Madhya Pradesh / New Delhi / Mumbai / Vancouver / Ankara

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.