February 17, 2022

IGrain’s Rahul Chauhan provides information on pricing and current inventories, as well as import figures and news from domestic and international markets.

Prices down due to continuous selling by importers

Government slashes lentil import duty and extended import time lines to 30 Sept, 2022

Mumbai

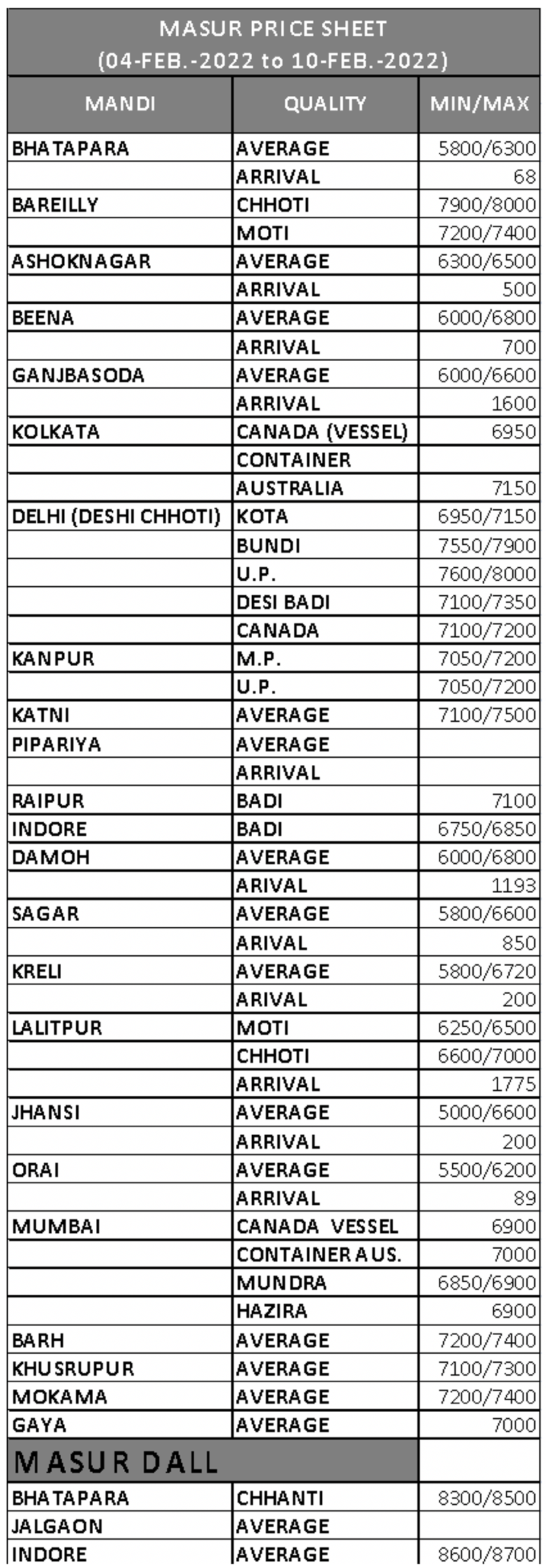

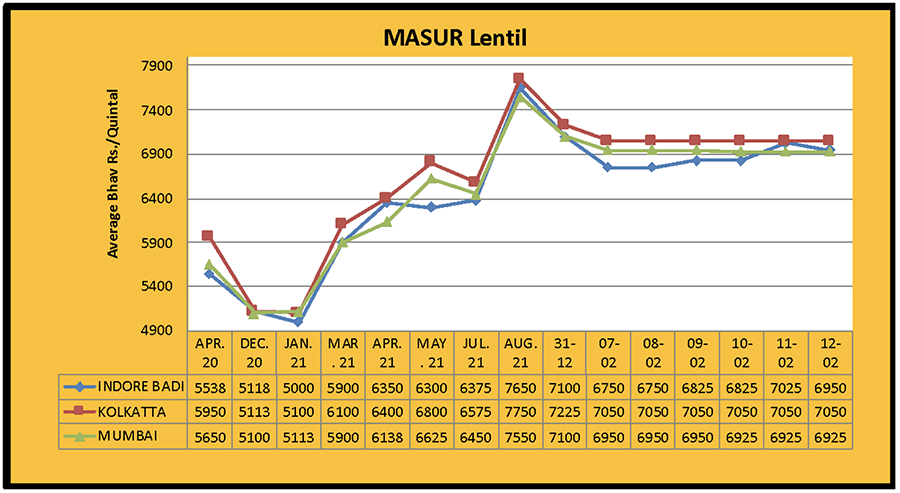

Due to continuous selling by importers, pressure was seen in imported lentil prices and there were no fluctuations. Last week, desi lentil buying improved. Due to lack of demand, Mumbai lentils did not see any rally and prices remained stable: Mundra traded at Rs. 6,850/6,900, Hazira at Rs. 6,900, Container Canada at Rs. 6,900 and Australia at Rs. 7,000 per quintal over the weekend. Similarly, Kolkata prices also saw no volatility and Canada prices remained at Rs. 6,950 and Australia at Rs. 7,150 per quintal over the weekend.

Delhi

Delhi lentils registered a jump of Rs. 250/350 per quintal due to reduced selling prices of imported stocks and better demand. Bundi line traded at Rs. 7,800, Uttar Pradesh line at Rs. 7,900, indigenous large size at Rs. 7,450 and Imported at Rs. 7,250 per quintal.

Madhya Pradesh

Madhya Pradesh prices registered strong growth last week due to a weakening of stockists' bidding and better offtake. An increase of Rs. 350 per quintal was seen in Katni Masoor, Rs. 250 in Indore, Rs. 200 in Ashoknagar, Rs. 200 in Ganjbasoda, Rs. 500 in Damoh and Rs. 400 in Sagar and, with these increases, prices of Katni were Rs. 7,450-7,500, Indore Rs. 7,000/7,050, Ashoknagar Rs. 6,500/6,600, Ganjbasoda Rs. 6,100/6,600, Damoh Rs. 6,500/6,800 and Sagar Rs. 6,200/6,800 per quintal over the weekend.

Uttar Pradesh

A bearish trend was seen in lentil prices in UP. Bareilly Large prices increased by Rs. 150 per quintal to Rs. 7,450 per quintal while Lalitpur prices saw a fall of Rs. 200 per quintal, bringing prices of the large variety fell to Rs 6,300 and the small variety to Rs. 6,800 per quintal over the weekend. Due to normal demand, Kanpur lentils did not see any changes and was traded at Rs. 7,200 per quintal over the weekend.

Other

In Bihar, buying was a little weak last week and throughout the state prices declined by Rs. 200 per quintal to Rs. 7,200. Khushrupur traded at Rs. 7,100, Mokama at Rs. 7,200 and Gaya at Rs. 7,000 per quintal. Raipur prices recorded an improvement of Rs. 25 per quintal this week due to increased sporadic buying and prices were Rs. 7,125 per quintal.

Split Lentil

Last week, buying and selling of Masoor dal was normal as the market was flat. Prices remained stable at Rs. 8,300/8,700 per quintal.

Myanmar producers and exporters upset due to ban on import of moong

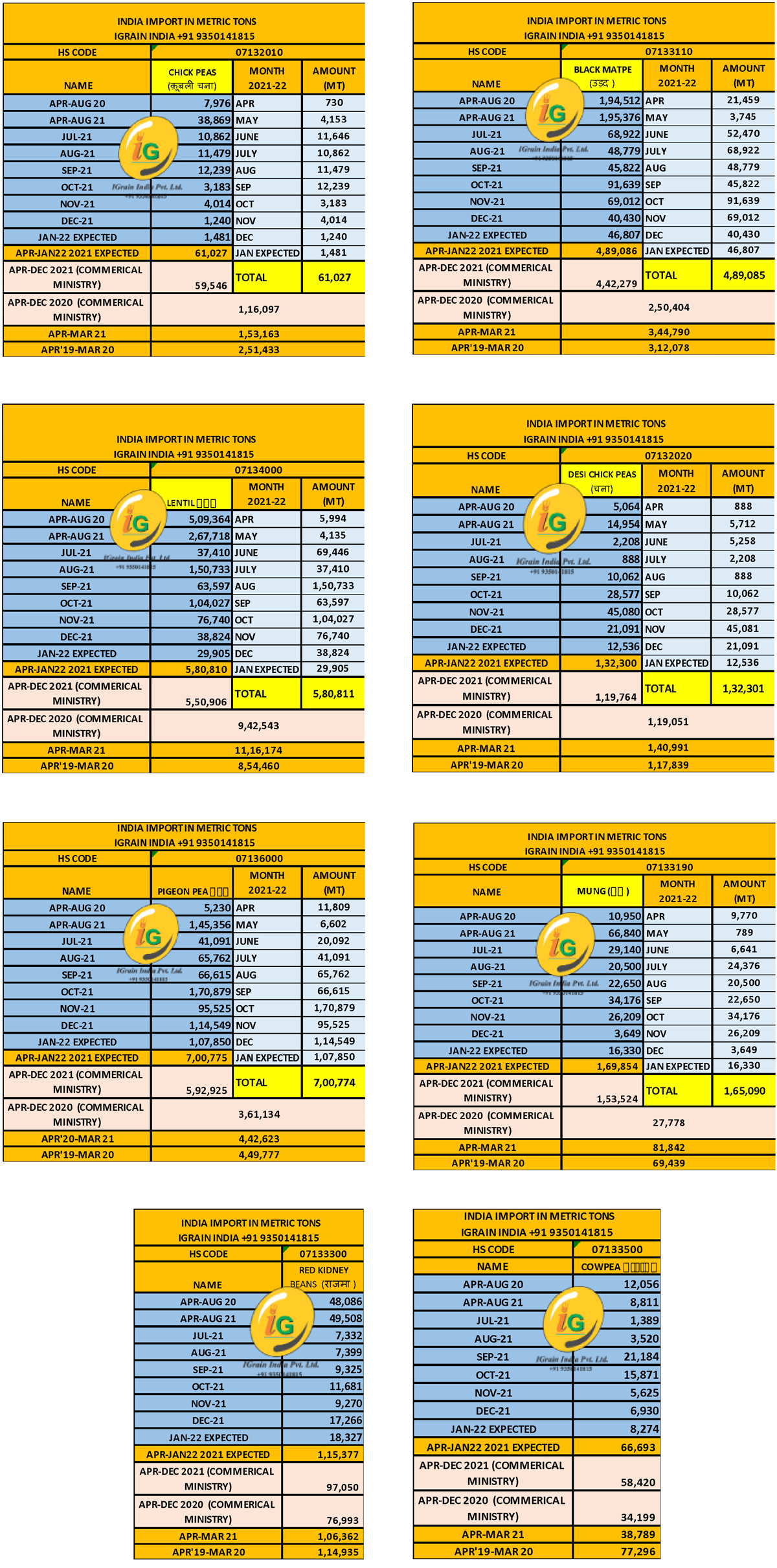

Mandalay. Most Indian moong imports come from Myanmar and East African countries, and, with a sudden ban on imports by the government last week, the problems of these foreign farmers and exporters have increased.

According to Vatsal Livani, President of Overseas Agro Traders, a well-known business organization of Myanmar, the sudden policy change by the Government of India has caused great hardship to all stakeholders in the supply chain, particularly smallholder farmers in Myanmar, and has provoked an environment of uncertainty in the market.

Myanmar traders started buying moong from farmers and entering into export contracts with Indian buyers after imports of moong in India were placed on the free list. These deals were done for the period until March 31, 2022 and also received advance amounts from Indian importers.

Contracts of about 1,400 containers have been signed, with a total worth of around $ 30 million (Rs 227 crore). All these containers, currently waiting for shipment at Myanmar ports, will no longer be able to receive the bill of lading. Advance payment has been made from some other places, including Singapore, against the order received from India. Due to the paucity of space at the ports, it takes 12-15 days for these containers laden with moong to reach the ports and be loaded onto the ships, following a process of inspection, fumigation, clearance from customs department. Livani has urged the Government of India to give traders sufficient time to settle old deals before imposing restrictions on imports and retain the existing free import policy until March 31, 2022. During the financial year 2020-21, volumes of moong worth $ 771.40 lakh were imported into India, while moong worth $ 769 lakh was imported in the first half of the current year.

Lentil production expected to increase by 15 to 25 percent in Madhya Pradesh

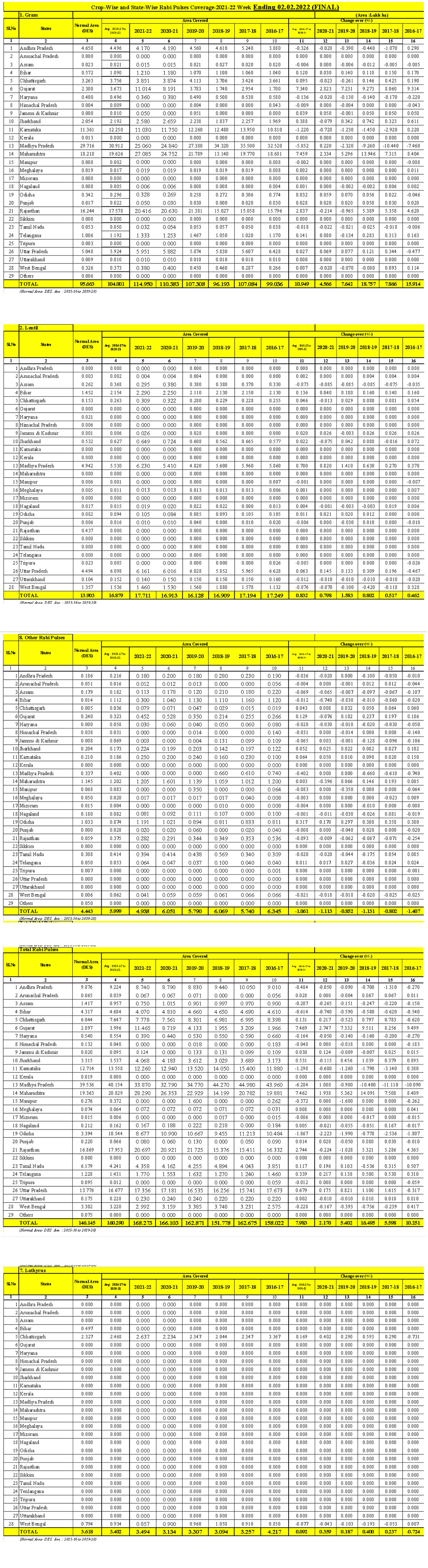

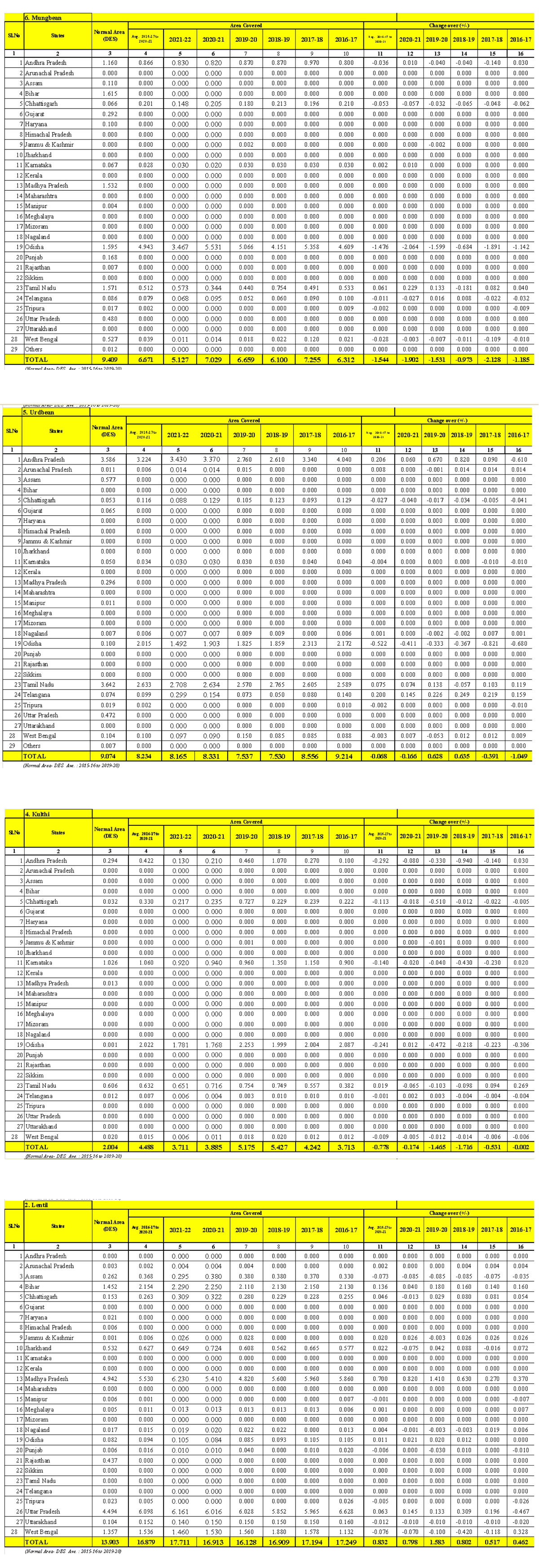

Bhopal. In Madhya Pradesh - the leading producer of lentils in India -, not only did the sown area increase by 10-15% in the current Rabi season, but the average yield rate of the crop is also expected to increase, resulting in an estimated increase of 15-25% in total production compared to last year.

According to Arun Soni, Managing Director of Shridhar Industries Pvt Ltd, a pulse processing firm based in Katni, Madhya Pradesh farmers in the Shajapur and Shujalpur line have shown good interest in lentil sowing and the total area has increased by 10-15%. Due to favourable weather, the condition of the crop is also better.

Similarly, in the Sagar, Vidisha and Ganjbasoda lines, the harvest is looking encouraging due to good sowing and favorable weather conditions. The crop condition is also good in Pipariya and Jabalpur, another important producing belt, and sowing has increased in the Satna and Rewa lines.

Overall, the production area is expected to be high, and both quality and yields are expected to improve.

The millers and stockists who were holding out on buying and waiting for the prices to drop have started buying the goods. Mr. Soni commented that, even if there is a strong arrival of new goods, the spot market price of lentils will not fall below the government support price (Rs. 5500 per quintal), while the price of gram will remain around Rs 5000 per quintal. This season, Madhya Pradesh will probably come second in terms of gram production, behind Maharashtra. The arrival of new lentils and gram is expected to start from next month.

Changes in Turkish lentil import and export policies

Ankara. Lentils imports have picked up as domestic production fell sharply due to a severe drought in Türkiye, the world's second-largest importer of lentils after India. On the other hand, exports have slowed and there was a sharp decline in Turkish lentil exports in June. Data from the Turkish Statistical Institute (Turk Stat) shows that Türkiye's total lentil exports declined by 25% from 20,331 tons in May to 15,204 tons in June. In fact, Türkiye only exported about 1.53 lakh tons of lentils during the first half of the current financial year, much less than the 2.45 lakh tons exported in the same period last year. In June, 2,785 tons of lentils were exported from Türkiye to Syria, 1,300 tons to Germany and 1,042 tons to England.

Import, meanwhile, increased significantly from 290 tons in May to 681 tons in June, while imports of 4,000 tons were recorded in the first half of the FY. After June, Turkish importers started buying heavily. According to rough estimates, overall Turkish imports of lentils may be as much as 4.50-5.00 lakh tons in this FY as domestic production is estimated to have declined by 40-50% as compared to last year.

The increased activity of Turkish importers may cause difficulties for Indian importers as Türkiye mainly imports lentils from Canada and Australia, who also export to India.

Due to severe drought in Canada, lentil production is expected to drop drastically and there are also signs of decreased quality impact, causing a reduction in supply and availability. There is expected to be strong competition between buyers from India and Türkiye.

Meanwhile, the global market price of lentils is likely to remain very high and bullish. Importers from Bangladesh and the United Arab Emirates are also showing great interest in purchasing lentils. Although Indian lentil import duty has been reduced from 30% to zero, due to lower availability, prices will be higher in exporting countries and imports will still be expensive. Lack of containers and high shipping charges are also affecting the lentil business.

Availability of lentils in Canada is estimated to be 2.038 million tons.

Regina. Last year in Canada, the world's largest producer and exporter of lentils, the crop was badly damaged due to a severe drought, resulting in a sharp decline in production. The total availability of lentils during the current marketing season (August-July) of 2021/22 is estimated to be limited to just 2.038 million tons, based on remaining stock and normal import patterns.

Lentil production in Canada has come down to 1.606 million tons as against 2.868 million tons estimated in July 2021. Similarly, import volumes are estimated to have reduced from 0.11 million tons to 25,000 tons. By the end of December 2021, 0.805 million tons of lentils were exported from Canada and about 52,00 tons were used in the domestic division. At the beginning of 2022, lentil stocks were about 1.180 million tons, including stocks of 1.035 MMT with producers and 0.146 MMT with the trade sector. Prices jumped to a new record level due to the significantly reduced Canadian production but growers still did not show much interest in selling their stock as they waited for the prices to rise further. As a result, in the five months of August to December 2021, lentil exports were only a little over 0.8 MMT.

Due to extremely high market prices, buyers from other major importing countries including India and Türkiye started stepping back.

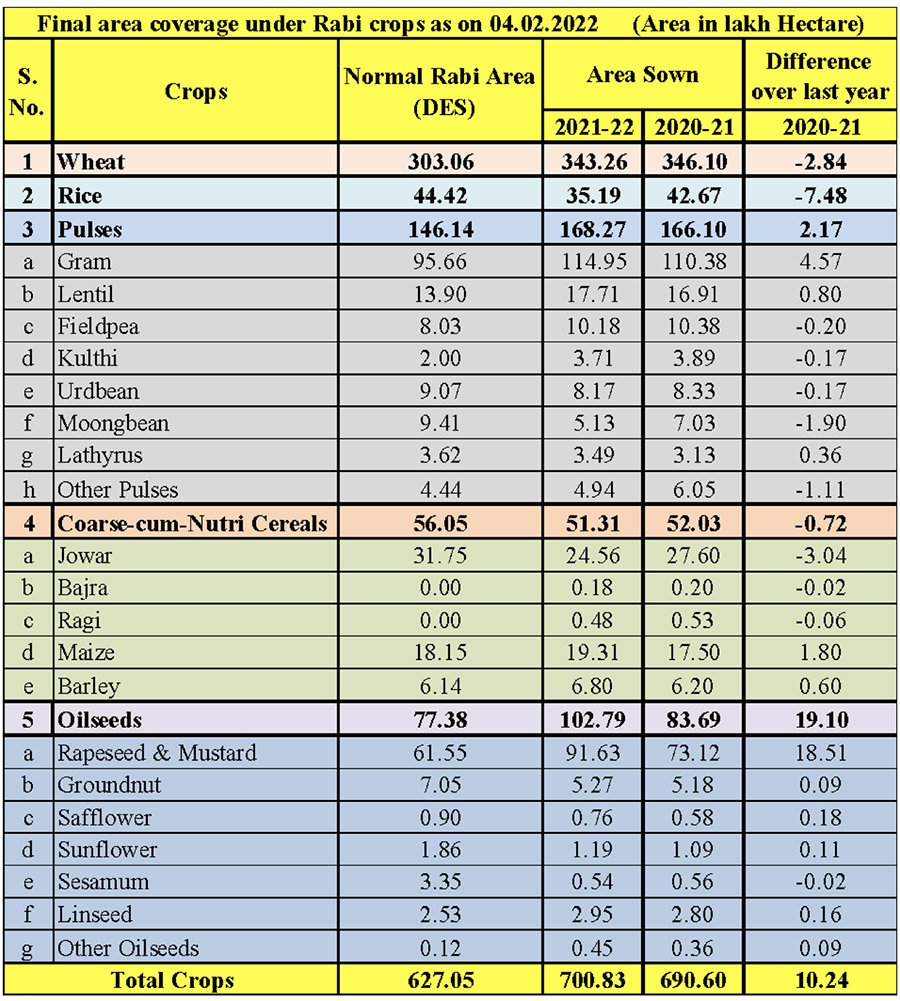

The sowing of the new Canadian lentil crop is scheduled to start from April and will continue through June. The new crop will start arriving from August with harvesting reaching its peak in September. If export performance remains sluggish, the outstanding surplus stock of lentils may remain high despite a sharp fall in production. Next harvest’s production volumes are expected to increase somewhat, which may lead to an increase in total availability and bring down the prices. In such a situation, the producers will be forced to sell their product at a lower price. In India, the total sown area of lentils has increased by about 70,000 hectares from last season.

Abbreviations

Tuar/ Arhar: Pigeon Peas PP

Mung: Green Mung

Urad: Black Matpe

Chana: Gram, Desi Chickpea

Matar: Pea

Masur: Lentil

Besan: Gram Flour

Mandi: Market yard

Bhav: Prices

Dal/Daal: Processed Pulses (Directly for human consumption)

Rs: Indian Rupees (1$=Rs 75.16) 15 Feb, 22 at 01:21 PM IST

Rahul Chauhan

Director, IGrain India

igrainind@gmail.com

+91 9350141815

Twitter igrain_india

IGrain / Rahul Chauhan / India / Lentil / Mumbai / Delhi / Madhya Pradesh / Uttar Pradesh / Chick Peas / Desi Chick Peas / Black Matpe / Mung / Red Kidney / Cowpea / Pigeon pea

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.