March 10, 2021

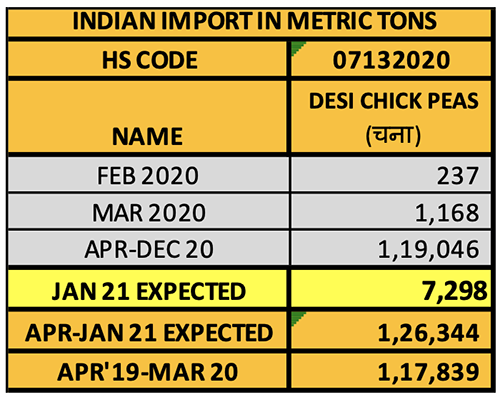

IGrain’s Rahul Chauhan provides information on pricing and current inventories, as well as import figures and news from domestic and international markets.

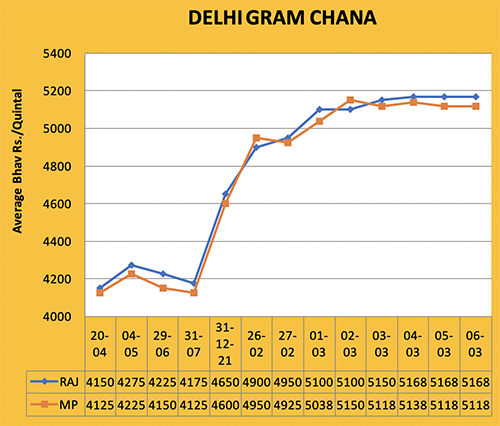

Last week, gram arrivals were slower than expected. Miller demand was normal. A surge in spot and futures markets was seen due to lesser availability. In states like Maharashtra and Karnataka, new crop started arriving 15 days ago. In Madhya Pradesh, the top gram producing state, new crop will start arriving soon. In Rajasthan, the second biggest producer, new crop may begin to arrive in the third or fourth week of March. Across India, the sowing of the crop is better than last year. Stockists/traders learned from experience that if the government holds large inventories, it puts pressure on the market throughout the year. Processed chana demand is normal. Greater demand may come with the Holi Festival. Delhi chana prices increased by Rs. 200 to Rs. 5,172/100 kg.

Port

Chana prices at Mumbai port increased by up to Rs. 300-305 and traded at Rs. 4,850-4,950 in Mumbai. Demand may increase further.

Rajasthan

New crop will begin arriving by the end of March. Daytime temperatures are warmer than normal. The late seeded crop may be impacted. Chana prices increased by Rs. 100-200 and traded at Rs. 4,700-4,800 in Jaipur and increased to Rs. 4,650 in Sumerpur.

Madhya Pradesh

In the local market yards of Madhya Pradesh, new crop arrivals are slowly increasing and may peak from March 15. Prices increased by Rs. 100-175 and traded at Rs. 4900-5050 in Ashoknagar, Rs. 4975-5100 in Katni and Rs. 5,200 in Indore.

Maharashtra

In Maharashtra, new crop arrivals are increasing by the day. Due to increases in port prices, local market prices rose by Rs. 200. Chana traded at Rs. 4825-4925 in Jalgaon, Rs. 4800-5100 in Solapur and Rs. 4850-5125 in Akola.

The Maharashtra Agriculture department’s second estimate pegged the state’s production at 2.467 million MT. In 2018/19, the state produced 1.397 million MT and in 2019/20 production increased to 2.24 million MT. Based on this estimate, the yields were lower than last years.

Karnataka

Prices increased by Rs. 150 and chana traded at Rs. 4,696 in Raichur and Rs. 4850-5250 in Bagalkot. Prices also increased.

Gujrat

According to the Gujrat Agriculture Department’s second advance estimate, the state seeded 7.83 lakh hectares to gram and production is expected to amount to 1.3 million MT. Last year, the state produced 0.625 million MT. Sowing and yields are up and production has improved this year. Dahod chana traded at Rs. 4,800-4,900.

Others

Kanpur chana prices increased by Rs. 160 and traded at Rs. 5,250.

Processed Gram

As the market for whole gram increased, processed chana dal prices increased by Rs. 300-400 and traded at Rs. 6,400.

State 2019 (In Metric Tons)

State- Quantity

Telangana 34,500

Rajasthan 1,20,398.31

Maharashtra 22,346.35

Madhya Pradesh 5,76,745.58

Andhra Pradesh 3,470.85

Gujrat 17,068.4

Haryana 207.6

Uttar Pradesh 486.8

Karnataka 33.4

Total 7,75,257.29

Season 2020

Andhra Pradesh 1,27,915.1

Karnataka 1,01,843.45

Rajasthan 6,15,716.88

Telangana 47,600

Maharashtra 3,70,718.90

Madhya Pradesh 7,06,313.62

Uttar Pradesh 38,498.18

Haryana 10,636.46

Gujrat 1,24,039.7

Total Procurement 21,43,282.28

Government procurement dropped as crop traded above MSP

The Department of Public Distribution and Consumer Affairs planned to procure 5.19 million MT of kharif and 2.82 million MT of rabi crops, including pulses and oilseeds. For the kharif season, it procured only 309,347 MT of pulses and oilseeds. Rabi season procurement may commence on March 15. The procurement quantity is less than last year as prices are above MSP. The government sanctioned the procurement of pulses and oilseeds from Tamilnadu, Karnataka, Telangana, Maharashtra, Haryana, Madhya Pradesh, Odisha, Rajasthan and Haryana. During the kharif season, 164,000 farmers sold mung, urad, pigeon peas and soybeans for which the government transferred Rs. 1,666 crores into farmers’ accounts.

The government mainly procures gram, lentils and mustard seeds from farmers during the rabi season. This year, production is seen to be better or equivalent to last year. For the past four months, the average price of most crops is above MSP. Last week, chana traded above MSP.

As the government scrapped the Essential Commodities Act, stockists, traders, millers and companies are building up stocks.

If prices are above MSP, government stocks will be reduced and in the future the market will trade at higher levels.

Chana back on charts

In India’s leading future exchange, NCDEX, chana traded at Rs. 5,600/100 kg in October. In December, chana prices fell due to the selling of government stocks. In January, prices also fell. March future was trading at Rs. 4,900.

With the release of official production estimates, the market increased although less production was assumed. Due to increased future prices, spot prices also improved.

As a result of increased temperatures in the northern part of the country, the production and quality of the crop may suffer. In rainfed areas, soil moisture levels are even lower. The size of the grain is small.

Pulse production in Maharashtra estimated at more than 4.3 million MT

In the Western Provinces of the country, Maharashtra produces a large quantity of pigeon peas (tuar) and gram. Apart from this, good yields of mung and urad can also be reported. The state agriculture department has estimated the total production of pulses for the 2020/21 season at nearly 4.33 million MT. For the kharif season, production is estimated at 1.754 million MT and for the rabi season it is estimated at 2.576 million MT. According to the report, the 2020/21 kharif season production of pigeon peas was 1.178 million MT, mung was 0.227 million MT and urad was 0.39 million MT.

Gram production is estimated at 2.467 million MT.

In Maharashtra, 2.179 million hectares were sown to pulses during the kharif season, including 1.236 million hectares to pigeon peas, 0.43 million hectares to mung and 0.39 million hectares to urad. For the rabi season, 2.442 million hectares were seeded to pulses, including 2.294 million hectares to gram and 0.147 million hectares to other pulses.

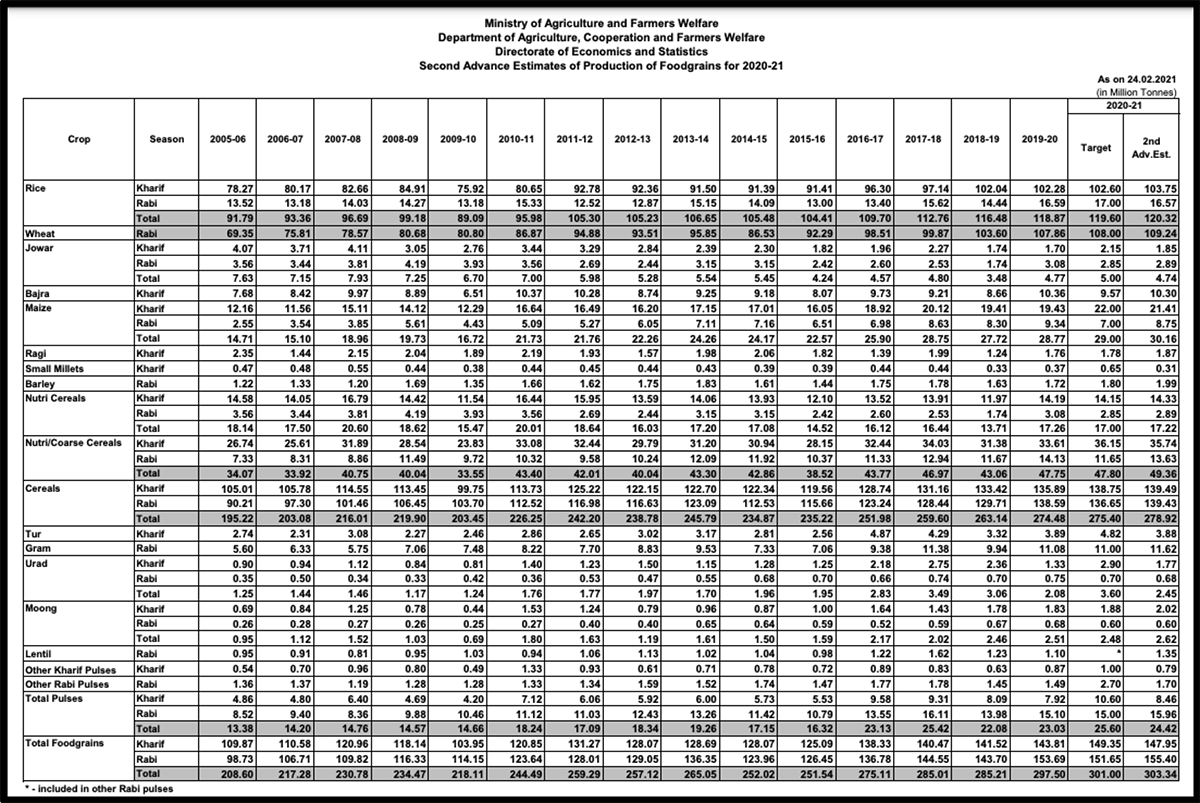

Chana production may increase by 5-7 lakh MT

At the national level, 112.00 lakh hectares were seeded to gram, up 4.70 lakh hectares or 4.35% from last year’s 107.30 lakh hectares. The average seeded area is 92.75 lakh hectares. The weather remains favorable. If there is no serious event or natural disaster in the next four to six weeks, gram production could increase by 5-7 lakh MT over the previous season. According to the government, 113.50 lakh MT of gram was produced in 2019/20. Based on this number, this season’s production could top 118 lakh MT. According to industry sources, last rabi season’s production was 80-85 lakh MT and the maximum expected this season is 9 million MT, which is almost equal to domestic annual demand. The area sown to gram increased significantly in Maharashtra and Gujarat, but decreased in Madhya Pradesh, Karnataka and Rajasthan. New crop has started arriving in Maharashtra-Karnataka and the pace may pick up in other states next month. The minimum support price for gram has been fixed from Rs. 4,875 to Rs. 5,100 per quintal. Earlier, the price was trending higher than the support price, but now it has dropped off considerably. In the peak season for arrivals, the price may intensify and then soften in the off-season.

SECOND PRODUCTION ESTIMATES: DEPARTMENT OF AGRICULTURE, COOPERATION & FAMERS WELFARE

Abbreviations

Tuar/ Arhar: Pigeon Peas PP

Mung: Green Mung

Urad: Black Matpe

Chana: Gram, Desi Chickpea

Matar: Pea

Masur: Lentil

Mandi: Market yard

Bhav: Prices

Dal/Daal: Processed Pulses (Directly for human consumption)

Rs: Indian Rupees (1$=Rs 72.95)

Rahul Chauhan

Director, IGrain India

igrainind@gmail.com

+91 9350141815

Twitter igrain_india

India / Rahul Chauhan / chana / desi chickpeas / gram / Rajasthan / Madhya Pradesh / Maharashtra / Karnataka / Gujrat

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.