October 22, 2020

IGrain’s Rahul Chauhan provides information on pricing and current inventories, as well as import figures and news from domestic and international markets.

Highlights from the past week:

Rundown of Indian Markets: Downward trend on kabuli chana (chickpea) prices likely to end?

Ports

Declining prices for other pulses, like desi gram, pigeon peas, etc., put downward pressure on kabuli gram prices. Sellers were active but customer demand was low and prices fell.

Due to the low demand, stockists had to sell at reduced margins. For the market to improve, consumer demand has to increase.

By the weekend, the price of kabuli chana fell by Rs.500 to Rs.6,950/7,100 per quintal on weak buying. In Madhya Pradesh’s Indore market yard, the price fell by Rs.100 to Rs.6,500/7,100 per quintal.

Indore reported 3,500-4,000 bags of daily arrivals of kabuli chana. Dewas reported the same amount. In Dewas market yard, prices fell by by Rs.300 and stood at Rs.5,000-6,800 by the weekend. In Ujjain, the price fell by Rs.100 and in Ratlam by Rs.100. In other market yards, there was trading at lower prices.

The sowing of kabuli chana is underway in several states, including Madhya Pradesh. Sources indicate sowing progress is at 60-70%. In Karnataka, it is nearly complete. Reports indicate the sowing area is down from last year, which should support the market.

Imported chickpeas from Sudan are arriving at port. In Sudan, quoted prices are reported at Rs.5,500-5,550 per quintal, Mumbai port. India’s festive season has begun, and demand may improve, which may lead to a possible surge in prices.

News Blurbs

Import of Desi and Kabuli Chana is Very Slow

Two to three years ago, India imported millions of tons of desi gram. Now that figure is down to thousands of tons. In fact, there has been a sharp decline in chickpea imports due to increased domestic production, low market prices and the imposition of onerous tariffs. The import duty on desi gram is currently 60%. As of a few months ago, the domestic price on gram was declining and imports were not economically beneficial.

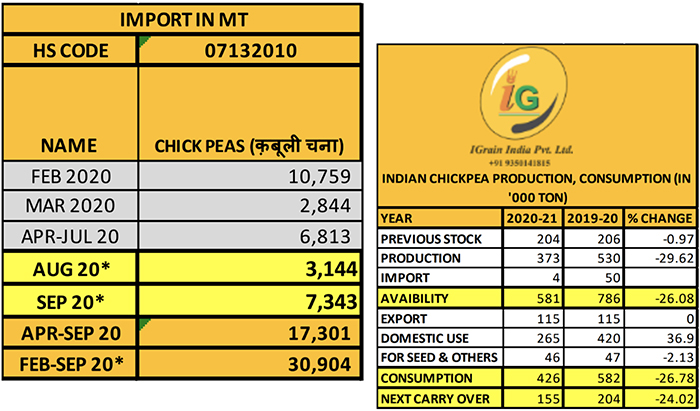

With respect to kabuli gram, India is both an importer and exporter. Data indicates that about 11,000 MT were imported in February. That volume dropped to 2,844 MT in March. In the four-month period from April to July, 6,813 MT of kabuli chana was imported. In August, imports totaled 3,144 MT and rose to 7,343 MT in September. In the eight months from February to September, imports totaled 30,904 MT. In the first six months of the current financial year (April-September), imports amounted to 17,301 MT.

Kabuli gram usage decreased due to long term activities in the consuming areas. Although production has also declined, prices remained under pressure for a few months as demand and consumption conditions weakened. Later, however, market conditions began to improve. Madhya Pradesh and Nimar are now seeing prices soften slightly on new arrivals from Malwa division. Export performance is also discouraging. Due to festive season demand and supply in the mandis, the price of desi gram is much higher than the minimum support price.

Festive season is expected to see increased demand and consumption

The seeding of rabi season desi and kabuli chana got underway just as consumption is starting to trend upward. In general, during the festive months from August to November, there is greater demand and consumption of gram and its value-added products (such as pulse and gram flour). Following the festive season, consumption can continue into the winter months if supplies remain available. The situation has become quite complicated.

Prices of desi chana as well as kabuli chana may increase drastically in the coming days.

Compared to the previous month, kabuli chana prices have increased by 10-20%, and may rise by more than Rs 100/kg in the coming days.

India is the world’s top pulse prodder and consumer. Pulse crop productivity, however, has a difficult time keeping up with demand. Consequently, India has to import large quantities of pulses. On the one hand, demand and consumption is rapidly increasing, while on the other government agencies are actively procuring product.

Bombay High Court orders the release of imported peas lying at ports

In November 2019, the Bombay High Court ordered the release of consignments of imported peas for which all conditions had been fulfilled. The government had already given importers permission to clear the cargo and importers paid a fine of about 10%, but customs officials were reluctant to release the consignments for technical reasons. Of the 38,500 MT of pea imports in question, only 1,206 MT had been cleared.

Importers had to spend large amounts to clear the pea imports. The High Court, however, was asked by the Customs Department and the Directorate General of Foreign Trade (DGFT) to hold the implementation of its ruling while they elevate the matter to the Supreme Court. But the High Court rejected this request. The decision will be challenged at the Supreme Court and it is likely that a stay order will be issued. But that will take time. Pea consignments of up to 5,000 MT can be cleared before the Supreme Court passes a stay order.

Due to several notifications issued by the Directorate General of Foreign Trade (DGFT) and the Union Ministry of Commerce, the matter has continually been delayed. The Bombay High Court feels that the quality of peas being held at ports and in custom warehouses may deteriorate and should therefore be released as early as possible. Importers have fulfilled the government's conditions.

Immediate compensation for crop damage demanded in Maharashtra

Untimely torrential rains in October have caused tremendous damage to kharif crops in Maharashtra. Farmers’ organizations are demanding compensation for crop damage from the government to the tune of Rs.50,000 per hectare ($ 680/hectare). Maharashtra’s Chief Minister has ordered an official assessment of crop damage.

Additionally, in the past few days, heavy rains and strong winds in various parts of Maharashtra have caused further damage to kharif crops. Preliminary estimates indicate more than 5 million hectares of kharif crops have been damaged, including soybean and cotton crops, as well as urad and groundnut crops. Vidarbha and Marathwada divisions reported the greatest crop damage.

Maharashtra is the top soybean, cotton and pigeon pea producing state in India. It also produces large volumes of other pulses and oilseeds.

Abbreviations

Kabuli Chana: Chickpea

Tuar/ Arhar: Pigeon Peas

Mung: Green Mung

Urad: Black Matpe

Chana: Gram

Matar: Pea

Masur: Lentil

Mandi: Market yard

Bhav: Prices

Dal: Processed Pulses (Directly for human consumption)

Rs.: Indian Rupees (1$=Rs.73-74)

Rahul Chauhan

Director, IGrain India

igrainind@gmail.com

+91 9350141815

Twitter igrain_india

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.