No major ups and downs seen in the market

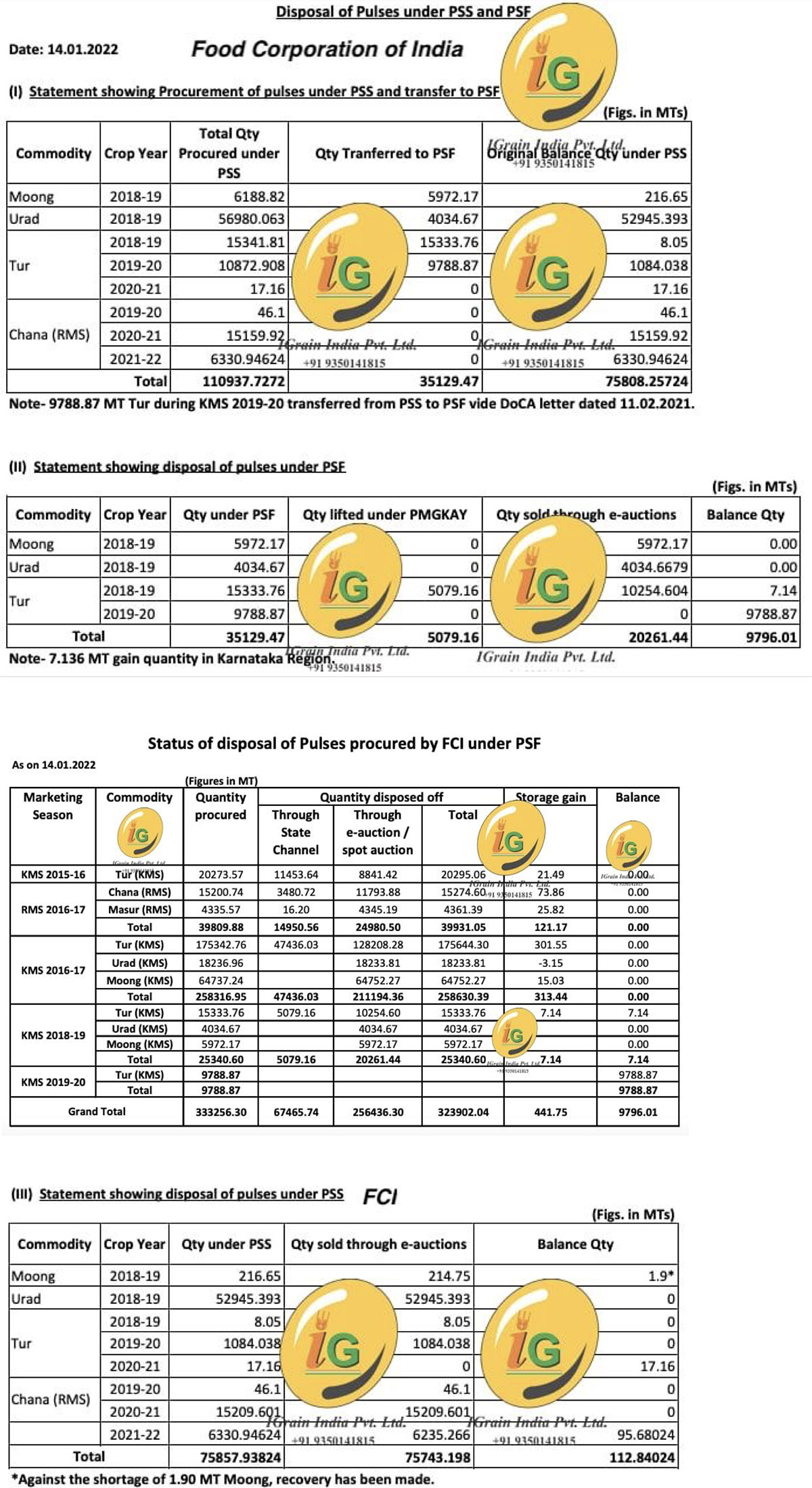

Continuous selling of chana by Nafed put a brake on rising prices thanks to consistent passing of tenders at low prices. Prices moved backwards as demand was sluggish.

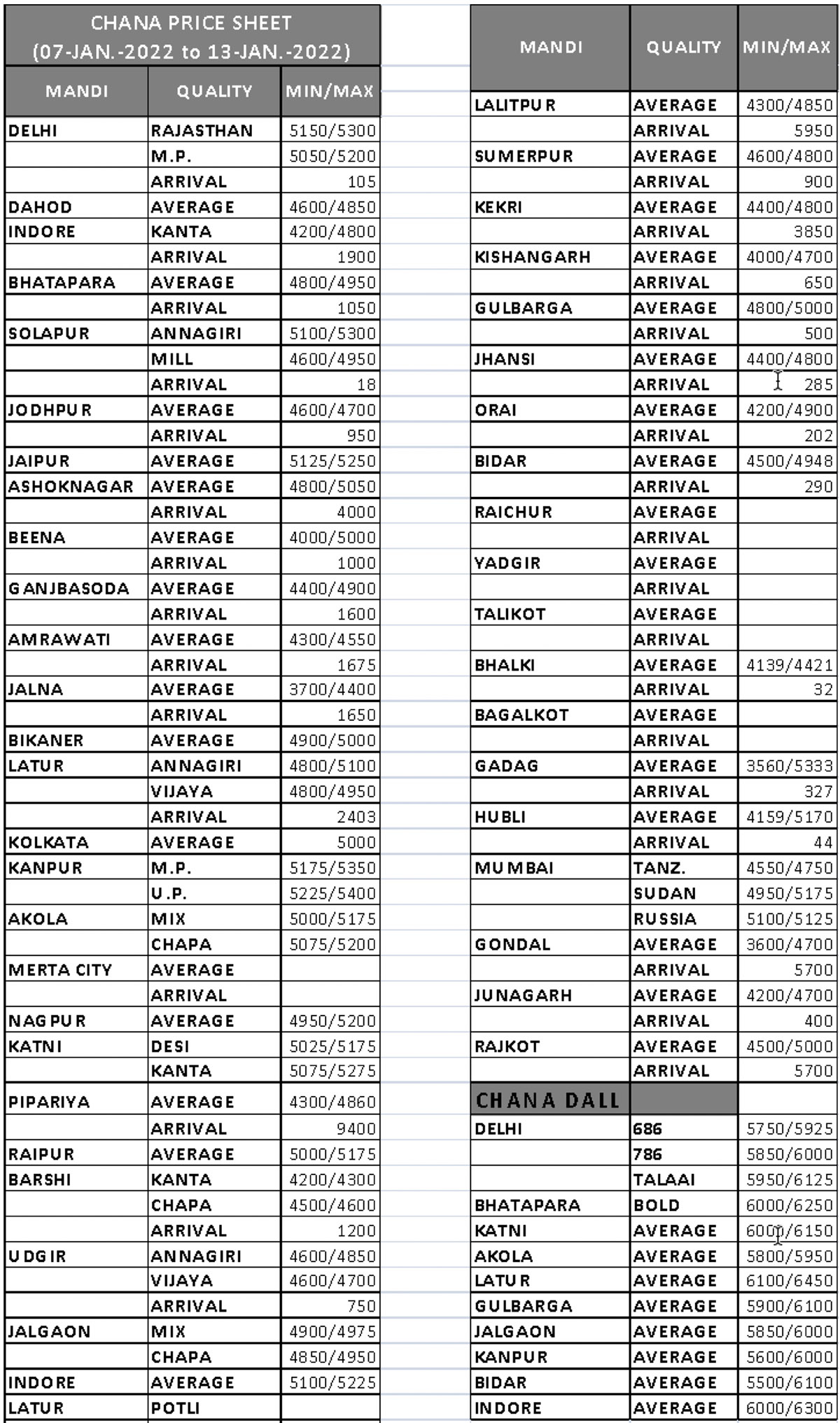

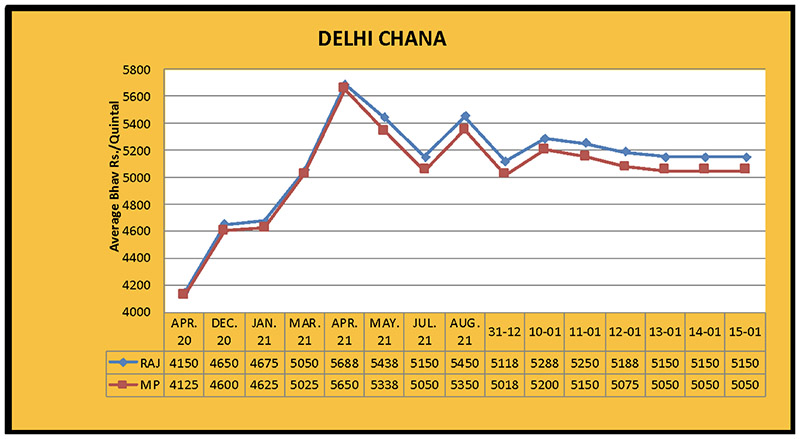

Delhi

Delhi prices recorded a decrease of Rs. 25 per quintal and the Madhya Pradesh Line traded at Rs. 5050/quintal while the Rajasthan Line remained at Rs 5,150 per quintal over the weekend. Sellers are reluctant to sell at reduced prices. Prices may increase next week.

Port

Meanwhile, Mumbai prices recorded an improvement of Rs. 50 due to increased buying. Tanzania old stock prices rose to Rs. 4,600 per quintal and new to Rs. 4,750 per quintal over the weekend.

Rajasthan

The demand for Rajasthan chana showed an upward trend during the last week. Due to the improvement in demand, an increase of Rs. 50/100 per quintal was recorded and Jaipur sold at Rs. 5,125/5,150, Sumerpur Rs. 4,700/4,750, Kekdi Rs. 4,500/4,700, and Kishangarh Rs. 4,000 /4,650 per quintal.

Maharashtra

Maharashtra prices fluctuated due to sluggish buying and selling. An increase of Rs. 50 per quintal was recorded in Akola, Rs. 50 in Jalgaon and Rs. 100 in Nagpur. In Ahmednagar, however, prices fell by Rs 100, in Barshi by Rs. 50 and in Amravati Rs. 50 per quintal. With this trend, Akola traded at Rs. 5,050/5,125, Jalgaon Rs. 4,950, Nagpur Rs. 5,050/5,100, Ahmednagar Rs. 4,800/5,000, Barshi Rs. 4,250/4,600 and Amravati Rs. 4,500 per quintal at the weekend.

Madhya Pradesh

Normal demand was seen in one of the largest chana producing states: Madhya Pradesh. No big changes were observed. At the weekend, Katni traded at Rs. 5,000/5,050, Indore Rs. 5,100/5,125, Ashoknagar Rs. 4,800/4,900, Bina Rs. 4,400 /4,900 and Ganjbasoda at Rs. 4,400/4,800 a quintal.

Karnataka

Arrivals of new stock started in Karnataka's Bidar market yard, where arrivals were 100/150 bags a day and prices increased by Rs. 75 per quintal to Rs. 4,800/4,948 per quintal at the weekend. Gulbarga prices, however, stayed in range of Rs. 4800/5000 per quintal.

Other Markets

Due to weak demand from millers, Raipur prices recorded a drop of Rs. 50 per quintal and traded at Rs. 4,950/5,050 per quintal. An improvement of Rs. 25 per quintal was recorded in Kanpur and prices went up to Rs. 5,200/5,250 per quintal. Rajkot prices remained muted at Rs. 4,500/5,000 per quintal.

Chana Dal

Last week, an improvement in the demand of Chana dal was observed. Prices increased by Rs. 100/150 per quintal and, with this increase, Delhi Chana dal reached Rs. 5,850/5,950, Katni Rs. 6,025, Jalgaon Rs. 6,000, Kanpur Rs. 5,950/6,000 and Indore Rs. 6,200/ 6,300 per quintal.

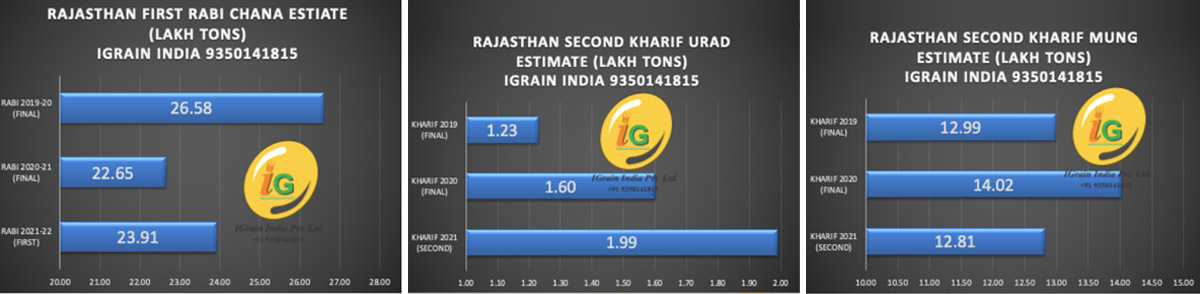

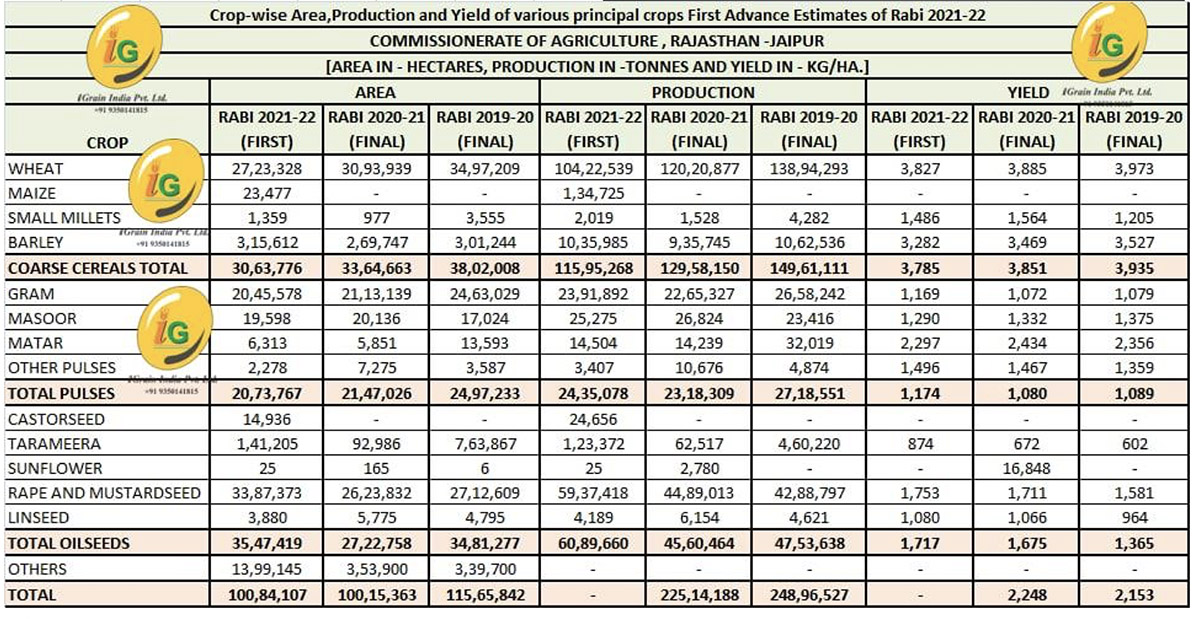

Despite increase in sowing, there is doubt in increasing the production of gram

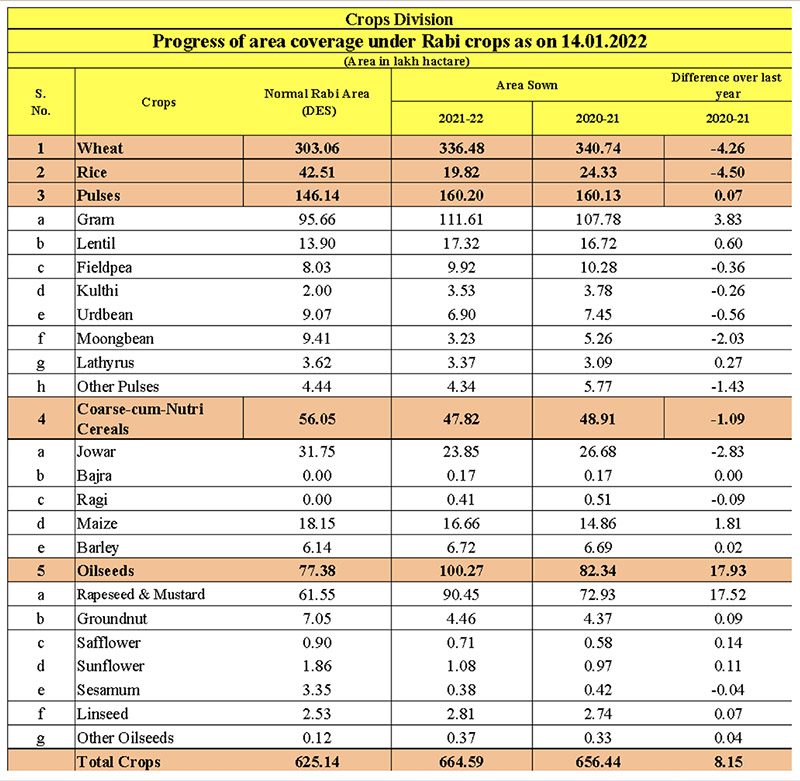

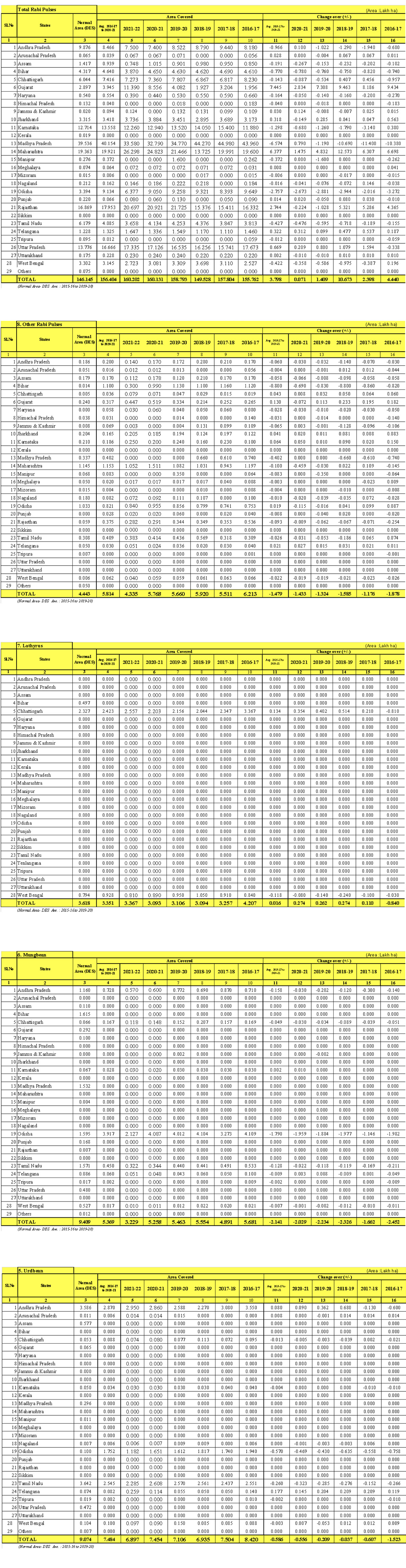

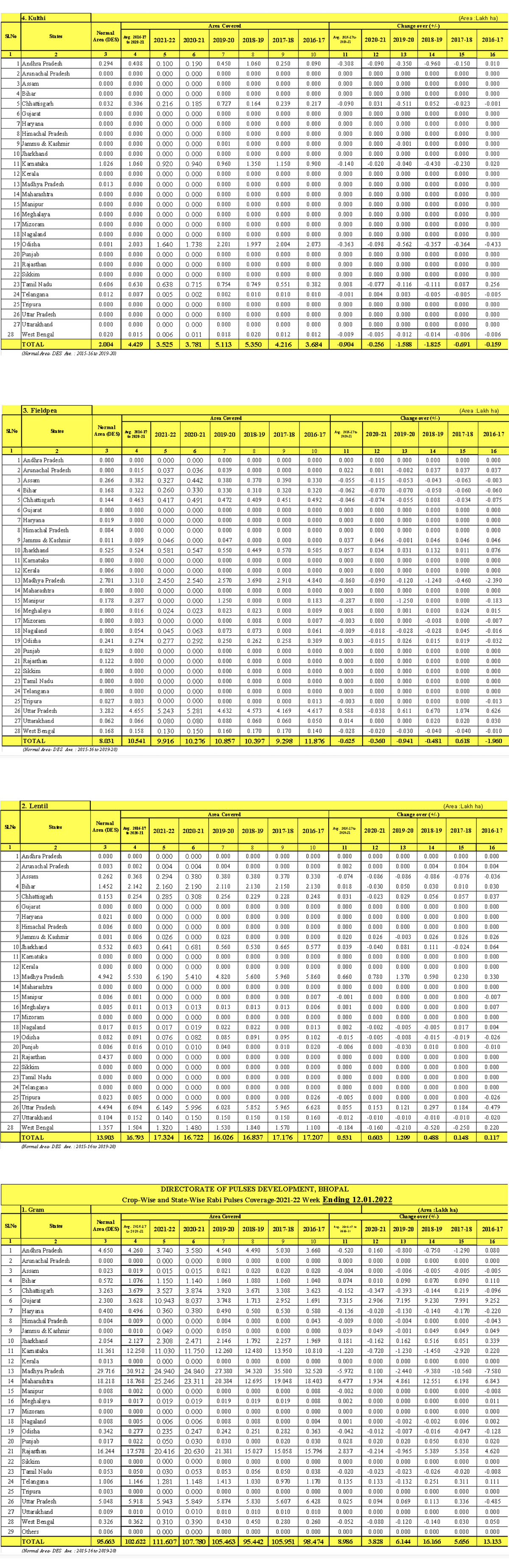

New Delhi. Although data received from various producing states caused the Union Agriculture Ministry to estimate the production area of gram to increase by 3.83 lakh hectare from 107.78 lakh hectares last year to 111.61 lakh hectares in the current season, the traders are predicting a lower total sowing area.

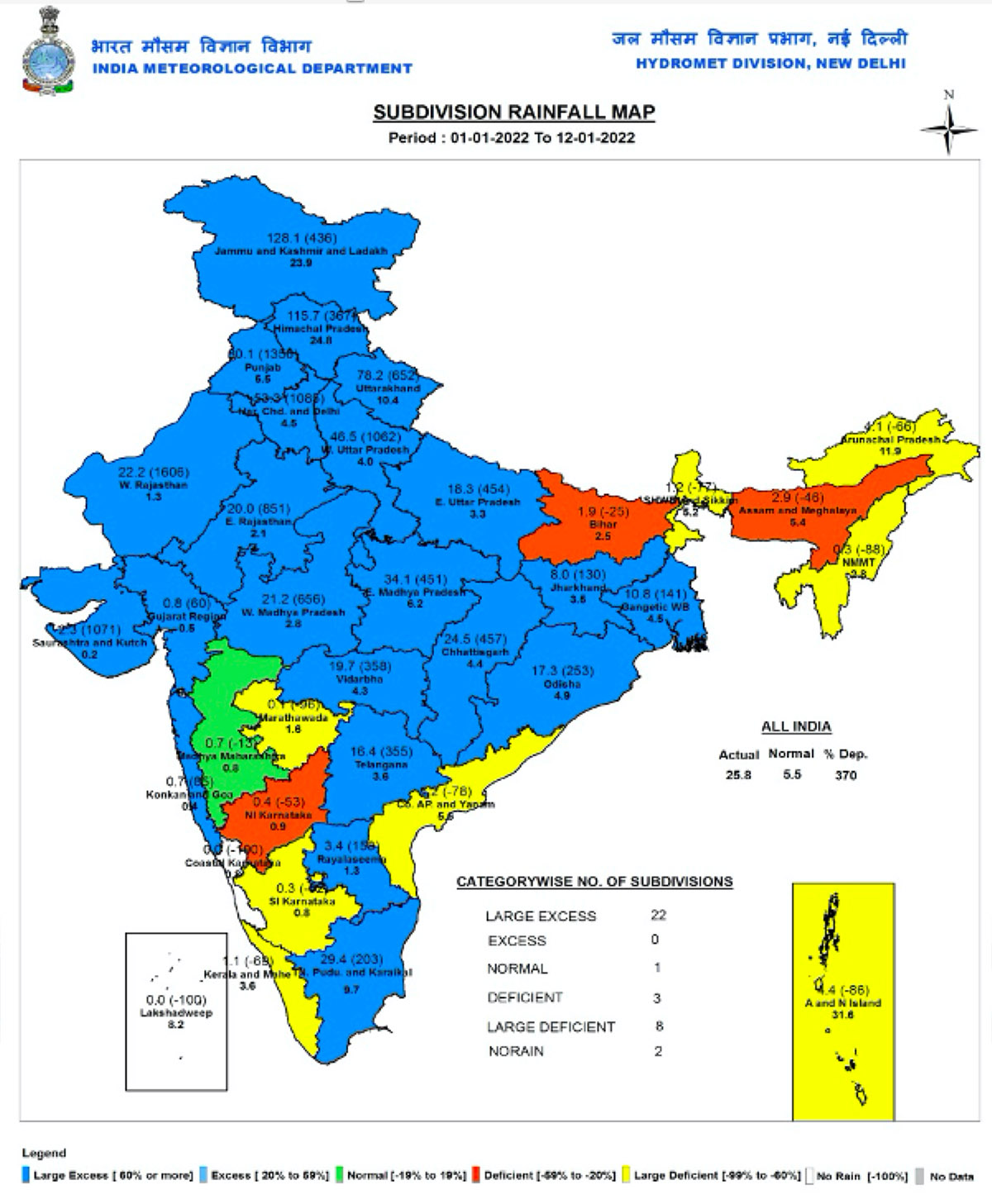

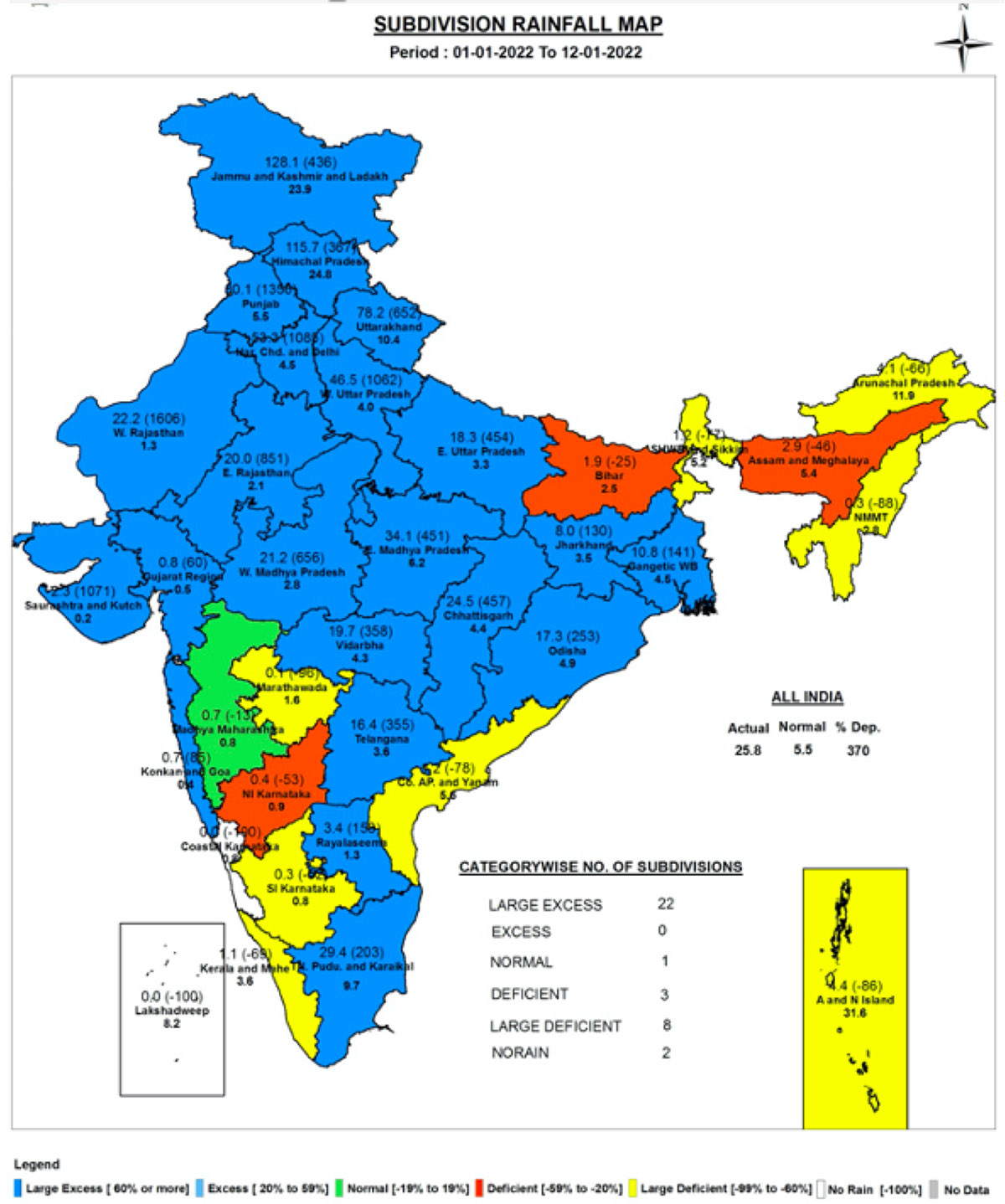

Due to unseasonal rains, strong winds and hailstorms, crops are also being damaged in major producing states such as Madhya Pradesh, Maharashtra and Uttar Pradesh. Rajasthan, Haryana, Punjab and Gujarat received rains but the overall weather in the southern states is still largely clear.

The average annual domestic consumption of gram is 90-95 lakh tons and usually less than production. There is a heavy import duty of 60 percent on desi gram but the LDC Chana import duty is nil. Generally, in December and January, the price of gram increases but this year, due to government intervention, there have been heavy imports of tuar and urad, which indirectly slowed down chana prices.

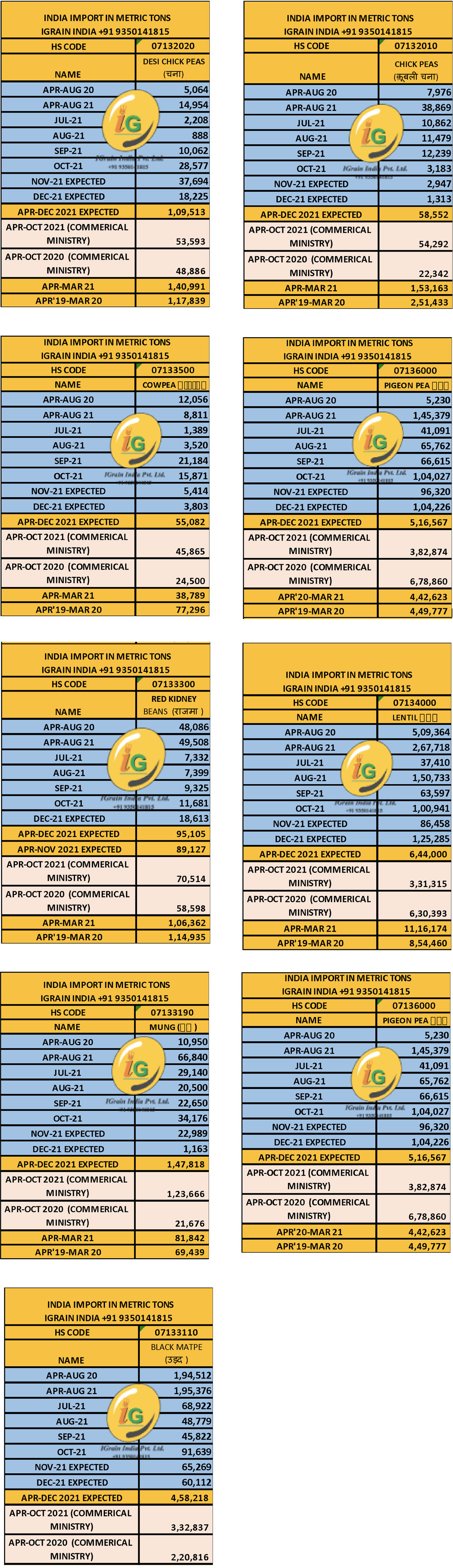

The total imports of desi chana between April and December is estimated at 1.10 lakh tons and that of kabuli chana at 58,000 tons

New Delhi. Currently, Chana has an import duty of 66% and a duty of 44% on kabuli chana is also applicable. However, it is still being imported, mainly from LDC countries.

According to the data available, between April and December 2021, import of kabuli chana and desi chana reached 58,552 tons and 1,09,513 tons respectively.

The import of desi chana increased almost three times as compared to April-August 2020, reaching 14,954 tons in April-August 2021 as compared to 5,064 tons. In the year 2021, 2,208 tonnes were imported in July, 888 tonnes in August, 10,062 tonnes in September and 28,577 tonnes in October. Equally, 37,694 tons of gram are estimated to have been imported in November 2021 and 18,225 tonnes in December 2021, a total of 1,09,513 tons. Data from the Union Commerce Ministry shows that between April and October 2021, imports were 53,593 tons, which was slightly higher than the import of 48,886 tonnes in the same months of the year 2020. During the FY 2020/21, a total of 1,40,991 tons of desi gram was imported, about 23,000 tons more than that of 2019-20, which was 1,17,839 tons. Desi gram is imported mainly from African countries and Australia.

Apart from this, the import of kabuli chana during April-August 2021 has increased by close to 39,000 tons, which was almost five times more than the import of 8,000 tons as compared to the same period in 2020. In July 2021 a quantity of 10,862 tons were imported, 11,479 tons in August 11,479, 12,239 tons in September and 3,183 tons in October. According to the Union Ministry of Commerce, from April to October 2021, the total import of kabuli chana increased to 54,292 tons, almost five times more than the same period of the previous year. A quantity of 2,947 tonnes is estimated to have been imported in November 2021 and 1,313 tonnes in December. In the last financial year, a total of 1,53,163 tons of chickpeas were imported, which was much less than the 2,51,433 tons in the financial year 2019-20. Equally, there is a strong possibility of import reduction in the current financial year.

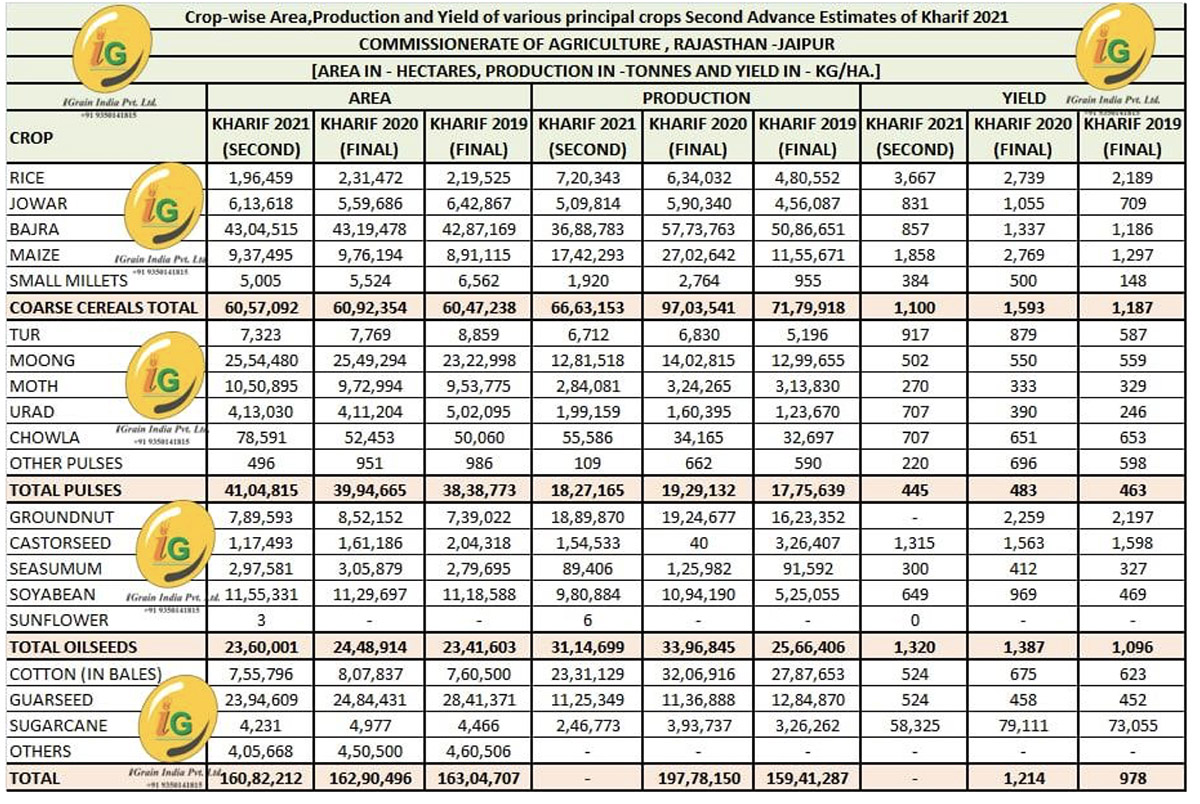

Chana crop affected in Vidarbha due to rain - signs of increase in supply of tuar when sky is clear

Nagpur. Due to last week's unseasonal rains and hailstorms, crops of gram and tuar in the Vidarbha division of Maharashtra were affected, resulting in a strengthening of prices. Now, the weather has cleared to a great extent, which may increase arrivals of tuar in the mandis.

According to the available data, during the current financial year until December 2021, about 5 lakh tons of tuar were imported and, by March 2022, an additional 1.50 lakh tons may be imported. Concerning the domestic production of tuar, the government has projected a potential total of 44.30 lakh tons while the traders estimate this number to be between 32-35 lakh tons. Total imports of tuar are expected to increase from 4.42 lakh tons in 2020-21 to 6.50 lakh tons in 2021-22.

According to critics, the production of tuar will not be encouraging this year but, when the weather clears, supply is expected to increase. This season, tuar production was expected to be excellent due to an increase in the sown area and favourable weather in the initial phase. But, due to poor weather conditions in both top producing states - Maharashtra and Karnataka -, production is now expected to decline significantly.

In Maharashtra, damage to chana crops were reported. In Gujarat, sowing has jumped to a new record level while in Karnataka the area has decreased. In states like Madhya Pradesh, Rajasthan and Uttar Pradesh, there has been little change in the sown area of gram. The first arrivals of the new crops will start relatively early in Maharashtra and Karnataka as compared to other states. On January 11, a large volume of unseasonal rain was seen in the Vidarbha division, due to which there is a possibility of more damage to gram crops than to tuar. About 75% of the tuar crop is already in bins but farmers are not ready to sell at a lower price.

Hail storm and heavy rains damage Rabi crops in UP and MP

Jhansi. In Uttar Pradesh and Madhya Pradesh, several districts received hailstorms along with heavy rains, due to which Rabi crops were severely damaged. Sowing of wheat, gram, lentils, peas, mustard and maize is done on a large scale in these states.

According to the available data, the sown area of wheat is 94.30 lakh hectares in Uttar Pradesh and 90.55 lakh hectares in Madhya Pradesh. The area in both the provinces is lower than last year. Similarly, in Madhya Pradesh 24.94 lakh hectares of gram have been sown while in Uttar Pradesh 5.94 lakh hectares were sown. This year, there has been a slight change in the sown area of gram in these two provinces as compared to last year. The area of lentils increased from 5.41 lakh hectares to 6.21 lakh hectares in Madhya Pradesh and in Uttar Pradesh improved from 5.99 lakh hectares to 6.14 lakh hectares. Pea acreage, however, decreased from 2.54 lakh hectares to 2.45 lakh hectares in Madhya Pradesh and to 5.24 lakh hectares from 5.28 lakh hectares in Uttar Pradesh.

Weather conditions were generally favourable for Rabi crops but the recent hailstorms have damaged the crop in some areas. In most parts of these states, Rabi crops have also benefited. The damage caused by the hailstorm is still being assessed and, in the meantime, farmers have demanded compensation from the government. It is worth noting that Uttar Pradesh and Madhya Pradesh are the top two producing states of wheat, lentils and peas. At present, there is no clear data about the crop damage but it appears that damage has only occurred in a limited area and will not have much impact on the overall production estimate. The period of January to March is very important for Rabi crops - if the weather is favourable, the production in these two provinces can be spectacular.

Huge reduction in paddy area in Telangana; increased sowing of pulses, oilseeds and maize

Hyderabad. In Telangana - the most important paddy producing state of South India -, farmers are being forced to increase the area under pulses, oilseeds and maize and reduce the area of paddy due to the central government’s decision to purchase a limited amount of Rabi paddy at the minimum support price (MSP). The central government has sufficient stock of Sela rice to meet the domestic demand for the next four-five years so it does not want to buy any more - a big blow to the farmers. As per the available data, so far in the current Rabi season the area of paddy in Telangana has reached only 2.30 lakh acres, which is only one-third of the 6.90 lakh acres in the same period last year. Instead of paddy, farmers are opting to plant pulses, oilseeds and maize. The sown area of oilseeds has jumped from 2.20 lakh acres to 3.51 lakh acres and that of pulses has similarly increased from 3.23 lakh acres to 4.07 lakh acres as compared to last season. Similarly, the area of maize also improved from 1.22 lakh acres to 2.02 lakh acres.

The sowing of Rabi crops is likely to continue until the end of January and the area may increase further. As of January 10, 2022, the total sown area of Rabi crops in Telangana was only 13.13 lakh acres as against the normal average area of 46 lakh acres. The total area in Telangana during the entire period of the last rabi season stood at 54 lakh acres, of which the paddy area comprised 39 lakh acres. According to the agriculture minister, the production area in Telangana is likely to drop by at least 50 per cent during the current Rabi season as compared to last year while the remaining area may be devoted to the cultivation of dhania as farmers have tied up with rice mills. As a result, there will be no burden or pressure on the government for the purchase of paddy.

DATED 10.01.22

STATE/ PRICES (IN RS./QUINTAL)

MADHYA PRADESH CHANA RABI 2018- 4,301

RABI 2019 CHANA

GUJRAT 4,050

MADHYA PRADESH 4601

RABI 2020 CHANA

RAJASTHA 4,878-4,941

MADHYA PRADESH 4,801-4,851

MASUR RABI 2020

MADHYA PRADESH 6701

MASUR RABI 2021

TAMILNADU 7,405-7,415

DATED 11.01.22

CHANA RABI 2020

RAJASTHAN 4,962-4,963

MP 4,800-4,831

MUNG RABI 2021

TAMIL NADU 7,401

DATED 13.01.22

ANDHRA PRADESH RAI 2020 CHANA 4,721

Abbreviations

Tuar/ Arhar: Pigeon Peas PP

Mung: Green Mung

Urad: Black Matpe

Chana: Gram, Desi Chickpea

Matar: Pea

Masur: Lentil

Besan: Gram Flour

Mandi: Market yard

Bhav: Prices

Dal/Daal: Processed Pulses (Directly for human consumption)

Rs: Indian Rupees (1$=Rs 74.24) 17 Jan. 22 at 03:08 PM IST

Rahul Chauhan

Director, IGrain India

igrainind@gmail.com

+91 9350141815

Twitter igrain_india

IGrain / Rahul Chauhan / India / Mumbai / Burma / Delhi / Maharashtra / Uttar Pradesh / Rajasthan / Madhya Pradesh / Karnataka / Chana / Desi Chick peas / Mung / Lentil / Black Matpe / Pigeon Pea / Red kidney / Cowpea

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.