October 27, 2021

IGrain’s Rahul Chauhan provides information on pricing and current inventories, as well as import figures and news from domestic and international markets.

CONTINUOUS DOWNFALL IN CHANA PRICES- DEMAND LESS EVEN WITH FESTIVE DEMAND

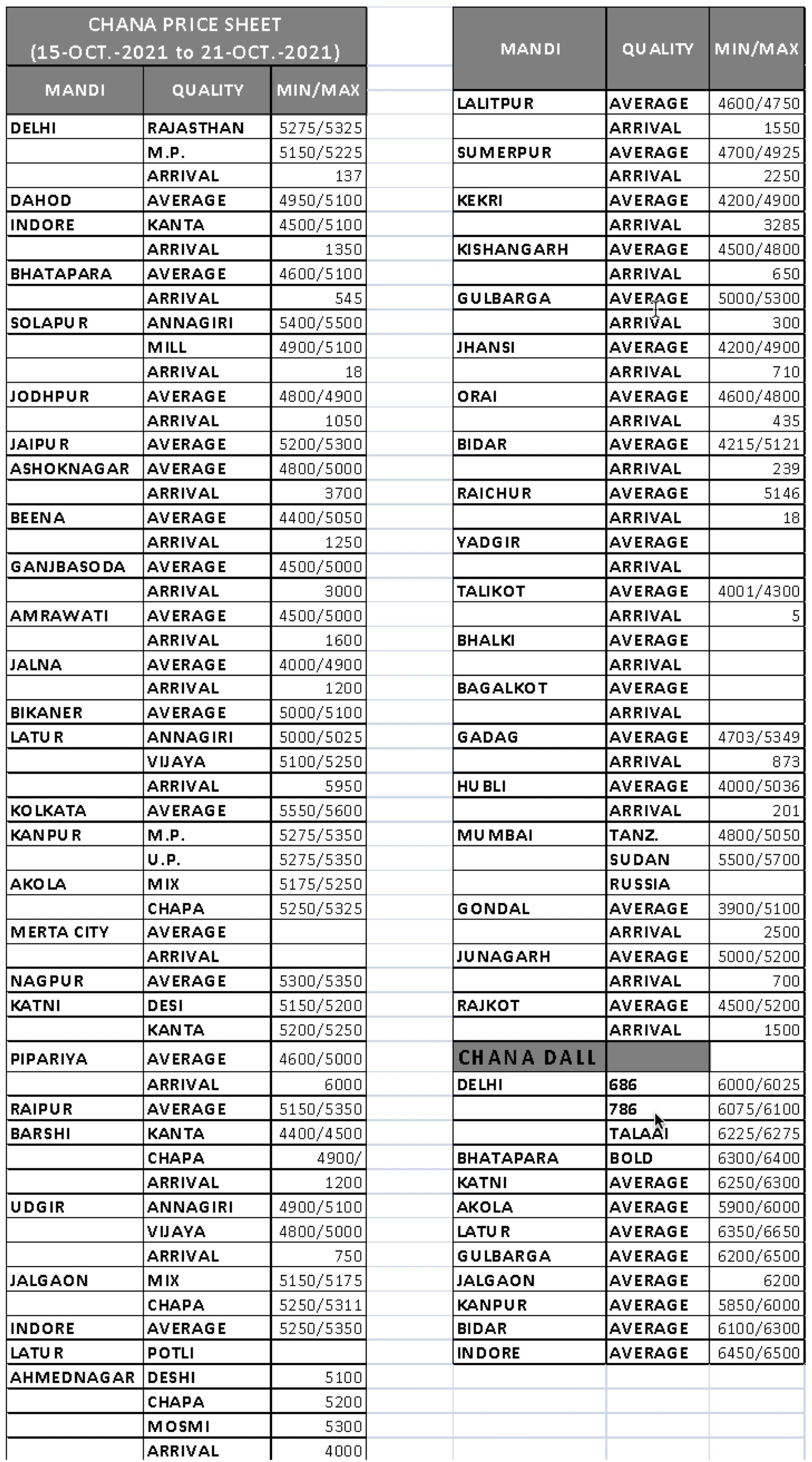

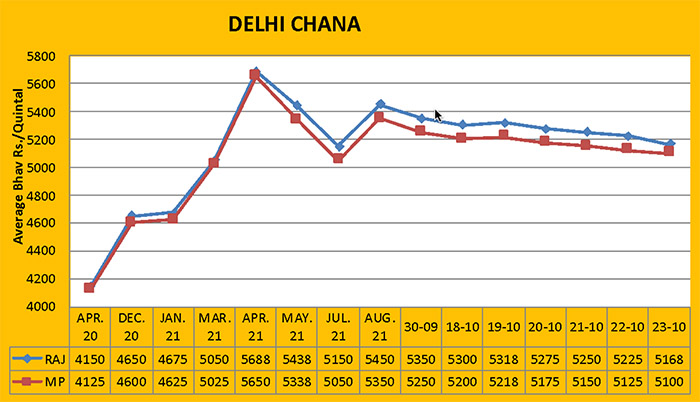

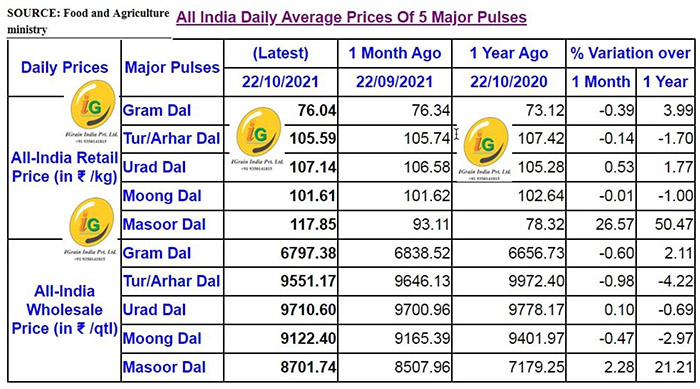

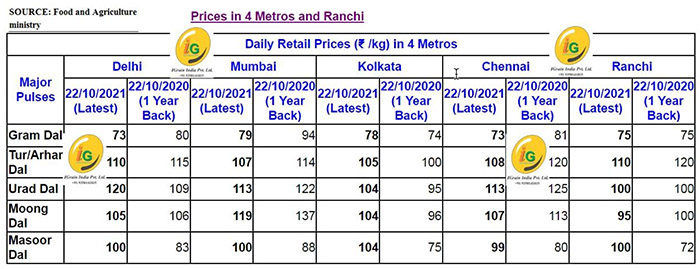

Chana continues to decline due to panic selling. Due to the lack of availability of customer support and continued selling pressure, the prices of gram are decreasing continuously. The festive season has started, but sales of gram dal and gram flour are low.

Delhi

Due to lack of demand, Delhi gram recorded a fall of Rs 75/100 per quintal last weekend and with this fall, it traded at Rs. 5,200/5,225 in the Rajasthan line and Rs. 5,100/5,125 in the Madhya Pradesh line. The daily arrival of chana on Lawrence Road this week was 20/25 motor compared to 15/20 motor last week.

Port

Buying and selling of imported gram remained sluggish and consequently chana at the Mumbai Port did not see any bullishness or bearishness. Tanzania old and new chana sold at Rs. 5,000/quintal and remained stable over the weekend.

Rajasthan

In Rajasthan, chana showed a bearish trend due to weak demand. In Jaipur, prices fell by Rs. 75 to Rs. 5,200/5,225, in Jodhpur by Rs. 50 to Rs. 4,800/4,850 and in Kishangarh by Rs. 50 to Rs. 4,750 per quintal.

Madhya Pradesh

Last week, the arrival of chana increased in the mandis of Madhya Pradesh as traders sold it in order to buy soybeans. In Madhya Pradesh, prices reduced by Rs. 75/150 per quintal due to increased arrivals and selling pressure. In Katni, prices fell to Rs. 5,050-5,100, in Indore, to Rs. 5,200, in Ashok Nagar to Rs. 4,800/4,950, in Bina to Rs. 4,500-4,900 and in Ganjbasoda to Rs. 4500-4900 per quintal.

Maharashtra

Last week, buying and selling were sluggish in Maharashtra, and prices did not therefore change much over the weekend. By the weekend, prices were Rs. 4,900/5,500 in Solapur, Rs. 5,000/5,125 in Latur, Rs. 5,150/5,225 in Akola and Rs. 5,100/5,300 in Ahmednagar per quintal and remained stable.

Other Markets

Due to the impact of an overall fall in prices and weak demand, Kanpur prices fell by Rs. 100 per quintal to Rs. 5,250/5,270 per quintal at the weekend. Similarly, Raipur prices also declined by Rs. 150 per quintal to Rs. 5,100/5,200. Due to weak buying, Rajkot and Gondal prices recorded a fall of Rs. 200-200 per quintal to Rs. 4,500/5,000 and Rs. 3,700/4,900 per quintal, respectively.

Chana Dal

Due to the impact of lower prices and lack of demand, gram dal is also down by Rs 75/125 per quintal with prices falling to Rs. 5,950/6,500 per quintal over the weekend.

Gram Production and availability may reduce

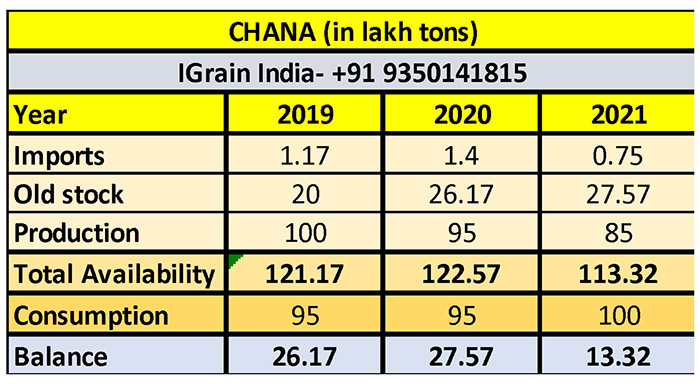

The production of chana in the last Rabi season fell to around 85 lakh tons, which was much lower than last year's production of 95 lakh tons and the 2019 production of 100 lakh tons.

Total imports from various countries was 1.17 lakh tons in the 2018-19 season and 1.40 lakh tons in 2019-20 This number is likely to fall to 75 thousand tons in 2020-21 season.

On the other hand, domestic consumption of chana is expected to increase by 5 lakh tons to 100 lakh tons this year after remaining stable at 95 lakh tons in the 2018-19 and 2019-20 marketing seasons.

There may be a sharp decline in balance stocks. Sowing has started in some areas and the speed is likely to increase rapidly as the season approaches.

As per rough estimates, during the current marketing season of 2020-21 the total availability of desi chana will reach 113.32 lakh tons, comprising stocks of 27.57 lakh tons, a production of 85 lakh tons and imports of 75 thousand tons.

Taking into account 100 lakh tonnes of domestic consumption, 13.32 lakh tons of stock will be left at the end of the season. This year’s opening stocks were 20.17 lakh tons and together with a production of 95 lakh tons and imports of 1.40 lakh tons, the total availability of chana reached 122.57 lakh tons in the last marketing season. With domestic consumption of 95 lakh tones, there was a surplus of 27.57 lakh tons.

The top producing states in the country include Madhya Pradesh, Rajasthan, Maharashtra, Karnataka, Gujarat, Uttar Pradesh, Andhra Pradesh and Telangana. The domestic market price of chana is now close to or less than the minimum support price, while the prices of lentils are above the support price.

The government procures huge amounts of wheat at the minimum support price. Last year, good prices of mustard and lentil resulted in a reduction in sowing.

Condition of the crops deteriorated due to 36 percent surplus rainfall in the current month

With the offset of the South-West Monsoon and the onset of the North-East Monsoon, many parts of the country are receiving unseasonal torrential rains, which has worsened the condition of Kharif crops. So far this month, 36 percent more rainfall than the national average has been received. Above normal rainfall is reported in three out of four geographical divisions of the country, while the rains are still continuing in many provinces.

The northwestern part of the country received 135 percent excess rainfall this month, which was more than other parts. A 36 percent surplus of rainfall was recorded in the southern peninsula and 35 percent in the central region. Barring some parts of Northeast India and Coastal Andhra Pradesh, all the other areas of the country received moderate to heavy rainfall.

Heavy rains and landslides have caused heavy damage in many areas, including Kerala. Due to the increased water levels in dams and reservoirs, gates were forced to open. On October 19, the gates of some of the largest reservoirs in Kerala were opened, including the reservoirs of Idukki.

On the other hand, heavy rains are continuing in Bihar-Bengal. Rains continue in Madhya Pradesh, Uttar Pradesh and Uttarakhand and are expected to do so for a few days. Uttarakhand and Himachal Pradesh received heavy rainfall yesterday. This rain is affecting the harvesting and preparation of Kharif crops as well as the sowing of Rabi crops. Heavy crop damage has been reported in some provinces. In Punjab-Haryana and Uttar Pradesh, the pace of paddy harvesting is slow. In many states, fields are filled with water and the moisture content of crops is excessive. There will be a delay in the sowing of Rabi crops.

Australia harvesting of chana may start soon; good production expected

In Australia, preparations have begun for the early harvesting of the new chickpea crop in the central and southern regions of Queensland. Harvesting is expected to begin from mid-November in most of the northern part of New South Wales. In central Queensland, typhoons and rains have delayed harvesting in some areas but the yield and quality of chickpeas have not been affected. The quality of the crop that has been harvested so far is said to be very good.

Crops such as wheat, canola, chickpea and lentils are produced on a large scale during the winter in Australia. Last year, production was good and the trend is expected to continue this year.

According to a report by Rabo Bank, the 2021-22 season is once again going to prove to be the 'golden year' for the production of winter crops in Australia.

The report has estimated the gross production of cereal crops, oilseeds and pulses at 528.70 lakh tons, which is 5 percent less than the previous season but 25 percent more than the five-year average.

The production of canola is expected to increase by 14 percent from last year to reach the peak level of 51.60 lakh tons this time, which is 48 percent higher than the five-year average. Wheat production in Australia is expected to be 3.19 million tons, which is 4 percent less than last year but 35 percent higher than the five-year average. Similarly, the production of barley is estimated to decline by 10 percent to 117 lakh tons as compared to last year but is nonetheless 7 percent more than the five-year average production. Chana production is also looking impressive this year.

Gram flour demand may increase in the future

Despite the continuation of the festive season, trade analysts are puzzled by the slow demand for gram and other pulses. Likewise, demand for gram flour (Besan) is also unusually low. However, industry critics believe that there may be good demand for chana before Diwali, and prices are expected to strengthen as a result. The pulses market has calmed down to a great extent due to various government decisions. Most of the chana stocks have already been consumed and sowing has also started so prices should have remained high and brisk during the supply off-season. The demand for gram for seeding should also increase, particularly considering the major festival of Diwali is also upcoming. Stockists and producers are selling chana at a slow pace. Up until recently, sowing of gram was hampered. The market should have picked up more than this but instead the prices are showing signs of moderation or stability, which is surprising.

Abbreviations

Tuar/ Arhar: Pigeon Peas PP

Mung: Green Mung

Urad: Black Matpe

Chana: Gram, Desi Chickpea

Matar: Pea

Masur: Lentil

Besan: Gram Flour

Mandi: Market yard

Bhav: Prices

Dal/Daal: Processed Pulses (Directly for human consumption)

Rs: Indian Rupees (1$=Rs 75.14)

Rahul Chauhan

Director, IGrain India

igrainind@gmail.com

+91 9350141815

Twitter igrain_india

IGrain / Rahul Chauhan / India / Chana / Delhi / Rajasthan / Madhya Pradesh / Maharashtra / Chana Dal / Black Matpe / Mung / Red Kidney / Cowpea / Lentil / Pigeon Pea

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.