Chana prices decline due to weak demand

Delhi

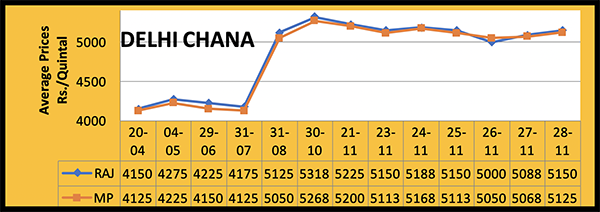

During this past week, spot prices on gram were influenced by future markets. Decreased demand for more than 3 months is now holding back any rise in prices. NAFED is releasing huge quantities of gram into the market. Due to downtrend in futures market and less demand from millers, gram prices in Delhi fell by Rs. 100-125/kg and settled at Rs. 5,050-5,100 per 100 Kg.

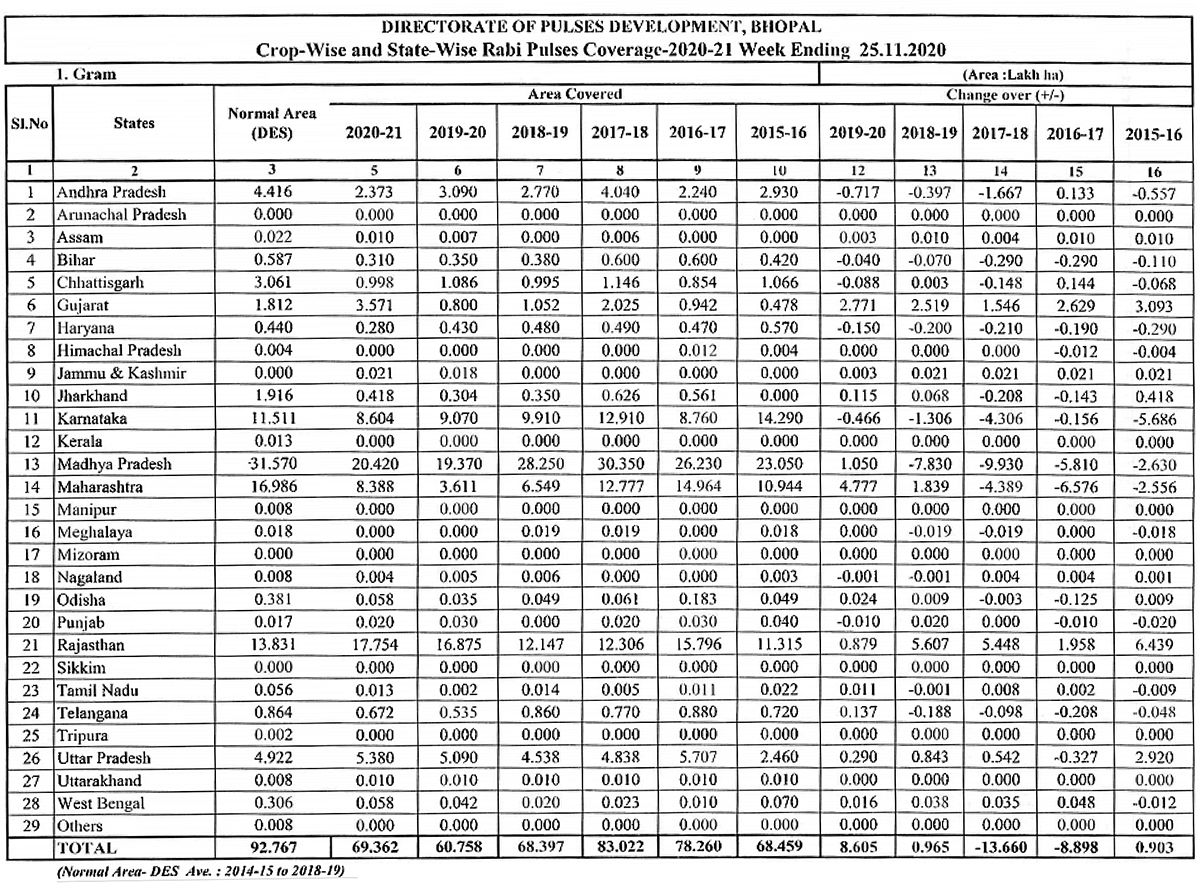

Gram sowing is in full swing. As of 27 November, the area seeded to gram reached 69.36 lakh hectares, compared to 60.76 lakh hectares at this time last year. Sowing increased by 8.6 lakh hectares. Crop condition is good and will be excellent if it rains one or two more times.

Mumbai port

After seeing a downtrend in Delhi market, Mumbai prices came under pressure and by the weekend fell by Rs. 50-100. Prices settled at Rs. 5,300 in Kolkata and Rs. 5,050/quintal in Mumbai. Stable demand is expected in the coming weeks.

Madhya Pradesh (top gram producer)

Arrivals in market yards declined in India’s top gram producing state. Demand is a major concern throughout India. Gram prices fell by R. 100-150 and traded at Rs. 5,000/100 Kg in Indore, Rs. 4,600-4,650 in Ashok Nagar, Rs. 4200-4600 in Ganjbasoda, Rs. 4,900-4,950 in Kanti and Rs. 4,000-4,400 in Pipariya.

Rajasthan (second biggest gram producer)

Over the weekend, gram was trading at Rs. 4,900-5,100/100 kg in Kishangarh, Rs. 4,500-4,650 in Sumerpur, Rs. 4,600-4,700 in Jodhpur and Rs. 5,100-5,125 in Jaipur. A price reduction of Rs. 50-100 was seen over the weekend.

Maharashtra (third biggest gram producer)

In Maharashtra’s local market yards, the demand was less then expected. As in other markets, gram prices also decreased in the major markets of Maharashtra. Gram traded at Rs. 4,800-5,400 in Solapur, Rs. 4,500-4,800 in Amravati, Rs. 4,600-4,700 in Latur, Rs. 4,900-4950 in Akola, Rs. 5,100-5,150 in Jalgaon and Rs. 4,950-5,100 in Nagpur. An overall downtrend of Rs. 100-150 was recorded over the weekend.

Others

In Dahod, chana prices fell by Rs. 175 and traded at Rs. 4,750-4,950/quintal. In Kanpur, chana prices slipped by Rs. 50 and product sold at Rs. 5,125/quintal. Prices in Karnataka and Gulbarga fell by Rs. 100 and gram was traded at Rs. 4,000-4,600/quintal. Prices also fell in all other major and minor markets.

Processed Gram. Chana Dall

The fall in raw gram prices impacted processed gram prices. Chana dall prices fell by Rs. 150-300 and product sold at Rs. 5,800-6,500/quintal.

Demand should improve in the future as the relaxation of lockdown measures should see hotels reopen and marriages and parties resume.

PMGKAY ended on 30 November. Under this scheme, 1 kg of gram per family was distributed, exhausting 2018 rabi season chana.

Chana Dal

The effect of decreased chana prices was seen in dal prices. Due to the lack of demand, chana dal prices fell by Rs. 150-250 to Rs. 6,000-7,000 per quintal.

Demand from gram flour plants is expected to increase.

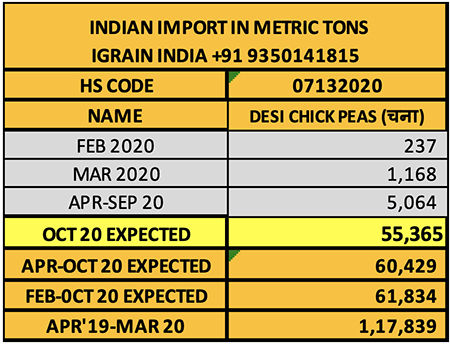

IMPORT OF CHANA (latest figures)

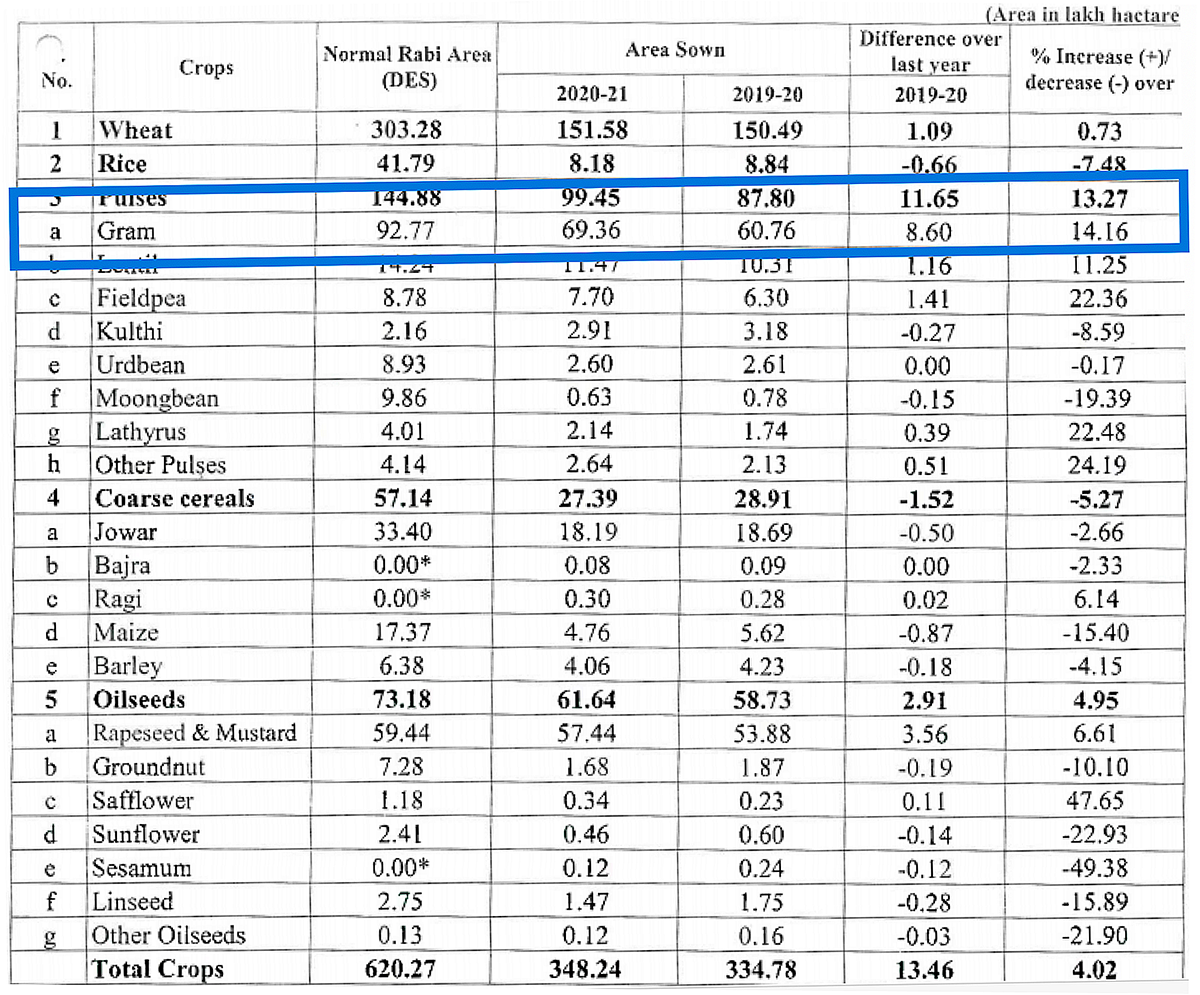

Rabi sowing progress reached 348 lakh hectares

Encouraged by the high market prices of various commodities and favorable weather conditions, Indian farmers are showing great interest in rabi crops this year. As a result, rabi sowing progress advanced to 348 lakh hectares, up from 335 lakh hectares at this time last year. The Union Agriculture Ministry reports sowing is progressing well and states are expected to hit their targets. Rabi sowing is progressing satisfactorily despite the COVID-19 outbreak.

Wheat sowing is nearly at the halfway point and there is good growth in the production area. Sowing increased from 15 million hectares last year to 152 lakh hectares.

The area under pulses increased by 11 lakh hectares or 13% and reached to 99 lakh hectares, up from 88 lakh hectares last year. The area sown to gram and lentils increased. High market prices are motivating farmers to expand the production area in other major pulse producing provinces, including Maharashtra, Gujarat, Madhya Pradesh and Uttar Pradesh. The government has also raised the minimum support price for pulses.

Winter rains are at near normal levels and nighttime temperatures have started declining. Crop condition is generally good and progressing satisfactorily. The strong pace of rabi sowing will continue in December.

Mixed trend on gram seen worldwide due to Australia’s production

This past week, the international gram market saw a mixed trend. In Australia, prices softened due to the vigorous harvesting of gram.

According to ABARES, gram production may reach 7.37 lakh tons. Currently, the demand for Australian gram in the Indian subcontinent is somewhat weak due to higher import taxes. Some importers from Bangladesh and Pakistan have received shipments but in limited quantities. Buyers from other countries, including Sri Lanka, have remained quiet, waiting for the increase in availability to soften prices. Australian producers and exporters are confident that the government of India will encourage gram imports by reducing the import duty on desi gram, like it did for lentils. But thus far the government of India has not given any indication that it will do so. India has a 60% import duty on gram and 40% on kabuli gram. India has been the biggest buyer of Australian gram but is now taking negligible quantities. In Canada, stocks of 9 mm or larger kabuli chana are running low; the limited supply of larger calibers has kept kabuli chana prices at high levels.

If the weather is favorable, India’s next gram crop should be excellent. The government cannot risk reducing the import duty on gram at this time, as it may adversely impact sowing. New crop gram arrivals usually come in March-April.

India’s pulse exports on the rise

Although India is the world's largest pulse producer, importer and consumer, it is not a major pulse exporter. But APEDA data indicates that during the first seven months of the current fiscal year (April-October), India’s pulse exports amounted to 1.82 lakh tonnes and generated revenue of Rs. 1,283 crore ($171 million). Over the same period last year, India’s pulse exports amounted to 1.33 lakh tonnes and generated revenues of Rs. 930 crore ($13.1 million). Earnings on pulse exports, therefore, are up 38% in rupee terms and 30.33% in dollar terms. The average offer price for pulses fell from $984 per tonne in 2019 to $940 per tonne in 2020. India exports conventional pulses to neighboring countries and organic pulses to America and Europe.

Sowing figures India

Abbreviations/ Hindi- English words

Tuar/ Arhar: Pigeon Peas

Mung: Green Mung

Urad: Black Matpe

Chana: Gram

Matar: Pea

Masur: Lentil

Mandi: Market yard

Bhav: Prices

Dal: Processed Pulses (Directly for human consumption)

Rs: Indian Rupees (1$=Rs 73-74)

Rahul Chauhan

Director, IGrain India

igrainind@gmail.com

+91 9350141815

Twitter igrain_india

India / chana / gram / Australia / Tanzania / rabi sowing / NAFED / PMGKY / New Delhi / Mumbai / Madhya Pradesh / Maharashtra

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.