30-40% drop in sales of pulses seeds in Maharashtra, one of the major producing states of pulses. Sales are also low in other states.

Excluding lentils, all pulse prices are lower than both new & old MSPs.

Monsoons are making slow progress; many states are waiting for rains to start sowing.

As of June 17, mungbeans had been sown in 0.19 million hectares, compared to 0.205 million hectares in the same period last year. Sowing of other pulses is also down due to the late arrival of monsoon rains and lower than average rainfall.

Mung import is restricted; pulse imports have increased significantly compared to last year.

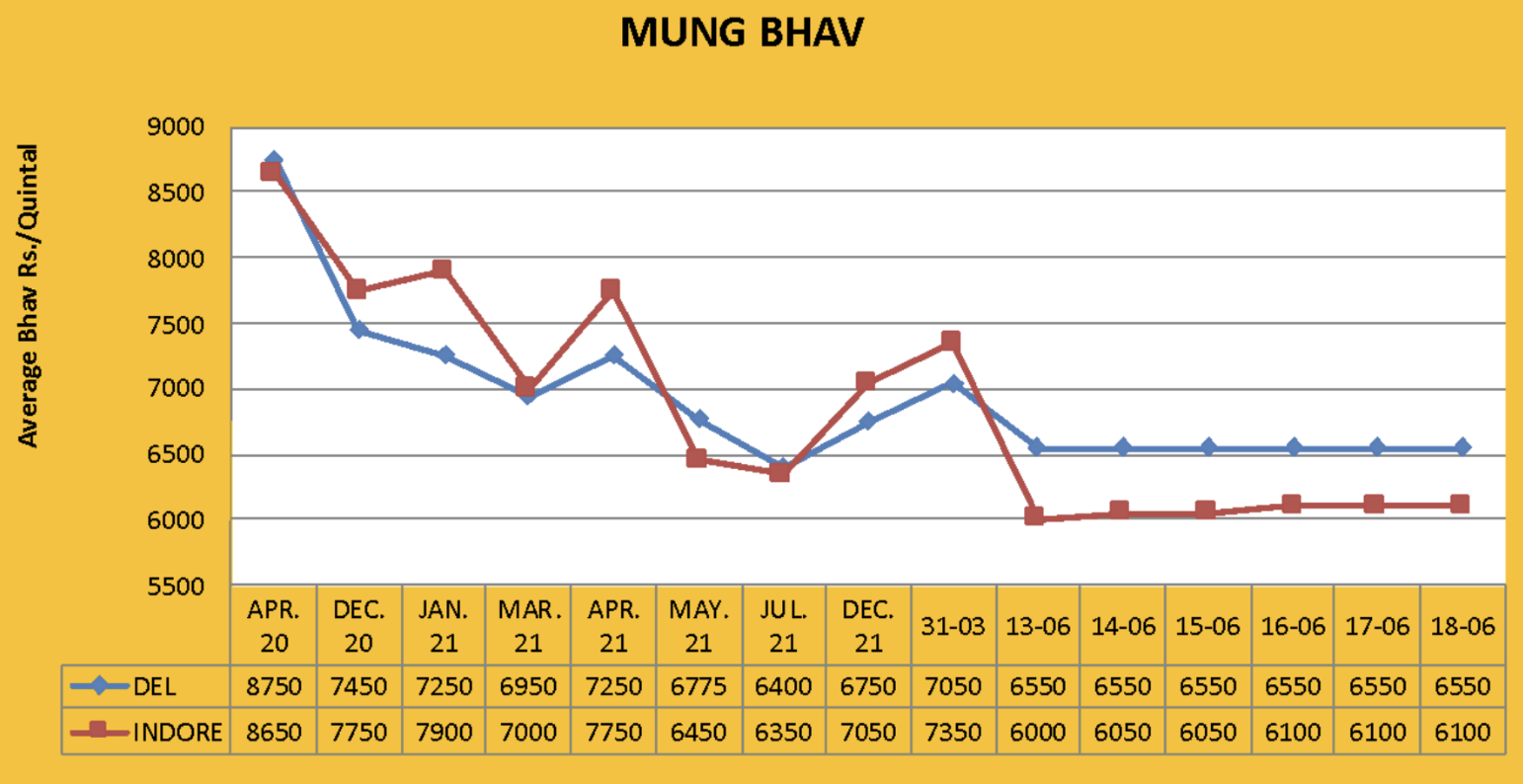

Mung prices fell last week due to increased profit-booking at higher prices compared to the week before. Due to weak demand across the board, prices in Delhi, Rajasthan and Madhya Pradesh fell by Rs. 200-300 and in Maharashtra they dropped by Rs. 100/200. Lalitpur prices also fell by Rs. 100 while Rajkot prices remained stable. No purchase movement was seen in mung dal and prices dropped by Rs. 200.

Punjab government beings mung bean procurement at MSP for the first time

Chandigarh. The Punjab Government has, for the first time in history, begun procurement of summer mung beans at the Minimum Support Price, which is Rs. 7,725. The Minister of the state appealed to farmers to increase mung bean production, promising to carry out procurement at the MSP and, as a result, the sown area of the pulse has doubled as compared to last year, from 50,000 to 100,000 acres. Production of around 50,000 tons is expected for the summer harvest.

Sowing of Kharif crops in Rajasthan and Gujrat is far behind last year

Jaipur. Due to lack of rains and high temperatures, sowing conditions for Kharif crops in Rajasthan has not been favorable, causing progress to fall behind that of last year. According to the State Agriculture Department, as of June 21 the sown area was estimated at 0.99 million hectares, a sharp decrease from the 1.383 million hectares sown in the same period last year.

The sown area of pulses crops has seriously decreased in both Rajasthan and Gujarat. In Rajasthan, the biggest producer of mung beans, the total area of pulses has dropped from 1.09 lakh hectares last year to just 0.81 lakh hectares this year, with the sown area of mung a mere 8,180 hectares compared to 1,46,570 hectares at the same time last year.

Pulses imports increased 9.44% to 2.7 million tons

New Delhi. Official data shows that pulse imports have increased by 9.44% since last year, from 2.466 million tons in 20/21 to 2.7 million tons in 21/22. There are two major reasons for this increase: first, India lost a significant amount of its domestic pulses crops due to crop damage caused by poor conditions and second, the government has removed two major pulses – tuar and urad - from the annual import quota system to the list of Open General License (OGL).

According to the Directorate General of Commercial Vigilance and Statistics (DGCIS), the import expenditure of pulses has also increased about 39% on last year. In 20/21, total import expenditure for pulses was Rs 11,937 crore or $ 1.61 billion, a figure which increased to Rs. 16,627 crore or $ 2.22 billion in 21/22.

According to trade analysts, since the free import of pulses (except mung) has been allowed to continue until March 2023, total imports in the current financial year (2022-23) are expected to reach 2.5-2.6 million tons. The main import destinations are Myanmar, Canada, Australia and African countries. The prices of pulses are now under control and most of them have come down below the minimum support price.

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.