April 26, 2021

With the harvest in the southernmost growing area set to begin in mere weeks, the GPC checks in on the status of the crop.

Bean field in Tucumán. Photo courtesy of Oscar Vizgarra.

As things stand at the moment, it appears that Argentina’s 2021 dry bean crop will be a marked improvement over last year’s harvest, when dry conditions and frost knocked down yields and resulted in small caliber sizes across all bean classes.

Sergio Raffaeli, former president and newly elected vice president of CLERA (Argentina’s Chamber of Pulses), reports that the crop was seeded in a timely manner with adequate soil moisture in most areas.

“In my opinion, the seeded area this year is not much different than last year, maybe 5-10% more. What may make a big difference is yields, provided weather conditions permit. Basically, we need rain during these days when the crop is flowering,” he says.

Since the seeding of the crop, normal weather conditions have prevailed and Raffaeli points out that, unlike last year, practically none of the crop had to be reseeded.

At the end of March, heavy rains did damage some bean crops in northern Salta Province, but this was a relatively small area. Oscar Vizgarra, coordinator of the dry legume project at the Obispo Colombres Agro-industrial Experimental Station in the province of Tucumán, heard no more than 10,000 hectares were affected.

In that same area, a grower interviewed for this article who wishes to remain anonymous expressed concern about high temperatures in February and in April that may affect productivity. For now, he anticipates normal yields, but cautions that the harvest there is more than a month away.

Besides the heat and tight soil moisture levels in the province of Santiago del Estero, the climate conditions have been generally favorable.

“It has been some time since I’ve seen bean plants develop this nicely,” says Vizgarra, who, in addition to visiting fields in the major growing areas, has also been receiving photographs from growers in the provinces of Chaco, Córdoba and Catamarca.

Below, we take a closer look at the planting of Argentina’s 2021 dry bean crop and where things stand as the combines gear up for harvest.

Argentina’s dry bean growing area has two distinct regions: the region north of the municipality of Rosario de la Frontera in the province of Salta and the region to the south. The northern region encompasses the provinces of Salta and Jujuy and is where most of Argentina’s alubia, colored and cranberry bean production occurs. The southern region, on the other hand, is predominantly black bean country.

Late last year, as growers defined their planting decisions, the low soybean prices of the previous harvest weighed on their minds and many viewed dry beans as an attractive alternative. There was especially strong interest in kidney beans and cranberry beans at the time, according to Vizgarra.

But interest in dry beans in general waned around December, when prices for soybeans and other major commodities surged upward. Consequently, not as many beans were planted as initial intentions indicated, explains the anonymous grower from the northern bean growing region.

“My sense is that maybe a few more beans were seeded this year compared to last year, but not much more,” he says. “And if more were seeded, it wasn’t white beans here in the north, but black beans in the south. Down there they also seeded more mung beans.”

Grower interest in black beans, Vizgarra elaborates, was spurred by news of production issues in Mexico and the U.S. He reports that producers in the southern growing region scrambled to find black bean seed through January.

Raffaeli adds that January also saw the government lift withholdings on several regional crops, beans among them, which helped improve their competitiveness against other crops.

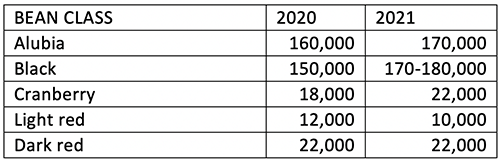

Overall, Vizgarra estimates at least 150,000 hectares were seeded to black beans this year, with some putting the area as high as 180,000 hectares. Over at CLERA, Raffaeli’s opinion is on the higher side; he estimates 170 – 180,000 hectares were seeded to black beans this year.

In terms of alubia beans, Raffaeli estimates 170,000 hectares were seeded to the white bean. Vizgarra describes grower interest in alubia beans as normal.

With respect to other bean classes, Vizgarra estimates 80-90,000 hectares were seeded to colored beans (mainly cranberry, light red kidney and dark red kidney beans) and 65-70,000 ha. to mung beans. Raffaeli estimates 22,000 ha. were seeded to cranberry beans and no more than 10,000 ha. were seeded to light red kidney beans; the dark red kidney bean area remained the same as last year (22,000 ha.). On mung beans, Raffaeli offers a more modest estimate of 40,000 ha.

Source: Sergio Raffaeli, CLERA

The country’s dry bean harvest begins in the southern region and progresses northward. In the south, it starts in earnest in May and could extend into late June. In the north, it mainly takes place during the months of June and July.

Vizgarra reports that growers in Córdoba have already started combining their bean crops. As the harvest advances, his focus is on disease issues.

“There have not been many disease issues so far,” he says. “But we are seeing a moderate incidence of golden and dwarf mosaic virus.”

The high temperatures that set in after planting created conditions for bacteriosis, but none materialized.

“What we are seeing in about the past two weeks is angular leaf spotting,” Vizgarra continues. “We are seeing it in Rosario de la Frontera, south of Tucumán and in parts of Catamarca. We are also seeing focalized cases of white mold that could become a problem if we get too much rain.”

More rain is needed, however, to ensure at least average yields. In the northern region, 20-30 mm of additional precipitation is needed over the next 40-50 days to make the crop, according to Raffaeli. Rains during the coming days are extremely important to improve yields over last year.

“The weather is a big factor,” says the anonymous grower from the northern region. “We need rain, but not too much. That and early frost are my major concerns.”

A lot can happen between now and the end of harvest, cautions Raffaeli. With that being said, if very good conditions prevail, he anticipates the overall average bean crop yield to come in at 1,300-1,400 kg/ha. In the northern growing region, the anonymous grower indicates that in his area alubia beans normally yield 1,200 – 1,300 kg/ha., colored beans around 1,300 kg/ha and black beans a bit more than 1,500 kg/ha. Over in Tucumán, where 25,000 ha. were seeded to beans (70% to black beans and 30% to colored beans), Vizgarra expects the average yield to end up around 1,500 kg/ha. and some lots to see yields in excess of 2,000 kg/ha.

In terms of carry-in, only 20,000 MT of alubia beans remained as of March and those inventories are expected to clear out before the new crop arrives. According to a CLERA report last year, the 2020 alubia bean crop amounted to 176,000 MT. From the start of Argentina’s MY 2020-21 in July through March 2021, alubia bean exports have amounted to 145,000 MT. Raffaeli expects exports will amount to around 165,000 MT by the end of the marketing year in June.

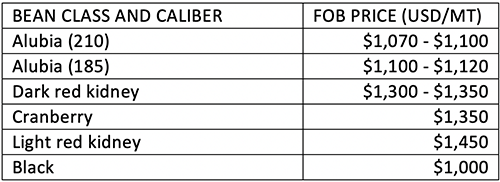

“Right now we are seeing a rush to sell white beans that has caused future contract prices to drop,” he says. “In my opinion, this is due to speculation and an incorrect reading of the market. In a normal year, Argentina produces 200,000 MT of alubia beans. After accounting for disappearance, seed and waste, that leaves an export availability of 162,000 MT. In 2019-20, we exported 200,000 MT, comprised of 190,000 MT of production and 10,000 MT of carry-in. That crop sold at a good price, so I think this rush to sell is misguided.”

On colored beans, because growers retain a greater percentage of the harvest for next season’s seed, Raffaeli anticipates production with roughly equal hectares seeded.

“Colored beans are selling well,” he reports. “In my opinion, cranberry, light red and dark red kidney beans have been oversold considering yields are not locked in yet.”

On black beans, Raffaeli sees a very positive outlook.

“We are expecting a good start with strong demand from Brazil, which is having production problems, and we are working to open up an import quota with Mexico. Overall there is good demand for black beans globally and with China’s withdrawal from the market, we have a good opportunity to have a very busy year at very good prices.”

Source: Sergio Raffaeli, CLERA

Argentina / Oscar Vizgarra / Sergio Raffaeli / CLERA / alubia beans / colored beans / cranberry beans / light red kidney beans / dark red kidney beans / black beans / mung beans

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.