November 28, 2022

AgPulse Analytica’s Gaurav Jain maps China’s journey to becoming the world’s biggest importer of peas and looks ahead to how the country can sustain its incredible growth.

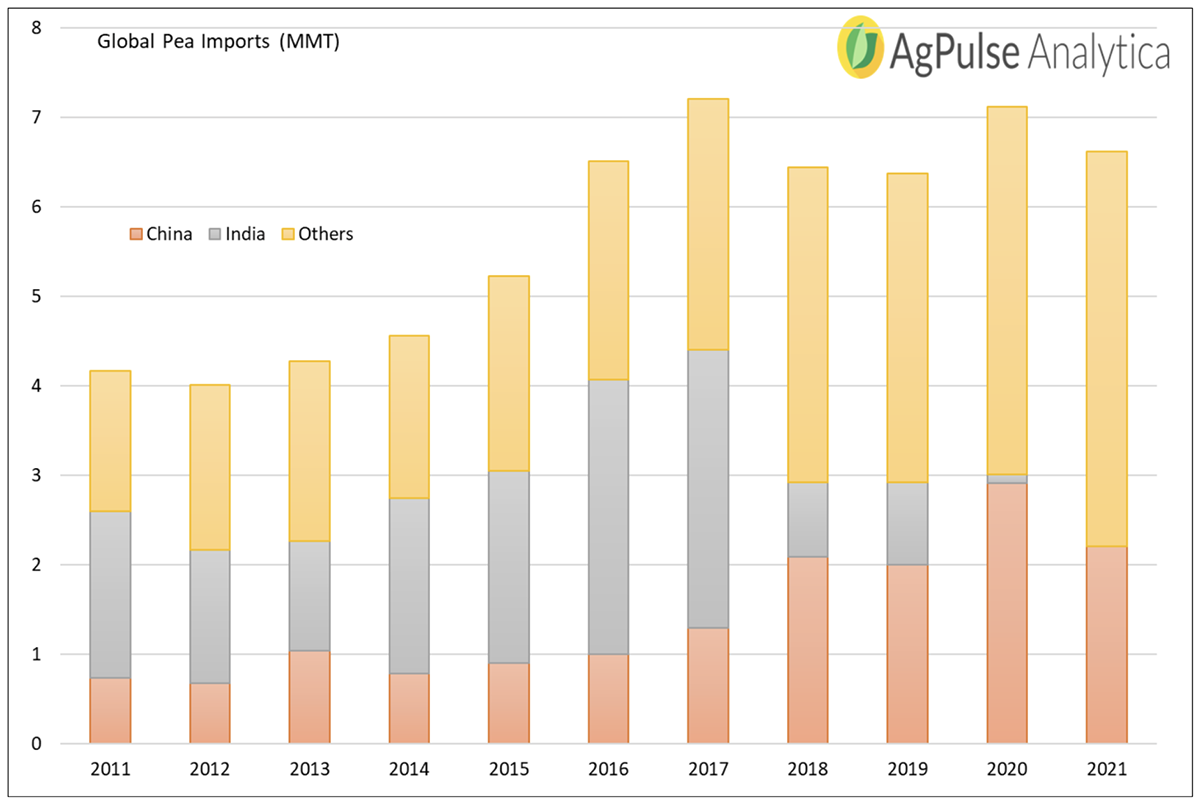

Over the past few years, China has emerged as the world’s top pea importer, a position that has become more dominant since India restricted pea imports in late 2017.

China’s market share in global trade increased from 15% in 2016 to 40% in 2020.

Image: AgPulse Analytica

In China, peas have seen increased usage across animal feed, pet food, snacks and in the fast-growing fractionation industry along the Eastern coastline. Over just four years, the import volume in absolute terms increased from less than a million tons to nearly three million.

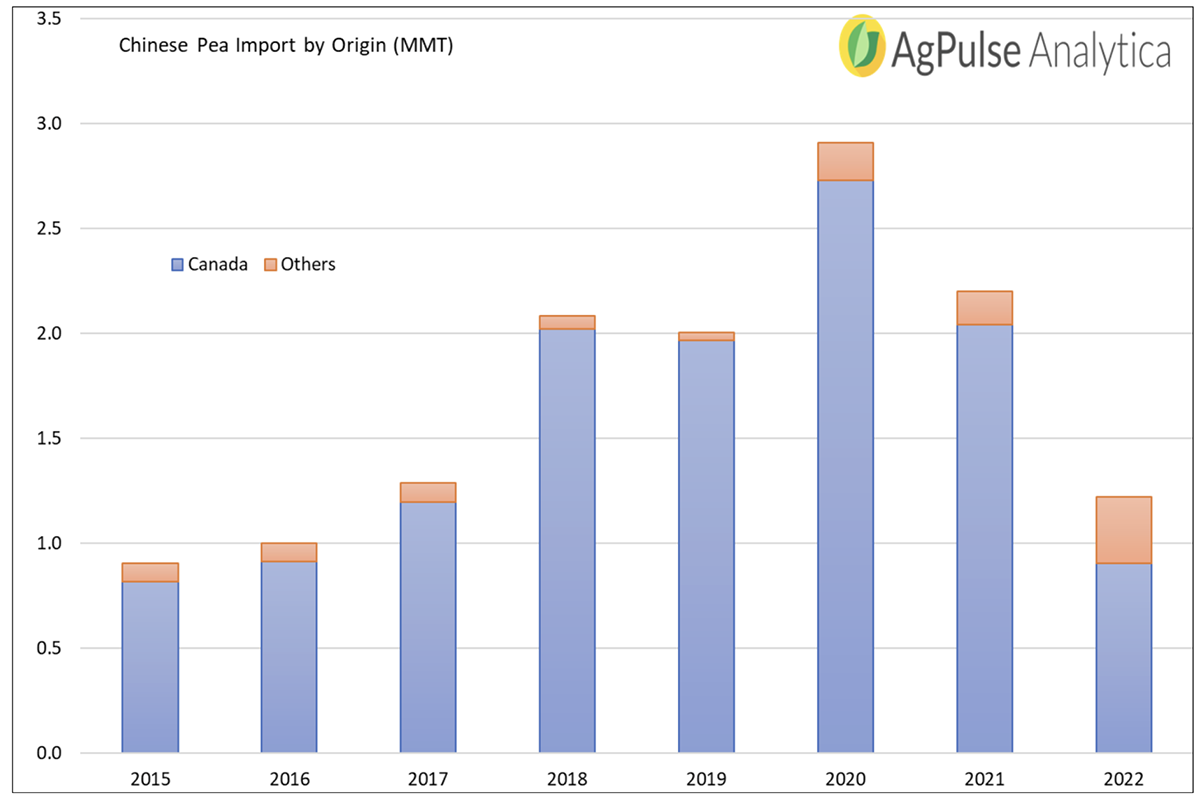

When it comes to peas, China’s main trade partner has historically been Canada - so much so that in 2019, the Canadian share in Chinese pea imports was 98.3%.

Image: AgPulse Analytica

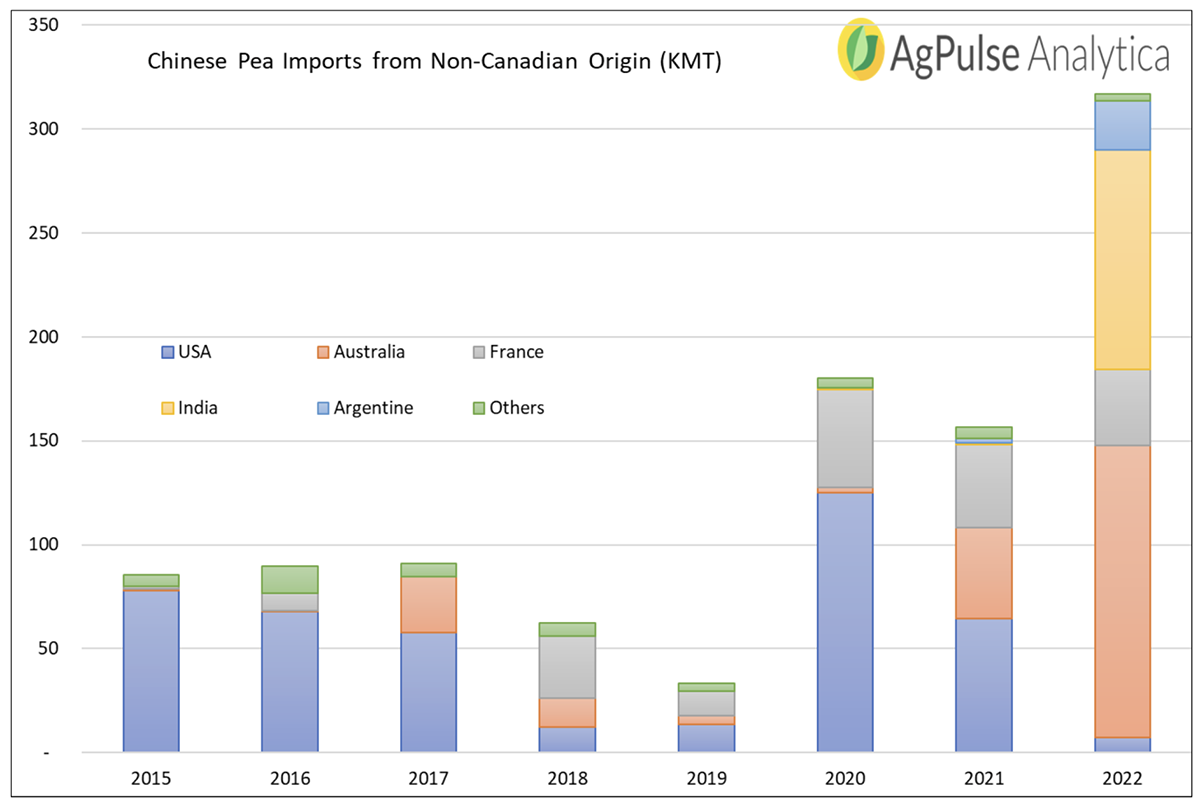

In 2021, a historic drought crippled Canadian agriculture and Chinese pea intake took a severe hit. Last year, the total imports dropped to 2.2 MMT from 2.91 MMT in 2020. The Chinese importers scoured other pea producing countries, importing relatively large quantities from Australia and France. In the first half of this year, imports from Australia increased further due to the easier availability of containers and China also imported some peas from Argentina as well as importing some old Canadian cargoes that had been stuck at Indian ports for years.

Image: AgPulse Analytica

In the marketing year 2022/23, Canadian production seems to have recovered from the drought and is back to normal. StatCan puts pea production at 3.59 MMT, up from 2.26 MMT last year but still 1 MMT below the 20/21 figure of 4.59 MMT. With carry-in depleted, the exportable surplus for the current marketing year will be 2.5 MMT, nearly 1.1 MMT lower than in 20/21.

At AgPulse Analytica, we assume that, out of 2.5 MMT of total Canadian pea exports, China will be able to get nearly 2 MMT, which will not be sufficient for its domestic consumption.

Looking to the future, lower availability from Canada will pose a threat to the growth of the Chinese pea industry and the search for other import origins will continue.

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.