March 9, 2022

Gaurav Jain of AG Pulse Analytica shares his insight into the effect of the Russian invasion of Ukraine on the global pulse market.

It is impossible for us to look at the war with a thought on markets only. With many friends in the region and human lives at stake, our thoughts and prayers are with the Ukrainian people. The situation remains fragile and is developing at a rapid pace. We sincerely hope that the situation is soon neutralized.

With movement in and out of the region severely restricted, the commodities market has consequently been impacted.

A large chunk of exportable surplus pulses from both countries has already been shipped for the year, while the remaining amount is unlikely to come to docks anytime soon. A sharply depreciated rouble and the cut from SWIFT will make farmers hold their produce in the short to medium term.

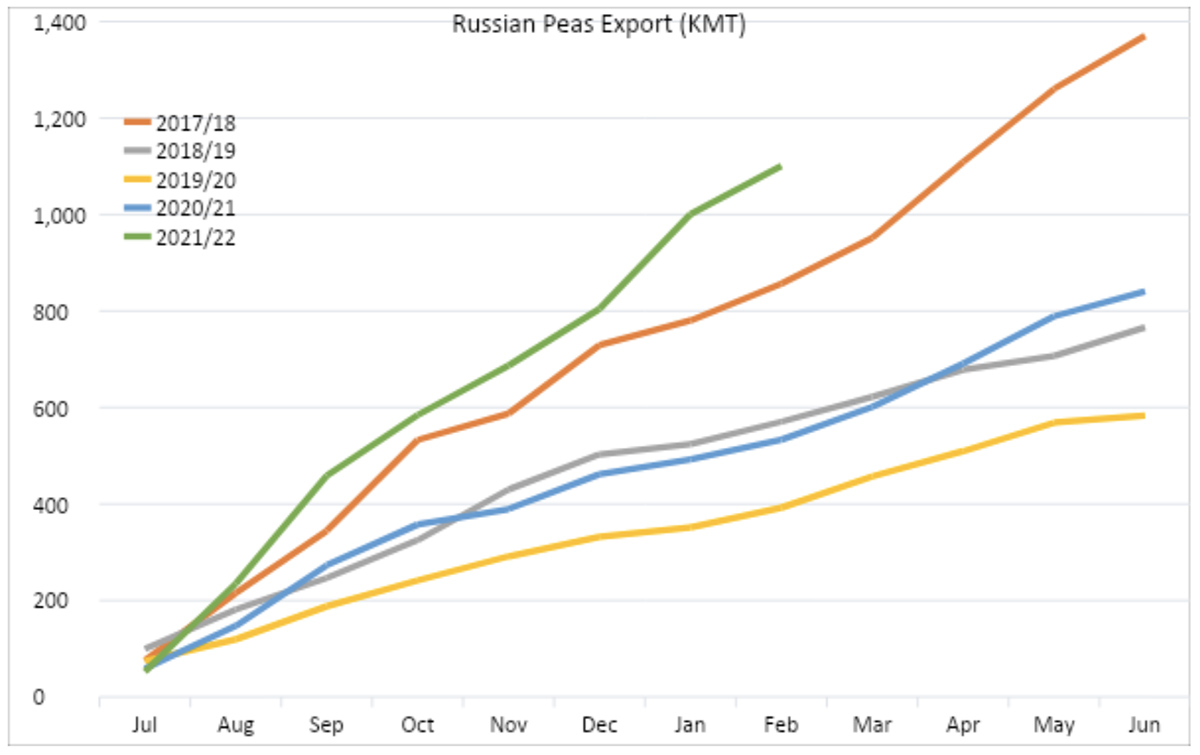

As per the latest available information, Russian pea exports exceeded 1.1 million MT while chickpeas are close to 200 thousand MT. Comparatively, only 390 thousand MT of peas and less than 190 thousand MT of chickpeas were shipped until February of the last marketing year (July-June).

We estimate that nearly 150 thousand MT of peas are waiting to be exported from Russia and negligible quantities of chickpeas.

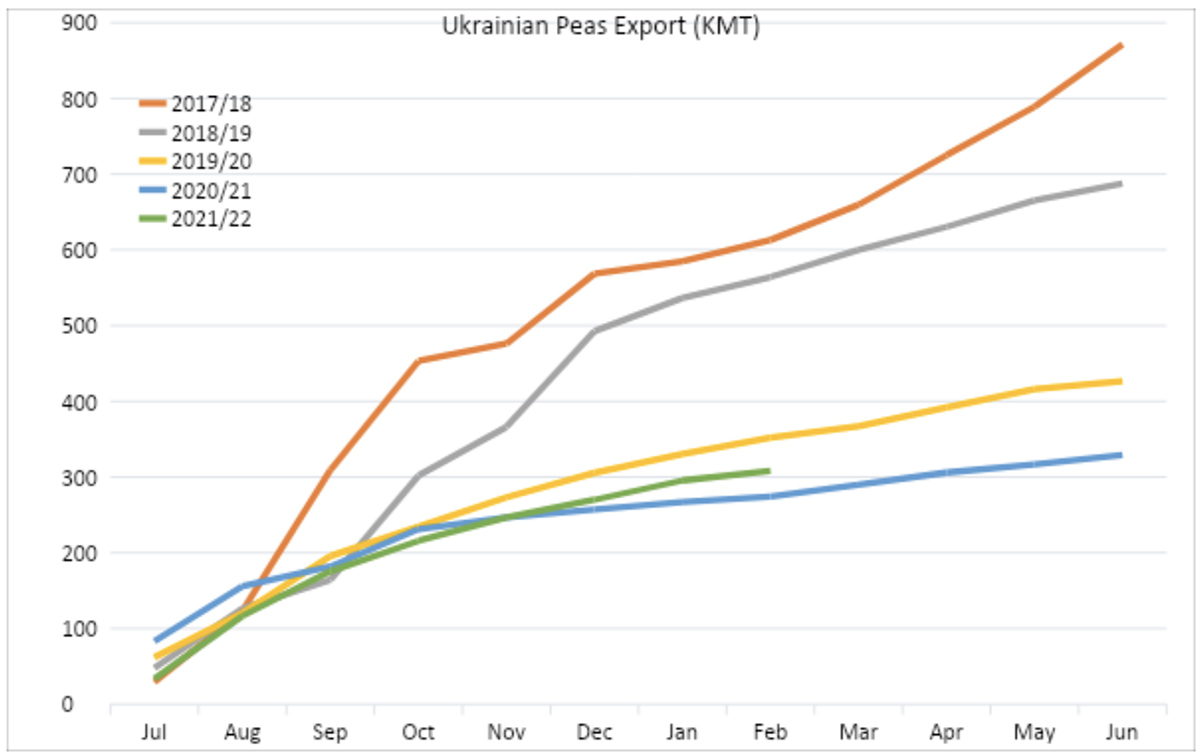

Nearly 310 thousand MT of Ukrainian peas has been exported for the current marketing year, out of an exportable surplus of 410 thousand MT. In the first eight months of the last marketing year, the country exported 274 thousand MT of peas.

The country restricted exports of lentils, beans and olive oil to stem domestic inflation in light of a high probability of shortages in the coming weeks.

To fulfil its domestic requirements, Türkiye is likely to increase its pulse imports from Canada in the short term. Though the Canadian and/or Australian cargo will not be reaching Turkish shores for Ramadan, we still expect Turkish importers to start calling Canadian traders soon, if they are not already active.

Pulse importers in Pakistan are likely to approach Myanmar and Sudan for their kabuli chickpea requirements and may substitute imported pea demand with their domestic desi chickpea crop instead of buying from Canada or elsewhere.

Italy was the largest buyer of peas from Russia and Ukraine combined in the marketing year 20/21 and is among the top three destinations in the current year, too. The domestic industry will notice the shortage as it doesn’t have many alternatives to Russian/Ukrainian peas.

Spain, which has emerged as a large pea importer in recent years, will similarly suffer a shortage due to reduced Russian and Ukrainian exports. From July to date, the country has imported less than 100 thousand MT of peas, compared to 172 thousand MT in the marketing year 2020/21 (July-June) and 187 thousand MT in 2019/20.

This is a crucial time for crops in Ukraine, with winter crops getting essential nutrition and the beginning of early planting for spring crops. However, at a time when farmers should be in the fields, they are either fighting, fleeing the country or sheltering from attacks.

Last year, Ukrainian farmers started spring planting in the last week of March and most of the peas were in the ground by the end of April.

This year’s Ukrainian crops will definitely suffer from yield losses and, the longer the conflict lasts, the worse it will become.

With the drought in North America in 2021, pulse supplies are already tight and the situation in Ukraine will only stretch limited supplies further. While it’s possible that the ever-increasing value-added sector will be ready to pay a higher price, the larger orthodox user base will have to ration demand in 2022.

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.