July 12, 2022

The last few years have seen big changes in the Mexican bean market with Covid-19 consequences, the threat of drought and fluctuating demand. Luke Wilkinson gives an update on the market as it stands.

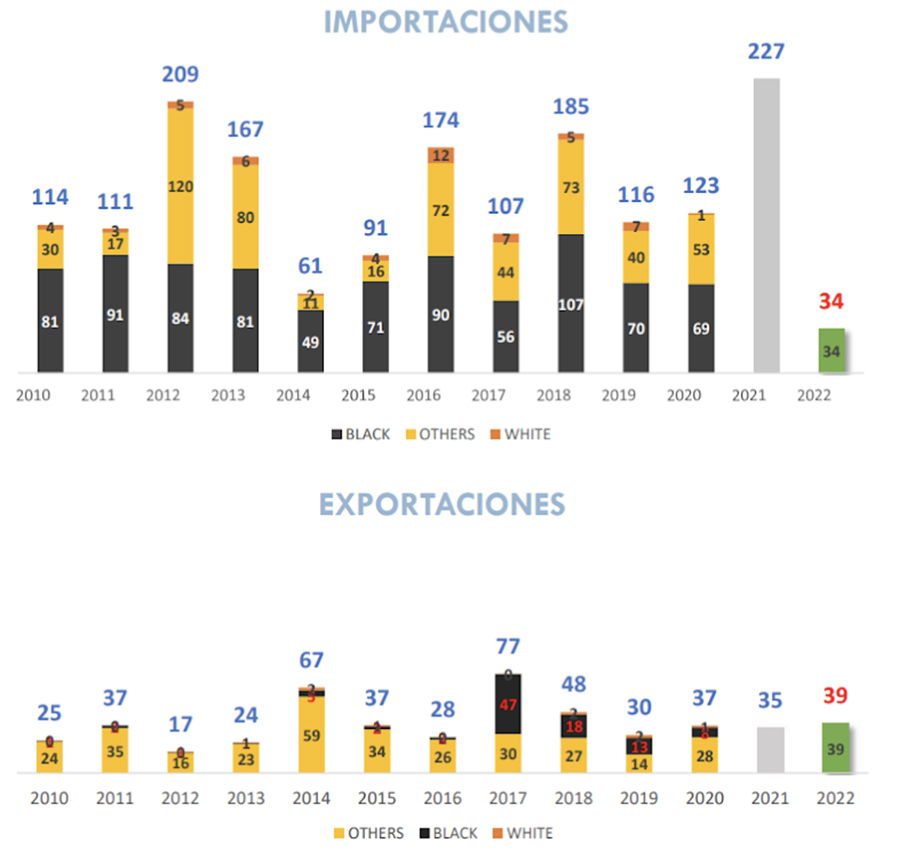

One of the immediate effects of the pandemic on the Mexican bean market in 2020/21 was a radical increase in imports, due to both the government waiving import duty for a longer period than usual and lower domestic production. Imports shot up to 226,538 tons, compared to 123,303 tons in 2019/20 - a rise of 84%. As of April of this commercial year 2021/22, imports had dropped back down by 78.2% compared to the same time the previous year.

It's fair to say that a post-pandemic decrease in bean imports was expected, however, what has been an interesting development in 2021/2022 is the increase in beans exported from Mexico. Production in 2021 grew by more than 11% compared to the previous year, which meant more availability for both national consumption and exports. This has no doubt played a big part in the growth of exports, which as of April had already reached 38,731 tons - a 68% rise from the year before.

An upswing in production is not the only reason for this growth in exports, as Felipe Sandoval, CEO of BeGrait International explains:

“Exports from Mexico have risen a lot due to a combination of elevated production in Mexico, and prices in other origins of beans being higher than usual. Normally this is the other way around and the other bean producers like the United States and Argentina have lower prices.

“This year," Felipe continues, “the roles have been reversed and a window has opened for the export of Mexican beans. To add to that, there has been a scarcity of beans in certain countries whose import duty has been reduced, or even canceled in some cases."

But how did Mexican prices become so competitive compared to those of the neighboring producers?

The US 2021 bean crop was affected by drought, leading to a price hike for US beans. This, says Cristobal Lopez of Comercializadora de Granos Los Arbolitos, was the root of Mexico's window for higher exports. “Their smaller harvest meant they needed to ask for higher prices, creating an opening for Mexico to export to the United States and other parts of the world. Our company exported to the US, Costa Rica and Panama – pinto and black beans."

The question of whether these reinvigorated exports will continue on their upwards trajectory is less clear, suggests Felipe Sandoval, “I wouldn't say that this will be a regular trend, or that from here on Mexican bean exports will keep growing. It’s still very early to predict how the prices will behave in the next cycle, and once we know more about that, it will give us an idea of how exports might behave.”

Sandoval is optimistic about Mexican production in the next cycle, saying, “I think it will be a good production in all varieties of beans, and production will be sufficient to meet consumption. We could also have a carryover that will allow us to begin the cycle after this one with an inventory of pinto, yellow, black and other varieties of beans."

As always, levels of production will rely on a variety of factors that are rarely in the control of farmers. Weather and rising costs in farming inputs due to inflation have been causing havoc internationally, putting pressure on producers and pushing up prices on all kinds of commodities. One can only wonder if this will have a significant effect on the coming Mexican bean crop.

That remains to be seen, suggests Cristobal Lopez, “Everything that has been harvested so far in 2022 has only come from Sinaloa, while Zacatecas, Durango and Nayarit are yet to be seeded. It's too early to say how those harvests will end up, as they will depend on the rain, fertilizer costs, diesel, and the moods of the producers.”

Some varieties of beans may also suffer a drop in production due to lack of interest from farmers in seeding them, says Lopez, “I’ve seen a lot less interest in Peruvian beans from producers, and states that harvest other varieties seem to be more enthusiastic about seeding.”

In May of this year, the Mexican government also waived the import duty on staple foods in order to offer its citizens relief from persistent inflation. The impact this will have on the import/export panorama will play out over the coming months but it seems possible that low cost staples such as beans could prove to be one of Mexico’s more convenient, cost-effective foods in the context of continued inflationary pressure.

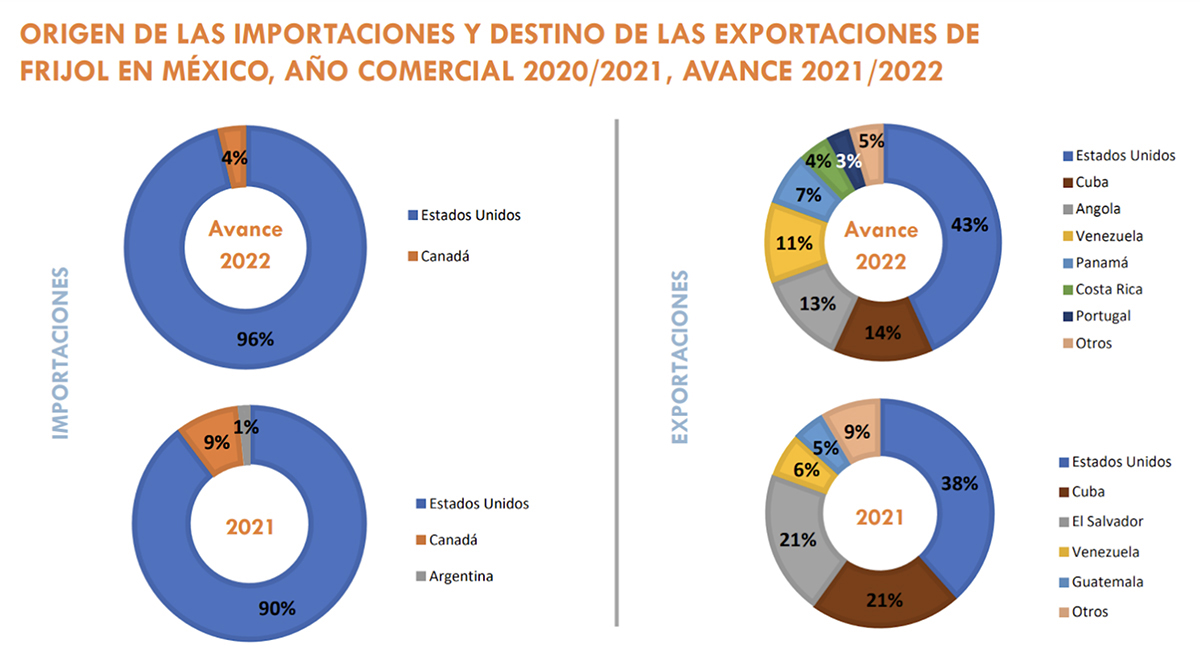

Import origins and export destinations for Mexican beans, FY 20/21, Advance 21/22

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.