September 6, 2021

Ahead of Ramadan, Gaurav Jain gives an update on the Australian Desi chickpea crop and subsequent pricing, supply and demand scenarios.

The main producers of desi chickpeas are India, Australia, Pakistan, Ethiopia, Tanzania and Myanmar. In Ethiopia domestic consumption is high, leaving only small quantities for export. Tanzania and Myanmar also export small quantities globally. India and Pakistan, despite their large crop size, are big importers of desis, leaving Australia as the major world supplier. In India and Pakistan, desi planting starts in October/November and the harvest is in March/April whereas in Australia planting starts in June/July and harvest is in October/November. The new Australian crop, therefore, typically fulfils the Indian and Pakistani demand before their own respective harvests.

After two bad years, Australia had a normal year in 2020/21 and exports out of the world's largest exporter of desi chickpeas have totalled 781 KMT in the first nine months, more than the combined total volume of the past two marketing years.

The Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) will release the next crop report on September 7. In its last report, the agency reported a number of 733 KMT, yet exports have already surpassed 781 KMT and are still going strong. For the marketing year 2020/21, we expect the agency to report a crop of 900 KMT.

Australia's chickpea growing regions have received good rains this year and yields for the chickpea crop is expected to be better than last year. We expect the 2021/22 crop to be more than one million tonnes.

Demand pull has typically been a bigger determining factor than the supply push when it comes to prices for Australian desi chickpeas. For example, the price rally of 2016/17 was led by large orders from India and Pakistan and likewise this year it was Pakistani importers demanding big numbers from farmers, whereas in 2019/20 a small Aussie crop failed to boost prices.

Interestingly, demand for the Holy month of Ramadan has also played a vital role in trade seasonality for the past few years.

Gregorian dates (±2) for Holy month of Ramadan are:

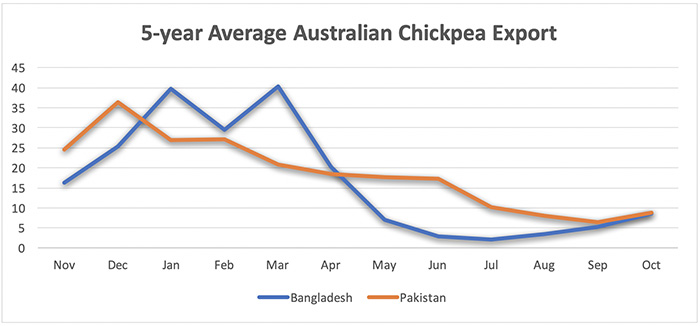

In many Islamic countries, domestic food demand peaks during the month, including the UAE, Pakistan and Bangladesh. Importers tend to procure a large portion of their annual requirements before the start of Ramadan to make the final product available on retailers' shelves during the month. Bangladesh is a perfect example of this and has imported on average over 60% of its annual demand in the three months leading to Ramadan in the past six years.

Bangladesh is likely to import more in the October-September period than in April-September this year, in line with the trend of procuring bulk of its requirements ahead of Ramadan, which will start earlier this year than in the past few years.

Pakistan, owing to its large domestic crop, managed to buck the Ramadan trend in the past few years, however, 2021/22 will be different. Out of the total consumption of 700 KMT, nearly 200 KMT is considered Ramadan demand. The Holy month is expected to start on April 3, 2022 and, as it will be difficult for the local harvest to reach retail shelves by that time, consumption will be filled by imports this year. Irrespective of domestic crop size, importers will be incentivized to front load their purchases, shipping the cargo between January and March.

As per the estimates, Pakistan's 2021 crop was only half the normal size, prompting higher demand, and Australia, on the back of a good crop, filled the void.

Due to low production in 2020/21, the carryover will also remain dependent upon Q3 and Q4 imports in the country. The last of the Australian crop year will keep Q3 import volumes low, and Pakistani millers will be ready to get their new crop shipped as soon as it is available in Q4.

Indian import policy remains the dark horse in the global chickpea market. If and when the government eases its import restrictions on desis, it will create a price storm internationally.

New crop values for Australian chickpeas are to remain high, with South Asian importers booking their cargoes and keeping the flow going during Q3’2021 and Q1’2022.

Low availability and high shipping costs are impeding factors, which the Australian exporters will have to deal with and from which we see no respite in the near future!

About Gaurav Jain

After leading research desk in both Physical and derivative Agricultural Commodities market for over 13 years, Gaurav Jain decided to start his own venture AgPulse Analytica in 2020. Through AgPulse, he is focused to provide a global perspective to the fragmented but fast-growing Pulses market. At present, coverage includes kabuli and desi varieties of chickpeas, lentils, and field peas. Mr. Jain can be reached at gaurav@agpulse.net or http://agpulse.net.

Chickpea / desi chickpea / India / Australia / Pakistan / Ethiopia / Tanzania / Myanmar / Bangladesh

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.