December 12, 2023

Norway’s imports of faba beans have been on the rise for the last five years, according to Pulse Atlas data. Looking at the numbers and talking to experts, we explore the story behind the increase.

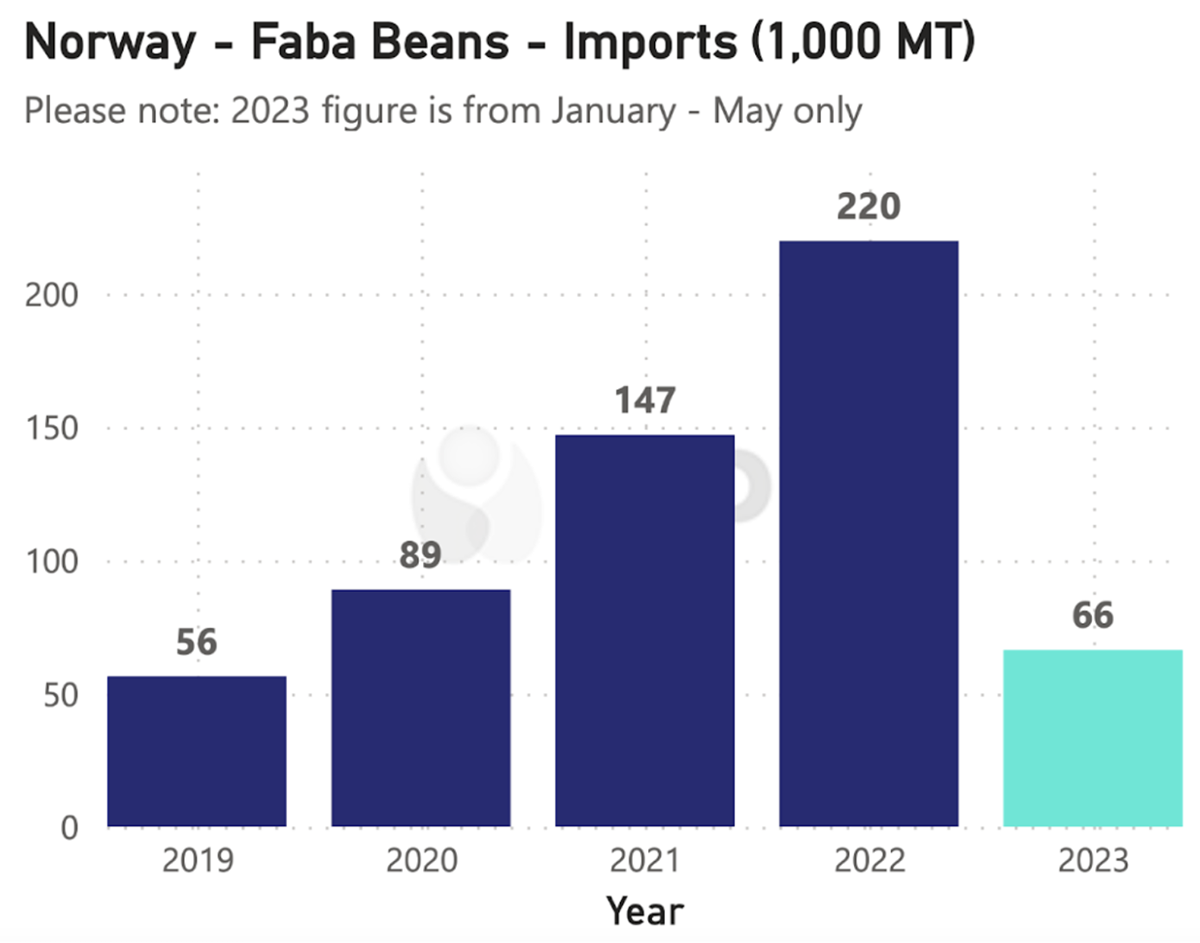

Norway Faba Bean Imports 2019-2023

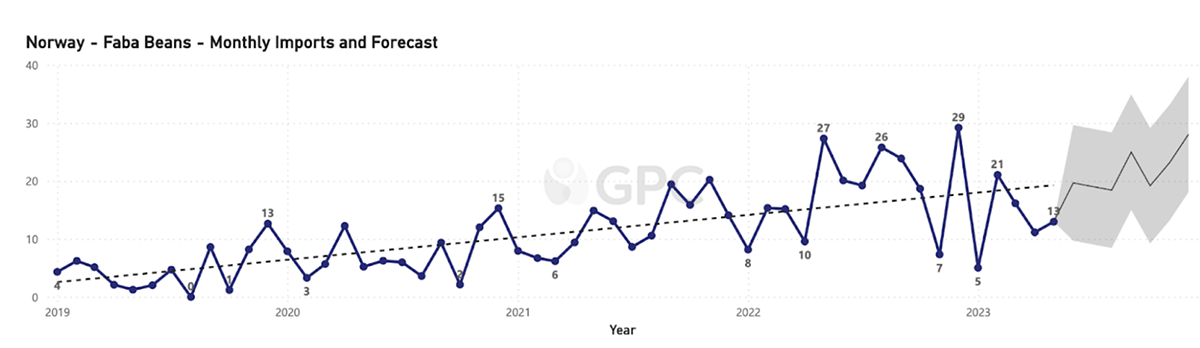

Norway Faba Bean Monthly Imports and Forecast

Exclusive Pulse Atlas Data shows a steadily increasing trend in Norway’s faba bean imports in the last five year. Jumping from just 56 thousand MT in 2019 to 220 thousand in 2022, the trend seems to be continuing into 2023, with import volumes for the first six months sitting at 66 thousand MT and expected to continue rising.

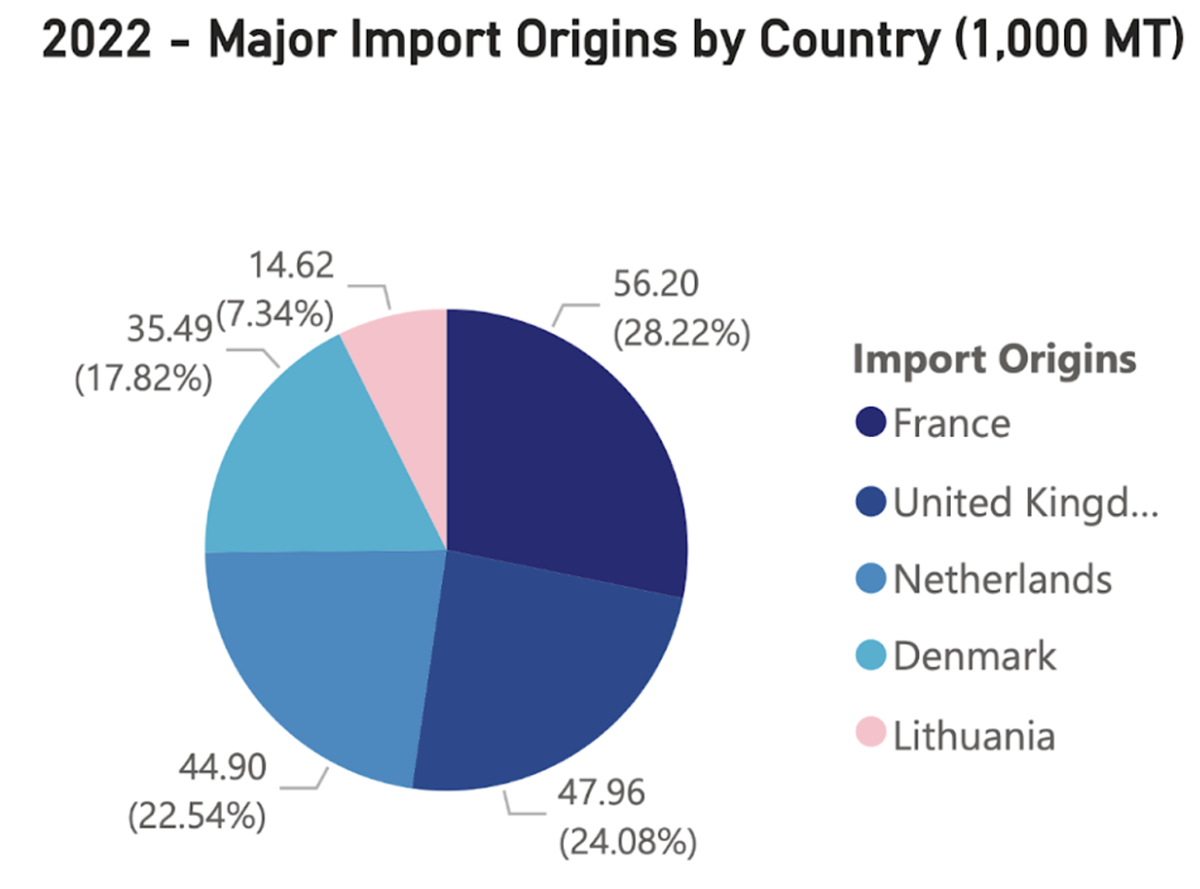

Norway faba bean import origins by country 2022

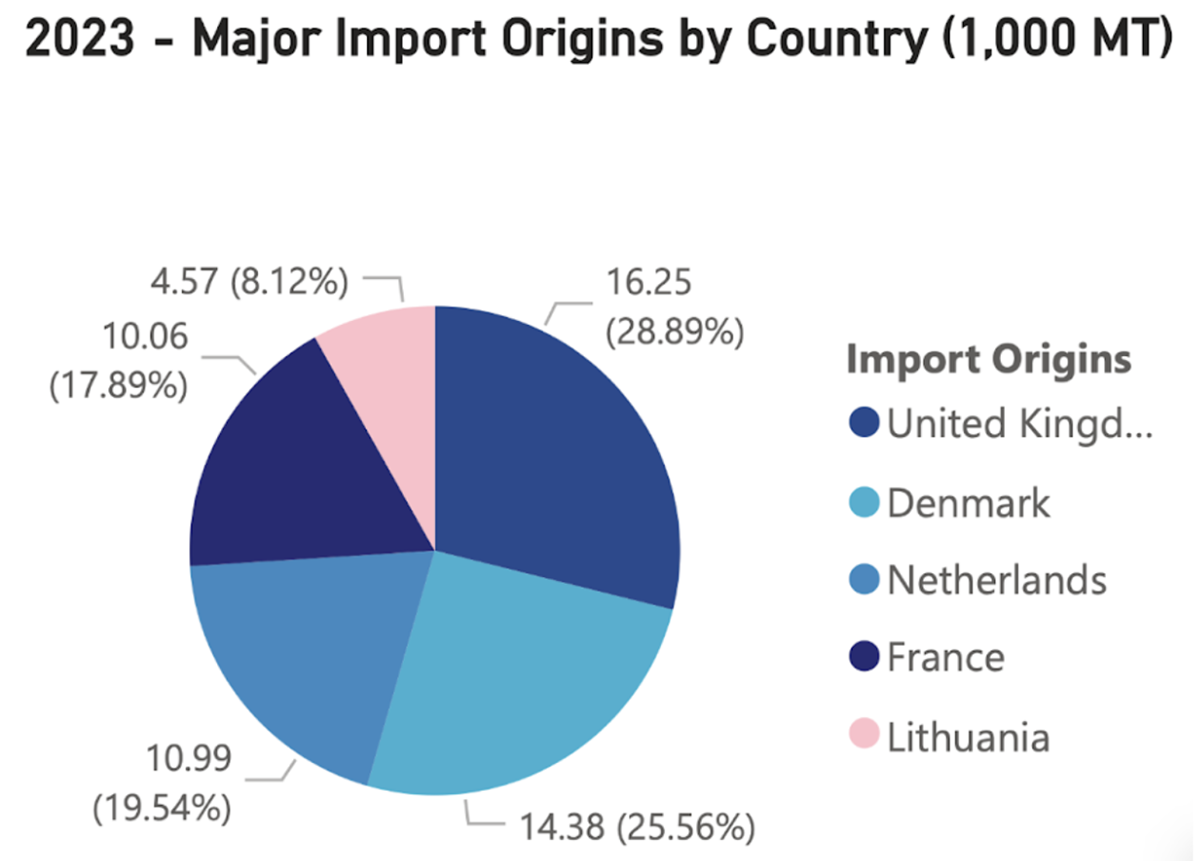

Norway faba bean import origins by country 2023

Andy Bury, Pulse Manager, Frontier Ag

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.