January 14, 2022

On Friday January 7, 2022, the OATA Myanmar hosted a Tuar & Urad Webinar, hosted by Mr. Vatsal Lilani and featuring panelists from both Myanmar and India.

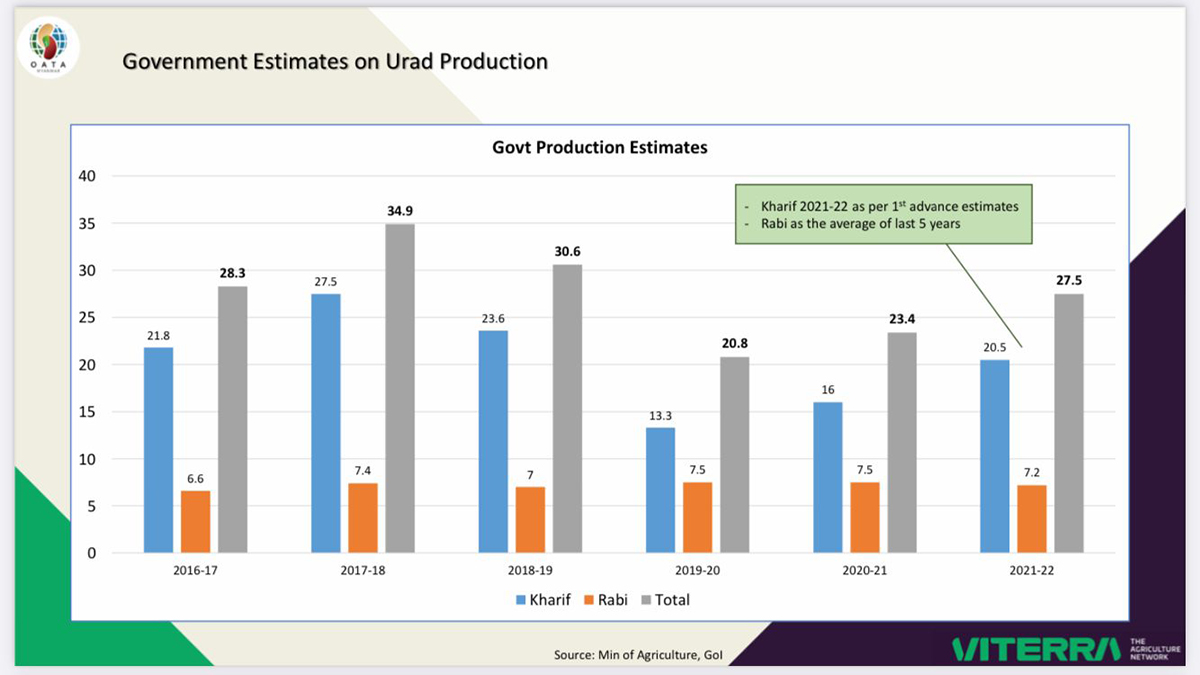

Mrs. Nidhi Khare of the Government of India gave the keynote address, highlighting Myanmar’s importance in the tuar and urad markets on the global stage. She indicated that India’s urad production in the FY 19/20 was 20.8 lakh MT, and 23.4 lakh MT in 20/21 and that imports in 19/20 were 3.12 lakh MT and 3.35 lakh MT in 20/21. The ARP in 20/21 was Rs. 104.49/kg and Rs. 107.74/kg in 21/22. At these prices, annual consumption of urad is about 27-28 lakh MT.

Moving onto tuar, Mrs. Khare indicated that production in 19/20 was 28.9 lakh MT and 20/21 was 32.8 lakh MT, imports in 19/20 were 4.5 lakh MT and 4.4 lakh MT in 20/21. The ARP in 20/21 was Rs. 99.57/kg and Rs. 105/81/kg in 21/22. At these prices, annual consumption as per trade estimates was 43.25 lakh MT.

Khare emphasised that Myanmar is an important source of India’s urad imports, making up about 69% of total imports over the past few years. For tuar, imports from Myanmar into India made up 32% of the total in 19/20 and 28% in 20/21. She also touched on the MoU signed between India and Myanmar and highlighted how beneficial this is for both countries.

As a result of policy changes, Khare indicated that the urad sowing area has increased and good production is expected in the next harvest, around 6-7 lakh MT. She is hopeful that the gap between supply and demand will be bridged and prices will be softened for citizens, underlining that pulses are the only source of good protein in the diets of many of the country’s large population.

Dr. N P Singh then gave an address about R&D in pulses, mentioning they are working on having more resilient crops to resist extreme weather conditions in india. Panelists discussed natural farming, which is set to be big in India and whether pesticide-free farming would yield enough to meet the huge demand.

Next, there was an Urad Panel Discussion with Mr. Hitesh Jain, Secretary of the OATA Myanmar and Mr. Lalit Pant, a trader at Viterra India.

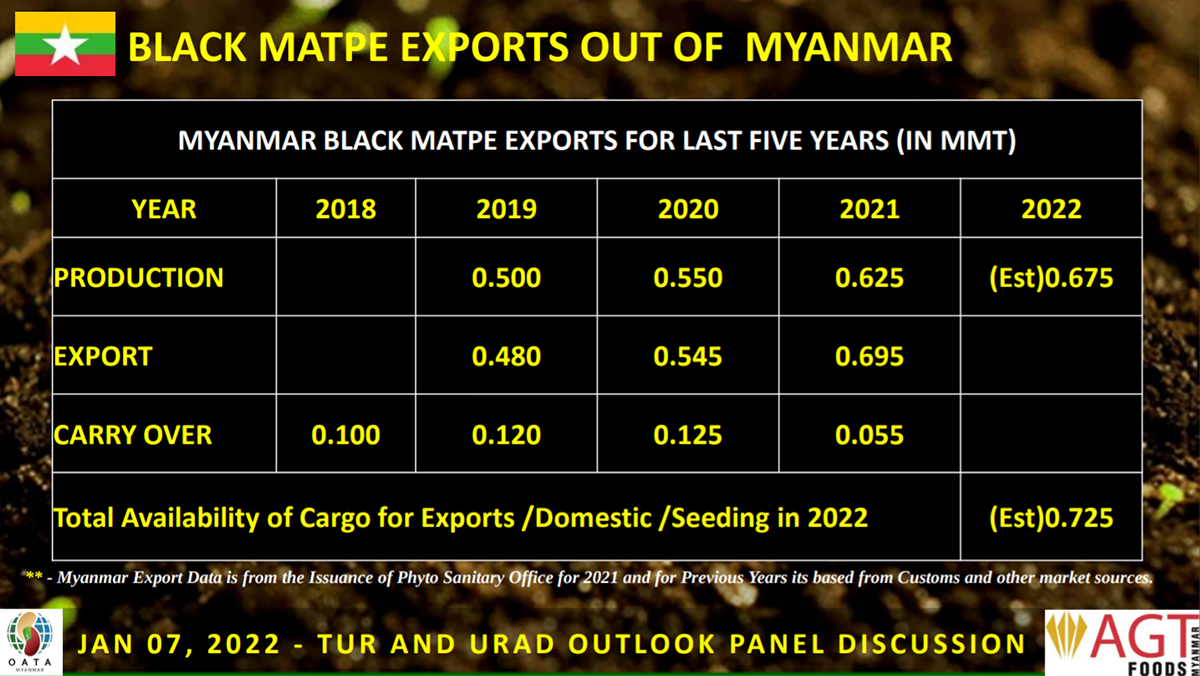

Mr. Jain began by discussing urad in Myanmar, indicating that production has been consistent at between 500 and 600 thousand tons over the past few years, 80% of which is exported to India. He stressed that Indian policies have a huge impact on Myanmar farmers. He predicted that the overall production of the ‘22 harvest may be 50 thousand tons higher than last year. Mr. Jain stressed that urad is a very important source of protein and a staple food for many in Myanmar and therefore must be available to all. Concerns were raised that even with the new MoU, even a 5% increase in consumption would result in a shortage in Myanmar. This, combined with more extreme weather events, would cause price surges.

In his presentation, Mr. Jain estimated that production in 2022 would be 0.675 MMT while, in 2021, production was 0.625 MMT, exports 0.695 MMT and carry over 0.055 MMT.

Image: OATA Myanmar

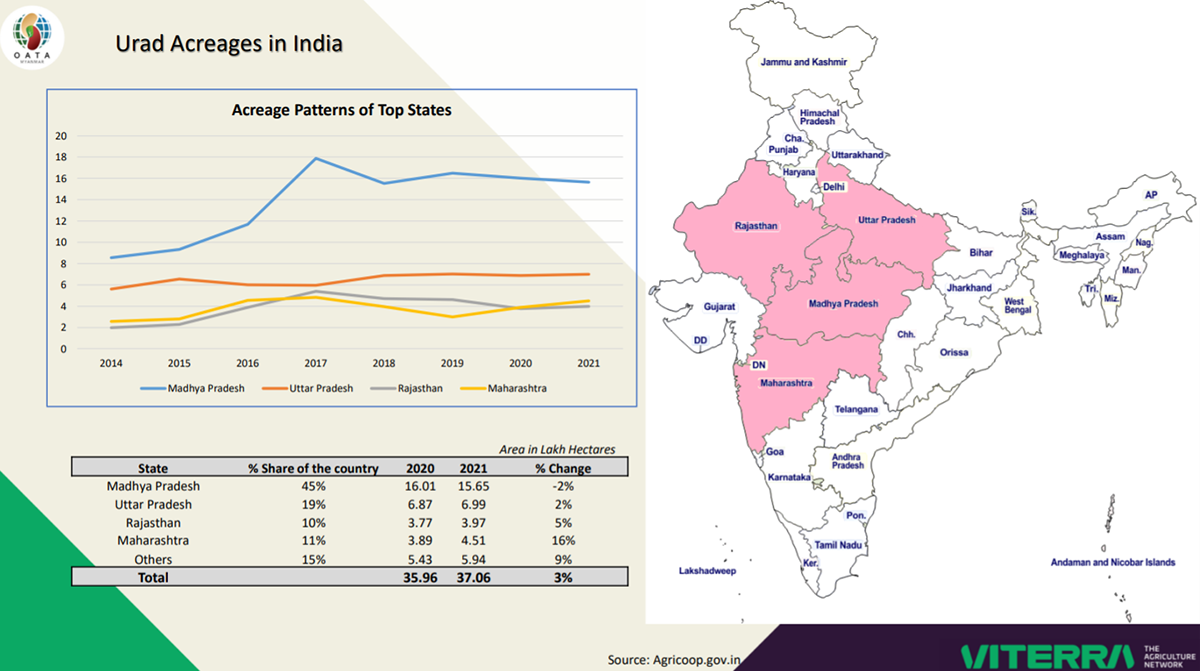

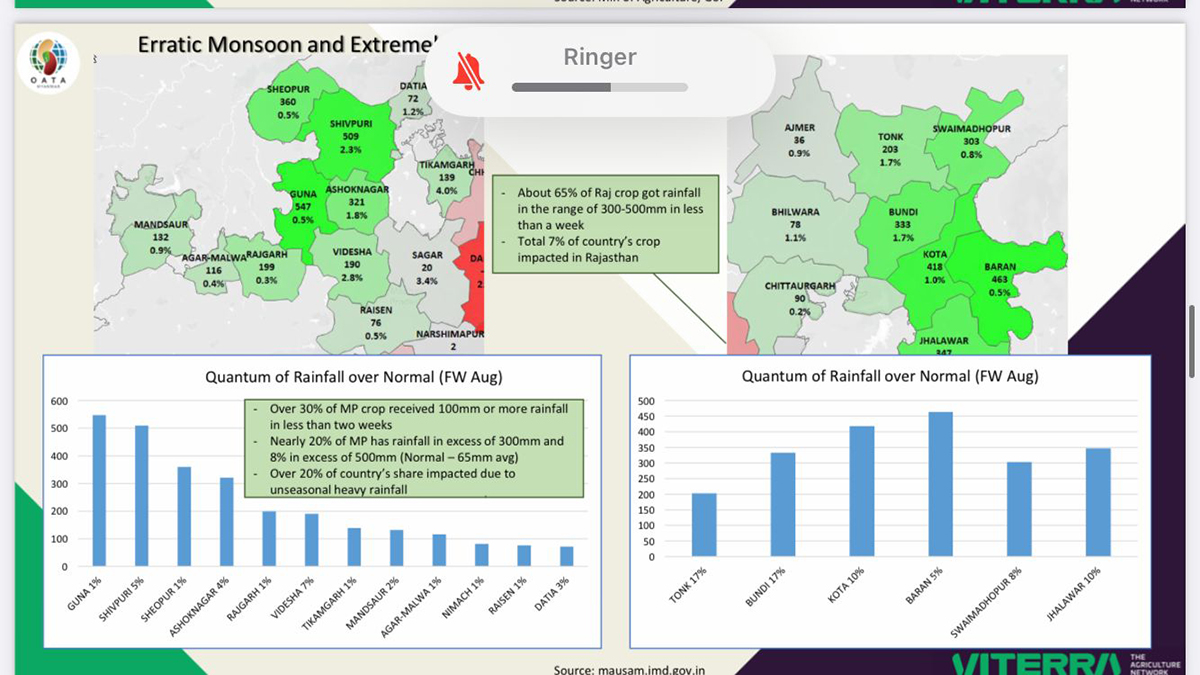

Mr. Lalit Pant went on to discuss the urad situation in India. He touched on acreages, indicating that the overall area in 2021 was the same as in 2020, highlighting that Madhya Pradesh has almost doubled its acreage in the last 7 years. Pant said that the government estimates production for 21/22 at 27.5 lakh hectares and there was excessive rainfall in MP and Rajasthan, which affected the crop.

Image: OATA Myanmar

Image: OATA Myanmar

Image: OATA Myanmar

As for prices, his data showed that they have stayed well over the MSP in the last 2 years due to low carryover stocks and a light market.

Image: OATA Myanmar

A chart showed that prices for Myanmar urad came down significantly at the end of December in India, falling below the MSP for the first time in months due to large numbers of imports and the decision to increase the import quota.

Image: OATA Myanmar

Next, there was a Tur Panel Discussion with Mr. Ananat Chhajed, Executive Committee Member of the OATA Myanmar and Mr. Nitin Kalantri, Chief Executive Officer at Kalantri Food Products.

Mr. Ananat gave a presentation on tuar in Myanmar. He underlined the importance of agriculture in the country, which makes up 37.8% of the GDP, 30% of total export earnings and employs 70% of the labour force. He also highlighted that 80-90% of Myanmar tuar is exported to India.

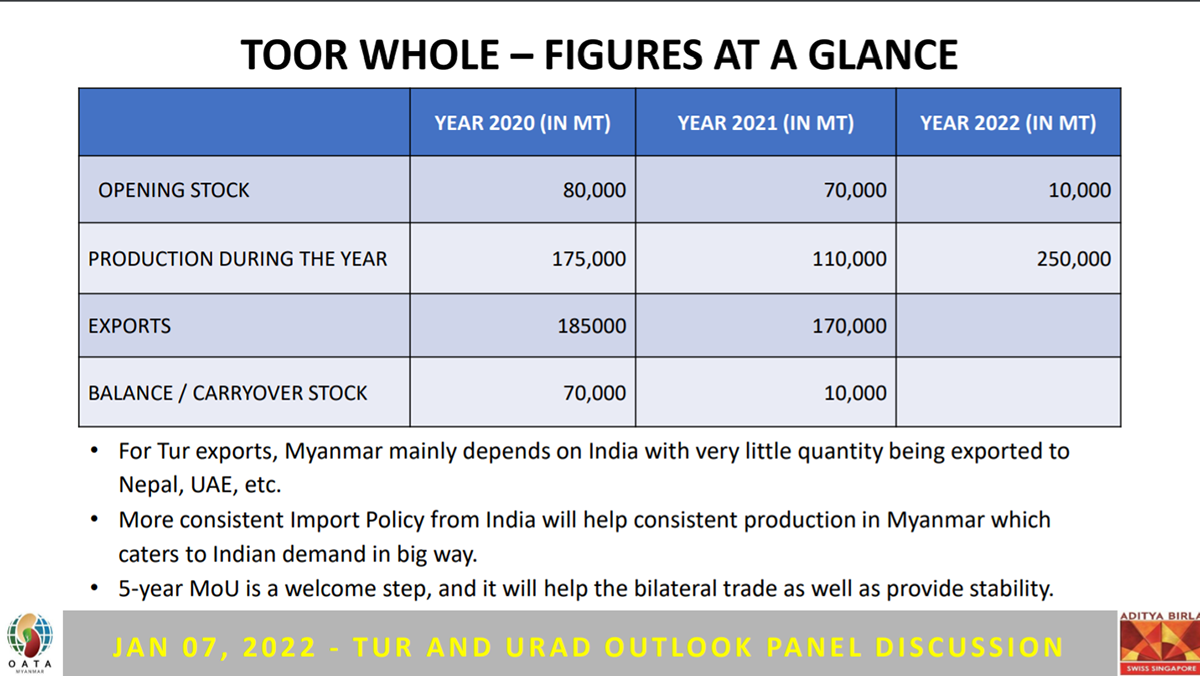

In a supply chart, Ananat showed that the opening stocks for 2022 were expected to be 10,000 MT and production to be 250,000 MT. This year’s opening stock is lower than last year’s but production is expected to be much higher.

Image: OATA Myanmar

Mr. Kalantri gave an outlook on India tuar, indicating that the sown area has increased to 49.49 lakh hectares, which is 5% more than last year. He highlighted that rains have damaged crops to an extent, with huge losses in Karnataka and also mentioned the predicted upcoming rains in the next weeks, which may hamper the quality of the next harvest’s crop. With this in mind, he expects the crop to be around 15-20% less than normal. Kalantri noted that the government released an estimated production number of 44.3 lakh tons, which is huge, but clarified that this number had taken in mind the increase in acreage but was released before the weather issues. Kalantri expects more like 35 lakh tons of total production, between 1.5-2 lakh tons lower than last year. The quality of the crop currently arriving in the mandis is inferior due to the rains; there have been lots of damaged crops, which is affecting prices. He finished by indicating that the quality has improved recently, having a positive effect on prices.

Moving onto imports, Kalantri indicated that there has been 4.9 lakh tons from April - December 2021 and a further 1.5-2 lakh tons are expected from January until April 15. Regarding carryover, he disclosed that Nafed is holding 1.5-1.7 lakh tons of tur and on the private front, including imports, there are 4.5-5 lakh tons of carryover. He also mentioned that farmers are currently big stockists and the government is looking to procure a good amount at the MSP as they need to improve their buffer stock.

Finally, discussing demand Kalantri noted that annual consumption of tuar in India is 39-40 lakh tons, mentioning that government interference and restrictions have affected the market and there has been a 30-40% cut in stockist and trader demand. He indicated that traders are trading hand to mouth and Covid restrictions have also limited demand for tuar dal, with the Omicron variant expected to continue affecting the situation. There is a seasonal jump expected when households procure for the whole year in March/April but, aside from this, demand is expected to be subdued throughout the year. Kalantri noted that the current rise in prices is due to empty inventory as traders and millers have cleared stocks in anticipation of the new tuar crop and there is a short-term break in the supply chain, which will be filled as new crops arrive until the end of January. Regarding prices, he expected between Rs. 5700 and 6500 and advised on abstaining from buying at higher prices to save on losses.

The last panel was an overview on Logistics in Myanmar by Mr. Sanjay Jain, Treasurer at the OATA Myanmar. In this short presentation, Mr. Jain highlighted that freight prices have been incredibly high and noted that in the last 6 months, shipping has been more bulk than container. He predicted that things will continue in this way because the Covid situation is still bad and the focus is heavily centred around shipments arriving on time.

Finally, Mr. Shyam Narsaria, Vice President at OATA Myanmar, gave his closing remarks, emphasizing that the MoU has only a 3 month time frame so, when there is a demand, they should supply and indicating that Myanmar is there to fulfil on the supply side.

OATA / Myanmar / India / Tuar / Urad / Vatsal Lilani / Nidhi Khare / Hitesh Jain / Lalit Pant / Ananat Chhajed / Nitin Kalantri / Sanjay Jain

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.