February 2, 2022

On January 28, 2022, the IPGA gave its first webinar of the year with an outlook on the Rabi 21/22 season.

The IPGA Knowledge Series Rabi Outlook & Kharif Production 2022 session was opened by IPGA CEO Sonia Kulkarni & Jitu Bheda, Chairman who introduced the webinar and announced the IPGA’s online World Pulses Day event, taking place from 4-7pm IST on February 10.

The session was moderated by Mr. Mrityuenjay Jha, the Commodity Editor & Anchor at Zee Business and included a presentation on pulses research, a production outlook for the Rabi crop in 2022 and a brief review of the 2021 Kharif crop. GPC coverage of the 2021 Kharif sowing and acreage can be found here.

The first presentation was given by Dr. Shiv Sewak, Director of the Indian Institute of Pulses Research and constituted an in-depth look at the crucial role pulses play in the diets of the Indian population as well as outlining the steps being taken to ensure greater food security for future generations. He highlighted the important role pulses play in the largely vegetarian cuntry of India and indicated that although the consumption level recommended by the ICMR is 52g per capita, the average availability of pulses is only 42g per capita. This, he pointed out, has triggered a problem of “hidden hunger”, a nutritional disorder caused by low protein consumption. Sewak outlined the nutritional threats such as a population in which around 800 million people are under-nourished, 50% of pregnant women are anemic and malnutrition is widespread.

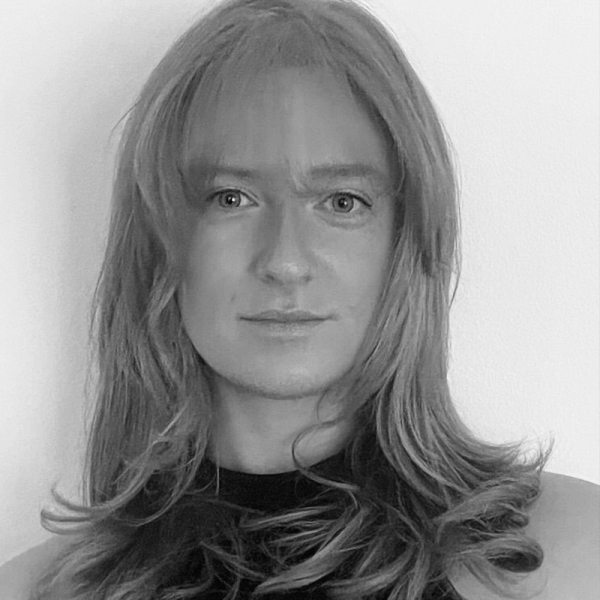

He then went on to detail the nutritional benefits of pulses and described the network of pulse research in India, which consists of the Indian Institute of Pulses Research and four regional stations. Sewak also highlighted that the impact of pulses research has led to a 50% increase in production between 2014 and 2021, resulting in reduced reliance on imports, increased seed production and better quality seeds for farmers.

Image: IPGA

The presentation also showed an image of the Pulse Revolution in India, which is composed of 3 pillars: innovation in seed systems, upscaling tech and policy support. It also mentioned future targets, one of which is to reach 40 million tons of production by 2050.

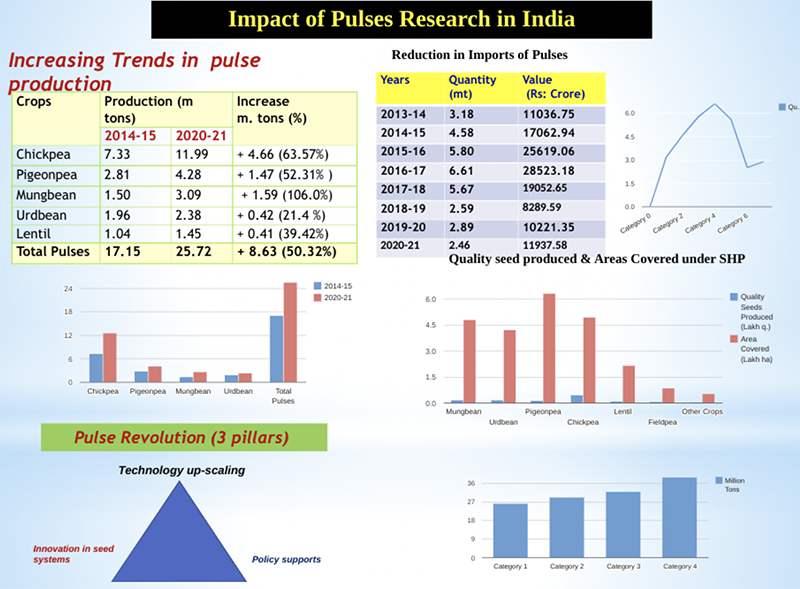

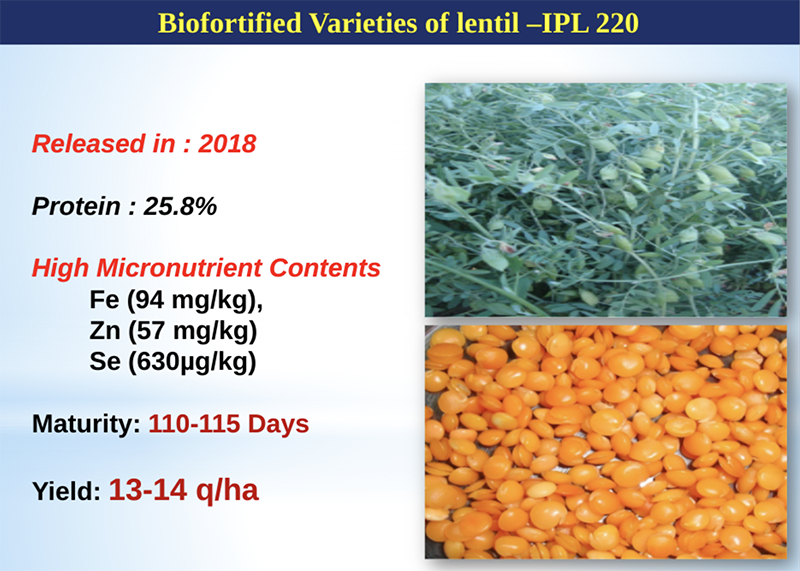

Sewak then gave a detailed overview of the research being done in pulses, touching on the extensive range of new varieties being developed by IIPR Kanpur. “Landmark” varieties included lentils with higher iron and zinc contents and several new types of chickpeas with modifications such as higher protein contents and wilt and drought resistance

Image: IPGA

Image: IPGA

He also touched on improvements in agronomy, presenting some results from crop diversification trials, different planting techniques, water-saving technology, weed management and use of biofertilizer.

Ms V N Saroja, Chief Strategic Advisor at Agriwatch gave a production outlook for the 2022 Rabi crop. First, she outlined the key impacting factors, namely delayed sowing due to extended monsoons, storms, rains and water logging and the possible impact on yields depending on the temperatures during the crops’ maturity stage; predicted frost, hail and rains in February; farmers favoring mustard seed and fertilizer availability issues.

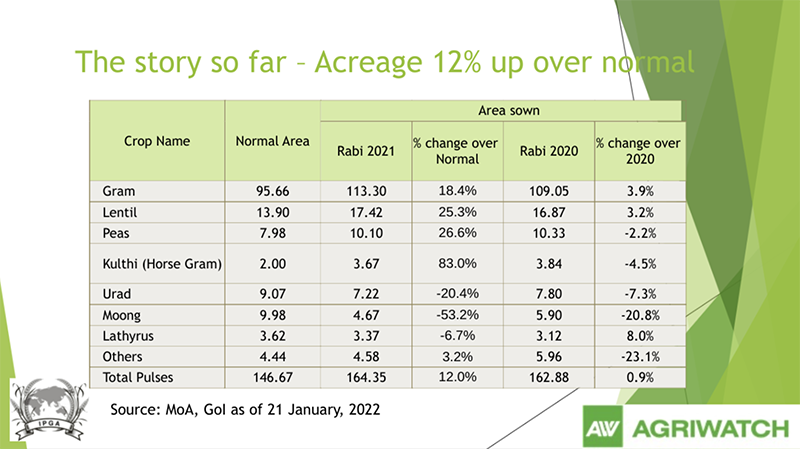

Saroja indicated that the total acreage is up 12% from last year, with gram and lentil in particular having increased by 3.9% and 3.2% respectively.

Image: IGPA

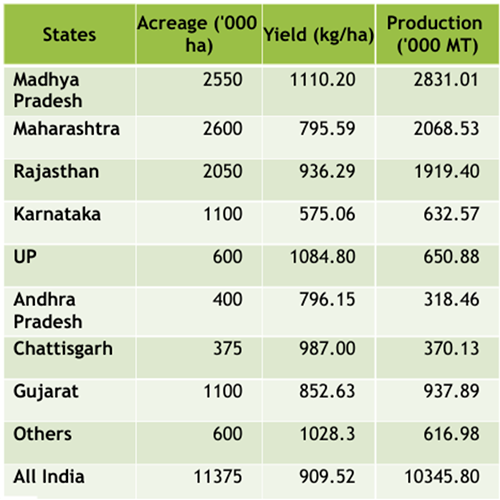

Starting with chana, the presentation showed that acreage in Gujarat is much higher than usual but a large amount of this is in non-traditional districts, which may have lower yields. Maharashtra acreage has followed on from the upward trend of the last few years while Madhya Pradesh has been declining for 3 years. Yields, she said, are likely to suffer in Maharashtra, Rajasthan, Andhra Pradesh and Gujarat due to sowing being delayed by 15-20 days and are estimated at 3.5% below normal in Maharashtra, 3% in Gujarat and 2% each in Rajasthan and Andhra Pradesh. The total production of chana is expected to be 10345.80 thousand MT

Image: IGPA

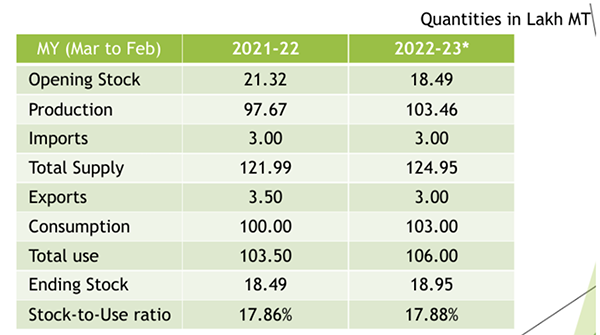

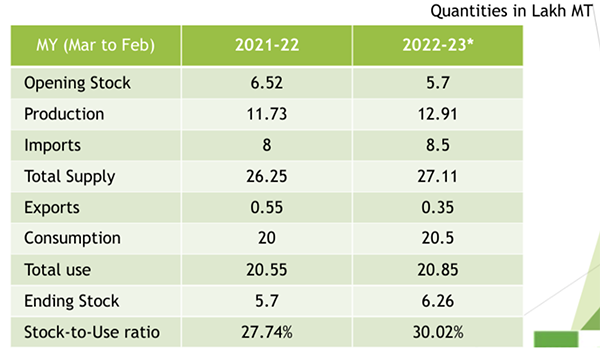

According to the presentation, the chana balance sheet for this year looks comfortable. Opening stocks are slightly lower than last year but it is expected that the crop size will be bigger and this will restore the balance. Prices are expected to stay in the current range.

Image: IGPA

Image: IGPA

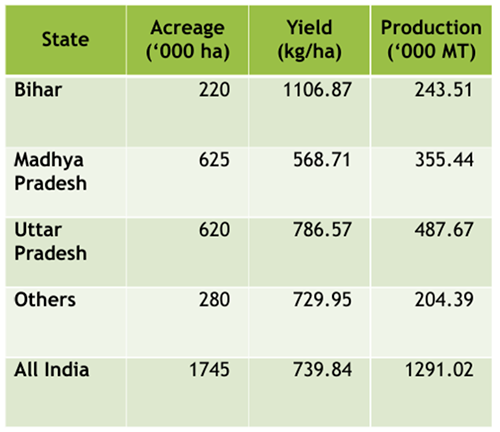

Moving onto masoor (lentil), the presentation indicated that although sowing was slow as traditional areas were waterlogged, the lost time was made up and the crop size is expected to be 10% higher than last year. Acreages in Uttar Pradesh and Madhya Pradesh are both significantly higher than last year but yields are expected to be the same as last year or slightly lower.

Image: IGPA

The balance sheet also showed an expected increase in consumption. It was highlighted that imports for this season will depend heavily on both domestic availability and the prices in Canada. The price chart showed a recent surge driven by the weather conditions.

Image: IGPA

Image: IGPA

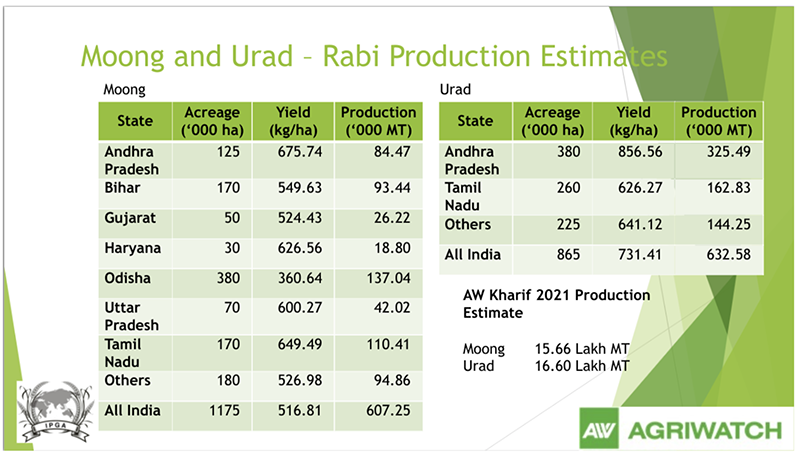

In her presentation, Soraja indicated that moong & urad yields are expected to be a little lower than last year but there are no problems expected regarding availability since the crop in Myanmar was excellent. Total production of moong is expected at 607.25 lakh tons and urad at 632.58 lakh tons. Prices are expected to stay in the current range for both crops.

Image: IPGA

Moving onto price expectations, Soraja indicated that chana prices are expected to stay around 5600 Rs. during the first half of the year but may increase to 5800-6000 Rs. later in the year. Masur prices have been high for the past two years due to high dependence on imports but may decline slightly to around 6800 Rs. once the new crop arrives. Prices are expected to stay in the 7000-7800 Rs. range for most of marketing year 22/23. Urad is expected to be stable in the 6800-7500 Rs. range until June 22, after which prices will depend on the sowing progress for the 22/23 crop. Moong availability has increased compared to the last few years and with the good crop in Myanmar and NAFED holding about 3.40 lakh MT of stocks, the market is expected to remain bearish until June with prices in the range of 6100-6600 Rs. until July, after which prices will depend on the sowing progress for the 22/23 crop.

Before finishing, Soraja shared an anecdote from her youth about the first pulses shock that happened in her life when she was 18 and tuar dal went from 18 Rs to 25 Rs. for the first time ever, shaking the budgets of middle-class families across the country. Her mother, she shared, started to blend lentils with tuar dal as a result and there was total revolt in the family. Then, last year, she took a bill to her mother to show her that lentils were more than tuar for the first time in her lifetime. Life has changed dramatically, she indicated, mostly because of weather events.

Mr. Nirav Desai, Director GGN Research gave a brief review of the ‘21 Kharif Crop, you can consult the GPC’s full coverage here. After his presentation, he concluded that the government has been successful in keeping prices under control but warned that both NAFED and stockists’ supplies have been depleting. With the upcoming crops, he indicated, farmers might not be willing to sell at lower prices and so from March/April, there will be pressure on prices. His advice was not to be patient for a month or so and not to liquidate stocks.

In the panel discussion, Bimal Kothari, Vice Chairman of the IPGA gave an estimate that by 2030, India will require 30-32 million tons of pulses and Saroja indicated that demand has been stable in the past few years and has remained in the range of 100-103 lakh tons. Even with lockdowns, she stressed, demand did not wane. However, it was highlighted that domestic demand is always short on supply by between 15-20%, a situation which is expected to continue for the next few years, meaning the reliance on imports will continue.

IPGA / Rabi Outlook / Kharif Production / India / Sonia Kulkarni / Rabi / Mrityuenjay Jha / Jitu Bheda / Shiv Sewak / V N Saroja / Nirav Desai / Bimal Kothari

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.