February 18, 2025

As the duty-free import deadline for yellow peas approaches, the uncertainty is reflected in prices. Read on to know all the updates and key factors influencing trade.

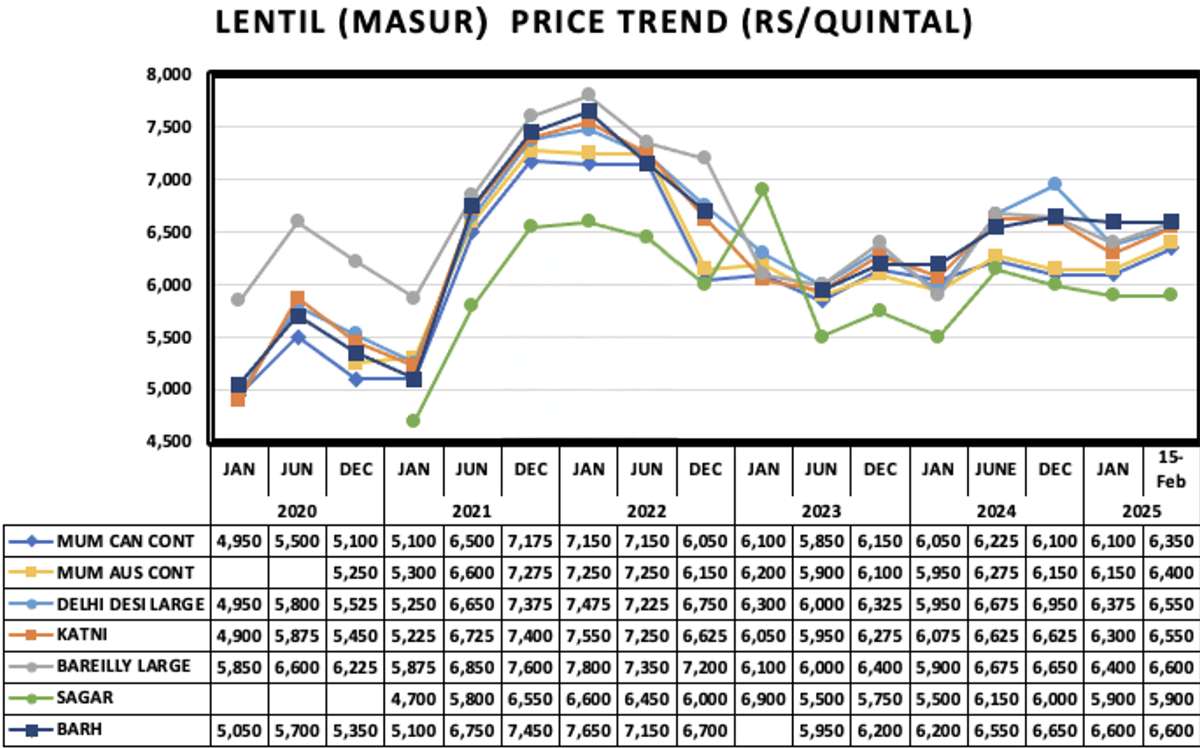

The weekly review of lentil prices highlights several regional fluctuations in the market due to varying demand and export performance, particularly influenced by Canada, the leading producer of lentils. Desi lentils saw a decline early in the week due to profit booking, weak buying, and increased sales. However, prices picked up towards the weekend with a boost in demand.

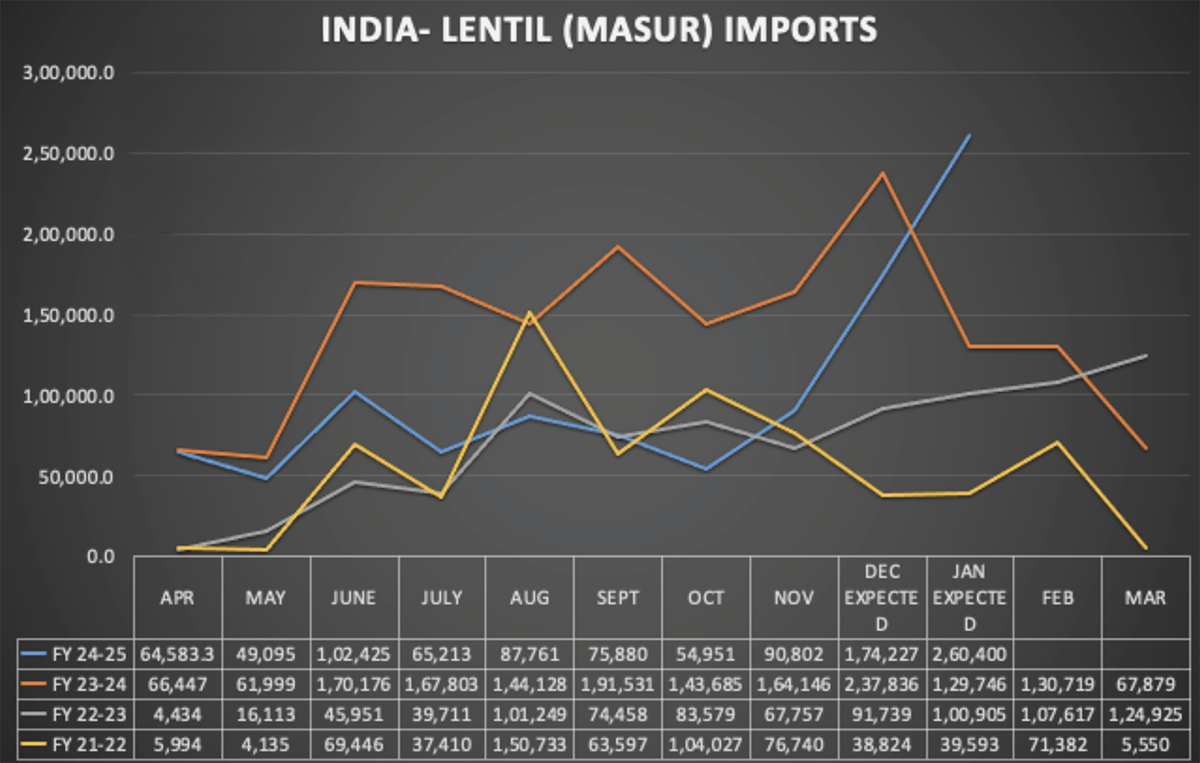

India is expected to import 1.03 mmt of lentils from April- January. In FY 2024-25 (April-March) India may import a total 1.1 million metric tonnes (mmt) of lentils, compared to last FY’s record imports of 1.6 million tonnes

Masoor Dal prices also saw an improvement last week, rising by Rs. 100 per quintal in various regions, including Indore, Barh, and Khushrupur. Market dynamics continue to show some regional volatility, influenced by both domestic demand and global export trends, especially from key producers like Canada.

READ THE FULL ARTICLE

IGrain India

IGrain India

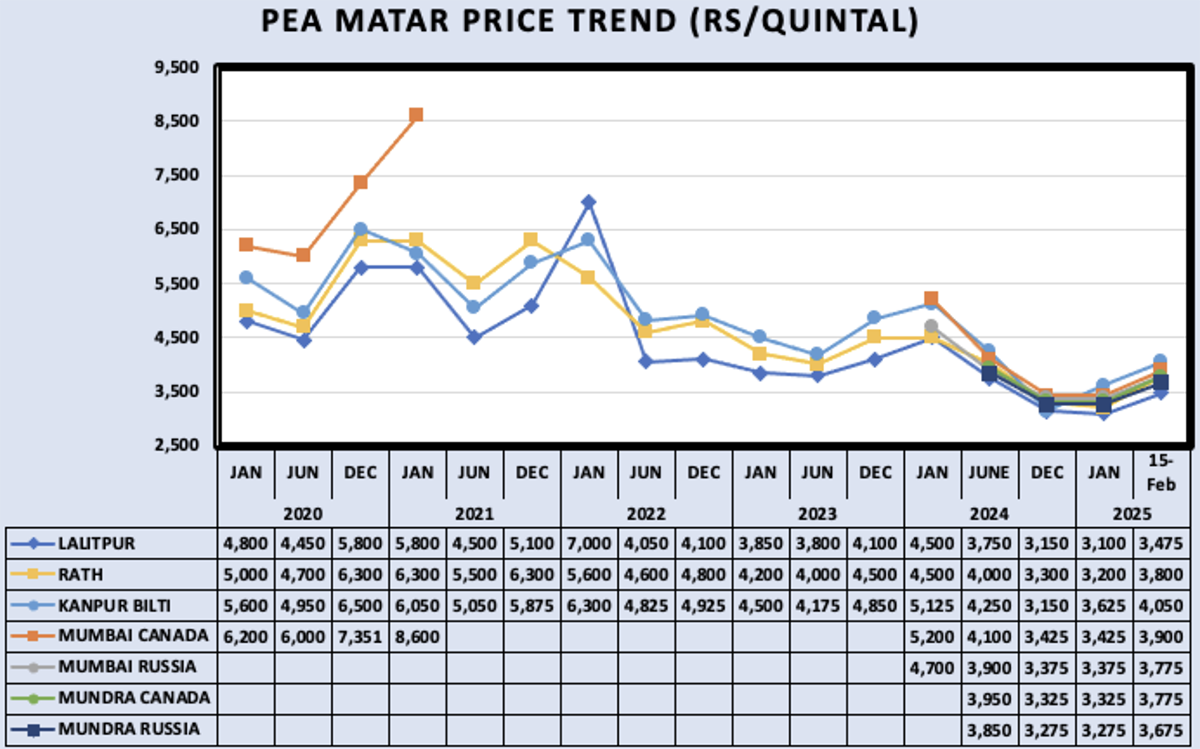

The weekly review of pea prices indicates a significant upward trend driven by several factors.

The duty-free import deadline for yellow peas ends on February 28, 2025, creating uncertainty around the potential for increased import limits. This has led to stockists becoming more active, which has helped push prices up.

Regarding import performance, Canada's pea exports showed better performance this year, despite a slight drop in December exports compared to November. However, the total exports from August to December 2024 were higher than in 2023, supporting the overall demand for peas. From the beginning of imports i.e., December 2023 to January 2025, India imported 3.2 mmt of peas. From January to December total expected imports may reach 2.98 mmt and from April to January FY import of 2.04 mmt is expected to be imported.

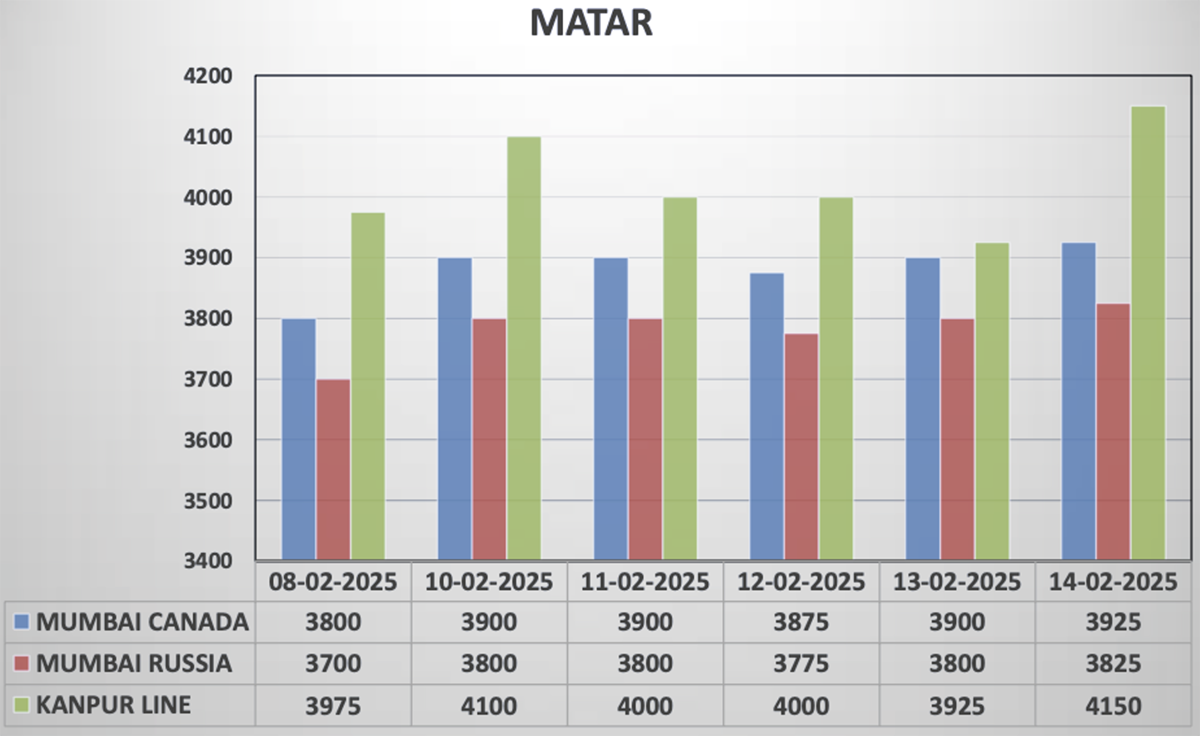

The combination of weak selling from importers and improved buying has resulted in a price increase for peas. For instance, imported peas saw a rise of Rs 125-150 per quintal, with prices for Canadian peas reaching Rs 3900-3925 and Russian peas at Rs 3800-3825. Domestic pea prices in Kanpur, Lalitpur, Mahoba, and other regions also saw substantial increases due to better demand.

The rise in pea prices has had a direct impact on pea dal prices, which increased by Rs 250 per quintal. In Kanpur, pea dal prices reached Rs 4400-4500 per quintal by the weekend.

Overall, the pea market is witnessing strong demand and price increases, driven by both domestic and international factors.

IGrain India

IGrain India

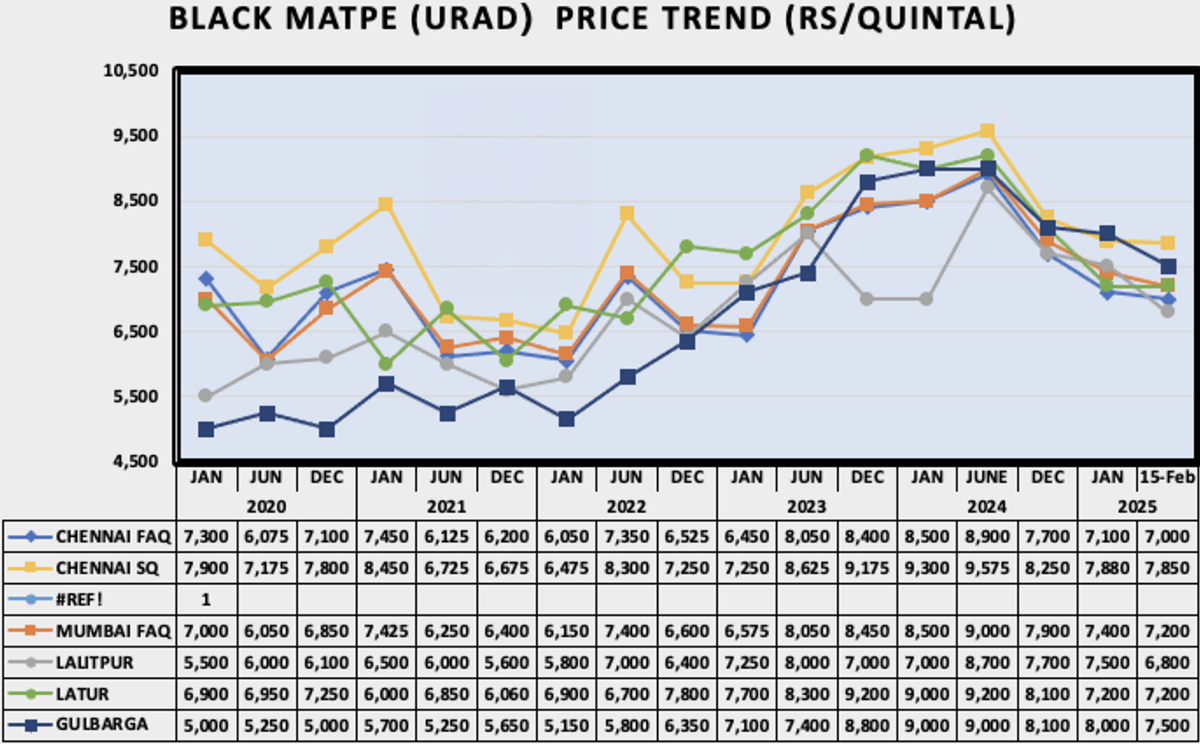

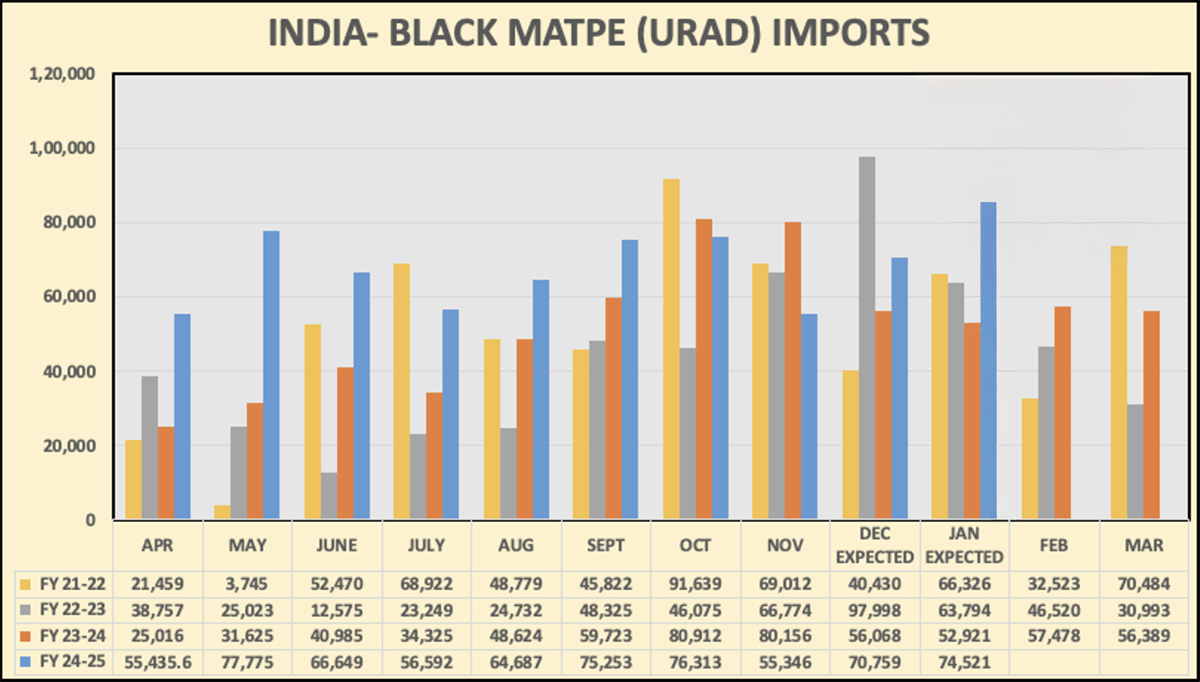

Urad (black matpe) prices have fallen this week, mainly due to weak demand, profit booking at higher prices, and sluggish buying. There has been a reduction in prices across major markets, such as Chennai, Kolkata, Delhi, Madhya Pradesh, and Maharashtra.

Urad imports are expected to reach 0.673 mmt from April to January 2025, surpassing last year's imports during the same period. The import deadline is set for March 31, 2025, with speculation of a possible extension in the coming week.

Urad prices have generally declined across different regions, with little change in urad dal prices. There is also anticipation regarding the extension of the urad import deadline in the near future.

IGrain India

IGrain India

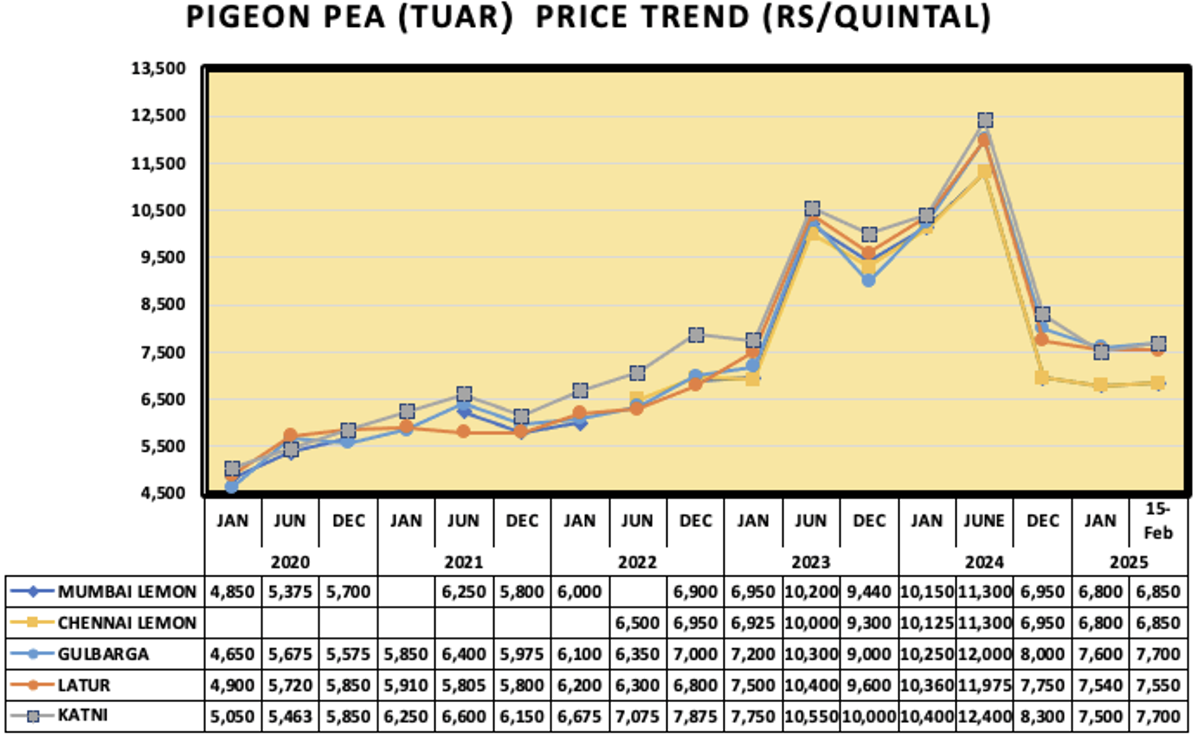

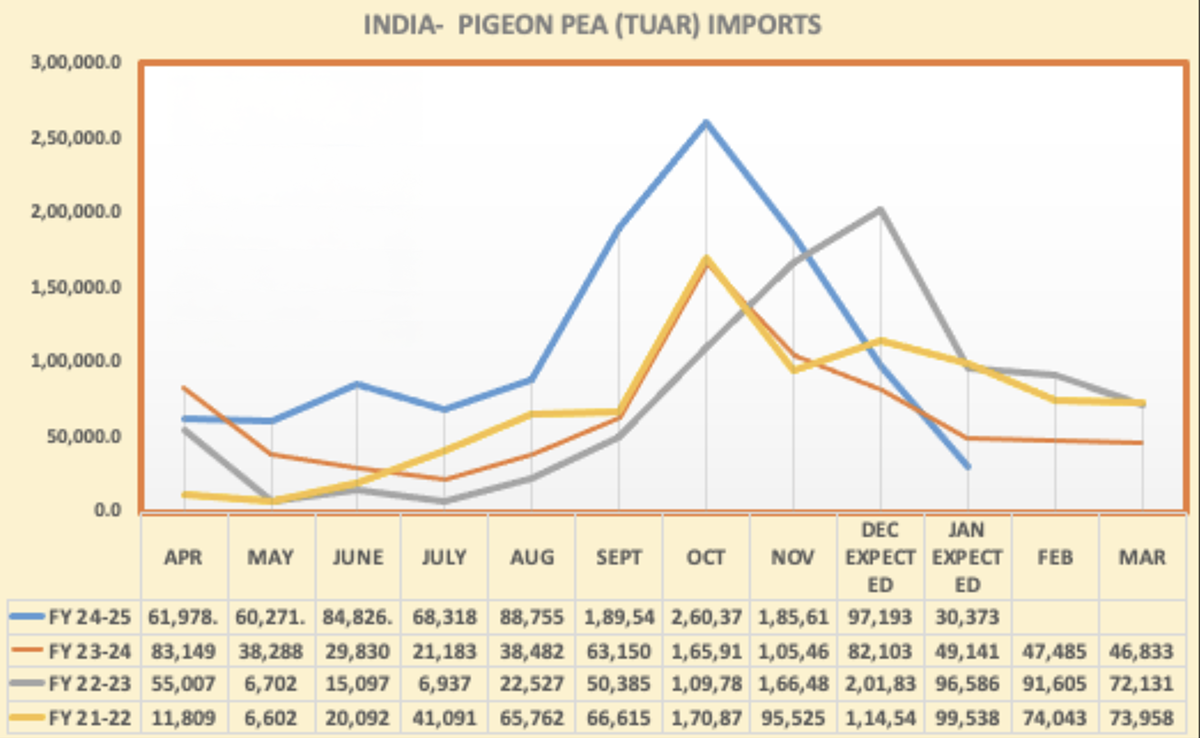

The tur (pigeon pea) market showed a positive trend this week, with prices rising due to higher demand, driven by active stockists and dal millers. The Union Agriculture Ministry estimates domestic production of about 3.5 mmt for the 2024-25 season. However, industry experts believe this could increase to 4 mmt, significantly higher than last year's 2.9 mmt. Additionally, imports are expected to rise, with Myanmar and African countries expected to supply 1 mmt, although the import price may cause challenges. In Burma, prices fluctuated by $10 per tonne but remained stable at $790 per tonne due to slow export demand.

The demand surge for tur also pushed tur dal prices up by Rs 150-300 per quintal. Overall, the market showed a positive outlook with a mix of price hikes due to increased demand and varying local factors.

IGrain India

IGrain India

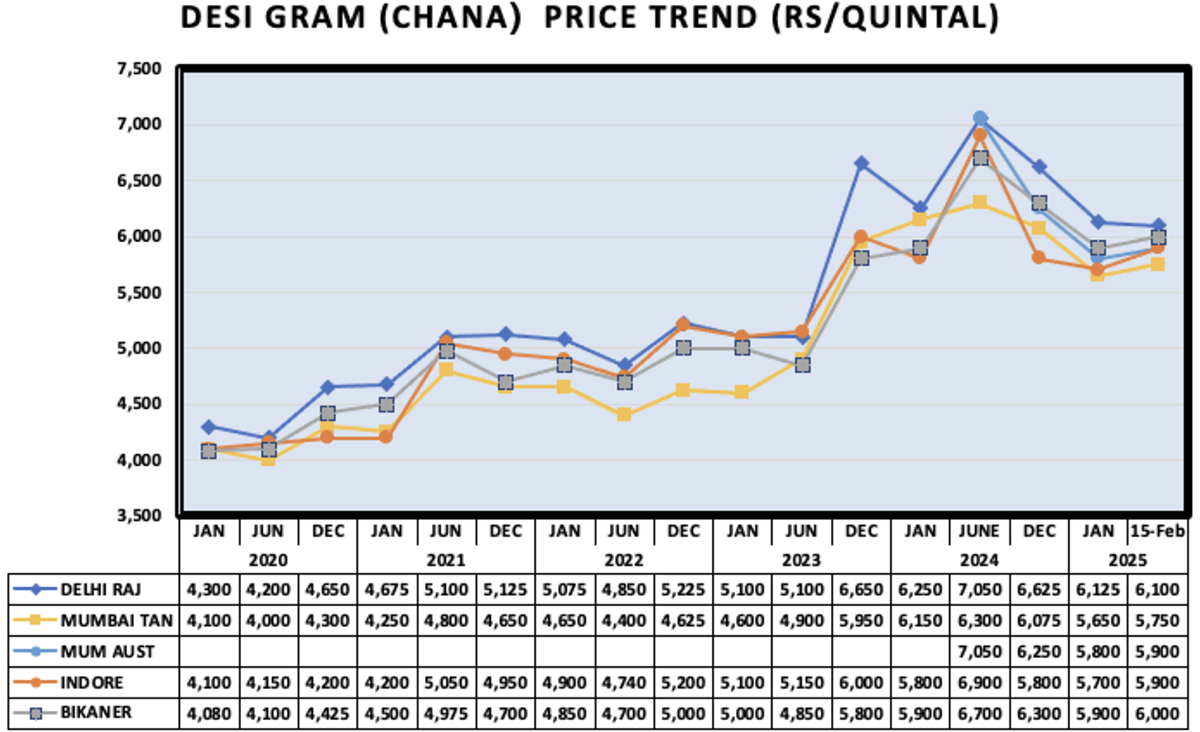

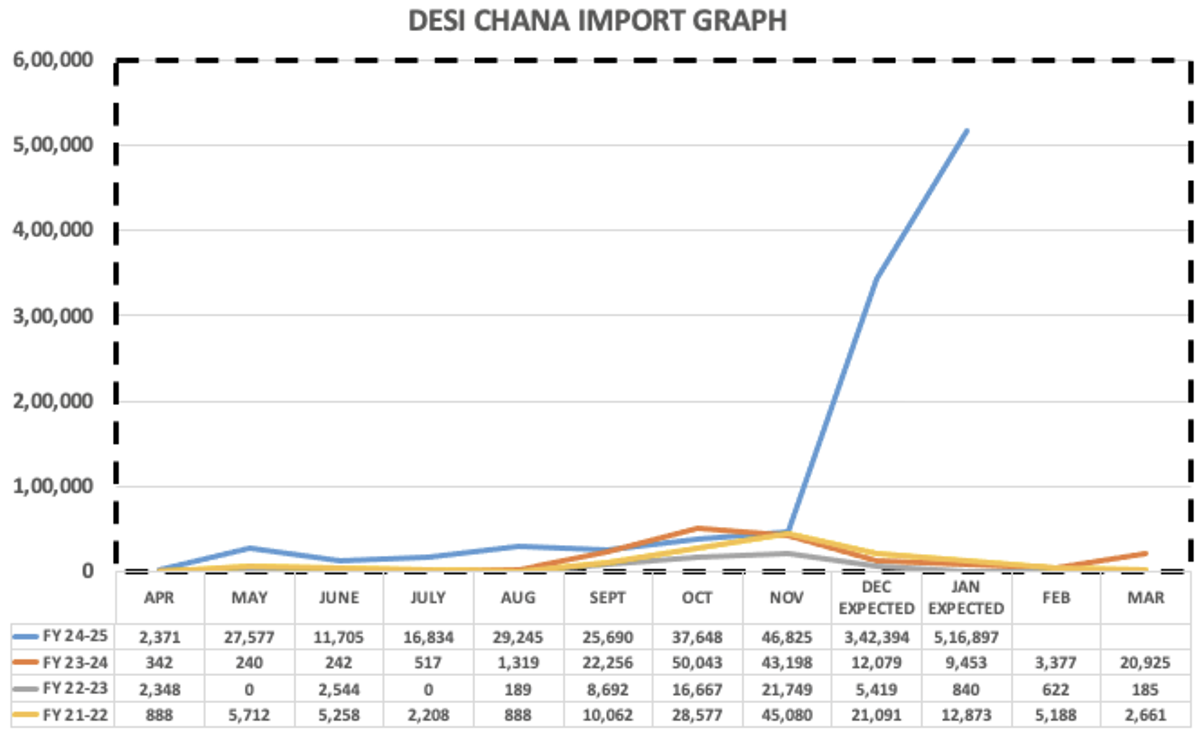

The gram (desi chickpea) market has seen a lot of profit booking, as buyers have shown limited interest, especially from dal millers, due to the weak demand for gram dal and gram flour. This lack of demand has resulted in decreased support for the rising prices.

The availability of new gram from the producing markets is rising, with new arrivals from Madhya Pradesh and Rajasthan expected to increase in March, and continued imports from Australia. All these factors are putting additional pressure on gram prices. This situation suggests that selling now, in line with profit booking, may be beneficial.

Overall, weak demand, rising supplies, and continued imports suggest that the gram market may remain under pressure in the coming weeks.

IGrain India

IGrain India

IGrain India

The Indian government may decide not to extend the duty-free import period for yellow peas beyond February 28, 2025. This decision follows approval of duty-free imports in December 2023, which had been extended multiple times.

The Ministry of Food, Consumer Affairs, and Public Distribution has confirmed that a final decision regarding the extension will be made during a high-level cabinet meeting chaired by the Union Home Minister. The food minister announced at the "Pulses Conclave 2025" that the duty-free import of yellow peas would come to an end. However, the Chairman of the India Pulses and Grains Association (IPGA) has suggested that the government might consider controlling yellow pea imports to protect the interests of farmers. He proposed either a complete ban on duty-free imports or partial restrictions.

In 2024, India saw a record import of 6.7 mmt of pulses, with yellow peas accounting for almost 3 mmt of this total. Adverse weather conditions and other factors had severely impacted domestic pulse production, which led to a surge in imports. However, the situation is expected to improve in 2025 with better domestic production, reducing the need for large imports.

The estimated pulse imports for 2024-25 are expected to be around 5.5 mmt. If the duty free import of yellow peas is stopped, total pulse imports in 2025-26 could decline. There are also discussions about imposing a 15-20% import duty on yellow peas in the future. It will be interesting to see what final decision is made after the cabinet meeting.

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.