June 9, 2020

A combination of factors including COVID-19 impacts and policymaking have bolstered the country’s already strong masoor import market.

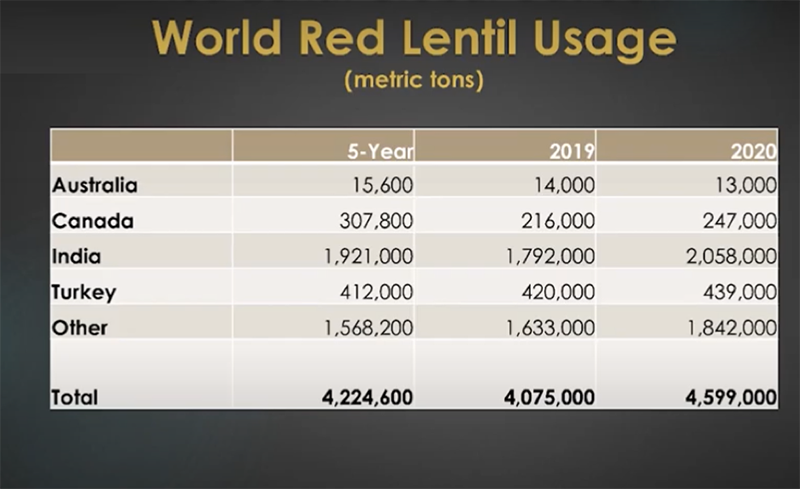

As one of Canada’s top purchasers of red lentils, India has consistently shown strong demand for the product as it works to supply its ever-growing population, and this year is no exception. In the midst of the COVID-19 pandemic and a countrywide lockdown that has been in place since late March, India is eager to secure stocks of staple foods, and—being an economic, nutrient-rich option—red lentils certainly fit the bill.

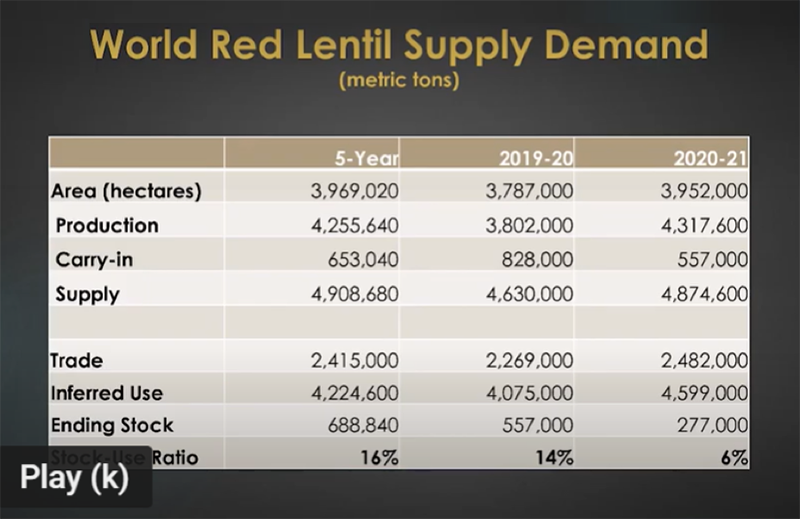

In a recent newsletter Rahul Chauhan of iGrain India noted that, “There is a possibility of lentil exports from Canada doubling this year compared to last year, which will result in the ending stock at the end of the season.” He and other analysts expect the market to remain strong in the coming months, with an uptick in prices thanks to immediate demand, at least until the new crop enters the picture in August.

“Lentil exports from Canada increased almost twice during the 2019-20 season compared to the 2018-19 season, which is expected to cause a huge drop in its outstanding surplus stock at the end of the season,” he added. “In fact, when the price of lentils started rising rapidly during March-April 2020, producers and stockists did not hesitate to take out their goods.”

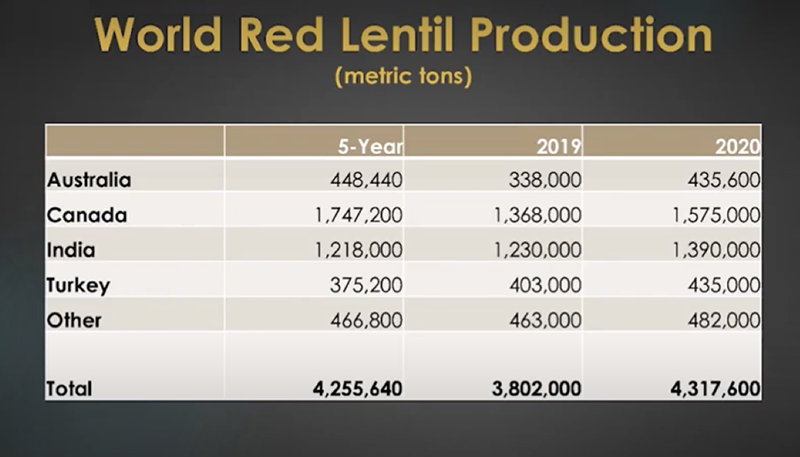

Chauhan has indicated an overall drop in India’s lentil production this year, presenting a figure of 1.20 million MT, which is lower than the government’s estimate of 1.44 million MT (Brian Clancey of Stat Pub thought the number would be 1.39 million MT, according to his presentation during the GPC’s Red Lentil Overview webinar on April 23. See chart below).

Source: Brian Clancey “Red Lentil Global Outlook” GPC webinar, April 16, 2020.

Heavy rains on the standing crop of lentils, Chauhan said, have affected production resulting in a shortage at the port. He estimates India’s demand this year to be as high as 2.5 million MT, meaning up to 1.3 million MT will need to be brought in from Canada and Australia mostly.

“This year’s crop size is small compared to last year’s,” he confirmed last week. “Importers have only one option left, and that is to import lentil only freely as gram production is high. Other pulse imports are restricted. To cater to consumption, we need to import more.”

Another factor to consider regarding India’s pulses market has been disruptions related to Covid-19. While this week will see the reopening of malls and temples across the country, reports have come out confirming record numbers of new cases of the deadly virus, which has already claimed the lives of over 7,000 people nationwide. India’s most industrialized state, Maharashtra, has surpassed China as a whole in the number of Covid-19 cases, with a total of 85,975 as of June 8.

Experts in the Indian pulses market have been watching this unprecedented situation unfold with a close eye. Chauhan noted how a shift in the breakdown of city vs. rural populations could affect consumption habits as daily wage workers have been forced to relocate during lockdown. “This may reduce consumption in cities for a while and may increase consumption in rural areas. Overall consumption will improve,” he said.

Sunil Kumar Singh, Additional Managing Director of the National Agricultural Cooperative Marketing Federation of India (NAFED), which works to procure and distribute pulses and other products to ensure availability to those in need, indicated that thankfully the pulses supply chain has continued to function and that a return to normalcy is in sight. He predicted shipping and transport systems would be fully back on track in the next four to six weeks.

“The situation has been easing up and right now is much under control,” he said. “Most of the mills have started work. The cargo transport has not been a problem because most of the stocks are being moved by rail and the government had exempted essential services, of which food distribution was a part, so they were not under the lockdown.”

Singh has confirmed, both during the GPC webinar and in a recent conversation, that India’s supply and production would not be affected as much as others have predicted. “We are comfortable in most of the pulses. Yes, we may be a little short on lentils, but the Indian harvest is on.”

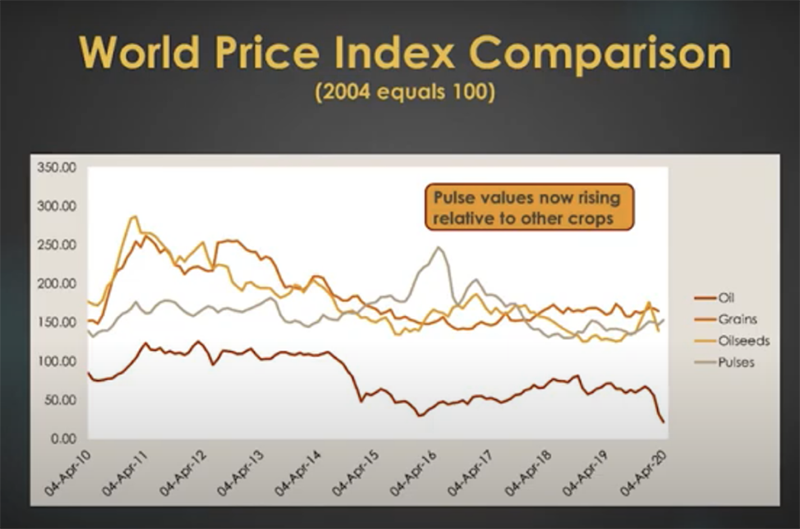

During his red lentil overview in the GPC webinar, veteran analyst Brian Clancey pointed out the relationship between the steep drop in oil prices as a result of Covid-19 and the positive price movements of pulses, including lentils. He argued that a drop in ethanol—and therefore corn—prices in North America were encouraging farmers to seed more pulses, though he wasn’t sure how much this would affect planting areas.

“I think the effect on price has been a little bit late to change growers seeding decisions,” he said. “With red lentils, the surpluses that we had accumulated in the last couple of years have been diminished a lot. The movement off of farms is excellent right now.”

Source: Brian Clancey “Red Lentil Global Outlook” GPC webinar, April 16, 2020.

Meanwhile, a number of policy-making decisions by the Indian government are expected to encourage the trade of red lentils from Canada and other countries, such as Australia. On June 2, the Ministry of Finance announced tariff reductions on lentils of U.S. and non-U.S. origin, from 50% to 30% and 30% to 10%, respectively (the additional 10% tax requirement means these percentages are effectively 33% and 11%). The reductions shall remain applicable until August 31, 2020. According to Mr. Singh, this move is intended to help move lentils through the supply chain as needed.

“This custom duty reduction is there to facilitate the trade and lower the cost of import to India and the ultimate availability,” he said. “It is only there to balance the demand and supply position of pulses in India and to have a steady price level that is quite useful and beneficial to the farmer and the consumer.”

Chauan said that the move seemed to have an immediate effect on lentil prices. “After the government announcement prices of lentil in Australia and Canada increased by $75/MT, but I believe this is due to competition between Australia and Canada. The Indian importer will be benefited.”

Speaking of prices, although red lentils have been selling on the lower end since peaking in 2016-17, there has been a recent upswing. According to Rayglen Commodities, Inc., red lentil prices in Canada jumped to as high as 33 cents in the past week but have since settled into the 31-cent range for old crop and 25-27 cents for new crop.

Australian producers also saw a $50/MT price jump immediately following the news, according to comments made by Grain Producers Australia chairman Andrew Weidemann to ABC News, though their current red lentil supplies are dwindling. In the GPC’s webinar Mostyn Gregg of Agrocorp International said Australia would likely run out of reds by July.

“Canada has to carry the exporting load for the world until we come on in November. So if we want to talk tonnes you’re looking at under the last 50,000 tonnes. It’s tight, very tight,” he said.

During the same webinar, Brian Clancey identified some other policy decisions related to yellow peas that he believed would factor into the red lentil market this season.

First, he pointed out that “the import quota for peas was changed from being basically any peas into half green peas and half other peas. Yellow peas had dominated that, so that may reduce the imports of yellow peas, which is important.”

Second, Clancey noted that a change in the way import duties are calculated would effectively raise the price of yellow peas to over $2000 per metric ton. “That means if India needs to plug any holes in regions for pulse supply for imports, it’s going to be looking at lentils because they are currently one of the most economic pulses.”

Canadian growers are currently hard at work to meet the likely surge in red lentil demand brought on by all of the above-mentioned factors.

“Grower prices for red lentils in Canada strengthened shortly before seeding,” said Carl Potts of Saskatchewan Pulse Growers. “We expect that this will have encouraged Canadian producers to plant more acres of red lentils this year. Although we had a slow start to seeding this year due to cool temperatures and in some areas some harvesting of last year’s crop to finish up, some very good weather in May allowed most of the crop to be planted on time.”

India / Canada / Australia / NAFED / Sunil Kumar Singh / Brian Clancey / Rahul Chauhan / Andrew Weidemann / Mostyn Gregg / Carl Potts

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.