July 11, 2024

Bringing together Pulse Atlas, government and industry data, we present the situation as it stands in the global dry pea market, looking at production and consumption across the biggest global players.

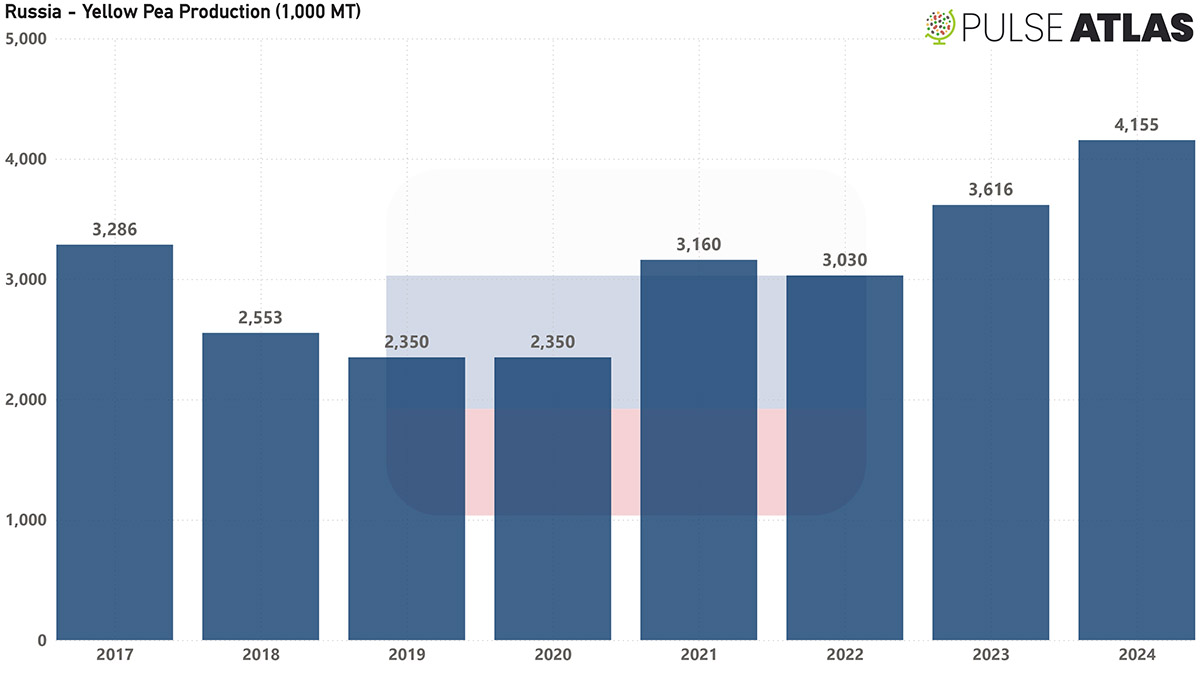

The weather has been a point of concern for Russia in the Southern, Central and Siberian regions. Due to this, there are varying opinions regarding the final total crop. Some in the trade expect a crop of between 4.2 MMT to 4.4 MMT, while others expect less than 4 MMT tons if the damage from the weather conditions is severe.

Russia increased the area for dry peas this year, with growers motivated by sustained demand from China and India’s removal of the import duty on yellow peas, both of which caused an uptick in prices.

Russia’s domestic demand of dry peas is around 2 MMT annually, meaning that approximately 1.9 – 2.4 MMT of this years crop tons will be available for export. Since the opening of trade between Russia and China, based on one report, more than 800,000 tons was exported from Russia to China between July 2023 and December 2023, while during the same period, Russia exported a little under 400,000 tons to Spain. However, the EU Council imposed a 50% duty on dry peas imports from Russia and Belarus as of June 2024, prohibiting exports into the EU and effectively removing Spain as a destination.

The prices of Russia to China CNF basis and Russia to India CNF basis for Jul / Aug shipments have both seen a slight decline in price, based on the price report issued by GPC on 5th July. The average price for both between 6th June to 27th June was US$435 / ton, while the reported price for both on 4th July was US$415 – US$420 / ton.

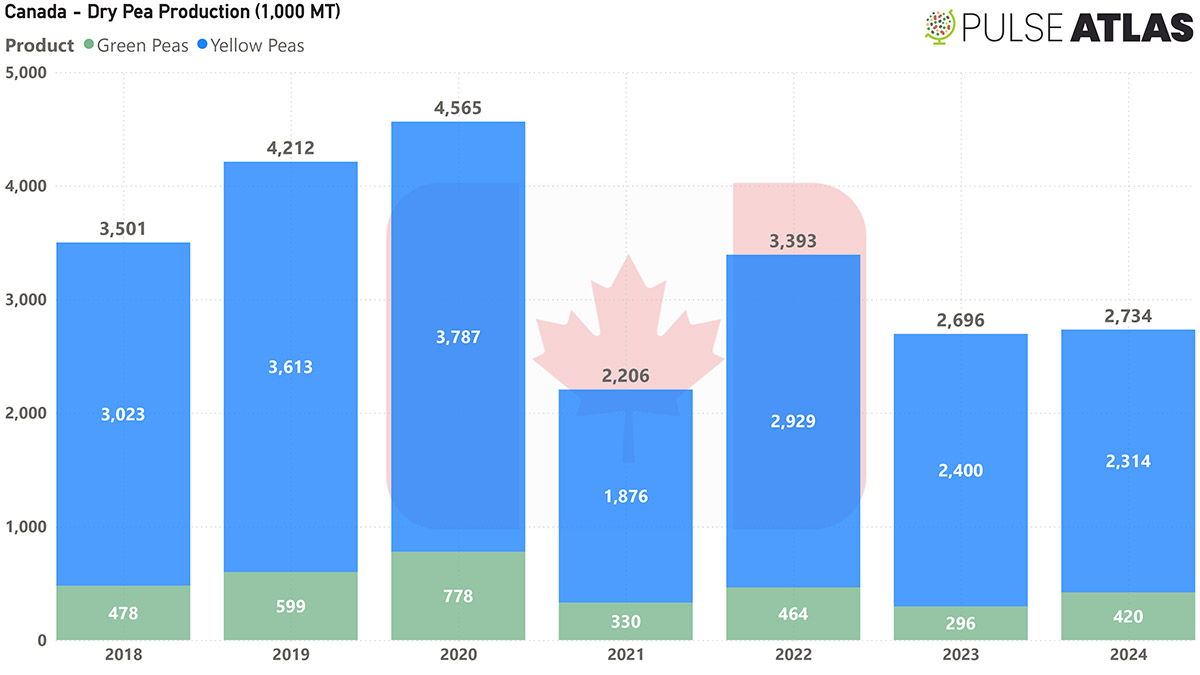

The crop in Canada has benefited from good rainfall, as dry pea seeding was completed in early June. A huge chunk of the dry pea crop is grown in Saskatchewan and based on reports coming out of there, the crop is rated at good to excellent condition.

Based on the Statcan report on 27th June, farmers have reported a 5.4% increase in the area under dry peas compared to 2023, rising to 3.2 million acres in 2024, which equates to roughly 1.3 million hectares. The breakdown will be approximately 2.6 million acres for yellow peas and approximately 0.46 million acres for green peas.

After 2017, the majority of Canadian yellow peas has been exported to China with an annual average of around 1.6 - 1.8 MMT, followed by almost 300,000 tons going to Bangladesh and around 100,000 tons going to Pakistan. China has also been the top destination for Canadian green peas. The exportable quantity this year should be around 1.8 - 2 MMT for yellow peas, as from the expected 2.8 MMT ton crop of yellow peas, approximately 700,000 tons are expected to fulfill domestic demand.

This year the export destinations ratio to China and other countries is expected to decrease, as India has returned as a buyer.

Based on the weekly pulses price report published by GPC on 5th July, the average price for Canada to India CNF Jul / Aug between 6th June to 27th June was US$501, while the reported price on 4th July was US$480. Forward shipments for Sep / Oct for the same destination on 4th July were reportedly priced at US$470. Average price for Canada to China CNF Jul / Aug between 6th June to 27th June was US$456, while reported price on 4th July was US$440. Forward shipments for Sep / Oct for the same destination on 4th July were reportedly priced at US$430.

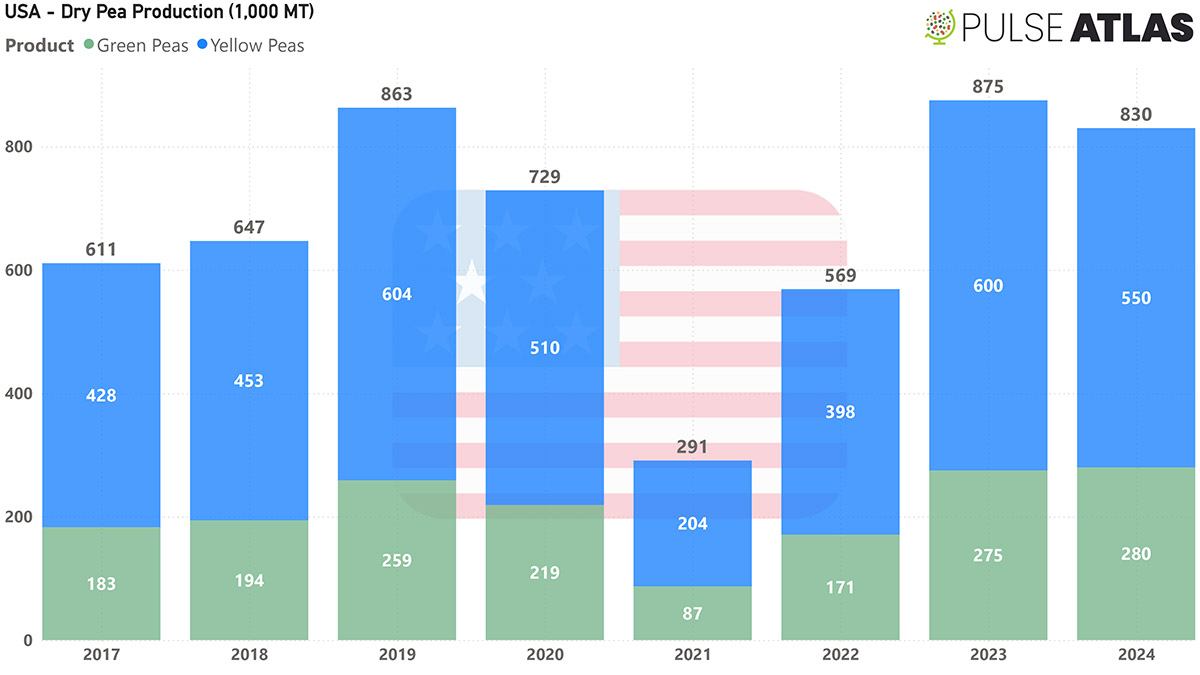

The USA is expected to have seeded approximately 400,000 hectares of dry peas, which is concentrated in the North Dakota and Montana regions. If weather conditions continue to be favorable, the USA is expected to produce between 800,000 to 900,000 MT of dry peas, out of which approximately 65% - 75% will be yellow peas.

Local demand in the USA is increasing YoY for dry peas, as they become more popular as animal feed. It remains to be seen if the USA needs to import any dry peas from Canada to satisfy local demand, which would reportedly come in through cross border trade.

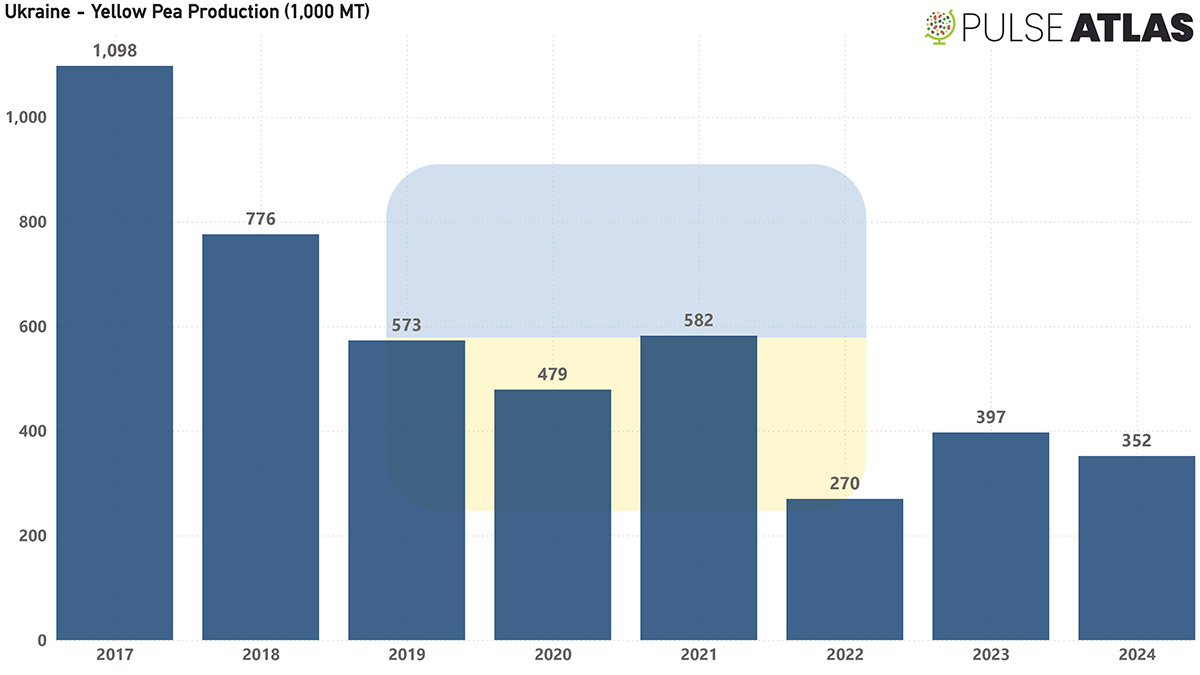

The Ukraine harvest is underway and based on information from the Government of Ukraine, planted area for dry peas is a little under 170,000 hectares. Crops in the northern, eastern and southern regions have seen harshly cold temperatures, which has resulted in some crop loss. Farmers are reportedly harvesting around 2 – 2.5 tonnes / hectare, according to Onur Vatan of EU-Nomia, and a report has stated that total dry pea production is expected at 425,000 MT to 475,000 MT, around 75% of which is yellow peas. The exportable quantity of yellow peas should be approximately 330,000 MT, according to a report by Deepak Rawat.

Historically, the majority of Ukraine’s crop has been exported to Türkiye and Spain with Türkiye taking the bigger chunk of Ukraine’s crop. However the re-entry of India into the yellow peas market will likely impact these traditional trade flows, too.

As of May 16, Ukraine to Mersin DAP by truck was approximately $445 / ton. Now, as there is next to no stock left to trade, traders in Ukraine are eagerly waiting for the new crop before trading can begun once again.

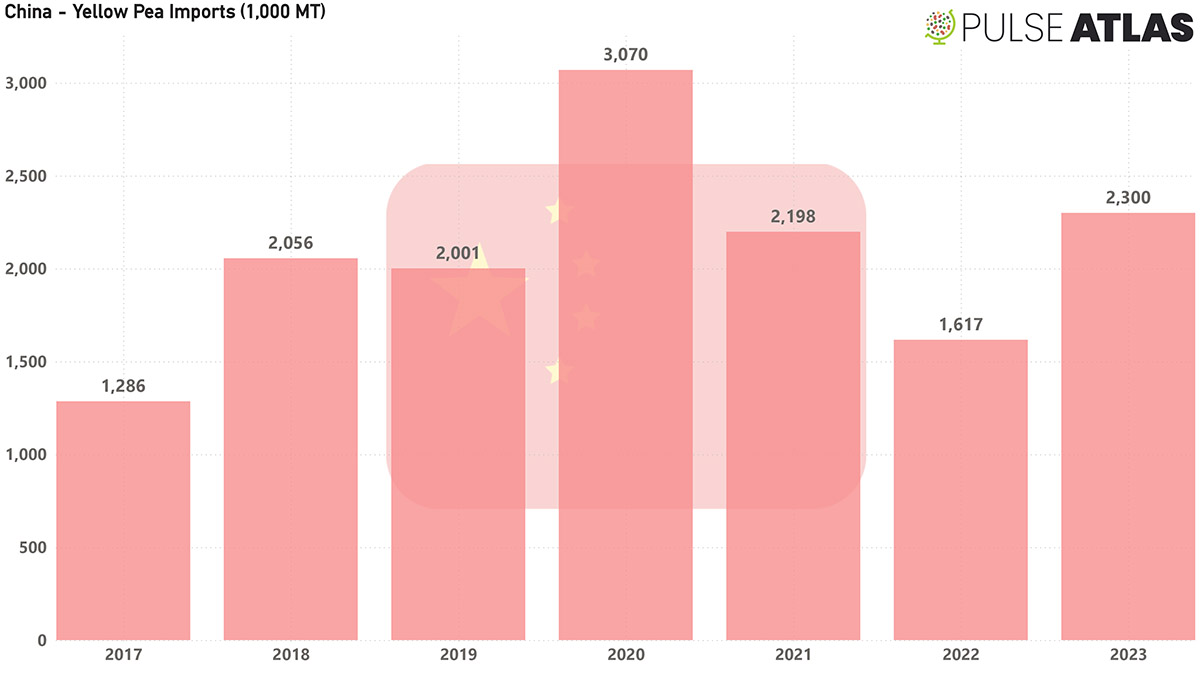

China’s demand on average is almost 3.7 MMT per year. Since June 2023, Russia’s contribution to Chinese imports has been 40-45%, while Canada’s has been almost 50%. Recently, the pace of yellow pea imports into China have reportedly slowed down due to reduced price competitiveness and lower stock levels at origins.

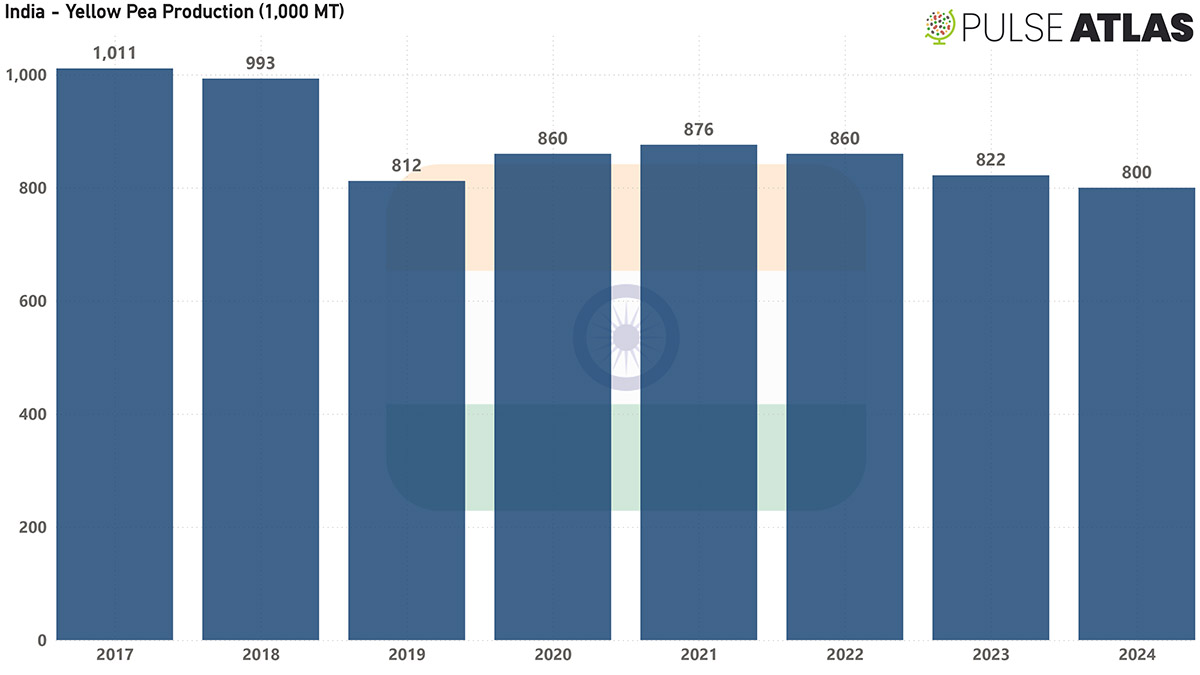

India harvested its yellow peas crop in Feb/March, with production at approximately 950,000 MT. out of which 800,000 tons are reportedly yellow peas. After the removal of the import tariff on yellow peas, Indian traders began heavily importing from Canada and Russia. Based on reports, import volumes were between 1.5 - 1.6 MMT between December 2023 and May 2024. Trading has experienced a slowdown in recent weeks due to inventory depletion at major origins has depleted and the stock limits and declaration imposed on traders by the government of India.

Based on a report by Deepak Rawat, India has stock of approximately 850,000 tons of imported peas, which is depressing the demand and prices of yellow peas in India.

The views and information in this report are comprised of government and industry sources. It is the responsibility of each member to independently verify the accuracy of the information.

dry pea / global pea market / yellow peas / green peas / India / Russia / China / USA / Canada / Ukraine / Pulse Atlas

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.