July 21, 2023

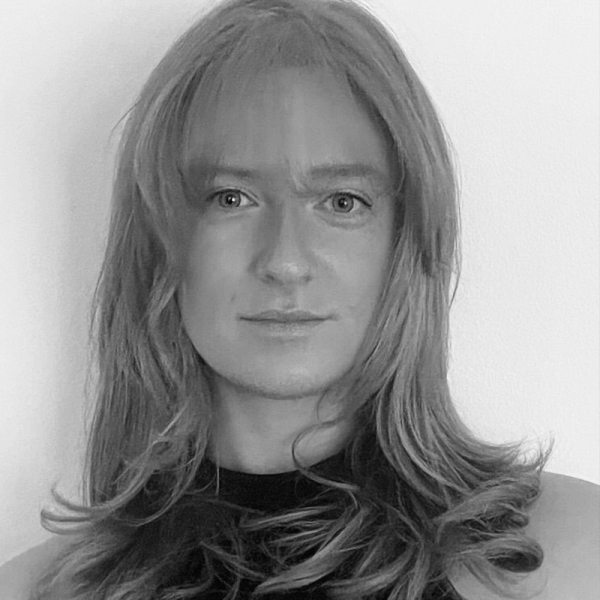

We chat to Frontier Agriculture’s Andy Bury about a new feed market for faba beans in the UK and Europe that’s filling the gap in demand left by Egypt.

So far 2023 is shaping up to be a fairly average year for faba bean production, Andy Bury, Pulse Manager at Frontier Agriculture expects around 650 thousand tonnes of UK production and tentatively estimates between 300-400 thousand tonnes in the Baltics. For Australia, he says, it’s too early to say but the expectation is around 450-500 thousand tonnes; whether or not El Nino will impact yields for crops Down Under remains to be seen.

While the supply side is fairly ordinary, Bury points out that it’s on the demand side that things have been out of the ordinary. “For human consumption, demand is mostly dominated by Egypt and Sudan. Given the warfare situation in Sudan, they won’t be importing any fabas for the coming year.”

Egypt typically dominates in faba demand for human consumption, importing between 500-700 thousand tonnes per annum. However, ongoing economic issues and a serious devaluation of the local currency is prohibiting imports of non-subsidised food items, of which faba is one. “There’s unlikely to be any volume to Egypt from the UK this year,” says Bury. “We normally export between 200 and 250 thousand tonnes but in the last marketing year we did 75 thousand.”

Rather than causing inflated carry-in stocks and pushing down prices, a new consuming market emerged and quickly started filling demand for UK faba beans in 2023:

“In Western Europe, we’re seeing increased consumption particularly into ruminant rations - so cattle, with an emphasis on dairy. This is a consumer move ahead in Europe largely driven by milk originators. Feed is a key criteria determining milk prices to commercial farmers; we saw this a few years ago in Germany when there was a push away from soya and now we’re seeing a big swing in the UK away from soya towards using domestically-grown proteins, which faba fills brilliantly.”

“We’re seeing a big swing in the UK away from soya towards using domestically-grown proteins, which faba fills brilliantly.”

Bury goes on to say that the recent growth represents a 25-35% increase in domestic consumption by feed compounders for faba beans and the demand is beginning to spill over into nearby European countries, notably the Netherlands and Germany, which are buying UK fabas to fulfil demand. “We are seeing and we will continue to see moves into poultry and pig feed as well,” he adds.

Elsewhere in consuming markets, faba’s high protein, fat and oil content means it continues to be a popular choice for aquafeed. While not showing quite the same immediate growth as cattle feed, Bury is confident the faba in aquafeed will see sustained, long-term growth.

While it’s clear that faba can never replace soya meal in terms of volumes, where it’s making in-roads is in the more specialist and demanding diets - a picture, Bury says, that is being replicated throughout Europe at the moment. He also cites faba’s “strong sustainability story” as a key factor pushing demand for cattle feed.

However, despite sustainability’s growing importance for European consumers, when it comes down to the line, price will win out: “On the demand side, it’s very price sensitive. The consumer - in this case, the feed maker - looks at faba in a basket of protein-related products, including soya and rapeseed. Sustainability is a strong driver but if [UK-grown] rapeseed meal gets to the same price, they’ll go for that as it has a higher protein content.”

“Sustainability is a strong driver but if [UK-grown] rapeseed meal gets to the same price, they’ll go for that as it has a higher protein content.”

On the farmer side, the model is slightly different. “The UK farmer - wrongly - looks at faba compared to wheat,” explains Bury. “If the price of fabas are 15-20% more than wheat, for them it looks OK. They appreciate it’s a lower yield and lower gross margin on the crop year but they’re aware that the following crop will give them an extra 10-15% wheat due to the nitrogen fixation and the fact that the roots break up the soil, which makes for an easy seed bed to plant the following crop.”

Looking ahead to the rest of the year, Bury explains that without Egypt on the demand side, the supply of fabas - which can be inconsistent - is more steady: “With a fairly average crop in the UK, continued demand from feed will hold values up relatively well. Big swings come when there’s a lot of upfront export business and the market shoots up towards the end as product runs out. It usually happens around February; this year it was May before we saw a big hike in prices. It’s much more even this year; a relatively good crop and slightly more known demand. That being said, there’s always some curveball in the market!”

READ THE FULL ARTICLE

faba / faba beans / Andy Bury / Frontier Agriculture / cow feed / feed rations / fava beans / Egypt / Australia / UK / Europe / the Baltics / feed demand / aquafeed / dairy cow rations

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.