August 12, 2022

AgPulse Analytica is predicting tight pea supplies in Europe due to dry weather in the main producing countries. In a market where Russian imports are restricted, Gaurav Jain discusses the implications.

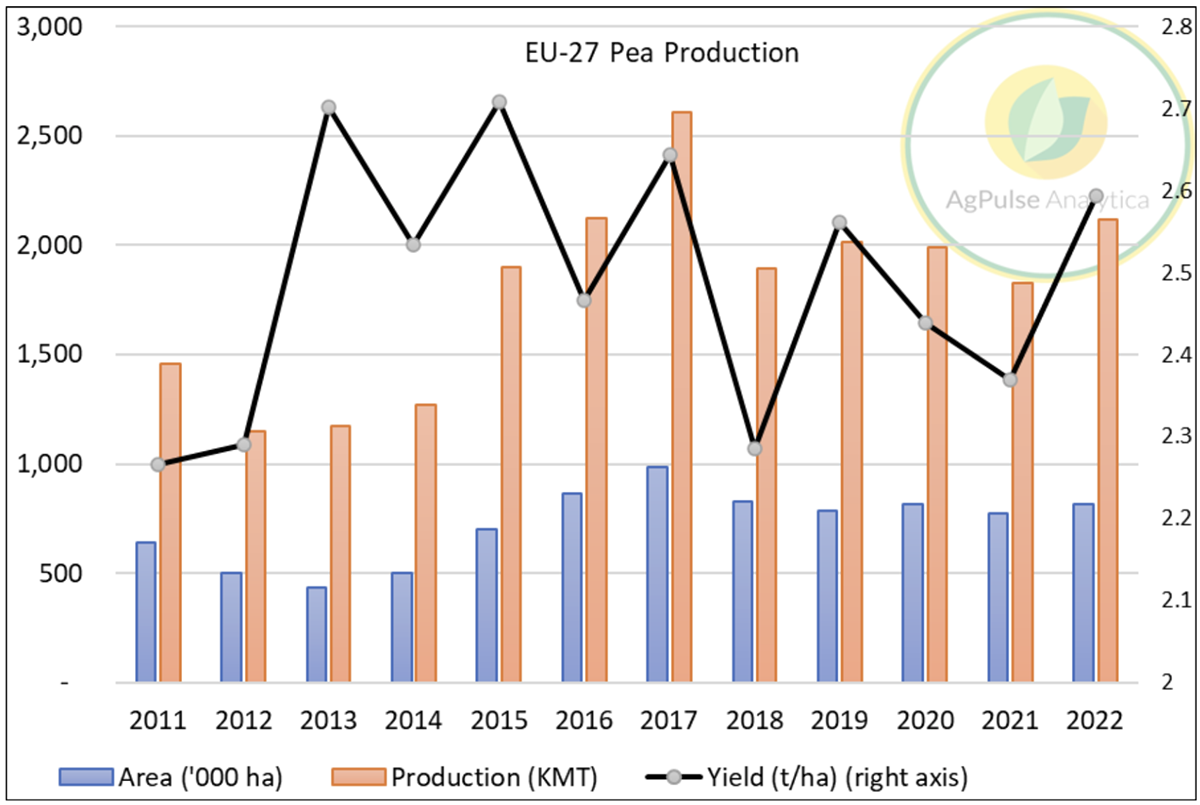

The European Commission is projecting a domestic pea crop of 2.12 MMT for the marketing year 2022/23 - an increase of 16% on last year. The EC attributes this overall increase to a 6% increase in sown area and a 9.5% increase in yields as compared to the 2021/22 season.

This year, many of the large pea-producing countries in Europe, such as France, Germany and Spain, suffered extremely dry weather; likewise the European nations around the Baltic and Black Seas went through periods of high heat and dryness.

The dry weather will certainly impact this year’s pulse production, which is why AgPulse Analytica doubts the projected yield of 2.59 t/ha, a number that would represent the highest yields in five years.

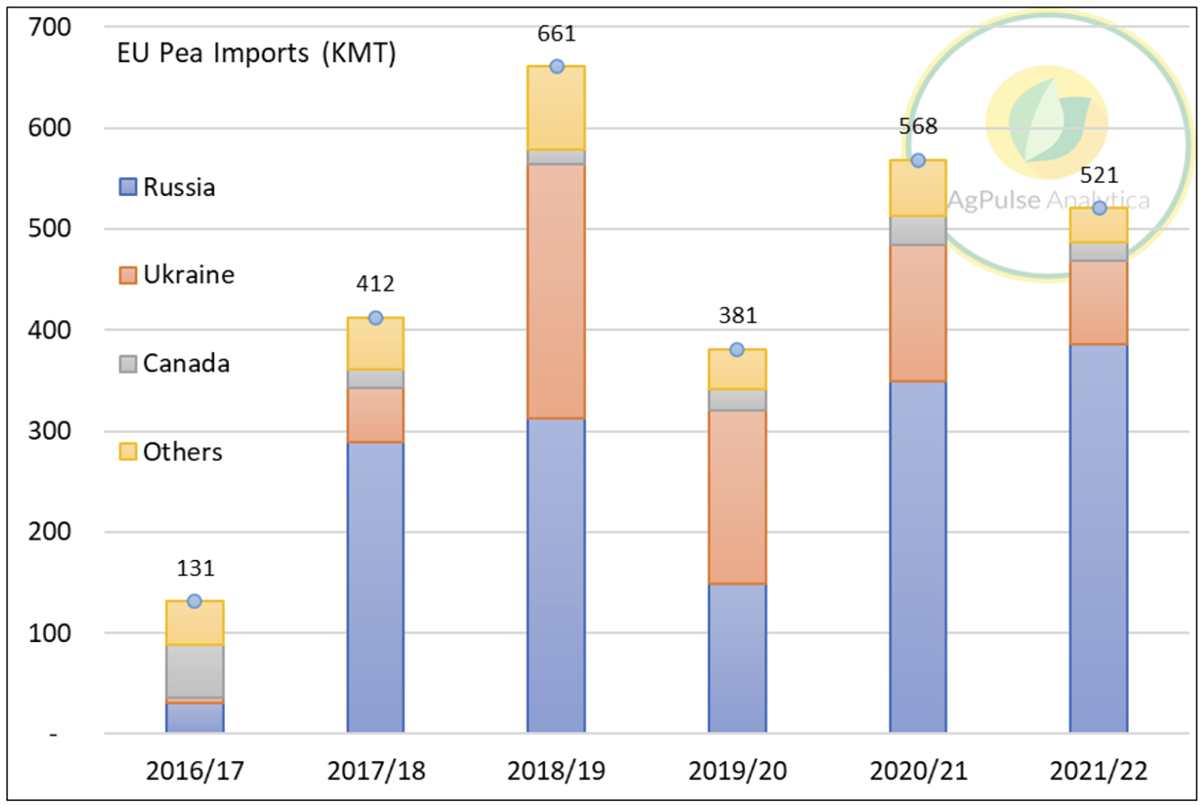

If we estimate the yield number at 2018 lows, the production figure would drop to 1.87 MMT, swelling the import requirement for which the European Union has traditionally been dependent upon Ukraine and Russia.

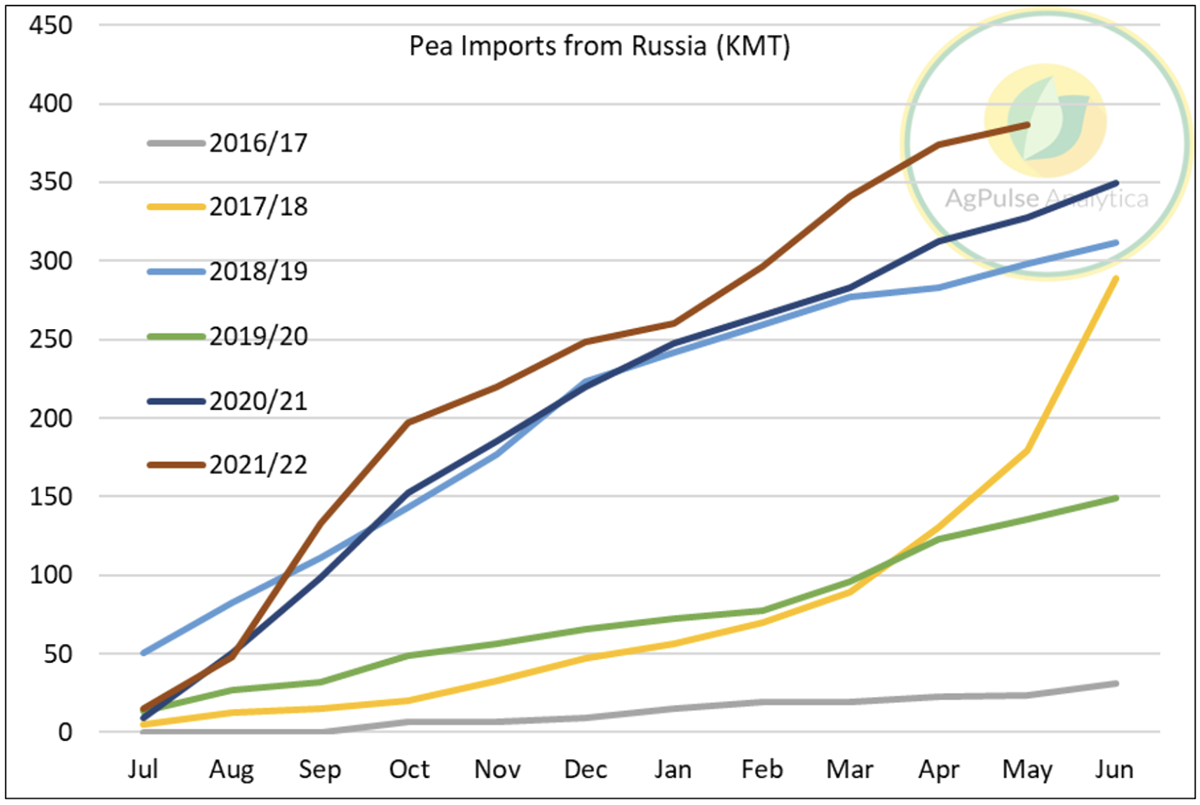

Over the years, supplies from these two countries made up 83-90% of total European pea imports. With the war in Ukraine leading to a smaller crop, Europe may find itself more dependent on Russia than usual. In fact, Russian pea exports to Europe for the period of Mar-May 2022 stand at the highest in four years.

Crops in Russia and Ukraine are at opposite ends of the spectrum this year. While Ukraine is projected to harvest nearly 250 KMT of peas, down 50% on last year, the Russian harvest is projected to reach record levels of 3.5 MMT, an increase of 10% on last year.

There is a big question mark around availability and prices of pea in Europe this year: how much will Russia be able to move into the EU and will China get active in the Russian market? With the pea crop in Russia soon harvested, it remains to be seen.

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.