December 5, 2023

Looking at the background and the current situation in India, some days ago Gaurav Jain spoke to experts about the ever-increasing possibility of an easing of pea import restrictions in 2024. Now it is official: India will allow duty-free imports of yellow peas until March 31, 2024, the government said in a notification late on December 7.

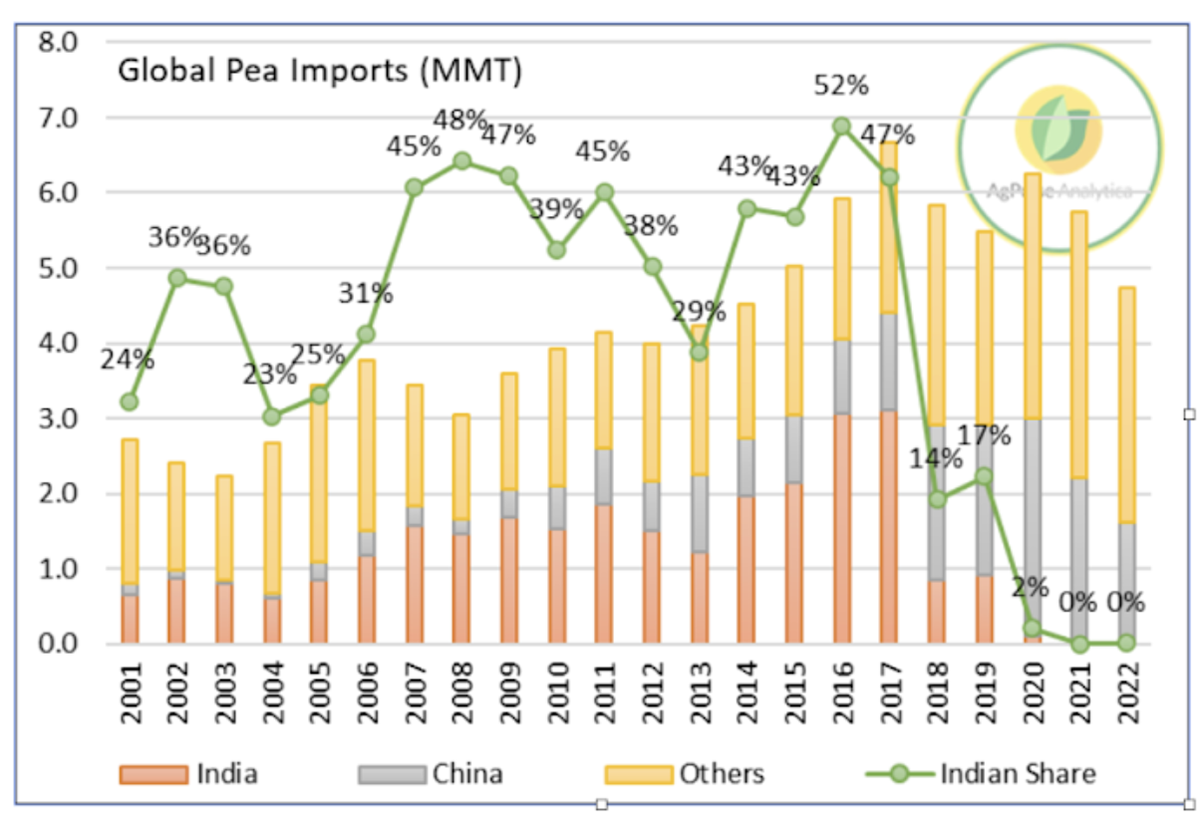

India was the world’s largest pea importer for a significant part of the last two decades until the federal government imposed punitive taxes on imports on November 7, 2017. Global pea markets have not been the same since.

To encourage domestic production and reduce reliance on imports, the Indian government started altering its import policies in the middle of 2017 and the changes continue even today: they announced that the country will allow duty-free imports of yellow peas from December 8, 2023 until March 31 next year.

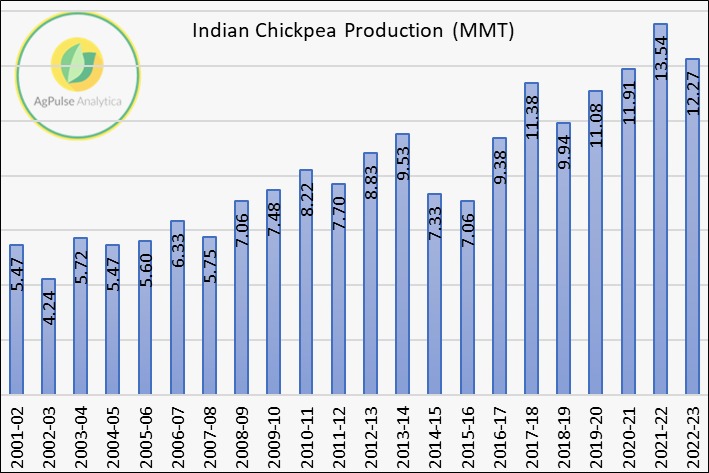

Indian farmers responded favorably to the increased prices in the domestic markets and chickpea production in the country topped the 10 million MT mark for the first time in 2017/18. Production has averaged 11.69 million MT ever since.

As well as imposing import restrictions, government agencies actively procured chickpea crops from farmers and built buffer stocks of over 2 million MT. The active procurement and distribution under various welfare schemes along with open market sales and the recent Bharat Dal program made chickpeas profitable for farmers to grow and affordable for consumers to buy.

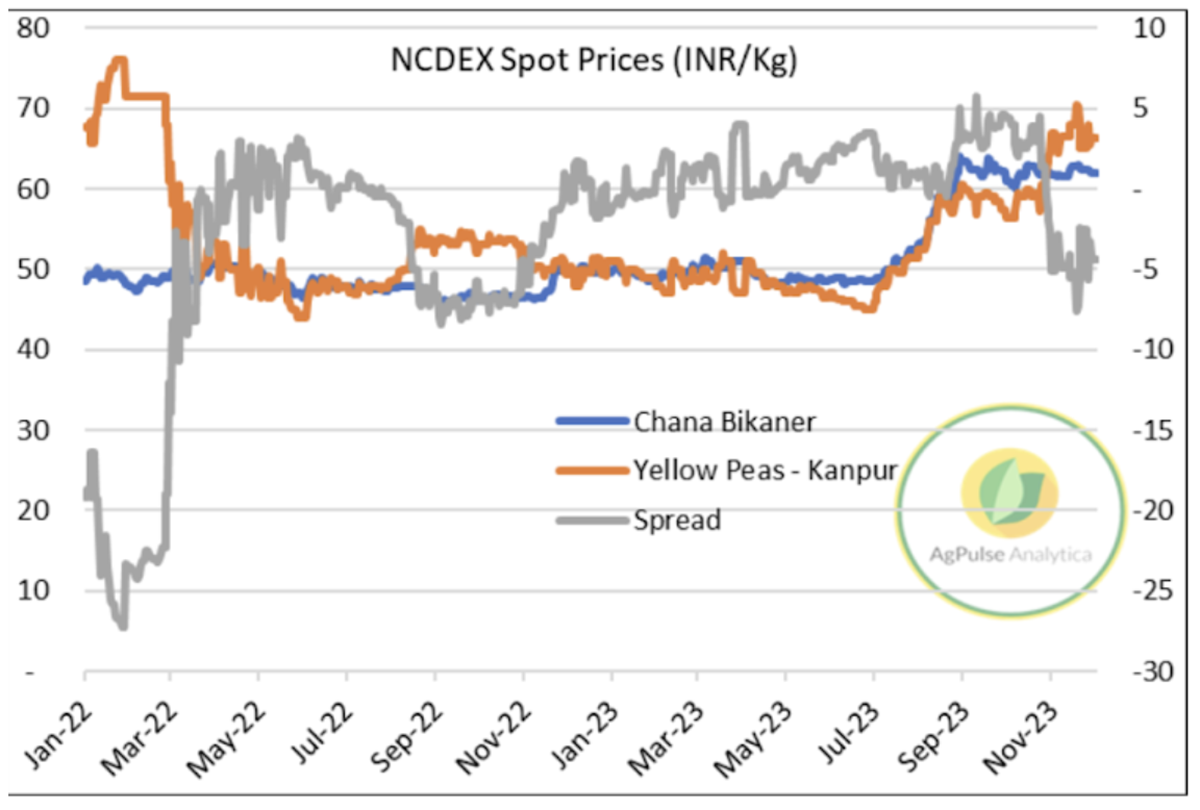

Domestic prices of desi chickpeas and yellow peas have been increasing swiftly since early July 2023. Despite NAFED auctioning desi chickpeas and selling Bharat Dal (chana dal) at a discounted price of INR 60/kg (~$720/T), the prices of the two commodities have been on the rise in domestic markets.

Yellow peas are once again trading at a premium to desi chickpeas at many of the centers and last month the benchmark price in Kanpur topped $550/T.

According to government statistics, India harvested the second-largest chickpea crop at 12.27 MMT in 2023. However, this figure is down 9.5% from the 2022 production.

Despite back-to-back large production figures, prices have been rising since the government procurement ended although they recently stabilized at around INR 62-63/kg at the benchmark Bikaner market.

Jeff Van Pevenage of Columbia Grain points out that if domestic prices of chana in India remain high, there is a strong possibility that the import restrictions on peas will ease. He also indicated that Russia, being the cheapest origin, is likely to be the chief source.

Given that India’s chickpea acreage is running lower this year and dry conditions are persisting, production could take a hit of 10% or more. Meanwhile, NAFED stocks are thinning out, with continuous sales of chickpeas and splits.

Vivek Agarwal, Managing Director of JLV Agro, points out that the policy change will depend upon the assessment of the chickpea crop this season and suggests that imports may only be opened for millers and in limited quantities.

Chickpea imports from Tanzania and other origins will not be sufficient to meet India’s domestic demand and bridge the production gap; it seems the only viable alternative will be to reduce duties on Australian chickpeas.

Russia’s enormous pea inventories are ready to cater to the Indian demand. Now that the decision of opening pea imports has been made before planting began in Canada, Russia and Europe for 2024, farmers in those regions may increase acreages.

India pea imports / yellow pea / desi chickpea / Australia / Russia / North America / Bharat Dal / chana dal / Jeff Van Pevenage / Vivek Agarwal

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.