June 29, 2023

Favorable prices and enormous production means India is set to emerge as a top exporter of desi chickpeas in 2023. What does this mean for Australian exporters? Gaurav Jain goes into detail.

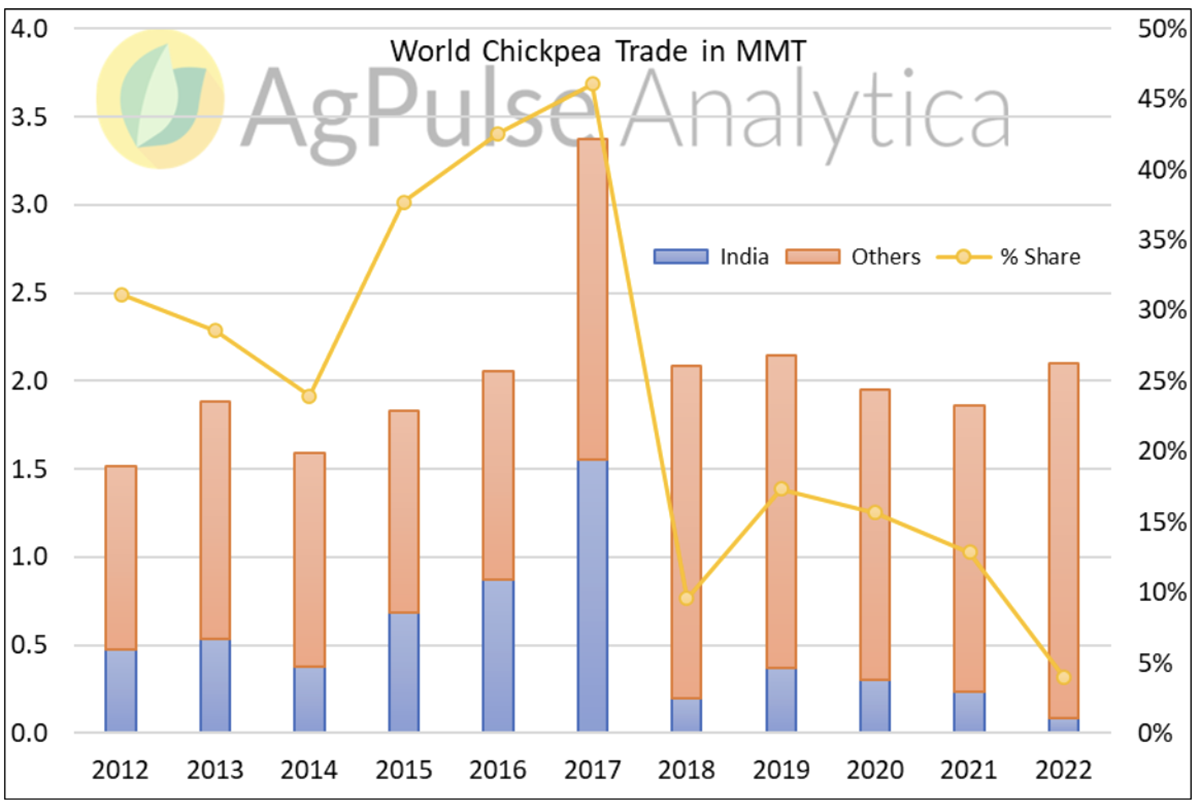

Despite being the world’s largest producer of desi chickpeas, India has traditionally been an importer and, more often than not, its import volumes in the world trade have eclipsed all others. The high point was in the year 2017, when Indian cornered 46% of global supply.

Chart: AgPulse Analytica

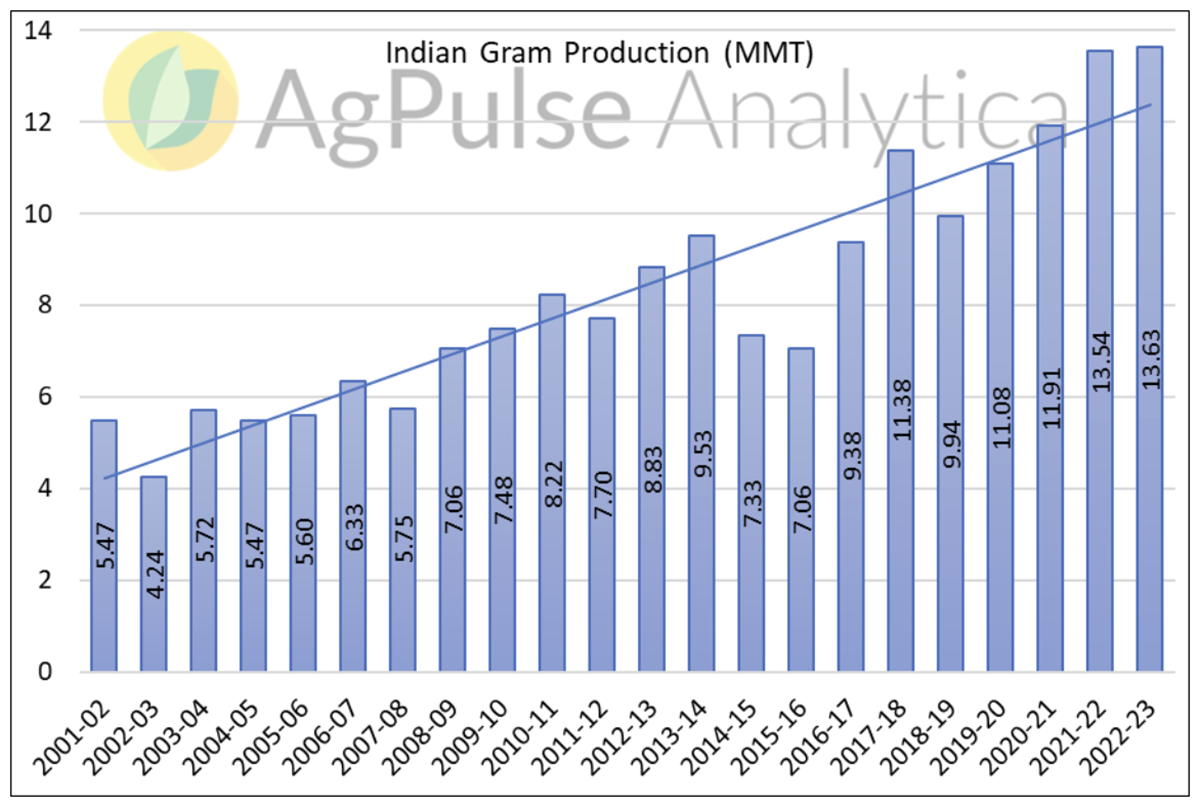

Since stagnation in domestic production from 2008/09 – 2015/16, the average desi chickpea production has been 11.91 MMT in the past six growing seasons. To prohibit higher availability causing a crash in prices and profitability, the Indian government restricted imports of both chickpeas and yellow peas and procured large quantities across states at an ever-increasing Minimum Support Price (MSP).

Chart: AgPulse Analytica

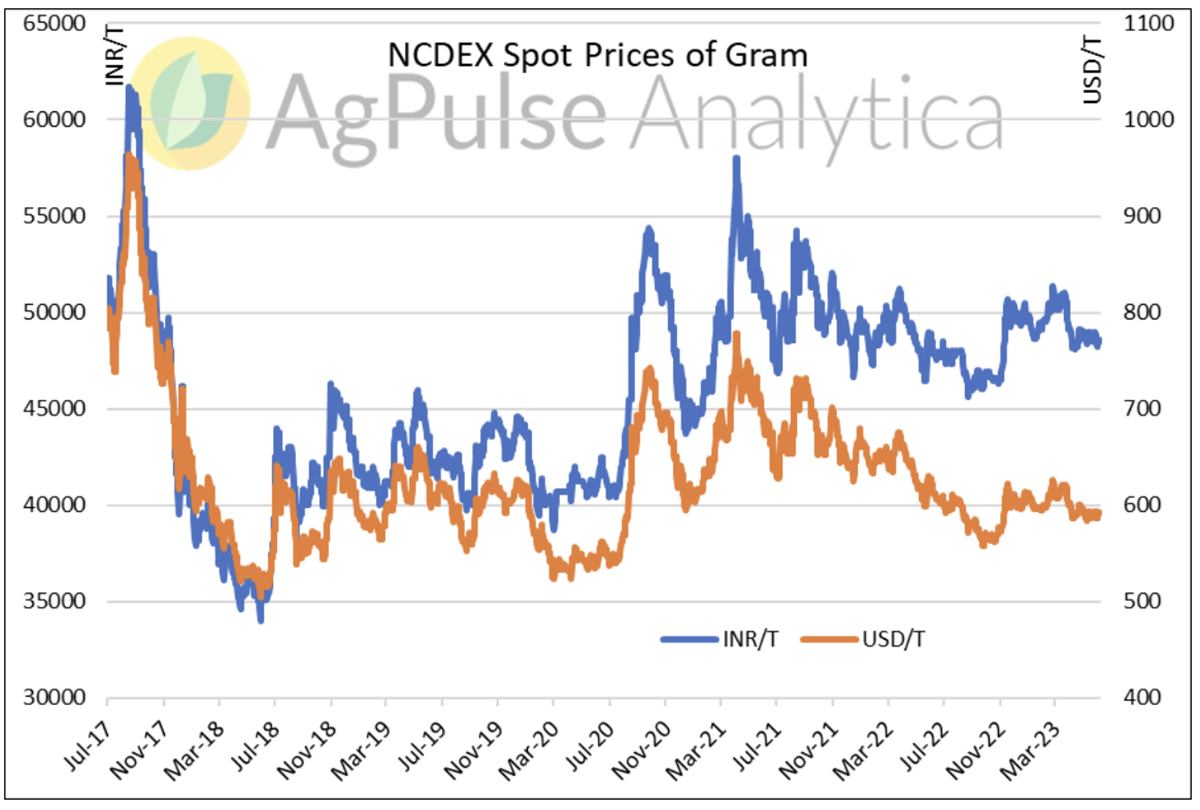

Despite the increasing MSP, huge production volumes and NAFED intervention have kept prices in check and Indian consumers have not seen a repeat of 2015-2017 when domestic production fell way below demand causing prices to rise sharply. The depreciation of the rupee has led the dollar value of Indian chickpeas to fall further and prices are currently ruling near $590/T.

Chart: AgPulse Analytica

India has traditionally been an exporter of large calibre kabuli chickpeas but now it seems desi exports are also taking off and competitive domestic prices mean the country is becomig a net exporter of the crop.

Higher inventory at NAFED levels and continuous distribution of procured pulses caused desi chickpea prices in domestic markets to rule below the MSP for the most part of the year. As a result, Indian produce is in parity with nearby destination markets, including Bangladesh, one of the large buyers of desis.

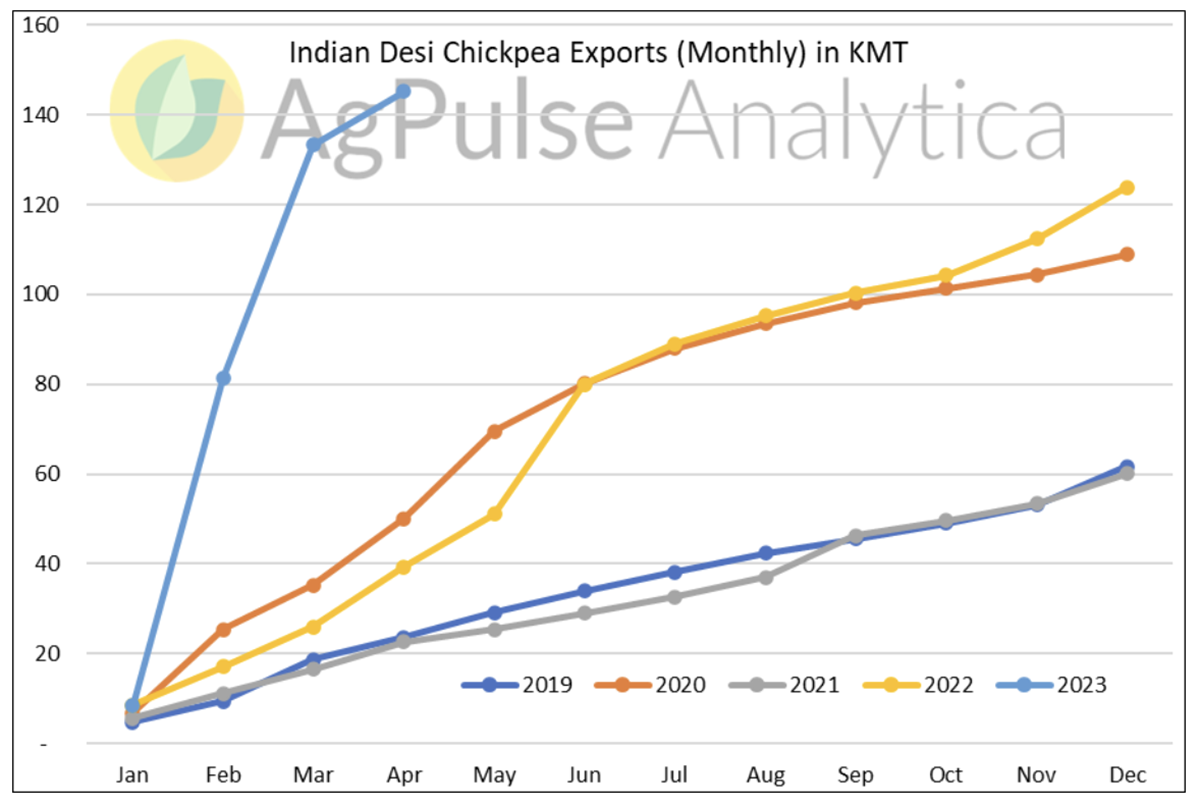

Chart: AgPulse Analytica

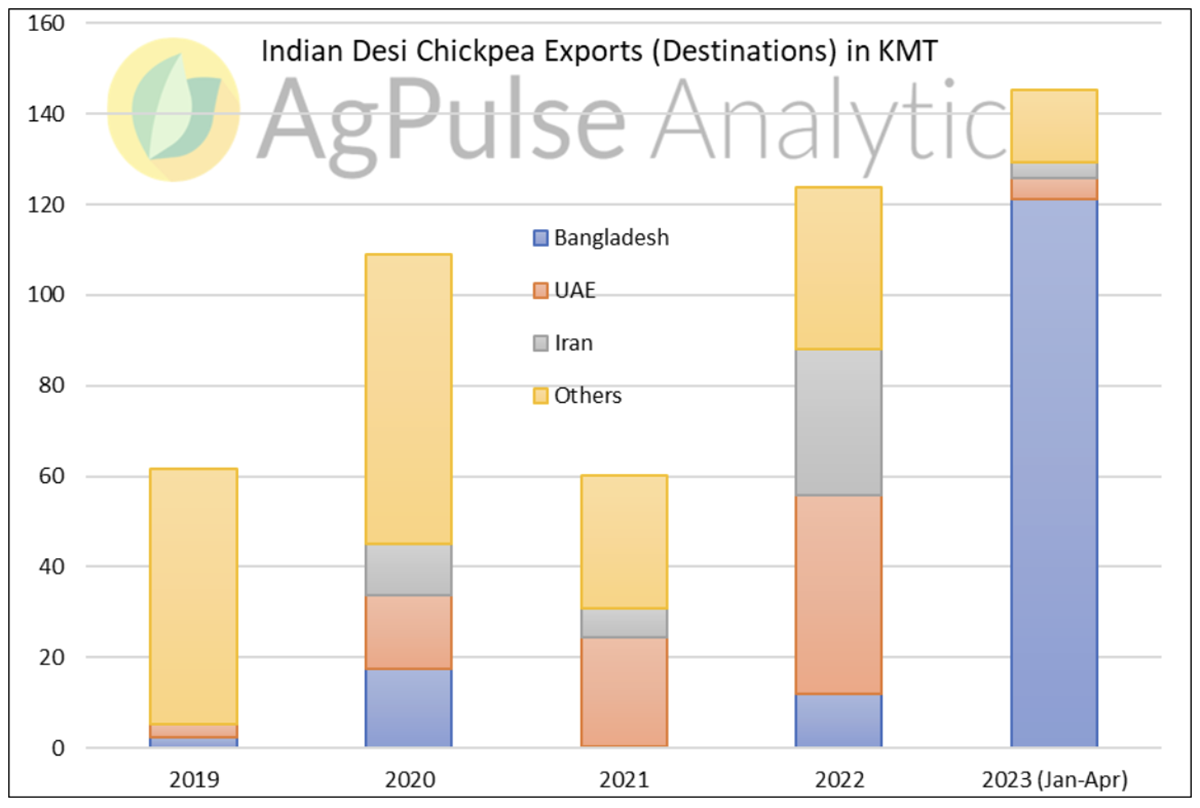

Last year, Indian desi chickpea exports were reported at 124 KMT, out of which the UAE was the top destination followed by Iran and Bangladesh and representing a new annual record for the country.

Chart: AgPulse Analytica

In the first four months of 2023, India exported 145 KMT of desi chickpeas, higher than the total of any of the previous years. The top three destinations were Bangladesh, the UAE and Iran.

Indian exporters will continue to seize the markets in Bangladesh, UAE, Iran and a few other destinations for the following reasons:

As a result, Indian chickpea exports will provide stiff competition for Australian exporters who will lose what has traditionally been their share of the pie in Asia. The only major destination not serviced by Indian exports is Pakistan and it is likely that Tanzania will provide tough competition for Australian exporters. With low domestic prices at its traditional destination (India), Tanzania is taking over the Pakistani market for desi chickpeas.

We expect India to export over 300 KMT of desi chickpeas in the current year, which will make it among the top two exporters in the world. Consequently, 2023 can prove to be a tough year for Australian chickpea growers and exporters.

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.