January 23, 2024

Gaurav Jain of AgPulse Analytica looks in detail at Chinese pea demand in 2023 and comments on the possible outcomes for the trade in 2024.

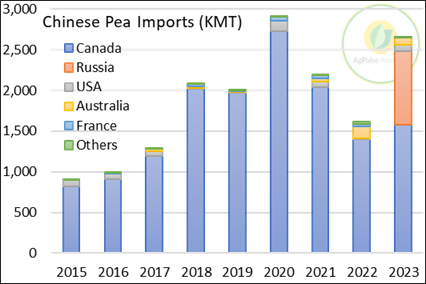

Last year, China - the world’s largest pea importer - imported 2.66 MMT of peas, the second-largest volume on record. The number represents an impressive 64% increase year-on-year and 23% higher than the five-year-average. Indubitably, opening the trade to Russian origin helped the country’s pea industry to get the raw material; China imported over 900,000 MT of Russian peas last year, making it the second most important origin after Canada.

Though Q4 (OND) has traditionally seen the highest import volume, 2023 was truly historic, with imports surpassing half a million tonnes in two out of three months. Of the total quarterly volume of 1.38 MMT, 682,000 MT came from Canada and 632,000 MT from Russia.

After getting the nod for pea exports from Chinese authorities in December, Russian traders were relatively slow to move; the first cargoes were cleared in March and shipment volumes picked up only in July. In the first half of 2023, China cleared only 77,017 MT of Russian peas, while the trade surged to 831,251 MT in the second half. With strong price competitiveness, Russia emerged as the top supplier to China in three months during the second half of 2023.

India recently eased all curbs (tariff and non-tariff) on pea imports until March 31, 2024, a change in government policy that stirred the global pulses market. Pea prices shot up at origins and traders in Canada, Russia and other origins are pushing large volumes of peas for India. The price rise dampened the demand in China and many other destinations.

As we noticed Q1 imports are weaker than in the preceding quarter, this year, the effect can be even greater as the trade is busy shipping to India. However, there is a high chance that the Chinese pea industry will have a strong demand in Q2 and beyond and Russia, with its large inventory, will likely be happy to fill the gap.

READ THE FULL ARTICLEDisclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.