December 21, 2022

Gaurav Jain goes into detail about the current supply and demand situation for desi chickpeas in the key markets leading up to the holy month of Ramadan.

The month of Ramadan is a time of spiritual reflection and discipline for Muslims around the world and, during this time, many people observe a fast between sunrise and sunset. In the runup to Ramadan across South Asia and the Middle East, there is usually an increased demand for pulses, which are inexpensive, widely available and high in nutrients, meaning they can help to sustain energy levels throughout the day.

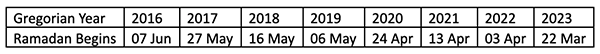

The Islamic calendar is based on the lunar cycle and as such the dates of Ramadan change every year. The corresponding start dates (±2) of Ramadan on the Gregorian calendar are:

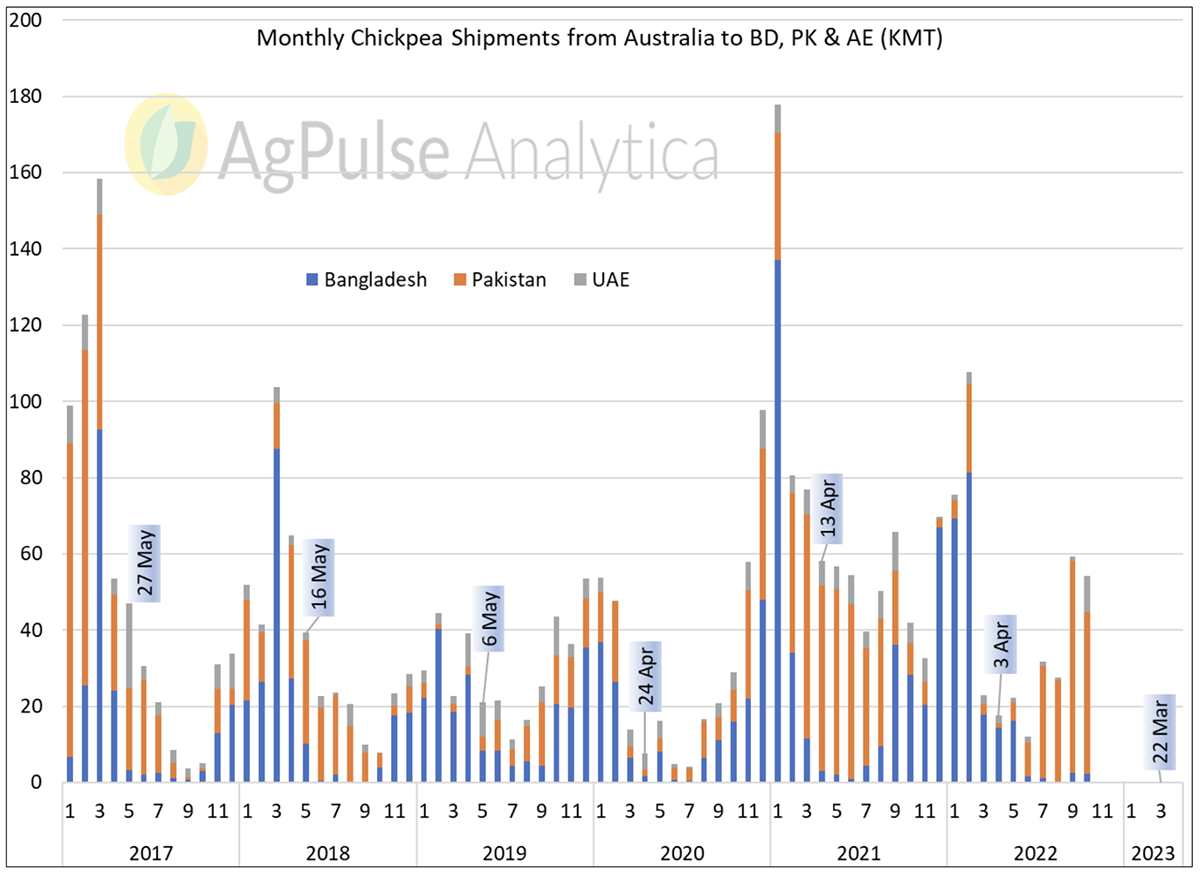

In regions where Ramadan is observed, chickpea demand tends to increase both before and during the holy period and importers in Pakistan, Bangladesh and the United Arab Emirates are more active at origins. For desi chickpeas, the preferred origin is Australia.

Due to their limited domestic crops, Bangladesh and the United Arab Emirates depend relatively highly on imports in the lead up to Ramadan. Conversely, in Pakistan the domestic desi chickpea crop has been sufficient to meet the majority of Ramadan demand over the past decade. In recent years, however, due to the varying dates of the holy month, this trend has been changing. The domestic crop in Pakistan is harvested in March and April and has not been available for consumption during Ramadan. As the dates of Ramadan continue to shift further into the growing season in the coming years, it is expected that Pakistan will start competing for supplies at the same time as Bangladesh.

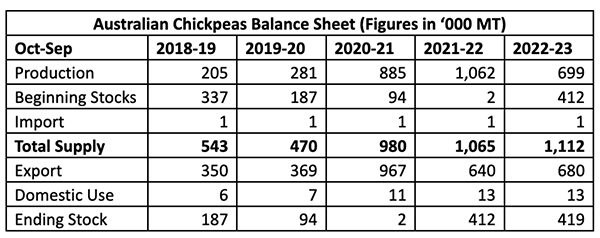

According to the AgPulse Yield Model, Australian chickpea production is expected to reach 700,000 metric tons this year, in contrast to the latest figure from ABARES, which is 595,000 metric tons. With production at this level, total supplies are expected to reach a five-year high of 1.1 million metric tons. Exportable supplies are projected at over 1 million metric tons and we suspect that there will be sufficient demand for these supplies. For the second year in a row, Australia will be left with more than 400 thousand metric tons of chickpeas.

Australia does not have much competition for its desi chickpeas on the global market as export volumes from other origins world total less than 100 thousand metric tons. Tanzania is the closest competing origin but most of its chickpeas from the 2022 crop have already been shipped.

Over the past two years, Bangladesh has increased its chickpea imports due to the high cost of peas. In 2021, a record 354,000 metric tons of Australian chickpeas were shipped to Bangladesh, almost double the amount from the previous year. It is anticipated that this trend will continue, with the final import figure for 2022 expected to exceed 300,000 metric tons, including more than 100,000 metric tons in the current quarter. However, logistical challenges and a tight foreign exchange situation in Bangladesh have restricted the flow of imports this year.

For its Ramadan export demand, Australia is expected to ship approximately 275,000 metric tons of chickpeas to Bangladesh between October 2022 and March 2023.

Since the end of 2020, record prices for yellow peas have led to an increase in demand for desi chickpeas in Pakistan. The domestic crop is expected to be larger this year compared to the past two years when weather-related damage significantly reduced the crop size. After producing 500,000 metric tons in 2020, production dipped to 270,000 metric tons in 2021 and 350,000 metric tons in 2022.

This season, elevated wheat prices led to a shift in acreage away from chickpeas for the 2023 crop. If the country realizes a better-than-average yield, crop production may reach 450,000 metric tons. However, with Ramadan starting in the midst of the harvest, it will be difficult to get the domestic crop to mills and shelves in time. As a result, Pakistan will likely need to import more chickpeas than it has in the past two decades to meet demand during Ramadan.

In 2021, Australia set a yearly record for desi chickpea exports, shipping 378,000 metric tons to Pakistan alone - a 168% increase from the previous year. The flow of imports has remained strong since July and it is expected that the final tally for 2022 will exceed the 300,000 metric ton mark. Similar to other destinations, logistical issues and a volatile foreign exchange situation for the Pakistani rupee have hindered the flow of imports this year. Pakistani importers have started using bulk vessels instead of containers to ease the availability and reduce freight costs, following ongoing issues with containers.

The Indian government is unlikely to ease its policy restrictions on chickpeas and/or dry peas in the near future. Low domestic prices in the second half of 2022 prompted increased exports to neighboring countries but with domestic prices now hovering around ?50/kg (~$600/T), the flow has weakened.

Strong demand for Australian desi chickpeas is expected in South Asian markets during the current quarter of 2022 and the first quarter of 2023. While total supplies at the point of origin still exceed the annual demand in these key markets, prices are expected to remain within a certain range. The financial capacity of Australian farmers to hold on to their supplies may provide support against any potential price decline.

Gaurav Jain / desi chickpeas / Pakistan / Australia / Ramadan / Bangladesh / United Arab Emirates

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.