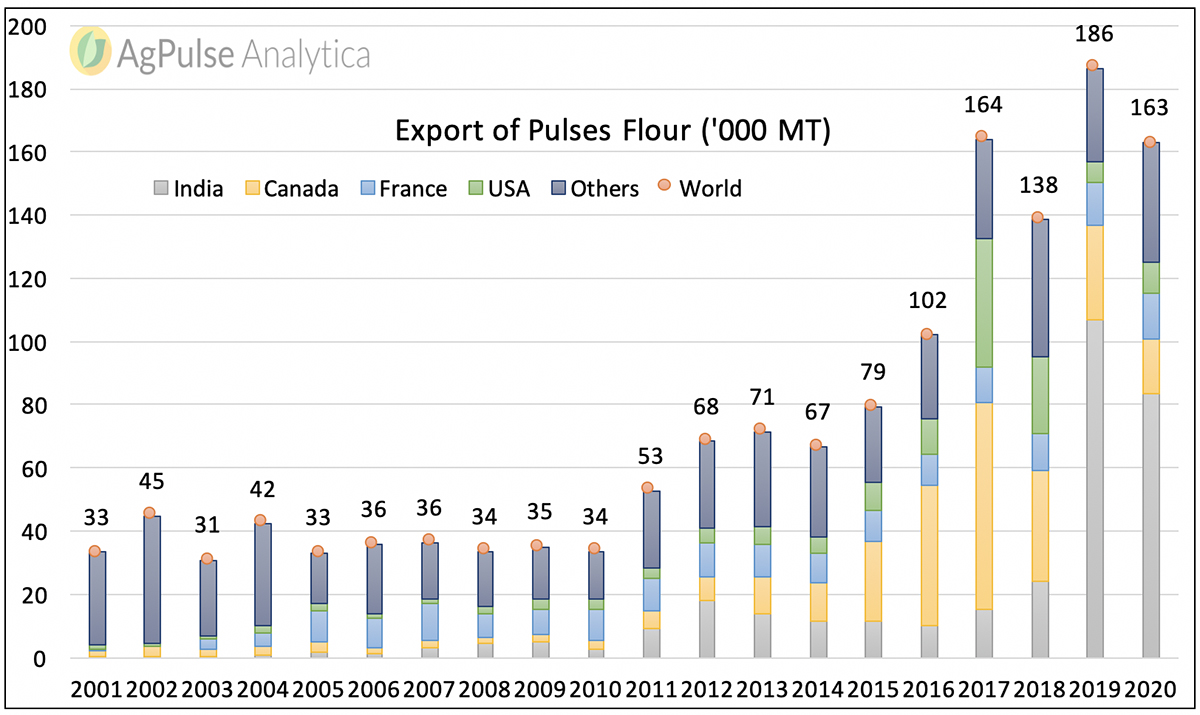

Compared to whole pulses, pulses flours have always been a small player when it comes to trade. Global trade of the product, which falls under the HS code of 110610 (Flour, meal and powder of peas, beans, lentils and the other dried leguminous vegetables of heading 0713) never exceeded 100,000 MT until 2015. Since then, however, we have seen incredible growth in global trade of pulse flours; unquestionably a consequence of the increasing popularity of plant-based diets over the past decade.

In 2020, the global trade for the HS Code stood at over 162,000 metric tonnes, more than double the 2015 levels.

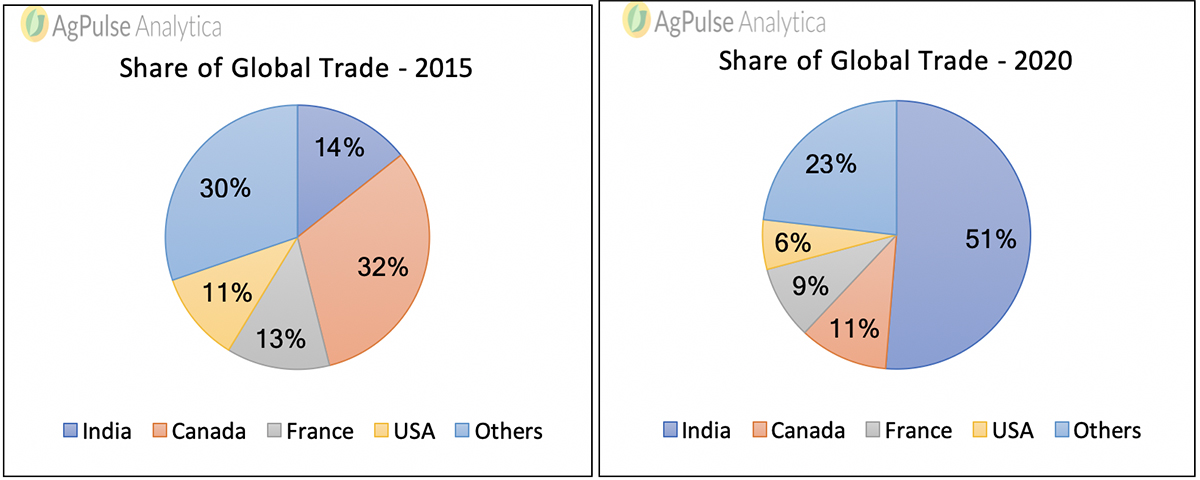

Canada, France, the US and India are all major exporters of the product. While Canada has been a dominant force in trade volumes, it is India that has seen the most dramatic increase in market share since the middle of 2019.

India is the largest producer, consumer and often importer of pulses in the world and has now become the largest supplier of pulses flours. The country’s share in the global trade increased from 14% in 2015 to 51% in 2020.

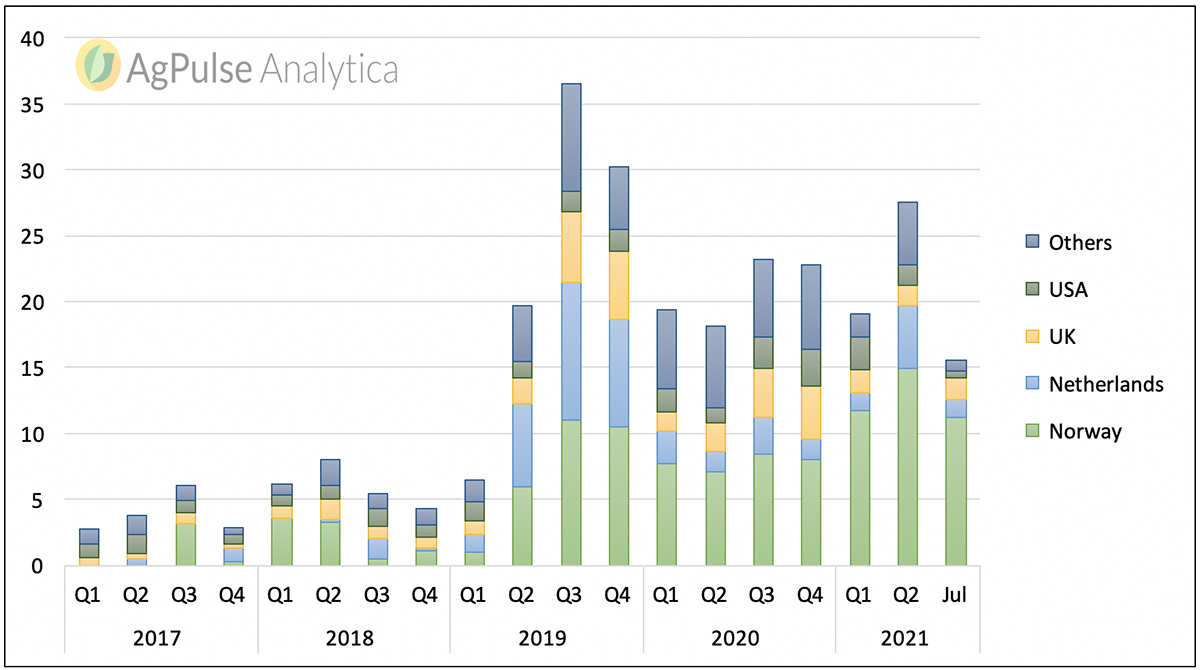

According to Customs data until July 2021, the primary destinations for India’s exports are Norway, the Netherlands, the United Kingdom and the United States.

The following chart shows the quarterly export figures in thousand MT and shows that shipments to Norway have remained high since the middle of 2019.

India processes a variety of pulses in bulk quantities and has an evolved domestic processing industry capable of cleaning, sorting, milling and packing pulses into any grade. This advantage is accentuated by the variety of raw material available to the processors, meaning they can cater to all and any importer demands.

Since 2019, the industry has expanded its offering beyond ‘besan’ (chickpea flour) for the Indian diaspora, and has ventured into supplying all types of pulses flour. The current volume is only the tip of the iceberg and the industry is expected to grow into double digits as we continue to see new applications of pulses in pet food, protein extraction, alternative meat and many more.

Could this be the value-added product that the Indian pulses industry is heading towards? Maybe, but the country has still not caught up with China, Europe or Canada in the protein extraction game, despite the large availability of raw materials and one of the largest vegetarian populations.

Indians still prefer to consume their pulses as ‘dal’, with the only pulses flour with any real popularity being ‘besan’. There is still much room for growth when it comes to pulses as concentrated protein and starches. Nonetheless, although it may take decades for Indian eating habits to change, India remains a player in the fast-evolving fractionation industry by supplying pulses flours to the world.

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.